IFRS S1 & S2: Step-by-Step Implementation Guide

Feb 8, 2026

Step-by-step guide to implement IFRS S1 and S2: assess applicability, run a gap analysis, set governance, measure GHG (Scopes 1–3) and use automation for audit-ready reporting.

IFRS S1 and S2 are global standards for sustainability and climate-related financial disclosures introduced on 1 January 2024. They focus on providing consistent, comparable, and reliable information about sustainability risks and opportunities that impact a company’s financial performance. IFRS S1 covers general sustainability-related disclosures, while IFRS S2 focuses specifically on climate risks, including mandatory reporting of greenhouse gas emissions (Scopes 1, 2, and 3). These standards align with the TCFD framework, making it easier for companies already using TCFD guidelines to comply.

Key Points:

Who Needs to Comply? Listed companies in the UK must comply under FCA rules. Large private companies and LLPs are under review for mandatory adoption, while SMEs and not-for-profits can opt in voluntarily.

Transition Reliefs: First-year relief includes focusing only on IFRS S2 (climate-related disclosures), deferring Scope 3 emissions, and publishing disclosures up to nine months after the year-end.

Implementation Steps: Assess applicability, conduct a gap analysis, establish governance, identify risks and metrics, and align financial data with sustainability reporting.

Technology Tools: Automation platforms like neoeco simplify data collection, ensure accuracy, and integrate sustainability data with financial systems.

These standards are reshaping corporate reporting by tying sustainability directly to financial outcomes, offering a clear framework for businesses and investors alike.

Webcast 1: Introduction and overview

Preparing for IFRS S1 and S2 Implementation

Before diving into full compliance, it's essential to evaluate client applicability, pinpoint reporting gaps, and set a clear timeline.

Assessing Applicability and Transition Reliefs

The compliance requirements for IFRS S1 and S2 differ depending on the client. These standards apply to profit-driven entities with external stakeholders - such as investors, lenders, or creditors - who depend on general-purpose financial reports for decision-making. Notably, they are relevant regardless of whether a client follows IFRS Accounting Standards, UK GAAP, or another framework.

The key question is whether sustainability or climate-related risks could “reasonably be expected to affect the entity’s prospects.” This includes impacts on cash flows, access to finance, or cost of capital over the short, medium, or long term. For businesses reliant on natural resources, operating in high-emission sectors, or facing regulatory risks, IFRS S2 is particularly relevant.

"This Standard requires an entity to disclose information about all sustainability‐related risks and opportunities that could reasonably be expected to affect the entity's cash flows, its access to finance or cost of capital over the short, medium or long term." – IFRS S1

For smaller clients or those with limited resources, the standards include proportionality measures. These allow entities to use “reasonable and supportable information” available at the reporting date, avoiding excessive costs or efforts.

Transition reliefs ease the burden of initial compliance. For example, entities can focus solely on climate-related disclosures under IFRS S2 in the first year, deferring broader sustainability topics under IFRS S1. Additionally, firms are exempt from disclosing Scope 3 emissions and comparative data for the prior year during this period. Sustainability disclosures can also be published later - either with the next half-year report or within nine months of the year-end. For more details, check out how ISSB reporting integrates into financial strategies.

Transition Relief | Description | Duration |

|---|---|---|

Climate-only | Focus solely on climate-related risks and opportunities (IFRS S2). | Reliefs apply in year one |

Scope 3 Emissions | Exemption from disclosing value chain (Scope 3) greenhouse gas emissions. | Reliefs apply in year one |

Comparative Data | No need to provide data for the previous reporting year. | Reliefs apply in year one |

Reporting Timing | Option to publish sustainability disclosures after financial statements. | Reliefs apply in year one |

These initial steps naturally lead into a detailed gap analysis.

Conducting a Gap Analysis

With transition reliefs in mind, conduct a thorough gap analysis to identify what’s already in place and what still needs development. Structure this analysis around the four core pillars: Governance, Strategy, Risk Management, and Metrics and Targets.

Start with governance. Review whether the board’s terms of reference include sustainability and climate oversight. Many boards are traditionally focused on financial risks and may need to formalise roles in this area. Also, check whether executive remuneration policies are tied to climate-related performance metrics - a specific requirement under IFRS S2.

