Scope 3 Emissions: Supplier Data Challenges

Feb 7, 2026

Supplier emissions data gaps undermine accurate Scope 3 reporting — use spend-based estimates, supplier engagement and automation to achieve audit-ready results.

Scope 3 emissions account for around 90% of a company’s carbon footprint, yet 80% of companies compiling TCFD reports struggle to disclose them. The main issue? Supplier data is unreliable or unavailable. Without accurate data, businesses rely on generic estimates that fail to reflect actual reductions, making reporting less precise.

Key challenges include:

Suppliers not sharing emissions data due to lack of tools or expertise.

Inconsistent data quality across suppliers, with no standardised frameworks.

Multi-tier supply chains making it hard to track emissions beyond direct suppliers.

Accounting firms lacking resources and expertise in carbon reporting.

Solutions to these challenges:

Use activity vs spend-based methods as a fallback for estimating emissions.

Engage suppliers by embedding data-sharing requirements into contracts.

Leverage automation tools to streamline data collection and reporting.

Platforms like neoeco integrate with accounting software to simplify tracking and provide audit-ready data. This shift from estimates to supplier-specific insights helps businesses measure actual progress while meeting reporting standards like GHGP and ISO 14064.

Webinar: The Practical Guide to Scope 3 Emissions (And Why They Matter Most)

Main Challenges in Collecting Supplier Data for Scope 3 Emissions

Reporting accurate Scope 3 emissions comes with its own set of obstacles, especially when it comes to gathering reliable data from suppliers. Accounting firms often face significant difficulties due to fragmented supply chains, inconsistent data practices, and limited internal resources.

Suppliers Don't Provide Emissions Data

The biggest hurdle? Most suppliers don't share their emissions data at all. Many simply don't have the systems or knowledge to measure their carbon footprint. Smaller suppliers are particularly affected, as they often lack the financial ability to invest in carbon accounting tools. For many, competing business priorities take precedence over sustainability efforts. On top of that, suppliers are frequently inundated with requests from multiple clients, leaving them unable to meet everyone’s demands. This creates a major gap in data availability. As Michael Lengahan, Associate Director at Anthesis, puts it:

you can't manage what you can't measure

Without supplier-provided data, firms are forced to rely on activity-based vs spend-based emission methods. Unfortunately, these estimates don’t reflect actual operational emissions, leading to less accurate reporting.

Data Quality and Standards Vary Between Suppliers

Even when suppliers do provide emissions data, the quality and consistency are all over the place. Some suppliers adhere to recognised standards like the GHG Protocol or ISO 14064, while others operate without any framework at all. This lack of uniformity creates headaches for accounting firms.

For emissions data to be useful, it needs to meet specific benchmarks: it should be recent (ideally less than three years old), regionally relevant (preferably at the country level), and tailored to the sector in question. When suppliers fail to meet these standards, firms are left with the laborious task of standardising inconsistent data into a format that’s ready for audits. This makes it hard to compare suppliers or track progress effectively over time.

Multi-Tier Supply Chains Are Difficult to Track

Supply chain complexity adds another layer of difficulty. Scope 3 emissions span the entire value chain, reaching far beyond an organisation's direct (Tier 1) suppliers. For instance, a manufacturer might buy components from a Tier 1 supplier, who sources materials from Tier 2 or Tier 3 suppliers. Each additional tier creates more opacity, making it incredibly challenging to track emissions.

Most organisations struggle to see beyond their immediate suppliers. Data from deeper in the supply chain is often stored in isolated spreadsheets, making it hard to integrate with financial systems. For accounting firms handling Scope 3 emissions reporting for multiple clients, this scattered data becomes nearly impossible to manage efficiently without robust systems. A more connected and streamlined approach to supply chain data is clearly needed.

Accounting Firms Lack Internal Expertise and Resources

Another major issue is that many accounting firms lack the tools and expertise to handle supplier emissions data effectively. Carbon accounting goes far beyond traditional financial reporting, requiring specialised knowledge. However, many firms haven’t invested in training their staff or adopting the necessary technology to process and verify supplier data.

