Ultimate Guide to ESG Stakeholder Prioritisation

Jan 7, 2026

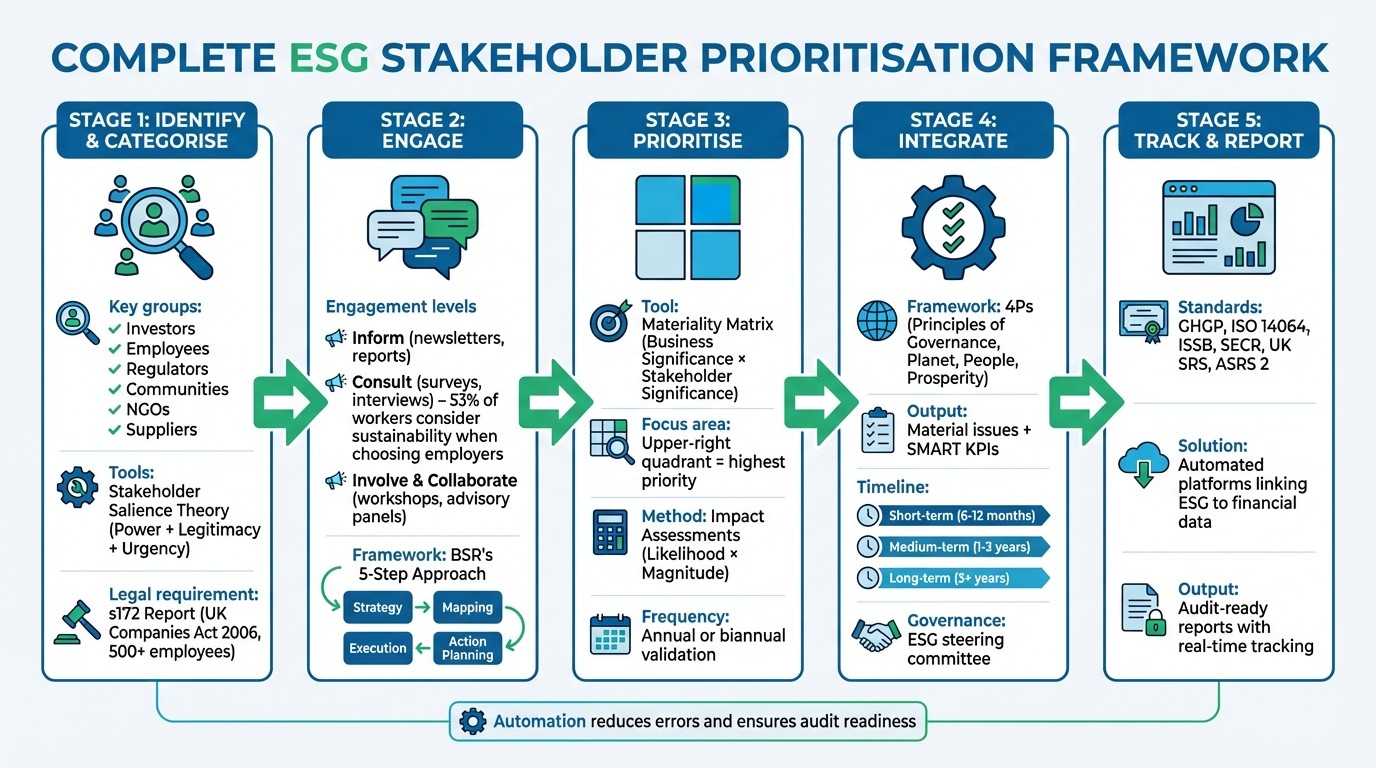

A practical 5-step guide to identify, engage and prioritise ESG stakeholders, set material KPIs and automate audit-ready reporting.

Prioritising ESG stakeholders helps organisations focus on what matters most. By identifying key groups like investors, employees, regulators, and communities, businesses can align their goals with societal needs and regulatory standards. This process ensures resources are directed towards issues that have the greatest impact on business performance and stakeholder concerns.

Key takeaways:

What it is: ESG stakeholder prioritisation ranks concerns across environmental, social, and governance areas.

Why it matters: It improves resource allocation, compliance, and trust with stakeholders.

How to do it: Use tools like materiality matrices, impact assessments, and frameworks (e.g., ISSB or CSRD materiality audits) to identify and act on critical issues.

