Canada ESG Materiality vs. ISSB Standards

Nov 5, 2025

Explore the complexities of Canada's new ESG standards and their alignment with global ISSB frameworks, focusing on materiality and compliance.

Navigating ESG reporting in Canada and globally just got more complex. With Canada's new sustainability standards (CSDS 1 & 2) coming into effect in January 2025, organisations must now balance local ESG materiality guidelines with the global ISSB standards (IFRS S1 & S2). Both frameworks aim to improve financial disclosures around sustainability, but they differ in timelines, scope, and regional priorities.

Key takeaways:

Canada's CSDS focuses on entity-specific materiality, factoring in local issues like Indigenous rights and biodiversity.

ISSB standards provide a global baseline, prioritising financial materiality with sector-specific guidance.

Canadian companies face extended deadlines (e.g., Scope 3 disclosures by 2027), while ISSB mandates stricter timelines.

Both frameworks require ESG data integration with financial reporting, presenting challenges for multinational firms.

Quick Comparison:

Aspect | Canada CSDS | ISSB Standards |

|---|---|---|

Materiality Approach | Entity-specific, context-driven | Global baseline |

Scope | Primarily single materiality | |

Key Priorities | Indigenous rights, biodiversity | Sector-specific via SASB |

Scope 3 Disclosure | By 2027 | Within 1 year of implementation |

Regulatory Status | Voluntary (mandatory likely soon) | Voluntary but widely adopted |

What this means for you:

Assess materiality using both frameworks to meet local and global requirements.

Align ESG data systems with financial reporting tools to handle compliance across jurisdictions.

Use Canada's longer transition periods to prepare robust systems while meeting stricter ISSB deadlines elsewhere.

Understanding these frameworks is essential for staying compliant and maintaining access to global capital markets.

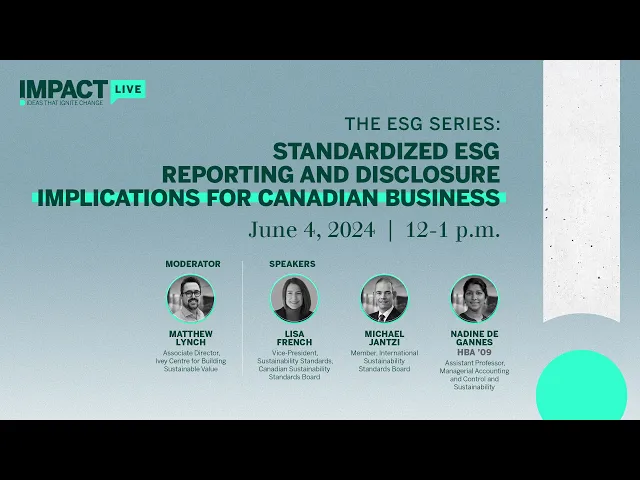

Impact Live: Standardized ESG reporting and disclosure | Implications for Canadian business | Event

Canada ESG Materiality Guidelines

Canada has outlined its ESG reporting approach through the Canadian Sustainability Disclosure Standards (CSDS 1 & 2), which come into effect on 1 January 2025. These standards aim to balance global best practices with Canada's specific environmental and social priorities, creating a tailored framework for ESG reporting.

Key Elements of Canadian ESG Guidelines

The CSDS 1 & 2 serve as Canada's primary ESG reporting framework, aligning closely with the ISSB's IFRS S1 and S2 standards but with adjustments to reflect Canada's unique context. A key feature of these standards is their focus on entity-specific materiality. This means that companies must evaluate materiality based on their own operations, risks, and value chains, rather than relying on generic benchmarks.

The Canadian Sustainability Standards Board (CSSB), established in June 2022, plays a pivotal role in ensuring these standards align globally while incorporating Canadian priorities. These include issues like Indigenous rights and biodiversity conservation. The framework also integrates SASB standards to ensure relevance across different sectors. For organisations aiming to merge sustainability and financial reporting, platforms such as neoeco offer solutions to streamline compliance with both CSDS and international requirements.

By combining global alignment with local priorities, these guidelines lay the groundwork for more stringent regulatory oversight, which is explored in the next section.

Regulatory Landscape and Enforcement in Canada

Although CSDS reporting is currently voluntary, Canadian securities laws already require disclosure of material risks, suggesting that mandatory ESG reporting may not be far off. The Canadian Securities Administrators (CSA) are expected to enforce these standards in future.

