ISSA 5000 for SMEs: What to Know

Feb 12, 2026

Clear overview of ISSA 5000 for SMEs: requirements, assurance options, estimated costs and steps to prepare audit-ready sustainability reports by Dec 2026.

ISSA 5000 is a global standard for verifying sustainability information, designed to help SMEs produce reliable, audit-ready sustainability reports. Published by the IAASB, it works with various reporting frameworks (e.g. UK SRS, IFRS S1 and S2) and supports both limited and reasonable assurance levels. SMEs in the UK must apply ISSA (UK) 5000 for reporting periods starting on or after 15 December 2026, with early adoption allowed.

Key Points:

What It Does: Verifies sustainability data (e.g. carbon emissions, governance, social impacts) to improve data reliability.

Who It’s For: SMEs and other organisations needing to meet reporting requirements like the UK Sustainability Disclosure Requirements or CSRD.

Why It Matters: Builds confidence in sustainability disclosures, simplifies compliance, and aligns with supply chain and investor expectations.

Costs: Limited assurance costs range from 0.013% to 0.026% of annual revenue (e.g. £13,000-£26,000 for a £10m turnover SME).

Challenges: SMEs face hurdles like limited resources, complex data collection (e.g. Scope 3 emissions reporting), and lack of expertise.

How to Prepare:

Organise Your Data: Use recognised frameworks (e.g. GHGP, ISO 14064) and ensure data is complete and ready for audit.

Conduct Risk Assessments: Identify gaps and align processes with ISSA 5000 requirements.

Choose Assurance Levels: Decide between limited or reasonable assurance based on your needs and budget.

Use Technology: Adopt tools (e.g. neoeco) to simplify data collection and reporting.

ISSA 5000 in Focus: Foundational Principles and Concepts - Oct 2, 2025

What is ISSA 5000 and Why It Matters for SMEs

With the growing need for transparency, understanding ISSA 5000 has become increasingly important for SMEs. Officially titled General Requirements for Sustainability Assurance Engagements, ISSA 5000 is a stand-alone standard issued by the IAASB. It provides a global framework for verifying sustainability data - covering areas like carbon emissions, social impacts, and governance practices. Notably, it’s designed to be used by both accountants and non-accountant professionals, such as environmental engineers, for assurance work.

One of its key features is being framework neutral, meaning it supports disclosures prepared under various systems, whether UK SRS, VSME, SECR, or international frameworks like IFRS S1 and S2. Mark Babington, Executive Director of Regulatory Standards at the FRC, highlighted its importance:

"The release of ISSA (UK) 5000 marks a significant step in establishing a consistent framework for sustainability assurance in the UK... By underpinning investor confidence in sustainability disclosures, this standard will help UK companies access capital more efficiently".

Core Objectives of ISSA 5000

The main aim of ISSA 5000 is to enhance the reliability and transparency of sustainability data, ensuring these disclosures are as credible as financial statements. This is especially important when dealing with investors, lenders, or large corporate clients conducting supply chain due diligence.

The standard is designed to be scalable, making it adaptable for businesses of all sizes and complexities. For example, a small manufacturer might use it to report basic energy usage under SECR, while a mid-sized firm could apply it for more complex ESG disclosures. ISSA 5000 supports both limited and reasonable assurance levels, allowing businesses to start with simpler verification processes and expand as their reporting matures.

How ISSA 5000 Applies to SMEs

ISSA 5000’s focus on trust and scalability translates into practical benefits for SMEs. In the UK, SMEs must begin applying ISSA (UK) 5000 for reporting periods starting on 15 December 2026, though early adoption is an option. This timeline aligns with the UK’s Sustainability Disclosure Requirements, giving businesses a clear roadmap for producing assured sustainability reports. Globally, similar standards are gaining traction - for instance, Australia’s equivalent, ASSA 5000, became effective on 1 January 2025.

For SMEs, ISSA 5000 is particularly valuable in meeting Scope 3 reporting requirements, as it standardises value chain data. If you’re part of a larger corporation’s supply chain, you’ll likely be asked to provide assured data on your emissions and sustainability practices. ISSA 5000 ensures your disclosures meet the high standards these larger clients demand. To get ahead, check out this guide on how traceability systems simplify Scope 3 reporting.

Another advantage is the flexibility in choosing assurance providers. Depending on your focus - whether carbon accounting, water usage, or social metrics - you can select the most suitable experts, not just traditional auditors. This flexibility is especially helpful for SMEs with tight budgets, allowing for targeted and affordable assurance services.