Outcomes: Better risk management and value creation, targeted ESG strategies, and measurable progress through KPIs.

This guide provides actionable steps to identify stakeholders, engage with them, and integrate their priorities into ESG strategies. It also highlights how automation tools, like neoeco, simplify reporting and ensure compliance with evolving regulations.

5-Step ESG Stakeholder Prioritisation Framework

How to Identify and Categorise ESG Stakeholders

Core Stakeholder Groups

The Stakeholder Model from the Business Roundtable highlights five key groups: customers, employees, communities, the environment, and suppliers - alongside shareholders. For ESG (Environmental, Social, and Governance) purposes, this scope broadens to include investors, regulators, and NGOs. Each group brings unique priorities to the table. Investors, for instance, focus on financial materiality and long-term value, while regulators ensure compliance with standards like ISSB reporting and the UK's SECR requirements. Employees often emphasise social issues such as diversity and workplace welfare, guided by laws like the Equality Act 2010. Meanwhile, communities increasingly advocate for environmental health and biodiversity, particularly under the Environment Act 2021.

The UK’s Companies Act 2006 provides a legal framework for stakeholder identification. Organisations with over 500 employees must include a s172 Report in their annual accounts, explaining how they engage with and consider stakeholder interests. This ensures that the perspectives of employees, customers, suppliers, and communities are considered, alongside those of shareholders.

Frameworks for Stakeholder Identification

Stakeholder Salience Theory is a practical tool for identifying and prioritising stakeholders. It evaluates three key attributes: Power (their influence on the business), Legitimacy (the validity of their claims), and Urgency (the time sensitivity of their concerns). For example, a regulator enforcing carbon reporting under the EU's Carbon Border Adjustment Mechanism (CBAM) would score high on all three attributes, making them a critical stakeholder. On the other hand, a local community group might lack formal power but could still carry high legitimacy and urgency when raising public health concerns about pollution.

Digital tools, such as social media monitoring and AI-driven analytics, are increasingly useful for identifying overlooked stakeholders. These technologies can help organisations quantify stakeholder demands and track emerging grassroots issues. This systematic approach provides a solid foundation for categorising stakeholders effectively.

How to Categorise Stakeholders for Analysis

After identifying stakeholders, the next step is categorisation, which sharpens the focus of analysis. Grouping stakeholders by their relevance and influence is key. For instance, institutional investors might be analysed separately from retail shareholders, or local community groups might be distinguished from international NGOs, to better reflect shared ESG priorities while accounting for differences in power, legitimacy, and urgency.

Materiality assessments are essential for pinpointing the ESG issues that matter most to specific groups and that carry measurable business impacts. Many large companies use the GRI framework to ensure inclusivity and focus on issues with significant stakeholder impact. For those tracking Scope 3 emissions, suppliers can be categorised based on their carbon intensity and readiness to engage in decarbonisation efforts. This structured process ensures that stakeholder analysis leads to actionable insights, rather than remaining a generic exercise.

Methods for Stakeholder Engagement

Levels of Stakeholder Engagement

The way organisations engage with stakeholders depends on factors like their influence, the complexity of the issues at hand, and the level of collaboration required. At its simplest, Inform strategies rely on tools like newsletters, annual reports, or website updates to share progress on ESG initiatives. This approach is ideal for stakeholders who only need to stay informed, such as retail shareholders or the general public.

Consult methods go a step further by actively seeking input through surveys, interviews, or focus groups. For example, research shows that 53% of workers consider a company's sustainability efforts when deciding where to work. This highlights why gathering employee feedback is crucial - not just for retention but also for fostering a positive workplace culture.

For high-priority stakeholders, Involve and Collaborate approaches are more suitable. Techniques like workshops, co-creation sessions, and advisory panels allow key groups - such as investors, regulators, and NGOs - to play an active role in shaping ESG strategies. Mike Tuffrey, Co-founder of Corporate Citizenship, cautions against using stakeholder mapping solely as a tool to "target key messages more ruthlessly." Instead, he emphasises the importance of genuinely listening:

If people see stakeholder maps as a way to target key messages more ruthlessly at stakeholders and make sure that they land, that is the wrong mentality.

By employing these varied engagement methods, businesses can ensure stakeholder insights are effectively translated into strategic actions.

