How to Assess Materiality for AASB S2 Compliance

Nov 24, 2025

Learn how to assess materiality for AASB S2 compliance, including risk identification, financial impact evaluation, and the role of technology.

Materiality is the cornerstone of AASB S2, a standard requiring organisations to disclose climate-related risks and opportunities that could influence decisions by investors, lenders, and creditors. This involves identifying risks, estimating their financial impact, and deciding what information is relevant for reports. A key focus is on forward-looking assessments covering short, medium, and long-term impacts.

Key Takeaways:

Materiality Definition: Information is material if it could influence decision-making.

Assessment Process:

Identify climate-related risks (physical and transitional) and opportunities.

Evaluate their financial impact (e.g., costs, revenues, asset values).

Apply a materiality filter to determine relevance.

Document decisions and evidence for transparency and audits.

Compliance Benefits: Clear assessments help prioritise resources and align with evolving regulations.

Technology's Role: Platforms like neoeco streamline data integration, automate processes, and ensure audit readiness.

AASB S2 compliance requires consistent updates, detailed documentation, and integrating financial data with sustainability metrics to meet disclosure requirements effectively.

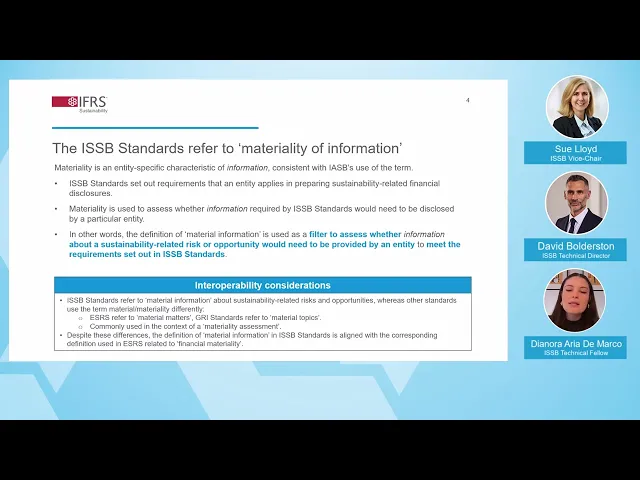

Webcast 2: The definition of material information and its application in ISSB Standards

Identifying Climate-Related Risks and Opportunities

To create an effective materiality assessment for AASB S2, it’s essential to identify climate-related factors that could influence financial performance. Accountants should take a close look at their clients' value chains, business models, and operating environments. This helps uncover risks and opportunities tied to climate issues. Collaboration across departments - finance, operations, and strategy - is crucial to ensure all relevant factors are considered. This groundwork is vital for pinpointing specific risks and opportunities.

Climate impacts can unfold over different timeframes. In the short term, businesses might face compliance costs or disruptions from extreme weather. Over the medium to long term, changes in market dynamics or shifts in consumer preferences could come into play.

Recognising Climate‐Related Risks and Opportunities

Climate-related risks generally fall into two main categories: physical and transitional. Physical risks are linked to events like natural disasters that can disrupt operations. Transitional risks, on the other hand, arise from changes in policies, technologies, or market conditions as economies shift towards lower-carbon models.

But where there are risks, there are also opportunities. For instance, initiatives that boost resource efficiency or tap into new market segments can create significant advantages. The key is to tailor these broad categories to the specific context of the business, ensuring the assessment is both relevant and actionable.

Evaluating Financial Impact

Once risks and opportunities are identified, it’s important to estimate their financial impact. Consider how they might affect revenue, costs, or asset values over different time horizons. For example, operational disruptions could lead to reduced sales or increased expenses, while efficiency improvements might lower costs. Scenario analysis is a useful tool here, helping to explore potential outcomes and assess the business’s sensitivity to these factors.

Documenting all key assumptions and methodologies is equally important to maintain records that are audit-ready.