Without these resources, firms end up relying on manual processes, which are slow, resource-intensive, and difficult to scale. This makes it harder to produce the accurate, audit-ready reports that clients are increasingly demanding. Bridging this skills and technology gap is essential for firms aiming to meet the growing expectations around emissions reporting.

These challenges highlight the pressing need for better systems and approaches to improve the accuracy and reliability of supplier data.

How to Address Supplier Data Challenges

These practical solutions build on the challenges discussed earlier, offering actionable steps to improve the accuracy of Scope 3 reporting.

Use Spend-Based Methods and Industry Averages

When supplier data is unavailable, a spend-based method can be a reliable fallback. This involves multiplying transaction data by generic industry factors to estimate emissions. While this approach isn't perfect, it fills gaps until primary data becomes accessible.

For better accuracy, focus on gathering primary activity-based data from suppliers in key emission-heavy areas and use secondary data as a backup. To ensure secondary data is trustworthy, it should meet specific criteria: it must be recent (ideally less than three years old), geographically relevant, and tailored to the sector.

Platforms like neoeco simplify this process by directly integrating with accounting systems like Xero, Sage, and QuickBooks, automating data collection and analysis.

Engage Suppliers and Include Data Requirements in Contracts

Inconsistent reporting is a common hurdle, and strong supplier relationships are key to overcoming it. Start by assessing the sustainability maturity of your suppliers. Group them based on their readiness to measure emissions, prioritising those already tracking emissions for quicker progress. For suppliers at the beginning of their sustainability journey, provide simple tools and templates aligned with the Greenhouse Gas Protocol to ensure consistent reporting. Using publicly available data can also reduce unnecessary data requests.

Embedding emissions reporting requirements in supplier contracts is another way to drive accountability. It signals to suppliers that data sharing will eventually become a standard expectation. As Emitwise explains:

For suppliers, remember: you are your customers' Scope 3 emissions. Your ability to collect and share emissions data will become a competitive advantage as businesses seek to meet compliance targets.

Use Technology to Automate Data Collection

Relying on manual processes for data collection isn't scalable. Automation is the way forward. Modern platforms categorise ledger entries into carbon data groups automatically, cutting down on manual effort and saving time.

These tools also provide transparency by tracking progress - highlighting completed tasks, missing data, and items ready for review. This level of detail is crucial for meeting ISO 14064 standards or preparing for assurance audits. By seamlessly integrating sustainability reporting into existing financial systems, businesses can manage carbon accounting efficiently without disrupting daily operations or requiring extensive staff training.

