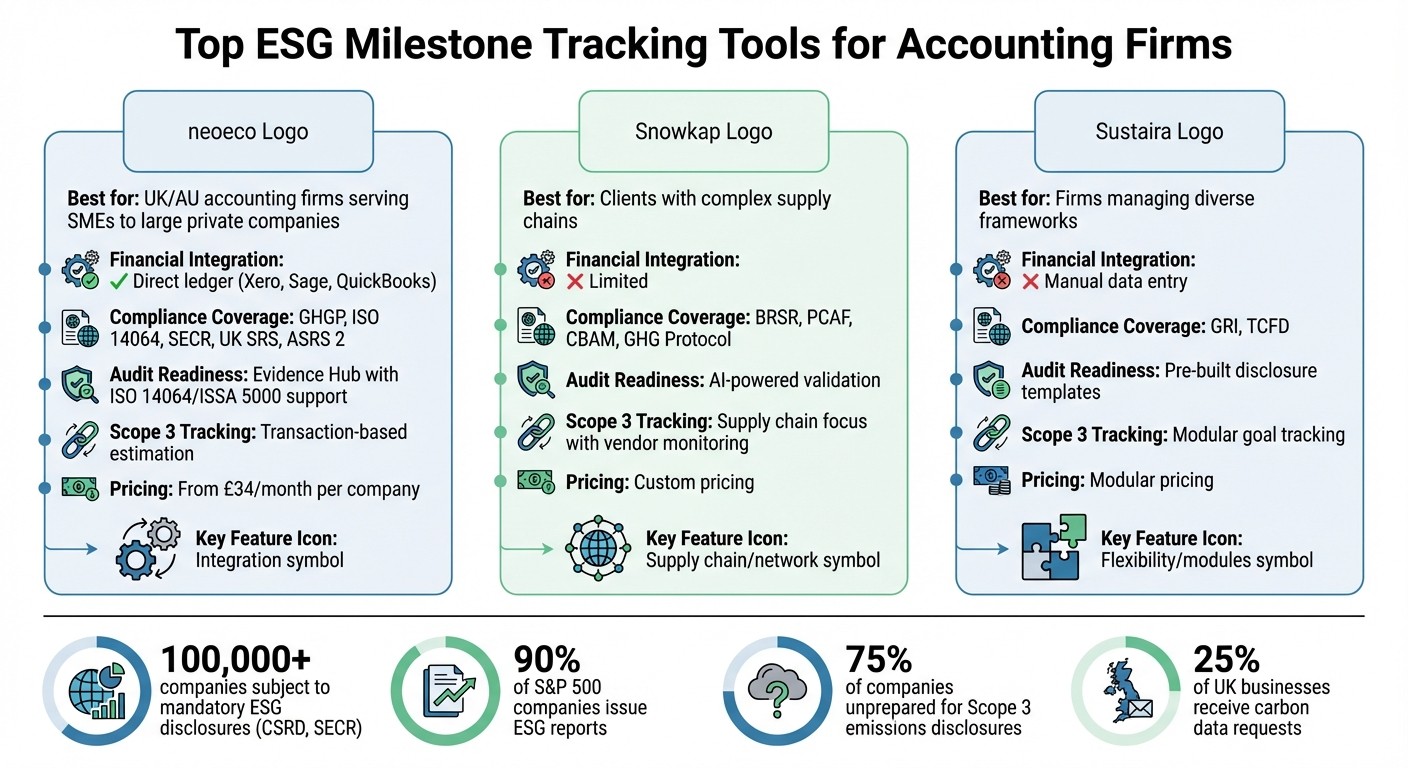

Top Tools for ESG Milestone Tracking

Jan 27, 2026

Finance-integrated ESG tools streamline SECR, ISO 14064 and Scope 3 reporting with ledger integration and audit-ready evidence.

Manually tracking ESG (Environmental, Social, and Governance) milestones is inefficient and prone to errors. With increasing regulations like SECR, UK SRS, and ISO 14064, accounting firms in the UK need reliable tools to ensure accurate reporting and compliance. Modern ESG software not only simplifies the process but also creates opportunities to offer ESG reporting as a service, giving firms a competitive edge.

Key features to look for in ESG tools:

Integration with accounting platforms (e.g., Xero, Sage, QuickBooks) for automatic data mapping.

Compliance-ready templates tailored to frameworks like SECR and ISO 14064.

Audit-ready documentation with secure evidence storage and real-time tracking.

Top Tools:

neoeco: Best for financial integration, offering automation and white-label reporting (£34/month).

Snowkap: Focused on supply chain and Scope 3 tracking with vendor monitoring.

Sustaira: Modular platform for tracking diverse ESG goals and KPIs.