Existing measures like Bill C-59 and the green procurement policy (applicable to contracts worth CA$25 million or more) already promote accurate ESG disclosures. These measures also include mandatory reporting on board and management diversity. Enforcement is primarily handled by securities regulators, and it is anticipated that future mandatory requirements will further enhance oversight.

Such regulatory developments underline the importance of custom approaches for high-impact sectors, which are discussed below.

Sector-Specific Considerations in Canada

Canada’s ESG framework provides tailored guidance for industries with significant environmental and social impacts, particularly the mining and energy sectors. These industries face intricate value chains and evolving regulations, requiring detailed data collection and robust stakeholder engagement.

To support sustainable growth, Canada is working on a green and transition taxonomy, designed to identify sustainable economic activities and attract private capital to these sectors. Additionally, the CSDS offers extended transition periods compared to ISSB standards, such as a three-year grace period before Scope 3 emissions reporting becomes mandatory.

ISSB Standards: Materiality and Disclosure Requirements

When comparing global and Canadian ESG reporting frameworks, it’s crucial to grasp the ISSB's approach. Through IFRS S1 and S2, the ISSB framework reshapes global ESG reporting by introducing detailed requirements that prioritise investor-focused information with a direct impact on enterprise value.

Core Principles of ISSB Standards

The ISSB framework is built around a single materiality principle. This means companies are required to disclose ESG information only if it could reasonably influence investor decisions or affect financial performance. This approach differs from frameworks like the Global Reporting Initiative (GRI) and the Corporate Sustainability Reporting Directive (CSRD), which use a double materiality lens, considering both financial impacts and broader societal effects.

The ISSB takes inspiration from the Task Force on Climate-related Financial Disclosures (TCFD), employing a four-pillar structure for climate-related risks and disclosures. It also incorporates guidance from the Sustainability Accounting Standards Board (SASB) to simplify reporting and avoid redundancy. By focusing on decision-useful information, the framework helps companies identify which ESG issues are financially material to their operations while ensuring global comparability. These principles lay the groundwork for the specific disclosure requirements outlined below.

Disclosure Requirements under ISSB Standards

Under the ISSB framework, companies must provide disclosures across four key areas: governance, strategy, risk management, and sustainability metrics and targets. These disclosures integrate ESG data with financial reporting to ensure they are audit-ready. The initial emphasis is on climate-related disclosures under IFRS S2, but IFRS S1 extends the scope to include all sustainability-related financial information. Consistent reporting boundaries and timelines are required, ensuring that ESG data is transparently linked to financial performance.

Organisations are expected to report on both current material impacts and forward-looking analyses. To ease the complexity of this integration, automated tools are increasingly being utilised. For example, platforms like neoeco's ISSB reporting solution provide automated systems that consolidate financial and sustainability data while ensuring compliance with IFRS S1 and S2.

Global Adoption and Implementation Trends

Starting 1st January 2024, more than 20 jurisdictions - including the UK, EU, Australia, Canada, Japan, and Singapore - will adopt ISSB-aligned standards, covering over 55% of global GDP. The framework enjoys strong support, with 78% of surveyed asset managers endorsing it, highlighting the growing demand for consistent and reliable ESG data to guide investment decisions.

This widespread support is fostering regulatory alignment, with ISSB standards becoming the foundation for many national reporting frameworks. In Canada, the Canadian Sustainability Standards Board (CSSB) has tailored ISSB requirements to local needs by introducing transitional measures. These include extended timelines of up to three years for Scope 3 emissions reporting and delayed quantitative scenario analysis. These adjustments reduce the implementation burden while keeping Canada aligned with the global baseline. As a result, multinational companies and asset managers adopting ISSB standards report better data quality and stronger engagement with stakeholders.

Canada ESG Materiality vs ISSB Standards Comparison

Examining how Canada's ESG materiality guidelines compare to ISSB standards reveals areas of both alignment and divergence, creating opportunities and challenges for organisations operating across different jurisdictions. Three key areas stand out where these differences and similarities influence reporting strategies.

Materiality Definitions and Scope Comparison

Both frameworks adopt a financial materiality approach, but their implementation methods differ significantly.

