5 Common TCFD Reporting Mistakes to Avoid

Jan 6, 2026

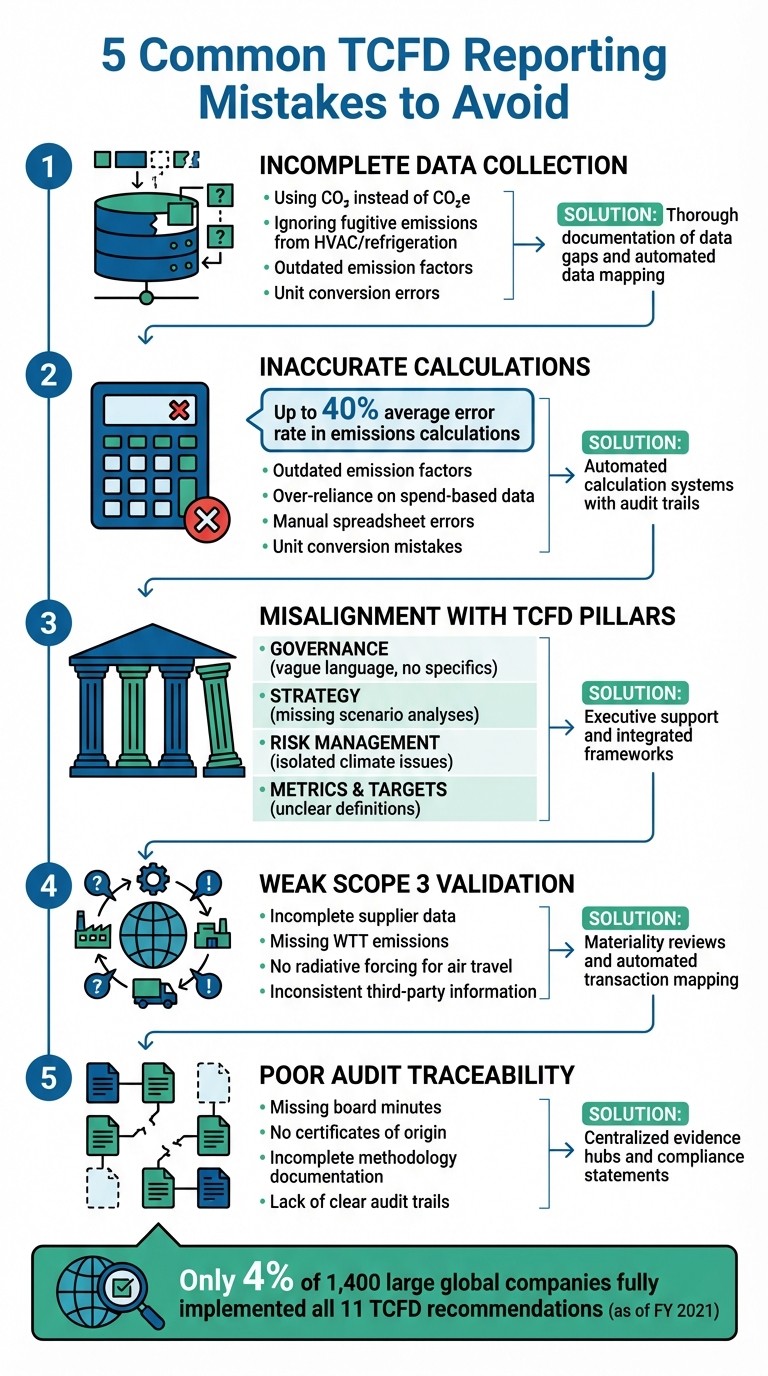

Five common TCFD reporting pitfalls — incomplete Scope 1‑3 data, calculation errors, weak supplier validation, misaligned governance and poor audit traceability.

Failing to meet TCFD standards can damage credibility, invite regulatory scrutiny, and risk non-compliance. Here's what you need to know to avoid the five most frequent mistakes in TCFD reporting:

Incomplete Data Collection: Many reports fail to gather accurate emissions data across all three scopes, especially Scope 3. Common errors include using CO₂ instead of CO₂e and outdated emission factors.

Inaccurate Calculations: Mistakes in emission factors, reliance on spend-based estimates, and manual spreadsheet errors can lead to significant inaccuracies.