Next, focus on strategy and risk management. Does the client have a defined transition plan? Are short-, medium-, and long-term time horizons clearly outlined? Crucially, can they perform scenario analysis to test climate resilience? This is a mandatory element under the standards.

For metrics and targets, evaluate the client’s current GHG accounting capabilities. IFRS S2 requires emissions to be broken down by constituent gases (e.g., methane, nitrous oxide) and specific categories like purchased goods or product use. Industry-specific guidance under IFRS S2 may also highlight additional disclosure requirements.

Mapping the value chain is another critical step. Both standards demand disclosures covering the entire value chain, not just direct operations. Assess whether the client can collect data from suppliers, distributors, and customers - particularly for Scope 3 emissions, which often pose the biggest challenge. For more on this, see Scope 3 emissions.

Finally, ensure financial data aligns with sustainability disclosures. This includes verifying that assumptions and figures used in sustainability reporting match those in financial statements. Accounting firms can bring their expertise here, bridging finance and sustainability through financially-integrated sustainability management.

Planning Your Implementation Timeline

Once the gap analysis is complete, create a timeline that incorporates transition reliefs and aligns with reporting deadlines.

Coordinate key milestones with the client’s reporting calendar. If timing relief is used, schedule sustainability disclosures to coincide with the half-year report or within nine months of the year-end. This staggered approach separates sustainability reporting from the year-end financial audit, easing pressure on teams.

Leverage the climate-only relief to prioritise climate governance and strategy in the first year. Broader sustainability topics can follow in later reporting cycles. Similarly, use the Scope 3 exemption to pilot supplier data collection without immediate disclosure requirements.

Allocate dedicated time for critical tasks like scenario analysis, stakeholder engagement, data validation, and internal reviews. Consider automating processes to reduce errors and inefficiencies, especially for value chain data and emissions reporting.