BSR's 5-Step Engagement Approach

BSR provides a structured framework to turn stakeholder input into actionable ESG strategies. It starts with Strategy Development, where the purpose of engagement is clearly defined - whether it’s identifying material issues, validating priorities, or co-creating solutions. This ensures the process is meaningful and tied to tangible business outcomes, rather than being a mere box-ticking exercise.

The next step is Stakeholder Mapping, which uses tools like Stakeholder Salience Theory to identify the most critical voices. During Preparation, the appropriate engagement format is designed - this could range from one-on-one interviews to collaborative workshops. The Engagement Execution phase is where organisations actively listen to stakeholders. This is the moment to engage "critical friends", such as NGOs like Oxfam or Transparency International, who can provide honest and unfiltered feedback that internal teams may shy away from offering. Finally, Action Planning ensures that the insights gathered lead to concrete commitments and measurable changes in ESG roadmaps and KPIs.

Boards can also benefit from internal feedback mechanisms, such as "voice of the employee" representatives or ad-hoc workshops, to assess organisational sentiment and culture. As Tuffrey points out, stakeholder engagement:

helps boards identify not just the issues that are flashing in the middle, but alerts them to those that are just starting to flash at the edges.

This structured approach lays the groundwork for integrating technology into the stakeholder engagement process.

Using Tools to Support Engagement

Digital tools are essential for aligning stakeholder engagement with long-term ESG strategies. Engagement efforts generate a wide range of data - from survey results to workshop discussions - that need to be synthesised into actionable insights. This is where technology steps in to streamline the process. Organisations focusing on Scope 3 emissions or preparing to align ESG data with ISSB standards must ensure that stakeholder feedback is seamlessly connected to financial and carbon accounting data.

Platforms like neoeco simplify this integration by linking stakeholder input directly to transaction-level ESG data. By running on clients' financial ledgers, neoeco ties priorities such as supplier decarbonisation or employee welfare to recognised emissions categories under GHGP and ISO 14064. The result is audit-ready reports that eliminate the need for manual data handling. This is especially beneficial for accounting firms working with SMEs or large private companies, helping them comply with SECR, UK SRS, and ASRS 2 requirements.

Summarised reports generated by these tools are particularly valuable for securing board-level support. Directors, who often have limited time, need concise and actionable insights rather than lengthy transcripts to make decisions based on stakeholder feedback. By automating data collection and validation, neoeco ensures that stakeholder engagement directly contributes to measurable ESG progress.

Techniques for ESG Stakeholder Prioritisation

Prioritisation Matrices

Once stakeholder feedback is collected, the next step is to identify which issues require immediate attention. Materiality matrices are a practical tool for this, offering a clear visual representation by plotting issues along two axes: business significance (e.g., financial impact, regulatory risks, operational factors) and stakeholder significance (e.g., importance to employees, investors, customers, or local communities). Issues landing in the upper-right quadrant - where both business and stakeholder significance are high - should become the focus of your ESG strategy and reporting.

For instance, if supply chain emissions emerge as a top concern for investors and align with regulatory obligations, addressing this should take precedence over less impactful issues, such as improving office recycling programmes.

This matrix approach helps organisations avoid spreading resources too thinly. It encourages leaders to make trade-offs and base their decisions on evidence, rather than trying to meet every stakeholder demand at once. This is especially beneficial for accounting firms advising on ISSB reporting, where materiality assessments play a key role in shaping disclosure requirements.

Impact Assessments

While matrices provide an overview, impact assessments offer a deeper layer of analysis by evaluating both the likelihood and magnitude of potential outcomes. Key questions include: How likely is this issue to impact operations or stakeholders? and If it does occur, how severe will the consequences be?

For example, a data breach may be less likely than employee turnover, but its potential consequences - like regulatory penalties, loss of customer trust, and reputational harm - could be far more severe.

The table below highlights differences between manual and automated impact assessments:

Aspect | Manual Process | Automated Process |

|---|---|---|

Data Quality | High risk of errors due to manual input | Fewer errors with automated validation and integration |

Audit Readiness | Limited traceability and version control | Complete audit trails with automated documentation |

Scalability | Difficult to manage as data grows | Easily scales alongside business growth |

Compliance | Manual tracking of regulatory changes | Automated updates for evolving requirements |

A key takeaway here is the importance of linking stakeholder concerns with financial data. Platforms like neoeco streamline this by connecting issues such as Scope 3 emissions reductions to transaction-level carbon data. This ensures priorities are backed by solid evidence rather than subjective opinions, creating audit-ready reports without the need for manual data handling.