Benefits of ISSA 5000 for SMEs

Building Trust with Stakeholders

ISSA 5000 enhances the credibility of sustainability disclosures, giving investors, clients, and regulators confidence in the reliability of your data. The International Auditing and Assurance Standards Board (IAASB) describes it as offering "a unified global approach to address the growing demand for trustworthy sustainability information to support stakeholder decisions". SMEs can choose between limited and reasonable assurance levels, tailoring the process to suit their stakeholders' expectations and budget constraints. By fostering trust, this standard boosts market perception and simplifies compliance efforts.

Easier Compliance for SMEs

For SMEs juggling multiple reporting requirements, ISSA 5000 simplifies the process by providing a single assurance framework. This eliminates the need for overlapping audits, reducing both costs and administrative burdens. Its scalable approach ensures that the level of audit effort matches the complexity of the business. Unlike older frameworks such as ISAE 3000 and ISAE 3410, ISSA 5000 stands alone, allowing SMEs to streamline their reporting processes and maintain audit readiness without overextending their resources.

Cost-Effective Assurance

ISSA 5000 also offers a cost-efficient path to compliance. Limited assurance engagements, which require fewer procedures and less evidence, provide a credible yet affordable option. According to EFRAG, annual costs for limited assurance range from 0.013% to 0.026% of revenue. For an SME with a £10 million turnover, this translates to approximately £13,000 to £26,000 annually. As Coolset highlights:

"The streamlined process can also speed up auditing - potentially cutting your overall compliance costs, too".

How to Implement ISSA 5000 in SME Sustainability Reporting

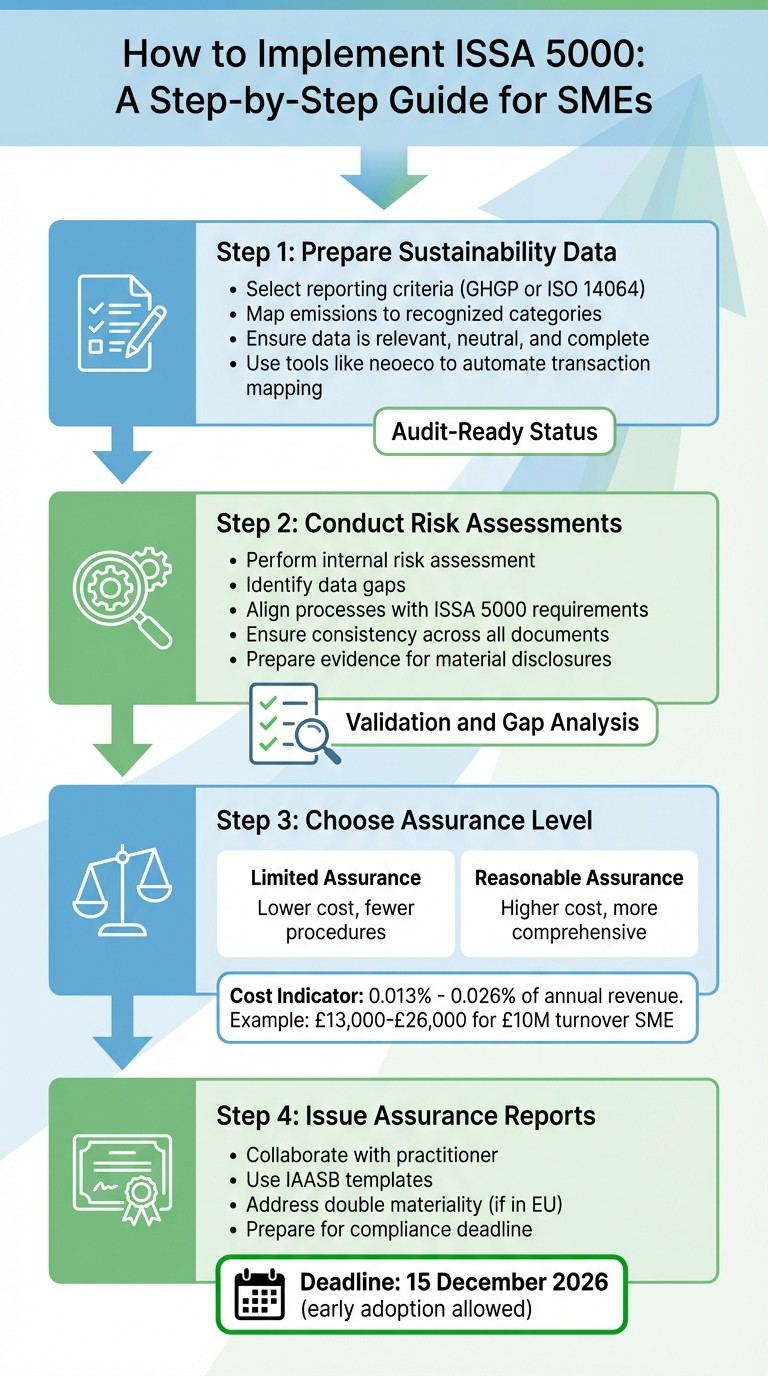

4-Step Guide to Implementing ISSA 5000 for SME Sustainability Reporting

To align with ISSA 5000's adaptable framework tailored for SMEs, follow these steps to establish effective sustainability reporting practices.