For accounting firms, integrating sustainability metrics with financial data is becoming a critical step. Tools like neoeco can simplify this process. neoeco automatically maps transactions to recognised emissions categories, providing audit-ready data and easing compliance efforts. After gathering this information, applying a materiality filter helps refine the assessment and focus on what truly matters.

Applying the Materiality Filter

Once you've identified and assessed climate-related factors, the next step is to apply a materiality filter. This filter helps narrow the focus to those factors that have a direct impact on economic decisions. To do this effectively, document the reasoning behind how each risk or opportunity is classified.

This detailed filtering process naturally results in thorough record-keeping, which is essential for ensuring clarity during audits.

Recording Materiality Decisions

Every decision related to materiality should be documented to align with AASB S2 requirements. Your records need to clearly explain why specific climate-related risks or opportunities were deemed material or immaterial. Include the criteria used and the evidence that supported these conclusions.

Modern platforms can make this process more manageable by offering features like audit-ready controls, centralised evidence storage, and easy access for auditors. These tools help you track documentation, securely store compliance files, and provide external reviewers with direct access to reports. This approach not only streamlines the audit process but also reduces the likelihood of last-minute issues. Always ensure your data is accurate, complete, and up-to-date to support a credible assessment.

In addition to simplifying record-keeping, these platforms promote consistency. Using policy builders and templates can standardise your documentation. As Jennifer Kaplan, a Sustainability Manager, shared:

"I found the Policy Builder extremely useful at our stage because having a template of a well-conceived policy helps in the standardisation of new practices and ensure that written guidelines are best-in-class."

Measuring and Disclosing Material Information

After identifying and documenting materiality decisions, the next step is turning those decisions into clear financial disclosures. AASB S2 requires organisations to measure and report material climate-related factors with accuracy.

This means directly linking climate-related risks and opportunities to financial statements, showing their effects on revenue, expenses, asset values, and future capital allocations.

Key Disclosure Requirements

Under AASB S2, disclosures must address critical financial areas like revenue, expenses, assets, liabilities, and capital allocation. For each material climate-related factor, you need to explain its impact on these financial statement items, both now and in future reporting periods.

For instance, revenue disclosures should highlight how climate factors affect sales patterns, pricing strategies, or market demand. If extreme weather disrupts supply chains, explain how this impacts revenue and for how long.

Expenses should reflect additional costs tied to climate adaptation, regulatory compliance, or operational changes - such as increased insurance premiums or carbon pricing.

Asset and liability measurements require close attention to impairment assessments and fair value adjustments. Climate-related factors might lead to faster depreciation or the need to write down certain assets. Similarly, provisions for environmental remediation or litigation should be quantified if they are material.

Scenario analysis should be integrated into strategic planning, with clear explanations of assumptions and the potential financial effects of various climate scenarios.

Finally, disclose your quantification methods, including data sources, calculation processes, and key assumptions, to provide transparency about the reliability and limitations of your estimates.

Addressing Measurement Challenges

Quantifying climate-related financial impacts can be tricky due to data availability issues. AASB S2 acknowledges this by allowing flexibility through its "without undue cost or effort" principle, which helps organisations stay compliant without excessive burden.

When precise figures aren’t possible, focus on detailed qualitative descriptions. Explain the nature and potential scale of the financial impacts, outline what limits precise measurement, and share your plans for improving accuracy over time.

To tackle data integration challenges, make use of existing financial ledger information by linking it with sustainability metrics. Modern accounting tools like Xero, Sage, and QuickBooks can integrate with specialised platforms that automatically connect transactions to carbon data, reducing the need for manual spreadsheets.

Audit readiness is another hurdle. Ensure your processes track data completeness, centralise compliance documents, and prepare for external reviews. Providing auditors with easy access to reports and supporting documents can streamline verification.

Set clear goals for improving measurement capabilities - whether by investing in advanced data systems, refining methodologies, or seeking expert advice.