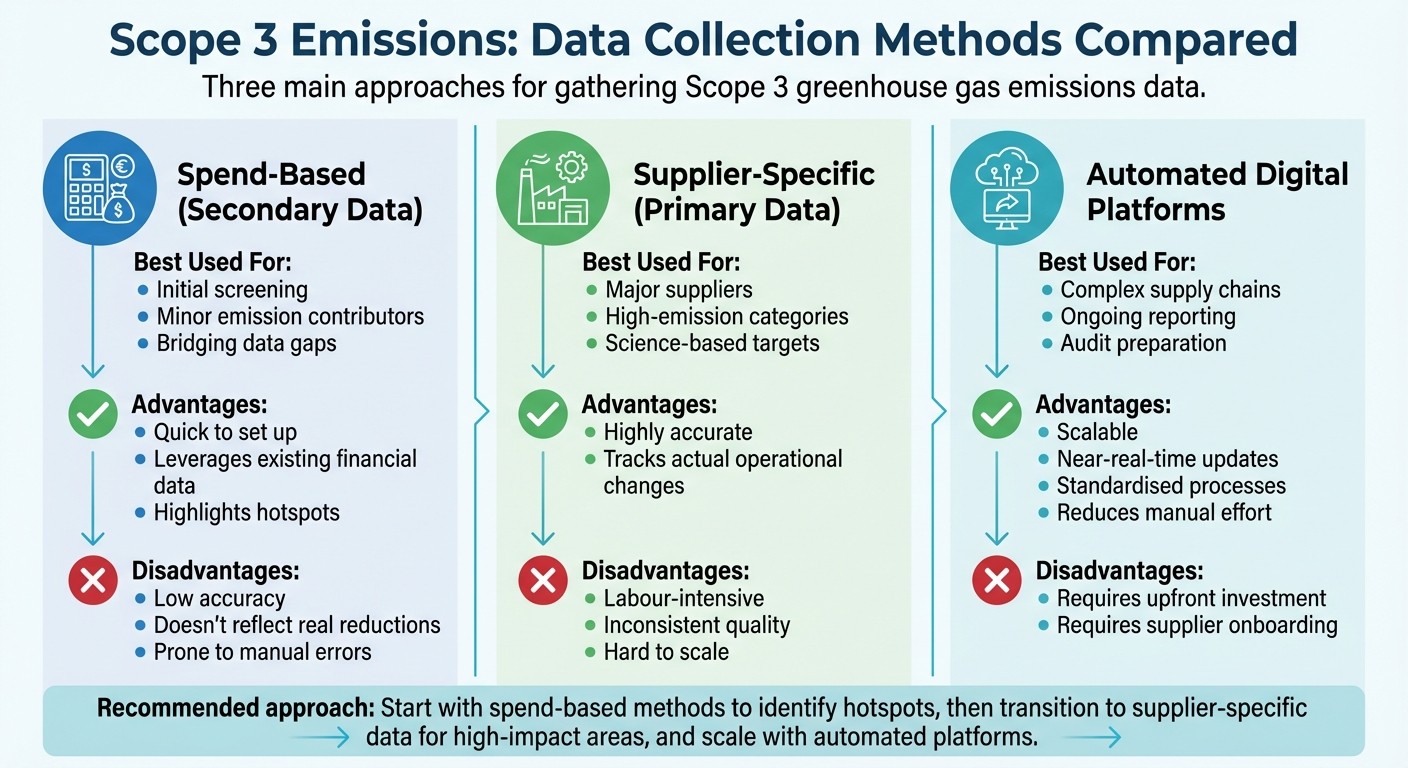

Comparison of Data Collection Methods

Comparison of Scope 3 Emissions Data Collection Methods

This section dives into the key methods for collecting supplier emissions data, building on the earlier discussion about challenges and solutions. The method you choose should align with your reporting goals and available resources, as each comes with its own trade-offs in terms of accuracy, effort, and scalability.

Spend-based methods rely on financial transaction data combined with emission factors (e.g., kgCO2e per £ spent). They’re quick to implement and provide a general baseline but lack precision.

Supplier-specific methods gather actual activity data, like energy use or fuel consumption, directly from suppliers. While these methods deliver more accurate insights and show real progress towards decarbonisation, they can be resource-heavy and tough to scale. This aligns with earlier recommendations to engage suppliers more effectively to address inconsistent reporting.

Automated digital tools bridge the gap by standardising data collection, flagging anomalies, and offering near-real-time updates - all without the heavy workload of manual processes. Platforms like neoeco integrate with accounting tools such as Xero, Sage, and QuickBooks, automatically mapping transactions to emissions categories in line with GHGP and ISO 14064. This eliminates the need for spreadsheets and manual conversions while maintaining high levels of accuracy.

Here’s a quick comparison of these methods:

Method | Best Used For | Advantages | Disadvantages |

|---|---|---|---|

Spend-Based (Secondary Data) | Initial screening; minor emission contributors; bridging data gaps | Quick to set up; leverages existing financial data; highlights hotspots | Low accuracy; doesn’t reflect real reductions; prone to manual errors |

Supplier-Specific (Primary Data) | Major suppliers; high-emission categories; science-based targets | Highly accurate; tracks actual operational changes | Labour-intensive; inconsistent quality; hard to scale |

Automated Digital Platforms | Complex supply chains; ongoing reporting; audit preparation | Scalable; near-real-time updates; standardised processes; reduces manual effort | Requires upfront investment and supplier onboarding |

A good approach is to start with spend-based methods to pinpoint emission hotspots, then move to primary vs secondary data for for high-impact areas. As your Scope 3 reporting evolves, automated tools become crucial for providing audit-ready data that meets ISO 14064 or ISSA 5000 standards, as previously discussed.