Misalignment with TCFD Pillars: Reports often treat TCFD's Governance, Strategy, Risk Management, and Metrics & Targets as a checklist, missing the depth and integration required.

Weak Scope 3 Validation: Supplier data is often incomplete or inconsistent, undermining the reliability of Scope 3 disclosures.

Poor Audit Traceability: Lack of documentation and audit trails can lead to compliance issues and regulatory rejection.

To address these issues, focus on thorough data collection, accurate calculations, aligning with TCFD's pillars, validating supplier data, and maintaining clear audit trails. Tools like neoeco can simplify processes by automating data mapping, ensuring compliance, and improving reporting accuracy.

5 Common TCFD Reporting Mistakes and How to Avoid Them

5 Steps to Reporting Climate Risks Using TCFD Standards Like a Pro!

1. Incomplete Data Collection Across Scopes

Incomplete emissions data is a common stumbling block for TCFD compliance. According to the FCA, the biggest reporting gaps are found in quantitative areas - especially metrics and targets - that rely on thorough data collection across all three scopes. This is particularly problematic for Scope 3 reporting, where activity-based data is often missing.

Scope 3 remains the toughest nut to crack. One frequent issue is reporting CO₂ figures instead of CO₂e (carbon dioxide equivalent), which fails to account for other greenhouse gases with much higher warming potential. Another common oversight is ignoring fugitive emissions from HVAC or refrigeration systems, even though some fluorinated gases have a global warming potential thousands of times greater than carbon dioxide.

Technical errors add to the complexity. These include using outdated emission factors, making unit conversion mistakes (like recording flights in miles but applying kilometre-based factors), and failing to reference standard methodologies such as the GHG Protocol or ISO 14064. Many firms also underestimate the time required to align emissions data with financial reporting cycles, often starting too late to provide audit-ready evidence.

Thoroughly document any data gaps. If certain details - like energy usage in shared office spaces - are unavailable, firms must clearly outline the exclusions, assumptions, and estimation methods used. Transparent documentation is a must under "comply or explain" requirements, as regulators may demand full details of the data preparation process to evaluate compliance. Without proper traceability, even well-meaning reports can draw regulatory scrutiny and erode investor confidence. Clear documentation not only supports compliance but also creates a stronger audit trail, linking data challenges to actionable solutions.

Platforms like neoeco simplify this process by mapping transactions to recognised emissions categories (GHGP, ISO 14064). By automating data mapping, neoeco addresses technical errors and documentation gaps, reducing manual mistakes and ensuring that Scope 1, 2, and 3 data are collected with the same precision as financial records.

2. Inaccurate Emissions Calculations and Assumptions

Even with access to complete data, errors in calculations and reliance on flawed assumptions can jeopardise compliance with TCFD standards. Research indicates that executives from global corporations estimate an average error rate of up to 40% in their emissions calculations.

One common issue is the use of outdated or incorrect emission factors. For example, applying generic diesel factors to petrol vehicles or failing to update factors annually - such as those provided by the latest EPA or NGER Measurement Determinations - can lead to inaccuracies. Another frequent problem is the over-reliance on spend-based data vs activity-based measurements. While spend-based estimates are easier to derive from financial records, they are less precise than activity-based data, such as litres of fuel used or kWh consumed. This approach often overlooks efficiency improvements. In fact, in 2024, the Manufacturing Technology Centre discovered that its initial Scope 3 emissions were underreported by 410% after switching from basic utility bill calculations to a comprehensive carbon accounting system that incorporated materials, transport, and fugitive emissions.

Manual processes further complicate these calculations. Using spreadsheets introduces risks like unit conversion errors - such as recording flight distances in miles but applying kilometre-based factors - or misplaced decimals, which can significantly distort results. Misinterpretations of boundaries also create challenges, particularly when organisations fail to differentiate between operational control, financial control, and equity share. This can result in double-counting or the omission of certain emissions entirely.

The consequences of these errors are far-reaching, as highlighted by industry leaders:

"Getting emissions data right is tough, but the cost of getting it wrong is higher. Regulators, investors, customers, and the general public are increasingly demanding credible, transparent climate disclosures."

– Maddy Osswald, Vice President of Operations, Sustainability, KERAMIDA Inc.