With these steps, organisations can establish robust measurement and disclosure practices while addressing challenges like data integration and audit readiness.

Using Technology for Materiality and Compliance

Technology is reshaping how accounting firms manage materiality assessments for AASB S2 compliance. Instead of relying on manual data entry, modern platforms automate processes and maintain precise audit trails. The goal is to adopt tools that complement your existing systems rather than replacing them entirely. This approach ensures minimal disruption, reduces training requirements, and leverages the financial data you already trust.

Using neoeco for Sustainability Accounting

When it comes to AASB S2 compliance, neoeco simplifies the journey from financial transactions to sustainability reporting. By integrating directly with popular financial tools like Xero, Sage, and QuickBooks, it eliminates the need for entirely new systems. Instead, it builds sustainability data directly from the financial information you already rely on.

One standout feature is its intelligent transaction mapping. Instead of manually categorising expenses or purchases, neoeco automatically links transactions to relevant carbon data and emissions categories. For example, fuel purchases and electricity bills are directly aligned with Scope 1 and Scope 2 emissions.

This automation is particularly valuable for materiality assessments. With detailed insights into a client’s spending on energy, transport, or supply chain activities, you can quickly identify climate-related risks that could significantly impact financial performance.

The platform also includes a user-friendly report builder. In just minutes, you can create professional reports complete with charts, data, and commentary. Reports can be customised with your firm’s branding, ensuring seamless client presentations. Plus, clear audit trails link every figure back to the original financial transaction, making compliance straightforward.

Live dashboards provide real-time updates, allowing you to track progress and share insights instantly. This is especially useful in materiality assessments, where you need to monitor changes in risk profiles or financial impacts as they occur.

neoeco also supports compliance workflows with built-in controls for task tracking, a policy hub for storing documentation, and easy auditor access to reports and supporting evidence. These features eliminate the last-minute rush to gather files when external reviewers arrive.

Designed to work across frameworks like GHGP, SECR, and UK SRS, neoeco ensures your technology investment remains relevant as AASB S2 requirements evolve. Its "one system for all rules" approach integrates smoothly into broader automation efforts, streamlining compliance even further.

Automating Processes with Technology

Beyond platform-specific advantages, automation in general offers huge benefits for materiality assessments. By pulling data directly from financial ledgers, automated systems significantly improve data accuracy, removing the errors and inefficiencies of manual entry.

Real-time dashboards provide early visibility into emerging risks and opportunities, enabling proactive decision-making rather than reactive responses. This kind of instant insight enriches client advisory conversations and enhances the overall assessment process.

Template-based reporting ensures consistency across clients and reporting periods. Standardised formats not only save time but also make internal reviews and external audits more efficient.

Integration is another key benefit. Automated tools that connect with your existing practice management systems, client portals, and financial software create a seamless workflow. Instead of juggling isolated tools, you can manage everything in one cohesive system.

Automation also supports a financially-integrated sustainability management approach, where sustainability metrics are directly tied to financial performance indicators. This connection strengthens materiality assessments by clearly linking climate-related factors to financial outcomes.

For firms exploring sustainability services, automation reduces the learning curve. You can deliver polished, professional results without needing to become experts in sustainability overnight. The technology handles the technical details, freeing you to focus on client relationships and strategic advice.

Finally, automated systems keep you on top of regulatory changes. Instead of manually tracking updates to AASB S2 standards, integrated platforms adapt as requirements evolve, ensuring your assessments stay compliant and up to date. This not only boosts confidence in your processes but also future-proofs your compliance efforts.

Key Takeaways for Accountants

In line with AASB S2, these points outline the critical steps for ensuring compliance. Materiality assessments can be effectively managed by following a structured process and utilising technology.

Main Steps for Materiality Assessment

There are four main steps to conducting a materiality assessment. First, identify risks and opportunities that could impact your client’s operations. These might include physical risks, such as extreme weather events disrupting supply chains, or transition risks, like the financial implications of carbon pricing on operational costs.