Conclusion

Supplier data continues to be the biggest hurdle in Scope 3 emissions reporting. Accounting firms must navigate reluctant suppliers, inconsistent methodologies, intricate supply chains, and a lack of expertise - all while producing reports that meet the standards of GHGP, ISO 14064, and the UK SRS. Considering that Scope 3 emissions often make up around 90% of an organisation's total carbon footprint, and that 80% of companies preparing TCFD reports find disclosing this data challenging or very challenging, the issue is both widespread and pressing. These challenges set the stage for finding effective solutions.

A practical approach combined with technology is critical. Start with spend-based methods to identify key emission hotspots, then actively engage suppliers and incorporate data requirements into contracts. As Scope 3 reporting evolves, automated platforms become indispensable for moving beyond manual spreadsheets.

Platforms like neoeco showcase how technology simplifies supplier data management. By integrating seamlessly with tools like Xero, Sage, and QuickBooks, neoeco links transactions to established emissions categories under GHGP and ISO 14064. It delivers finance-grade carbon data that's audit-ready under ISSA 5000. The platform reduces the need for endless email exchanges by automatically consolidating supplier data into detailed, interrogatable reports. This transition from secondary data estimates to primary supplier-specific data ensures you're tracking actual emission reductions, rather than just shifts in spending.

For accounting firms, this means the opportunity to provide compliance-ready sustainability services, expand advisory offerings, and create recurring revenue streams - all while maintaining the accuracy and transparency clients demand. Firms that tackle supplier data challenges now will position themselves as leaders in tomorrow's sustainability reporting landscape.

FAQs

Why is supplier data important for accurate Scope 3 emissions reporting?

Supplier data is crucial for Scope 3 emissions reporting, mainly because these emissions often account for the largest share of a company’s carbon footprint. Despite their significance, they are notoriously difficult to measure. Obtaining accurate data directly from suppliers ensures precise calculations, traceability, and audit readiness - essential for meeting compliance requirements like the UK’s SECR (Streamlined Energy and Carbon Reporting) and SRS (Sustainability Reporting Standards).

Scope 3 emissions encompass indirect activities across the entire supply chain, making the process of data collection and validation a complex task. However, automated tools can make a big difference by reducing errors and improving the overall quality of data. With Scope 3 emissions sometimes representing as much as 75% of a company’s total emissions, having reliable supplier data is critical. It not only supports credible reporting but also helps identify emission hotspots and meet the growing expectations of stakeholders.

How can companies encourage suppliers to share emissions data for Scope 3 reporting?

Companies can motivate suppliers to share emissions data by focusing on three core strategies:

1. Understand your suppliers' sustainability readiness

Evaluate how advanced your suppliers are in their sustainability efforts. This enables you to offer tailored guidance and pinpoint quick, achievable steps that make their participation less daunting. For suppliers new to emissions calculations, providing support can foster collaboration and build trust.

2. Simplify with automation

Using specialised ESG software to automate data collection and validation can make the reporting process smoother. Automation reduces manual effort, improves accuracy, and makes it easier for suppliers to provide reliable data.

3. Communicate benefits early and clearly

Engage suppliers from the outset and highlight how sharing emissions data can benefit them. Explain how it aligns with their own sustainability goals and helps lower their carbon footprint. Clear communication and practical assistance can boost engagement, making your Scope 3 reporting process more effective.

How do automation tools improve the accuracy and efficiency of Scope 3 emissions reporting?

Automation tools are transforming how organisations handle Scope 3 emissions reporting, making the process more accurate and efficient. By automating tasks like data collection and validation, these tools significantly reduce the risk of manual errors, delivering reliable, audit-ready information. They also pull in real-time data from various sources, allowing businesses to monitor emissions with a higher level of detail.

On top of that, automation helps organisations stay on top of changing regulations, such as the CSRD and ISSB. By keeping records accurate and easily traceable, these tools cut down the time and effort needed for manual processes. This ensures reports align with both regulatory requirements and stakeholder expectations. In short, automation improves data quality and speeds up reporting, freeing up businesses to focus on meaningful steps to lower their carbon footprint.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.