Step-by-Step Guide to IFRS S1 and S2 Compliance

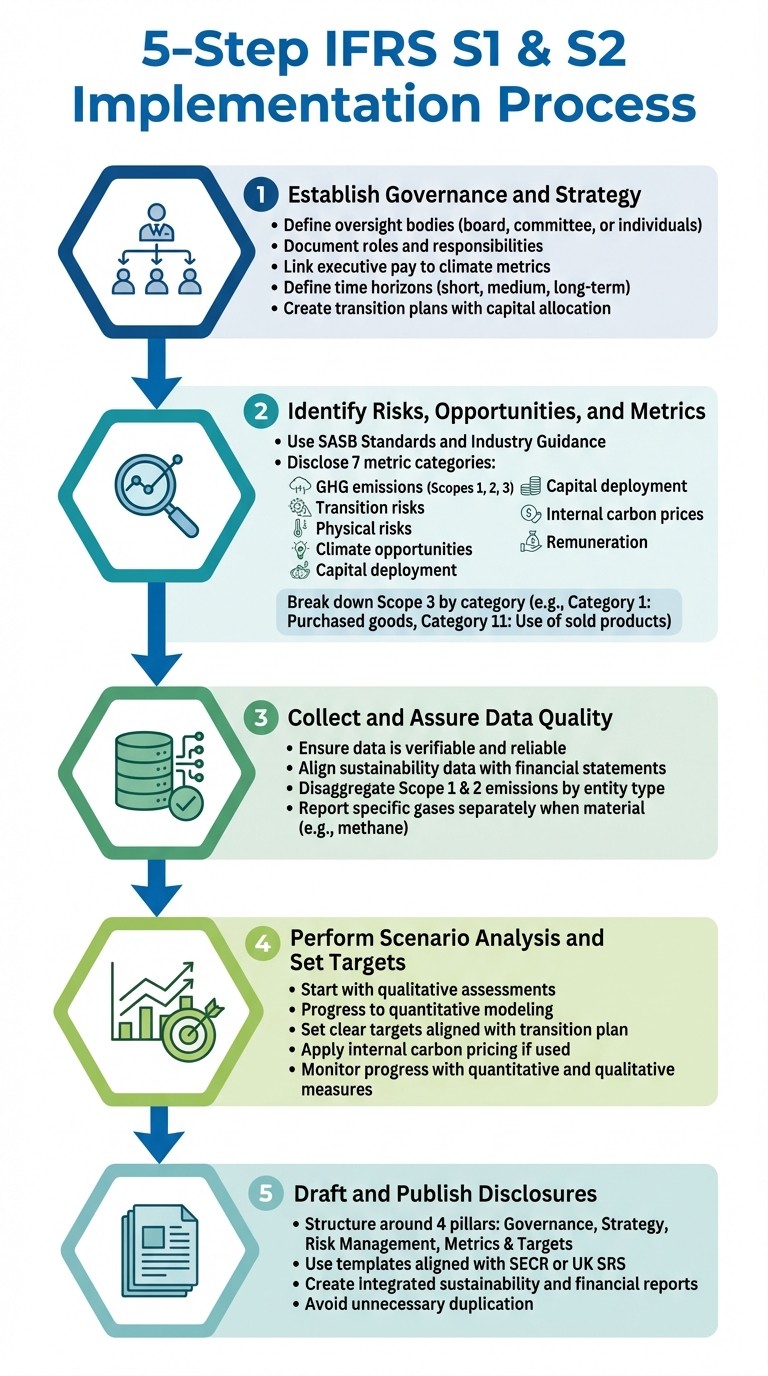

5-Step IFRS S1 and S2 Implementation Process for Accounting Firms

With preparation complete, it's time to move forward with implementing the standards in a structured way. Here’s how accounting firms and their clients can turn regulatory requirements into actionable steps.

Step 1: Establish Governance and Strategy

Start by defining who will oversee sustainability and climate-related risks. This could be the board, a specialised committee, or specific individuals. Their responsibilities need to be clearly documented - this includes formal terms of reference, mandates, and role descriptions. Boards now have an added responsibility to monitor sustainability risks, so it's essential to evaluate whether they have the necessary expertise or create plans to develop these skills.

A robust governance framework should also outline how often updates on sustainability issues are provided and ensure smooth information flow. Linking executive pay to climate-related performance metrics can further enhance accountability.

"The objective of climate-related financial disclosures on governance is to enable users of general purpose financial reports to understand the governance processes, controls and procedures an entity uses to monitor, manage and oversee climate-related risks and opportunities." – IFRS S2 Standard

When developing strategies, it’s important to define what "short", "medium", and "long term" mean for the organisation. These timeframes should align with existing strategic planning cycles. Explain how identified risks and opportunities impact the business model and value chain, considering specific geographical or asset-related factors. Transition plans should outline how resources, such as capital expenditure, will be allocated to climate adaptation or mitigation efforts.

Once governance and strategy are in place, the next step is pinpointing key risks and opportunities.

Step 2: Identify Risks, Opportunities, and Metrics

Building on the governance framework, identify material risks, opportunities, and measurable metrics by conducting a double materiality assessment. Use established resources like SASB Standards and the Industry-based Guidance on Implementing IFRS S2 to determine sustainability-related risks and opportunities. This process should rely on reasonable and supportable information, including past events, current conditions, and future forecasts, to spotlight material topics affecting cash flow, financing, or capital costs.

IFRS S2 requires disclosures across seven metric categories: greenhouse gas emissions, transition risks, physical risks, climate-related opportunities, capital deployment, internal carbon prices, and remuneration. For greenhouse gas emissions, organisations should measure absolute gross Scope 1, Scope 2, and Scope 3 emissions following the Greenhouse Gas Protocol Corporate Standard, unless local regulations specify otherwise.

Scope 3 emissions should be broken down by category, such as purchased goods and services (Category 1) or the use of sold products (Category 11), to ensure clarity. For transition risks, disclose the proportion of assets exposed to regulatory or market changes. For physical risks, include details like the percentage of assets located in areas prone to flooding or water stress. Climate-related opportunities might include revenue from low-carbon products or cost savings achieved through energy efficiency initiatives.

Step 3: Collect and Assure Data Quality

Accurate data is non-negotiable. Sustainability disclosures must be verifiable and provide a complete, neutral, and reliable view of risks. Data and assumptions used for sustainability reporting should align with those in financial statements to ensure consistency.

Present data in a clear and structured way. For instance, disaggregate Scope 1 and Scope 2 emissions between the consolidated accounting group and other investees, such as associates or joint ventures. If specific gases, like methane, are subject to regulations or present notable risks, report them separately. For example, some oil and gas companies report methane emissions within Scope 1 due to regulatory and reputational considerations.