To meet the TCFD’s Principle 6, which mandates disclosures to be reliable, verifiable, and objective, it is crucial to document every assumption, conversion factor, and methodology used. Creating a metadata audit trail for each entry - detailing its source, method, timestamp, and owner - is essential. Tools like neoeco can help eliminate manual errors by automatically mapping financial transactions to recognised emissions categories under GHGP and ISO 14064. These platforms ensure that conversion factors are up-to-date and calculations are audit-ready, supporting the rigorous standards required for TCFD reporting.

3. Misalignment with TCFD's Four Pillars

After tackling challenges in data collection and calculations, organisations face another hurdle: aligning their reports with the TCFD framework. This framework revolves around four key pillars - Governance, Strategy, Risk Management, and Metrics & Targets. Each pillar outlines how organisations should address climate-related risks and opportunities. In the UK, compliance with the FCA Listing Rules and the Climate-related Financial Disclosure Regulations mandates large entities to report specifically under these categories. However, many reports still fall short, often treating the TCFD framework as a simple checklist instead of a strategic tool.

Governance

Disclosures under this pillar often rely on vague, generic language, failing to detail specific governance processes. For example, companies might omit critical information such as how frequently the board reviews climate-related issues or who is directly responsible for overseeing progress. This lack of specificity raises questions about the robustness of their oversight.

Strategy

In the Strategy section, many reports neglect to include quantitative scenario analyses or fail to explain how climate risks could influence financial planning over different time horizons - short, medium, and long term. The FCA has flagged these omissions, identifying them as some of the most common gaps in reporting.

Risk Management

The Risk Management pillar emphasises the integration of climate risks into the organisation's overall risk framework. Yet, some companies isolate climate issues as standalone sustainability concerns rather than treating them as material financial risks. This siloed approach signals to investors that climate risks are not being prioritised appropriately.

Metrics & Targets

Clear, measurable data is critical under the Metrics & Targets pillar. This includes reporting Scope 1, Scope 2, and, when relevant, Scope 3 emissions. Additionally, organisations must define terms like "net zero" or "carbon neutral" and set interim targets to avoid accusations of greenwashing. By addressing these areas, reports can move beyond mere compliance and provide a genuine reflection of climate-related risks.

"If the entity's annual report does not include a compliance statement, then entities should not be using language such as 'aligned' or 'supported'."

– Financial Conduct Authority (FCA)

To achieve full alignment, companies need to secure executive-level support, assign clear responsibilities to risk and audit committees, and ensure internal reviews accurately reflect their disclosures. For organisations aiming to integrate climate data with financial reporting, tools like neoeco offer audit-ready solutions that adhere to recognised frameworks such as GHGP and ISO 14064, ensuring compliance across all four TCFD pillars.

4. Weak Supplier and Scope 3 Data Validation

After overcoming challenges in data collection and calculation, the next hurdle is validating supplier and Scope 3 data. These emissions - produced across a company’s value chain - typically make up the largest share of a business’s carbon footprint. Yet, they are notoriously difficult to verify. The Financial Reporting Council (FRC) has flagged Scope 3 metrics and targets as a key area of focus for the 2024/2025 reporting period, emphasising that limited data access often compromises the quality of disclosures. Without solid supplier data validation, businesses face the risk of audit issues and increased regulatory scrutiny. This highlights just how important rigorous supplier validation processes are.

The main challenge stems from inaccuracies in third-party data. Suppliers, landlords, and travel agents often provide incomplete or inconsistent information - such as reporting only CO₂ instead of CO₂e, neglecting radiative forcing (RF) for air travel, or excluding "well-to-tank" (WTT) emissions for fuel. These omissions significantly undermine the reliability of the data. For instance, when external data is submitted, accountants must ensure it includes WTT emissions and transmission and distribution (T&D) losses to guarantee it paints a complete picture. Taking these extra steps ensures that reports are not only comprehensive but also audit-ready.

To establish effective verification processes, start with a materiality review to pinpoint carbon hotspots within the supply chain. Assigning responsibility to risk committees for evaluating climate risks across the value chain is another crucial step. When supplier data is incomplete or unavailable, document the assumptions, estimates, and reasoning behind any omissions. This level of transparency helps meet regulatory expectations. Additionally, synchronising supplier data collection with financial reporting cycles ensures consistency and accuracy.