Regular Validation and Updates

Evaluation is not a one-time exercise. Stakeholder priorities can shift as regulations change, investor expectations evolve, and new societal challenges arise. That’s why regular validation - ideally conducted annually or biannually - is crucial. Internal reviews, combined with external validations, help ensure that priorities remain aligned with both the business strategy and stakeholder needs.

To streamline this process, priorities can be grouped into two categories: "Maintain" (areas performing well) and "Improve" (areas needing further investment). This approach helps allocate resources effectively and avoids stagnation in areas where progress may have slowed. Linking these priorities to SMART goals - Specific, Measurable, Achievable, Realistic, and Timely - ensures accountability.

Automation can further enhance this by replacing static reviews with ongoing monitoring and updates. This keeps stakeholder priorities aligned with evolving ESG demands, whether driven by new regulations like the UK Sustainability Reporting Standard or shifting investor expectations around climate-related disclosures.

Integrating Stakeholder Priorities into ESG Strategy

Defining Material Issues and KPIs

Once you've identified which stakeholder concerns matter most, the next step is turning these into material issues and measurable KPIs. This involves moving beyond general commitments - like "reduce carbon emissions" - and setting specific, trackable goals that align with both stakeholder expectations and business objectives.

A helpful approach is the "4Ps" framework, which organises metrics into four categories: Principles of Governance, Planet, People, and Prosperity. For example, if investors highlight supply chain emissions as a key concern, you could classify this under "Planet" and establish a KPI to track reductions in Scope 3 emissions from purchased goods. Similarly, if employees prioritise workplace diversity, this would fall under "People" and could be measured by tracking the percentage of leadership roles held by underrepresented groups.

It’s essential to set clear materiality thresholds from the outset. These thresholds define what makes an issue "material" enough to require strategic action and audit-ready documentation. By doing so, you prevent critical issues from being overlooked and ensure efforts remain focused. Establishing an ESG steering committee - including internal auditors - can further embed these assessments into broader risk management systems, ensuring alignment with financial controls.

Building ESG Roadmaps

Turning priorities into action requires a multi-year roadmap that lays out timelines, budgets, and specific initiatives. This roadmap should be a dynamic plan that not only sets new KPIs but also transforms business models.

Start by categorising initiatives into short-term (6–12 months), medium-term (1–3 years), and long-term (3+ years) goals. For instance, if reducing energy consumption is a priority, a short-term initiative might involve switching to energy-efficient lighting, while a medium-term goal could focus on investing in renewable energy. Similarly, if stakeholders call for improved climate-related disclosures, your roadmap should include milestones for aligning with frameworks such as ISSB reporting or the UK Sustainability Reporting Standard.

Budgeting plays a crucial role here. Resources should be allocated based on a matrix of business impact and stakeholder significance. High-priority issues - those in the upper-right quadrant - should receive the largest share of investment. To ensure seamless integration, break down silos between sustainability and finance teams, embedding ESG risks into everyday operations.

Tracking and Reporting Progress

Once the roadmap is underway, tracking and reporting progress becomes essential to maintaining alignment with stakeholder priorities. Many organisations struggle with manual data entry and spreadsheets, which are prone to errors and can jeopardise audit readiness. The answer lies in automation - using platforms that connect ESG metrics directly to financial data.

A good example is neoeco, which integrates with clients' financial ledgers to automatically map transactions to recognised emissions categories under GHGP, ISO 14064, and frameworks like SECR and UK SRS. This eliminates manual conversions and provides finance-grade, audit-ready carbon data. For accounting firms advising on ESG, such automation simplifies reporting and ensures it aligns with stakeholder expectations without the hassle of manual tracking.

To streamline processes further, consolidate overlapping verification steps between financial and sustainability audits into a shared evidence base. This saves time and enhances the credibility of your reporting. As regulations and stakeholder demands evolve, automated systems can update priorities and metrics in real-time, ensuring compliance and relevance. For more information on embedding sustainability into financial processes, check out the FiSM manifesto, which advocates treating ESG data with the same precision as financial records.

ESG webinar: Materiality assessments and stakeholder engagement

Conclusion

Prioritising ESG stakeholders is not a one-off task - it demands consistent effort and a structured approach. Start by identifying and categorising stakeholders, engage with them thoughtfully, and use clear frameworks to prioritise their concerns. From there, translate these priorities into measurable KPIs and actionable plans. Each step builds on the previous one, transforming broad commitments into tangible strategies that meet both stakeholder expectations and business goals. This approach lays a solid foundation for tackling operational challenges.