The Canadian Sustainability Disclosure Standards (CSDS) define materiality as entity-specific and context-driven, meaning companies must evaluate materiality based on their unique operations and value chain rather than relying on generic thresholds. On the other hand, the ISSB provides a global baseline that incorporates sector-specific guidance from SASB, covering 77 industries. Canadian companies are therefore required to balance local context with global comparability.

Aspect | Canada CSDS | ISSB Standards |

|---|---|---|

Approach | Entity-specific context | Global baseline |

Stakeholder Focus | Investors, regulators, financial markets | Investors, regulators, financial markets |

Sector Guidance | Canadian priorities, e.g., Indigenous rights | 77 industries via SASB integration |

Scope Coverage | Single materiality | Primarily single materiality |

While both frameworks share a focus on financial materiality, Canadian companies must also navigate sector-specific expectations, particularly during the transition as CSDS adapts ISSB standards for Canadian circumstances. This dual focus adds complexity, especially for multinational organisations managing local and global requirements simultaneously.

Disclosure and Compliance Requirements Comparison

The regulatory frameworks differ notably in timelines and enforcement mechanisms. As of 2025, CSDS remains voluntary but is expected to become mandatory for large Canadian companies, with smaller firms encouraged to participate voluntarily. Meanwhile, ISSB standards, though voluntary at the global level, are rapidly being adopted as mandatory by over 20 jurisdictions.

CSDS offers longer transition periods for certain disclosures compared to the ISSB's tighter timelines. For instance, under CSDS, Scope 3 emissions disclosures are deferred until fiscal years starting on or after 1 January 2027. In contrast, the ISSB requires Scope 3 disclosures within just one year of implementation.

Enforcement also varies. Canadian securities regulators will enforce CSDS once it becomes mandatory, while material ESG risks are already governed by existing securities laws. The ISSB relies on local regulators for adoption and enforcement, leading to a patchwork of approaches globally.

For multinational organisations, this means they may need to report Scope 3 emissions earlier in jurisdictions like the UK or EU than in Canada. This requires adaptable data systems and phased reporting strategies. Mapping out jurisdiction-specific requirements and timelines is crucial to ensure compliance across borders. These differences in timelines and enforcement directly impact the integration of ESG data with financial reporting.

ESG Data Integration into Financial Reporting

Both CSDS and ISSB require organisations to integrate ESG disclosures with financial statements, ensuring consistency in reporting entities and timelines. This creates significant challenges for multinational companies, especially those juggling local CSDS requirements alongside global ISSB standards.

To meet these demands, organisations need robust systems capable of aligning sustainability metrics with traditional financial reporting. Key obstacles include fragmented data systems and the complexity of adhering to multiple frameworks simultaneously.

Platforms like neoeco simplify this process by providing unified, audit-ready disclosures that comply with both ISSB and CSDS standards. These tools eliminate data silos and create a single source of truth, meeting the growing expectations of auditors and regulators.

Additionally, ESG data must meet the same standards of accuracy and verification as financial data. Companies that invest early in integrated ESG-financial management systems will be better prepared for the evolving regulatory environment and positioned to stay ahead in compliance efforts.

Alignment Strategies for Global Teams

As Canadian and ISSB standards increasingly align, global teams need to adjust their reporting methods to meet the demands of both frameworks. This requires tackling jurisdiction-specific challenges while ensuring cohesive ESG reporting strategies.

Conducting Dual Materiality Assessments

Understanding how materiality is defined by both frameworks is the first step in conducting effective dual materiality assessments. The Canadian ESG guidelines (CSDS) focus on entity-specific, context-driven assessments, urging companies to evaluate materiality based on their operations and value chain rather than generic benchmarks. On the other hand, ISSB offers a global baseline, incorporating sector-specific guidance from SASB.

To start, engage stakeholders to identify ESG issues that impact both financial performance and broader societal interests. For Canadian companies, this means considering local factors like Indigenous rights, which the Canadian Sustainability Standards Board (CSSB) is actively integrating into sustainability reporting.

Take, for example, a Canadian energy company. It might identify climate-related risks affecting financial outcomes (addressed by both CSDS and ISSB) while also consulting local Indigenous communities to understand social impacts. This dual lens not only ensures compliance but also builds trust with stakeholders.

Regularly reviewing and updating materiality assessments is crucial. As risks and regulations evolve, periodic evaluations help organisations stay ahead. These assessments also lay the groundwork for integrating ESG data into financial systems, ensuring a seamless connection between the two.