Preparing Sustainability Data

The cornerstone of ISSA 5000 compliance is ensuring your data is audit-ready - this means it must be relevant, neutral, and complete. Start by selecting and documenting your reporting criteria, such as GHGP or ISO 14064, ensuring they align with recognised sustainability standards. Then, map your emissions and sustainability metrics to these categories. This step guarantees data completeness and helps practitioners conduct risk assessments effectively.

For SMEs using financial data, tools like neoeco can simplify the process by automatically mapping transactions to recognised emissions categories, ensuring both accuracy and audit readiness. As the IAASB highlights:

"ISSA 5000 addresses assurance engagements on sustainability information reported by entities of all sizes and complexity, prepared under any suitable framework or other criteria".

Once your data is structured, the next step is to evaluate your internal controls through a thorough risk assessment.

Conducting Risk Assessments

Before involving an assurance practitioner, perform an internal risk assessment to pinpoint any data gaps. Compare your processes against ISSA 5000's requirements to ensure sustainability disclosures align with your financial statements and annual reports. Practitioners will review all available sustainability information to ensure consistency across documents.

Prepare evidence for all material disclosures. As Josephine Jackson, Vice-Chair of the IAASB, advises:

"Those who prepare sustainability reporting can anticipate additional or new requests from assurance practitioners for evidence to support all material disclosures being reported on sustainability".

Organise documentation that supports the accuracy and neutrality of your data. Be ready to explain how you identify material information that matters to your stakeholders. A comprehensive risk assessment lays the groundwork for clear and credible assurance reports.

Issuing Assurance Reports

With your data prepared and risks addressed, collaborate with your practitioner to determine whether to pursue limited or reasonable assurance. This decision will influence both the level of effort required and the language used in the final report. The IAASB offers illustrative templates for assurance reports to ensure your final document meets baseline standards. Reports can focus on selected disclosures or cover a broader scope, with conclusions ranging from unmodified to qualified, adverse, or disclaimers, depending on the evidence provided.

ISSA 5000 applies to assurance engagements on sustainability information for periods starting on or after 15 December 2026, although early adoption is allowed. If operating in regions like the EU, ensure your assurance process considers double materiality - addressing both financial and impact materiality - an approach supported by ISSA 5000. Following these steps will help ensure your sustainability disclosures are ready for the upcoming compliance requirements.

Challenges and Tools for SMEs Using ISSA 5000

Common Challenges for SMEs

Small and medium-sized enterprises (SMEs) play a vital role in Europe's economy. However, when it comes to implementing ISSA 5000, they often face unique hurdles. One of the biggest issues? Limited resources. Most SMEs don't have dedicated sustainability teams and instead rely on existing staff who are already stretched thin with other responsibilities. Financial constraints also make it tough to invest in ESG software, external assurance services, or specialised training.

Another major challenge is data complexity. Many SMEs still use outdated, manual spreadsheets to track emissions, which are prone to errors. Collecting accurate Scope 3 data - data from suppliers and partners - adds another layer of difficulty since SMEs often have little influence over their broader value chains. As Krishnamurthy M P, Ph.D., explains:

A one-size-fits-all approach does not work for SMEs and VSMEs. Addressing the data collection gap, cost barrier, and technical limitations is critical for equitable ESG integration.

The lack of expertise is just as pressing. Few SMEs have staff who are well-versed in carbon accounting, materiality assessments, or evaluating biodiversity impacts. On top of that, trying to navigate overlapping standards can lead to confusion and overwhelm. Without an immediate, clear return on investment, many SMEs choose to delay adopting these practices altogether.

These obstacles highlight the need for smarter tools and strategies to simplify compliance.

Using Technology for Compliance

Technology offers practical solutions to many of these challenges by streamlining data collection and improving audit readiness. Tools that sync directly with financial systems - like Xero, Sage, or QuickBooks - can automatically map transactions to recognised emissions categories under frameworks like the GHGP and ISO 14064. This eliminates the need for manual spreadsheets, saving time and reducing errors.