For many organisations, the real hurdle is execution. Relying on manual processes often leads to bottlenecks, inaccuracies, and difficulties in maintaining audit readiness. This is where automation becomes a game-changer. neoeco simplifies ESG data integration, ensuring audit-ready reporting by directly linking metrics to financial data and categorising transactions under recognised standards like GHGP, ISO 14064, SECR, and UK SRS. For accounting firms guiding clients on ESG, this eliminates the need for manual conversions and ensures compliance-ready reports. Beyond efficiency, automation prepares organisations to meet increasingly stringent regulatory demands.

As regulations tighten and stakeholder expectations grow, real-time tracking and reporting provide a crucial advantage. Automation bridges ESG data with financial records, as outlined in the FiSM approach, ensuring the same level of precision for ESG metrics as for financial data. This not only builds trust with stakeholders but also equips organisations to adapt to new disclosure requirements.

The most successful organisations treat ESG prioritisation as a strategic cornerstone, not just a compliance checkbox. They invest in effective tools, maintain open communication with stakeholders, and regularly reassess their priorities to stay in step with evolving expectations. When done right, stakeholder prioritisation becomes the bedrock of a resilient and trustworthy ESG strategy - delivering meaningful value to all parties. By embedding these principles, you complete the cycle of strategic ESG prioritisation laid out in this guide.

FAQs

How can businesses engage effectively with ESG stakeholders?

Engaging with ESG stakeholders effectively begins by identifying and prioritising their concerns through a materiality assessment. This process involves gathering insights from key groups - such as investors, employees, regulators, customers, and local communities - and aligning their perspectives with the organisation’s environmental, social, and governance impacts. Tools like surveys, workshops, and direct consultations play a vital role in validating these priorities and fostering trust.

Once these priorities are established, integrating ESG data with financial systems becomes essential for ensuring transparency and accuracy. Platforms like neoeco simplify this by automatically mapping financial transactions to recognised emissions categories (e.g., GHGP, ISO 14064, UK SECR). This eliminates the need for manual processes, produces audit-ready reports, and reduces the chance of errors, all while enhancing compliance and reinforcing stakeholder confidence.

Regular communication is also key. Providing updates through sustainability reports or advisory panels helps maintain an open dialogue, keeping stakeholders informed and engaged. By combining clear priorities, efficient data management, and transparent communication, businesses can transform ESG expectations into opportunities for progress and innovation.

What tools can help automate ESG reporting and ensure compliance?

Automating ESG reporting has become more straightforward with specialised software designed to simplify data collection, validation, and reporting. These tools are built to align with standards like ISSB, CSRD, and frameworks tailored to the UK. One standout option for accounting firms is neoeco, a platform that integrates seamlessly with a client’s financial ledger. It automatically categorises transactions into recognised emissions categories - such as GHGP, ISO 14064, SECR, UK SRS, and ASRS 2 - and produces precise, audit-ready carbon and sustainability reports. With its AI-powered system, neoeco not only ensures compliance but also significantly reduces manual work.

Other software solutions that connect financial systems like Xero, Sage, QuickBooks, MYOB, or NetSuite to ESG metrics offer similar benefits. These platforms centralise data, standardise reporting frameworks, and streamline compliance processes. By minimising errors and saving time, they help ensure that sustainability data aligns with financial records, providing a reliable single source of truth for both regulators and stakeholders.

Why is it important to regularly review stakeholder priorities in ESG planning?

Regularly revisiting stakeholder priorities is essential to keeping an organisation’s ESG (Environmental, Social, and Governance) initiatives in tune with what truly matters to investors, regulators, and other critical audiences. Without these updates, outdated concerns can cloud valuable insights, resulting in reports that miss the mark or fail to provide actionable information.

This practice doesn’t just refine reporting - it also fosters trust and ensures compliance with frameworks like ISSB and CSRD, which expect organisations to show that material topics are consistently reviewed. By engaging stakeholders through methods like surveys, meetings, or data-driven analysis, companies can uncover new risks and opportunities, enhance the precision of their disclosures, and even achieve measurable financial gains. For instance, businesses that embed ESG into their core strategy have been shown to boost performance by as much as 20%. In the end, regular validation plays a key role in building credible and forward-thinking ESG plans.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.