Tools for ESG-Finance Integration

Once materiality assessments are clearly defined, the next step is integrating ESG considerations into financial systems. This integration is often one of the toughest challenges for global teams working across multiple frameworks. Both CSDS and ISSB require organisations to align ESG disclosures with financial statements, ensuring consistency in timelines and reporting entities.

neoeco offers a solution with its Financially-integrated Sustainability Management (FiSM) platform. This tool connects finance and sustainability data, consolidating everything into a single system. By linking directly to established financial platforms like Xero, Sage, QuickBooks, Business Central, and SAP, it builds sustainability data from reliable financial sources. This eliminates data silos that can hinder effective ESG reporting.

The FiSM platform also uses AI-driven automation and Life Cycle Assessment (LCA) to provide real-time insights across environmental, social, and governance categories. This is particularly useful for managing the varying timelines between Canadian and ISSB requirements. For instance, Canada allows extended deadlines for Scope 3 emissions reporting until fiscal years beginning on or after 1 January 2027, whereas other jurisdictions may require these disclosures much sooner.

With audit-ready controls, the platform ensures that ESG data meets the same accuracy and verification standards expected of financial data. For organisations navigating ISSB reporting, tools like these are essential for managing multiple regulatory requirements while maintaining a single source of truth. Once the data is unified, the focus shifts to addressing regional and sector-specific challenges.

Managing Regional and Sector-Specific Challenges

Global teams must navigate the distinct differences between Canadian and ISSB frameworks, particularly around effective dates and transitional reliefs. Canada’s longer transition periods for certain disclosures contrast with ISSB’s tighter timelines, requiring organisations to manage parallel reporting tracks and phased implementation plans.

To address this, organisations should identify missing data points for each framework, prioritise high-impact areas, and roll out targeted data collection initiatives. This ensures they meet current requirements while preparing for future standards.

Cross-functional training is another critical step. Develop tailored training programmes that cover the nuances of both frameworks, create ESG working groups across departments, and provide regular updates on regulatory changes. Scenario-based workshops and e-learning modules can help teams grasp practical implications, while strong leadership involvement ensures alignment with overall organisational goals.

Sector-specific challenges add further complexity. While Canadian guidelines often emphasise local priorities, ISSB incorporates sector-specific advice through SASB standards. Organisations should collaborate with industry associations, use this guidance, and adopt digital tools to automate data collection for metrics relevant to their sector.

Robust data governance is essential. Policies should meet the requirements of both frameworks, using tools for data validation, maintaining clear audit trails, and conducting regular internal audits. Establishing a centralised ESG governance structure and seeking expert advice where needed can help organisations navigate evolving regulations and sector-specific expectations.

A harmonised reporting calendar is key to success. By accounting for varying transitional reliefs and requirements across jurisdictions, organisations can maintain compliance, avoid duplicated efforts, and ensure consistent data quality across all their reporting obligations.

Key Takeaways and Future Outlook

The comparison between Canada's ESG materiality guidelines and ISSB standards highlights a growing trend towards global alignment, with room for regional customisation. For organisations gearing up for the next stage of sustainability reporting, understanding these frameworks and their ongoing developments is crucial.

Main Comparison Points Summary

Here’s a look at the key similarities and differences: Both Canada's CSDS and ISSB standards are rooted in financial materiality, defining material information as anything that could influence investment or lending decisions, or impact a company’s cash flow or access to capital. The main distinction lies in how these standards are rolled out and adapted regionally.

Canada offers extended transitional reliefs - up to three years for Scope 3 emissions and scenario analysis - compared to the stricter timelines under the ISSB framework. This gives Canadian organisations more breathing room to build internal capacity while preparing for global alignment.

Starting from 1 January 2025, CSDS 1 and CSDS 2 will align closely with ISSB's IFRS S1 and S2 standards, with adjustments to address Canadian public interest needs. While currently voluntary, the Canadian Securities Administrators are considering making these standards mandatory for publicly listed companies.

Recommendations for Organisations

To get ahead of the curve, organisations should consider these steps:

Conduct a materiality assessment: Identify ESG factors that affect both financial performance and broader stakeholder interests.