For organisations managing data across multiple clients, platforms like neoeco simplify the process by automatically mapping transactions to recognised emissions categories under GHGP and ISO 14064 standards. These tools eliminate the need for manual conversions, minimise formula errors, and consolidate all data into a single, reliable source. By moving away from fragmented, spreadsheet-based systems, companies can streamline their reporting and produce audit-ready evidence with greater confidence.

5. Poor Audit Traceability and Missing Evidence

Even if emissions data aligns perfectly with the TCFD's four pillars, a lack of proper documentation can undermine the entire report. Without a clear and verifiable audit trail, confirming the accuracy of figures becomes nearly impossible. This leaves organisations exposed to regulatory scrutiny and potential compliance issues. This challenge isn't limited to carbon metrics; it also applies to governance records, risk assessments, and outputs from scenario analyses. The need for thorough documentation ties into broader requirements discussed in related contexts.

The Greenhouse Gas Protocol underscores this with its principle of Transparency, which calls for firms to "address all relevant issues in a factual and coherent manner, based on a clear audit trail". Yet, many organisations fall short in maintaining complete records. For example, regulators like the FCA might demand reconciliation of compliance statements with disclosures, along with detailed supporting documents outlining preparation processes. Missing records - such as board minutes documenting climate discussions or certificates of origin for green tariff electricity - can lead to regulatory rejection or requests for additional information.

Good evidence management begins with documenting methodologies and boundaries. Firms need to specify whether they used operational or financial control when setting boundaries, identify which emission factors were applied, and outline any assumptions or omissions made during the process. Many standards recommend a significance threshold of ±5% for structural changes, such as acquisitions or divestments, that require recalculating the base year. Additionally, fugitive emissions from f-gases, which can have a global warming potential thousands of times higher than carbon dioxide, make it critical to maintain detailed maintenance records.

To ensure traceability, assign clear roles and document the competencies of those involved in data collection and processing. Implement dual reporting for green tariff electricity - covering both market-based and location-based factors - and secure certificates of origin as evidence. A compliance statement, signed by a senior management member, should confirm the report’s accuracy and adherence to requirements.

For firms looking to simplify these processes, modern platforms can consolidate documentation needs. For instance, tools like neoeco offer audit-ready controls, live progress tracking via checklists, centralised storage in a Policy & Evidence Hub, secure auditor access, and the ability to replace manual workflows with automated systems. These solutions are particularly helpful for organisations managing multiple clients, ensuring streamlined and reliable evidence management.

How Accountants Can Avoid These Mistakes

With the UK transitioning from voluntary to mandatory TCFD-aligned reporting, accountants can no longer rely solely on spreadsheets to meet compliance demands. By November 2022, over 4,000 organisations worldwide had pledged support for the TCFD, representing a combined market value of US$27 trillion. Yet, a review of 1,400 large global companies revealed that as of fiscal year 2021, only 4% had fully implemented all eleven TCFD recommendations. This gap between intent and execution highlights the need for specialised tools that simplify compliance, reduce errors, and allow accountants to focus on higher-level strategic tasks. Moving to digital platforms not only eliminates manual mistakes but also enables advanced validation processes and smoother reporting workflows.

Modern sustainability accounting platforms are designed to address these challenges by automating data collection, embedding compliance requirements, and maintaining thorough audit trails. For example, tools like neoeco integrate seamlessly with accounting software such as Xero, Sage, and QuickBooks. By mapping transactions to recognised emissions categories under GHGP and ISO 14064, these platforms ensure accurate and consistent tracking of Scope 1, 2, and 3 emissions directly from the ledger, avoiding reliance on cumbersome spreadsheets.

For firms managing multiple clients, these platforms offer automated validation checks to catch calculation errors early, well before the audit stage. Built-in TCFD templates ensure all four pillars - Governance, Strategy, Risk Management, and Metrics & Targets - are thoroughly addressed. Generative AI further streamlines the process by drafting responses based on prior disclosures, ensuring consistency and compliance. These innovations can cut reporting timelines by up to 70%, giving accountants more time to focus on strategic advisory roles.

Additionally, these platforms provide comprehensive logs that track every change, user, and data source. Features like neoeco’s Policy & Evidence Hub centralise document storage, offer live checklists to monitor task progress, and enable secure auditor access. This eliminates the need for endless email exchanges, replacing them with a single, reliable system for verification. By creating a transparent and verifiable audit trail, these tools address traceability concerns through audit trail automation. For accountants aiming to venture into financially-integrated sustainability management, such platforms bridge the gap between finance and sustainability without disrupting existing workflows.