Step 4: Perform Scenario Analysis and Set Targets

Scenario analysis is a key tool for evaluating how resilient a business model and strategy are to climate-related risks. Start with qualitative assessments if quantitative modelling isn’t feasible yet, and gradually move to more detailed quantitative analysis as capabilities improve. Set clear targets that align with the organisation’s transition plan and monitor progress using both quantitative and qualitative measures.

If an internal carbon price is part of decision-making, explain how it’s applied and disclose the price per metric tonne of greenhouse gas emissions.

With targets defined, the next step is to consolidate findings into clear and cohesive disclosures.

Step 5: Draft and Publish Disclosures

Create integrated sustainability and financial reports that meet IFRS S1 and S2 requirements. Structure disclosures around key areas like governance, strategy, risk management, and metrics with associated targets. Use templates aligned with mandatory frameworks - such as SECR or the UK Sustainability Reporting Standards - to simplify compliance.

Avoid duplicating information unnecessarily. If sustainability risks are managed through an integrated approach, present a single, consolidated narrative instead of producing multiple separate reports.

Using Technology for Efficient Compliance

Manually collecting data for IFRS S1 and S2 compliance is not only laborious but also challenging to audit. Spreadsheets fall short when it comes to reliably tracking the disaggregation requirements for Scope 1, Scope 2, and Scope 3 emissions. This is especially problematic given that Category 1 (Purchased Goods and Services) can account for 60% of total disclosed emissions, while Category 11 (Use of Sold Products) often represents over 25%. Automation tools that directly integrate with financial ledgers offer a practical solution, ensuring data consistency, accuracy, and verifiability - key pillars of compliance under IFRS S1. These tools present a more efficient way to handle the complex demands of sustainability reporting.

Using neoeco for Sustainability Reporting

To support the data collection and assurance processes, neoeco offers sustainability accounting software tailored for accounting firms in the UK and Australia. It works seamlessly with Xero, Sage, and QuickBooks, pulling transactional data and automatically aligning it with recognised GHG emissions categories under frameworks such as GHGP, ISO 14064, SECR, UK SRS, and ASRS 2. This eliminates the need for manual data conversions while ensuring that sustainability disclosures align with financial statements.

The platform excels in breaking down emissions by Scope 3 categories, such as purchased goods or the use of sold products, and simplifies gas-specific reporting when needed. It generates compliance-ready reports tailored to specific frameworks, ensuring that entities meet the "comparable" and "understandable" qualitative characteristics required for IFRS reporting. For accounting firms managing multiple clients, neoeco offers a unified dashboard to oversee governance, strategy disclosures, and audit-ready documentation - removing the reliance on spreadsheets and email chains. For more details, explore how ISSB reporting integrates into a financial strategy.

Benefits of Automation in Carbon Accounting

Automation addresses many of the challenges associated with IFRS S1 compliance, such as the scarcity of specialists, high costs of manual processes, and the difficulty of sourcing reliable external data. By minimising manual errors, automation ensures the neutral and precise data that IFRS standards demand. It also allows firms to provide "reasonable and supportable information" without incurring the excessive costs or effort required by exhaustive manual processes.

"The greater the usefulness of information about a sustainability-related risk or opportunity for users, the greater the effort expected of an entity in obtaining that information." – IFRS Foundation

Automation enhances key aspects of sustainability reporting - comparability, verifiability, timeliness, and understandability. This is particularly valuable for intricate disaggregation tasks, like calculating financed emissions for asset managers. For instance, asset managers may need to calculate emissions for up to 98% of total Assets Under Management (AUM), often excluding only cash.

Managing Client Engagements More Efficiently

Beyond automation, efficient client management is essential for accounting firms. Handling multiple clients' sustainability reporting manually is simply unfeasible. neoeco simplifies this by allowing firms to manage all client data in one centralised platform. Its smart transaction mapping links ledger entries directly to Scope 1, 2, and 3 categories, reducing time and effort. Features like a live checklist highlight tasks that are completed, pending, or ready for review, while the Policy & Evidence Hub securely stores supporting documentation under frameworks like ISO 14064 or ISSA 5000.