Next, quantify the financial impacts these risks and opportunities might have on cash flows, asset values, and overall performance. AASB S2 emphasises the importance of forward-looking disclosures, so consider both short- and long-term effects.

Then, apply the materiality filter. This involves determining which risks and opportunities are significant enough to influence investor decisions. Use professional judgement to evaluate the scale of potential impacts, their likelihood, and the timeframes in which they might occur.

Finally, document your decisions and evidence. Comprehensive records are crucial, especially during audits, as they demonstrate the thoroughness of your assessment. Make sure to log not just your conclusions but also the reasoning and supporting data behind them.

Technology can simplify and enhance these steps, ensuring precision and readiness for audits.

How Technology Supports Future Compliance

Once your materiality assessment is complete, technology helps maintain compliance and simplifies updates. Advanced platforms tailored for accounting firms turn materiality assessments into efficient, data-driven processes. By integrating with financial systems like Xero, Sage, and QuickBooks, these tools eliminate manual data entry while ensuring accuracy.

neoeco, for example, automates mapping and documentation, connecting financial data with sustainability criteria. Its intelligent transaction mapping offers insights into spending patterns, highlighting risks like fluctuating energy costs or transport-related expenses.

The platform also provides audit-ready controls and a policy hub to systematically manage materiality decisions and supporting evidence. Real-time dashboards allow for continuous monitoring of risk profiles and financial impacts, enabling proactive updates to assessments instead of reactive adjustments.

As AASB S2 requirements evolve, platforms like neoeco adapt automatically, reducing administrative workload and ensuring compliance remains seamless. This technology allows you to deliver professional, well-documented results without needing to become an expert in sustainability, freeing you to focus on strengthening client relationships and offering strategic advice.

FAQs

How can businesses identify and prioritise climate-related risks and opportunities to ensure AASB S2 compliance?

To tackle AASB S2 compliance effectively, businesses need to start by examining their operations and financial data to pinpoint areas with notable environmental impact. This means looking at physical risks, such as extreme weather events, alongside transition risks, like evolving regulations or changes in market demand.

A crucial part of this process is conducting materiality assessments. Focus on identifying risks and opportunities that could significantly affect your financial performance, daily operations, or reputation. Collaborating with stakeholders and using advanced tools like neoeco - which connects sustainability data directly to financial systems - can make this process more efficient and precise. By aligning your efforts with established frameworks like GHGP and ISO 14064, you can generate audit-ready reports and position your business for long-term success.

What are the main challenges in assessing the financial impact of climate-related factors, and how can they be managed effectively?

Quantifying the financial effects of climate-related factors is no simple task. The sheer complexity of data, ever-changing regulations, and the unpredictability of future scenarios make it a tough nut to crack. Accountants, in particular, often struggle to source reliable, finance-grade data and ensure it aligns with compliance frameworks like AASB S2.

One way to tackle these hurdles is by using sustainability accounting tools that seamlessly integrate with financial systems. These tools ensure data is not only accurate but also ready for audits. Take platforms like neoeco, for instance. They simplify the process by automatically mapping transactions to recognised emissions categories. This approach eliminates the hassle of manual calculations or juggling spreadsheets. With such tools in place, firms can streamline their compliance efforts, minimise errors, and concentrate on delivering meaningful insights to their clients.

How can technology like neoeco simplify materiality assessments and ensure compliance with AASB S2?

Technology like neoeco simplifies the process of conducting materiality assessments by automating intricate calculations. It links financial transactions directly to established emissions categories, ensuring alignment with frameworks such as the GHGP, ISO 14064, and AASB S2 - all without the need for manual intervention.

With its ability to keep thorough records of every calculation and underlying assumption, neoeco produces audit-ready reports that can stand up to the scrutiny of auditors and regulators. This not only minimises mistakes and saves valuable time but also gives accounting firms greater confidence in their sustainability reporting efforts.