Adopt integrated technology platforms: Choose systems that connect ESG metrics directly to financial data. Tools like Xero, Sage, QuickBooks, Business Central, and SAP can help eliminate data silos, enabling smoother, more accurate reporting.

Invest in cross-functional training: Build expertise across teams by offering training on both CSDS and ISSB standards. Form ESG working groups to ensure departments stay informed about regulatory updates and their practical implications.

Strengthen data governance: Implement policies that meet the requirements of both frameworks. Use tools for data validation, maintain clear audit trails, and conduct regular internal audits. A centralised ESG governance structure with expert support can help navigate complex regulations and sector-specific challenges.

Use transitional reliefs wisely: For example, Canadian government suppliers bidding on contracts over £19.7 million must disclose GHG emissions and set reduction targets (as of April 2023). Use the extended timelines to build thorough systems instead of rushing compliance.

These steps will help organisations prepare for the shifting regulatory landscape.

Future Regulatory Trends Monitoring

Organisations that follow these recommendations will be better equipped for upcoming changes. Expect mandatory reporting to expand, starting with large financial institutions in Canada. By 2024, large Canadian banks, insurance companies, and federally regulated financial institutions will likely face mandatory ESG reporting aligned with ISSB standards.

Canada’s move from voluntary to more structured sustainability reporting reflects a broader push for transparency as a pillar of corporate accountability. Future changes may include phased mandatory climate-related disclosures for large companies and deeper alignment of CSDS with ISSB standards.

Additionally, Canadian regulators are expected to require mandatory assurance and third-party validation of ESG data. Organisations should prepare by establishing audit-ready controls and documentation processes similar to those used in financial reporting.

To stay ahead, subscribe to updates from regulatory bodies like the CSSB and ISSB, join industry groups, and leverage advisory services for early insights. Regular scenario planning and benchmarking against peers can further support proactive adaptation to new standards.

FAQs

How do Canada’s Sustainability Disclosure Standards (CSDS) address Indigenous rights and biodiversity compared to the ISSB standards?

While there isn't much detailed information yet on how the Canadian Sustainability Disclosure Standards (CSDS) specifically tackle Indigenous rights and biodiversity compared to the ISSB standards, it's clear that the CSDS framework is likely to highlight Canada's unique priorities. This approach will likely include a focused consideration of Indigenous communities and biodiversity, aligning closely with the nation's environmental and social goals.

For organisations aiming to meet global standards like ISSB while also addressing region-specific concerns such as Indigenous rights, tools like neoeco can be invaluable. These platforms help integrate sustainability and financial data, ensuring compliance with both international guidelines and local requirements.

What challenges do multinational companies face when aligning ESG data with financial reporting under CSDS and ISSB standards?

Multinational companies face several obstacles when trying to integrate ESG data with financial reporting under frameworks like the CSDS and ISSB standards. A key challenge is dealing with differing definitions of materiality across various jurisdictions. These differences can create inconsistencies in reporting requirements and complicate data collection processes, especially for organisations operating in multiple regions with varying regulatory demands.

Another significant issue is aligning ESG metrics with traditional financial data. Sustainability data is often qualitative or fragmented, making it difficult to merge with the more quantitative structure of financial reporting. To bridge this gap, companies often need to invest heavily in tools and systems capable of unifying these two distinct data streams.

Solutions like neoeco offer a way to tackle these challenges. By automating ESG data integration and ensuring adherence to global standards like ISSB (IFRS S1 & S2), such platforms streamline the process. Using AI and Life Cycle Assessment methodologies, they deliver real-time, audit-ready insights, simplifying reporting and improving collaboration across teams.

How could Canadian companies benefit from the longer transition periods under CSDS compared to the tighter timelines of ISSB standards?

Canadian companies may appreciate the extended transition periods provided by the Canadian Sustainability Disclosure Standards (CSDS). These longer timelines offer organisations extra breathing room to fine-tune their ESG reporting processes. For businesses unfamiliar with global standards like the ISSB (IFRS S1 & S2), this gradual approach can make it easier to develop the necessary infrastructure and build expertise over time.

This extended period also creates an opportunity to better integrate sustainability data with financial reporting systems. By aligning these processes, companies can ensure they meet compliance requirements without sacrificing the quality of their disclosures. Tools such as neoeco can play a key role here, simplifying ESG reporting, ensuring alignment with multiple frameworks, and delivering real-time insights into sustainability performance.