Conclusion

The five pitfalls discussed - incomplete data collection, inaccurate calculations, misalignment with TCFD's four pillars, weak Scope 3 validation, and poor audit traceability - can seriously jeopardise both compliance efforts and organisational credibility. With the UK leading the way as the first G20 nation to mandate TCFD-aligned disclosures, over 1,300 major UK companies and financial institutions are now under scrutiny. Regulatory bodies like the Financial Reporting Council (FRC) and Financial Conduct Authority (FCA) are tightening their oversight of metrics, targets, and net-zero commitments for the 2024/25 reporting periods.

"The assessment of own compliance was sometimes inadequate, particularly when disclosures are limited in content." - Financial Conduct Authority (FCA)

Technology offers a powerful solution. Platforms designed to automate data collection and maintain traceable ESG data systems make compliance more manageable and reliable. Currently, 60% of the world's 100 largest public companies either support TCFD recommendations or report in alignment with them. This trend reflects a growing commitment to combining financial precision with sustainable practices. Tools like neoeco are bridging these gaps by integrating financial and sustainability data, ensuring organisations are prepared for audits and regulatory reviews.

However, technology alone isn’t enough. Internal coordination plays a vital role. Establishing a cross-functional task force that connects finance, risk, and sustainability teams can help maintain consistent and accurate data across the organisation. Additionally, documenting reporting boundaries and implementing a base-year recalculation policy for events like mergers or acquisitions can further enhance the quality of disclosures. By adopting these strategies, your TCFD report won’t just meet regulatory standards - it will also help build trust with stakeholders.

FAQs

What’s the best way to ensure my TCFD report aligns with the four key pillars?

To make sure your TCFD report meets the four key pillars – Governance, Strategy, Risk Management, and Metrics & Targets – focus on presenting clear, well-supported, and interconnected information.

For Governance, outline how your board takes responsibility for climate-related issues. Be specific about how often these matters are discussed and how they influence decisions like executive pay and capital investments. When addressing Strategy, explain how climate risks and opportunities affect your business in the short, medium, and long term. Use scenario analysis to demonstrate how these factors guide your strategic planning. Under Risk Management, integrate climate-related risks into your current risk frameworks. Assign clear ownership and ensure regular monitoring to track progress. Finally, for Metrics & Targets, rely on established standards like the GHG Protocol to measure emissions. Set specific, measurable goals and report on your progress with full transparency.

Leveraging a sustainability platform that connects seamlessly with your financial data can make this process more efficient. These tools can automate emissions tracking and provide audit-ready disclosures, helping you stay compliant and build trust while reducing the risk of reporting errors.

How can we improve the accuracy of Scope 3 emissions reporting?

To ensure your Scope 3 emissions reporting is as precise as possible, approach it with the same diligence you would apply to financial reporting. Start by using a recognised framework, like the GHG Protocol or ISO 14064-1, and stick to key principles such as relevance, completeness, and accuracy. Centralising your data in a single, audit-ready system - integrated with your accounting software - can significantly reduce manual errors and ensure transactions are correctly aligned with emissions categories, such as those outlined in the UK SRS.

Work closely with your suppliers from the outset to collect primary data, which helps reduce dependence on generic emission factors. Be sure to document any assumptions or estimates clearly. Regularly cross-check financial data with emissions calculations, and update conversion factors whenever necessary. To further strengthen your reporting, consider independent verification or conducting an internal audit to meet TCFD and SECR requirements. This approach will not only improve data quality but also reduce errors and increase trust in your reports.

Why is audit traceability important for TCFD compliance, and how can it be enhanced?

Audit traceability plays a key role in meeting TCFD compliance by establishing a transparent and verifiable link between financial data and climate-related disclosures. This connection not only boosts the trustworthiness of reports but also ensures organisations meet regulatory expectations with solid, audit-ready documentation.

To enhance audit traceability, companies can adopt integrated tools that centralise and automate data collection. These tools simplify the process by aligning financial transactions with recognised emissions categories and standardised frameworks, enabling precise and reliable sustainability reporting at a finance-grade level.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.