Firms can also invite auditors to access evidence securely, generate branded client reports, and track performance metrics such as emissions intensity and trends - all through a single interface. This streamlined approach not only boosts efficiency but also creates opportunities for firms to expand into sustainability services, unlocking new revenue streams.

Conclusion and Key Takeaways

Key Steps Recap

To implement IFRS S1 and S2 effectively, focus on four key areas: governance, strategy, risk management, and metrics & targets. This involves outlining how sustainability is embedded into governance practices, identifying climate-related risks and opportunities that could impact your business model, and creating transition plans tied to your financial planning. Establish clear processes for evaluating and prioritising risks, and set measurable goals - such as absolute gross Scope 1, 2, and 3 emissions targets. Ensure that sustainability disclosures align seamlessly with financial statements, using consistent data and assumptions throughout. Tools like neoeco can streamline this process by automating data collection and aligning it with recognised frameworks, reducing manual errors and producing audit-ready outputs. These steps create a solid foundation for accounting firms to act immediately.

Benefits of IFRS S1 and S2 Compliance

Following these standards offers several key advantages. They provide investors, lenders, and creditors with actionable insights by clearly linking sustainability risks to cash flow, financing, and capital costs. Adopting these standards ensures transparency by presenting all relevant risks and opportunities in a clear and reliable manner, giving a trustworthy view of a company's future prospects. Using a standardised framework also makes information comparable across industries and regions, a critical factor in building investor trust. For accounting firms, compliance opens opportunities for new advisory and assurance services, while the emphasis on verifiability guarantees the delivery of high-quality, reliable data.

Next Steps for Accounting Firms

Begin with a gap analysis to identify areas where your firm falls short of IFRS S1 and S2 requirements. Use the four core content areas as a guide to locate missing data or processes. Stay informed about jurisdictional updates - by June 2025, 33 jurisdictions had adopted or were using ISSB Standards, with the UK set to finalise its Sustainability Reporting Standards (UK SRS) in autumn 2025. Take advantage of transitional reliefs, such as the "climate-first" provisions, which allow initial reporting to focus solely on climate-related risks for the first two years. Access free resources for application guidance, and prepare for assurance requirements by training your team. Setting up robust data systems now, especially for challenging areas like Scope 3 emissions, will ensure your firm is ready to deliver compliance efficiently and profitably.

FAQs

What is the difference between IFRS S1 and IFRS S2?

The main distinction between IFRS S1 and IFRS S2 lies in their areas of focus. IFRS S1 sets out the general requirements for sustainability-related financial disclosures. It establishes the framework, principles, and key content that organisations need to adhere to when reporting on sustainability.

On the other hand, IFRS S2 zeroes in on climate-specific disclosures. It provides detailed guidance on areas such as governance, strategy, risk management, and the metrics organisations should use to report on climate-related matters.

Together, these standards aim to ensure that organisations deliver clear and consistent information about sustainability and climate-related financial aspects, enabling stakeholders to make well-informed decisions.

How can businesses use transition reliefs to simplify their first year of IFRS S1 and S2 compliance?

Businesses navigating their first year of compliance with IFRS S1 and S2 can benefit from transition reliefs designed to ease the process and lighten the load of initial implementation. These reliefs offer a phased approach, giving organisations the flexibility to meet disclosure requirements gradually as they refine their systems and processes.

By prioritising the essential compliance elements and progressively improving their reporting capabilities, companies can transition more smoothly while staying aligned with the new sustainability disclosure standards. Detailed guidance on applying these transition reliefs is provided alongside the standards, helping organisations use these measures effectively.

How can technology simplify the implementation of IFRS S1 and S2 reporting requirements?

Technology plays a crucial role in simplifying IFRS S1 and S2 reporting by automating essential tasks like data collection, categorisation, and report generation. Modern tools can directly link financial transactions to recognised emissions categories, ensuring precision while significantly cutting down on manual work. This eliminates reliance on spreadsheets and manual data conversions, allowing organisations to create sustainability reports ready for audits with greater efficiency and full compliance with IFRS standards.

In addition, digital platforms streamline the management of complex disclosures, such as climate risks and greenhouse gas emissions, by providing real-time updates and customised guidance. These solutions integrate directly with financial data, ensuring consistent application of the standards. This not only saves valuable time but also boosts reliability for organisations as they navigate changing regulatory requirements.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.