A good example is neoeco, a platform that works with clients' financial data to generate audit-ready reports that align with ISSA 5000 verification standards. By centralising all documentation and linking supporting evidence (like invoices or certificates) directly to data points, SMEs can simplify the audit process and cut down on rework costs. This kind of integration not only reduces mistakes but also helps SMEs make the most of their limited resources.

The flexibility of these tools is particularly useful for SMEs, as they may need to scale their reporting efforts as regulations evolve. It's worth noting that the ISSA 5000 standard will apply to assurance engagements on sustainability information for periods starting on or after 15 December 2026.

Tips for Success

To make the most of technology-driven compliance tools, SMEs can follow these practical steps:

Start with a materiality assessment. Focus on the ESG issues that are most relevant to your business and stakeholders. This helps you avoid wasting resources on metrics that don't matter. Begin with simpler areas like Scope 1 and 2 emissions, then expand to more challenging areas like Scope 3 or biodiversity as your capabilities grow.

Standardise your data collection processes early on. Shift away from manual spreadsheets and adopt digital tools that integrate with your existing systems. Use pre-built compliance templates to organise your data in a way that's easy for auditors to review, which can help prevent delays and extra fees. Keep a digital audit trail that links evidence to each disclosure - this is essential for meeting ISSA 5000's assurance requirements.

Seek external expertise. Work with accounting firms or consultants experienced in ISSA 5000 to conduct initial risk assessments and decide whether limited or reasonable assurance is the right fit for your business. Collaborating with industry associations can also help SMEs share resources and learn from best practices, easing the compliance burden.

As the Sustainability Directory puts it:

SMEs often struggle to balance immediate financial pressures with long-term sustainability goals, leading to delayed or incomplete ESG integration - but with the right tools and support, this balance becomes achievable.

Conclusion

ISSA 5000 is set to become a global standard for sustainability assurance, and SMEs should begin preparations now. With its requirements applying to reporting periods starting on or after 15 December 2026, this is an ideal time to get ahead. Its flexible, framework-neutral design means it works seamlessly with existing standards like CSRD, GRI, and ISSB, making it especially useful for smaller organisations managing compliance on tight budgets.

The advantages of ISSA 5000 are clear: greater stakeholder trust, smoother audit processes, and reduced risks of greenwashing. These benefits not only ensure compliance but also help protect your organisation's reputation. As the IAASB highlights:

ISSA 5000 provides a unified global approach to address the growing demand for trustworthy sustainability information to support stakeholder decisions.

To get started, focus on a few key steps. First, conduct a materiality assessment to pinpoint your most critical ESG impacts. Then, streamline your data collection using digital tools that integrate with platforms like Xero, Sage, or QuickBooks. Tools such as neoeco can automatically map transactions to emissions categories and create audit-ready reports, saving time and reducing errors.

Next, document your internal controls and review materiality documentation and establish a clear digital audit trail. Collaborating with experienced accounting firms can also ensure your processes are robust. With limited assurance costs ranging from just 0.013% to 0.026% of revenue annually, this small investment can help you avoid hefty fines of up to €10 million under regulations like CSRD, while safeguarding your reputation. These proactive measures address compliance demands and position your business for sustainable, long-term success.

FAQs

Is ISSA (UK) 5000 mandatory for my SME, or can I choose not to apply it?

ISSA 5000 isn’t a requirement for SMEs, but it’s worth considering for businesses aiming to establish trust through recognised sustainability assurance. As expectations from stakeholders and regulators in the UK grow, aligning with this standard can help companies stay ahead of future compliance needs and demonstrate their commitment to responsible practices.

What evidence should we keep to ensure our sustainability data is audit-ready?

To make sure sustainability data is ready for audits, organisations need to keep evidence that demonstrates its accuracy, completeness, and reliability. This means maintaining thorough documentation for things like data collection methods, calculations, assumptions, and verification processes. Aligning these records with standards such as ISSA 5000 ensures compliance and makes the auditing process much smoother.

How do I choose between limited and reasonable assurance without overspending?

Deciding between limited assurance and reasonable assurance comes down to your budget, time constraints, and how much confidence you need in the report.

Limited assurance is a more cost-effective option. It involves less detailed procedures and is typically used for internal purposes or less critical reports.

Reasonable assurance, on the other hand, is more comprehensive. It’s the go-to choice when stakeholders require a higher level of confidence in the accuracy and reliability of the information.

Think about your reporting objectives and what level of scrutiny is necessary to meet your needs before making a choice.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.