Quick Comparison:

Feature | neoeco | Snowkap | Sustaira |

|---|---|---|---|

Financial Integration | Yes (Xero, Sage, QuickBooks) | Limited | Manual data entry |

Compliance Frameworks | GHGP, SECR, ISO 14064 | BRSR, GHG Protocol | |

Audit Support | Evidence Hub | AI-powered validation | Pre-built templates |

Scope 3 Tracking | Transaction-based estimation | Supply chain focus | Goal tracking modules |

Pricing | From £34/month | Custom pricing | Modular pricing |

Choose tools based on your clients' needs, focusing on compliance, data accuracy, and integration with existing systems. This ensures faster reporting, audit readiness, and the ability to meet growing ESG demands.

ESG Tracking Tools Comparison: neoeco vs Snowkap vs Sustaira

What to Look for in ESG Tracking Tools

The right ESG tracking tools can streamline compliance and client reporting by working seamlessly with your existing financial systems. These platforms bridge the gap between sustainability metrics and financial data, making ESG reporting more efficient and accurate.

Integration with Financial Systems

Look for tools that integrate smoothly with accounting software like Xero, Sage, and QuickBooks. By linking directly to clients' ledgers, these tools can automatically retrieve transaction data and map it to emissions categories under frameworks such as GHGP, ISO 14064, and UK-specific standards like SECR. Many advanced platforms include AI-powered "smart matching" features that connect ledger entries to Scope 1, 2, and 3 emissions categories. This approach, referred to as financially-integrated sustainability management, ensures your carbon data is as reliable and auditable as your financial records.

Compliance-Ready Reporting Templates

Pre-built reporting templates are another must-have feature. Tools offering templates tailored to frameworks like SECR, UK SRS, and ISO 14064 can save time and reduce errors. These templates ensure that your reports meet disclosure requirements, follow proper formatting, and categorise emissions data accurately. This not only speeds up the reporting process but also helps avoid issues during regulatory reviews.

Audit-Ready Documentation

A strong ESG tool should also provide a traceable ESG data system, documenting how every data point is collected, categorised, and calculated. Features like real-time logs of data sources, calculation methods, and user actions ensure you're prepared for regulatory inspections. Automated audit packs can further simplify the process, making sure that Scope 3 emissions and other ESG metrics are fully compliant with audit standards.

Top ESG Milestone Tracking Tools for Accounting Firms

The following tools are specifically designed to help accounting firms manage ESG milestone tracking by leveraging automation, ensuring compliance, and integrating seamlessly with existing financial systems. They address various aspects of sustainability reporting, from carbon accounting tied to ledgers to supply chain emissions tracking and flexible KPI management. These platforms are tailored to meet the needs of modern ESG reporting with features that simplify and streamline the process.

Here’s a closer look at some of the leading solutions available for ESG milestone tracking.

neoeco: Finance-Integrated ESG Management

neoeco is tailored for accounting firms in the UK and Australia, offering carbon accounting and sustainability services without disrupting current workflows. It automates the mapping of client transactions to emissions categories under frameworks like GHGP, ISO 14064, SECR, UK SRS, and ASRS 2. This eliminates the need for manual data entry or reliance on spreadsheets.

The platform also includes white-label reporting, enabling firms to create professional, custom-branded reports featuring their logos and colours for client presentations. Pricing starts at £34 per month per company (billed annually), with higher tiers offering added features and customisation options.

neoeco's Evidence Hub is another standout feature, securely storing all supporting documentation for audits or assurance under ISO 14064 or ISSA 5000. Auditors can access evidence directly through the platform, cutting down on back-and-forth emails. For firms looking to expand into ISSB reporting or manage Scope 3 emissions effectively using activity-based data, neoeco offers a streamlined solution that integrates with existing accounting workflows and requires minimal training.

Snowkap: Supply Chain and Scope 3 Tracking

While neoeco excels in financial integration, Snowkap focuses on supply chain data and Scope 3 emissions tracking. It’s ideal for clients managing complex supply chains, consolidating ESG data and monitoring vendor performance. Snowkap simplifies the collection and reporting of vendor data, ensuring accuracy and audit readiness through AI-powered validation.

The platform’s live dashboards provide real-time monitoring of emissions and compliance metrics, with features like anomaly detection and alerts. Snowkap aligns with global standards such as BRSR, PCAF, CBAM, and the GHG Protocol. Additionally, its supply chain assessment tools help firms identify high-emission vendors and collaborate on reduction strategies.

Sustaira: Flexible Goal and KPI Tracking

Sustaira stands out with its modular approach, offering tools to track a wide range of ESG goals. Designed to align with global frameworks like GRI and TCFD, Sustaira provides performance dashboards and pre-built disclosure templates. Its flexibility allows firms to select only the modules they need, making it a great option for handling diverse client requirements and supporting multiple reporting frameworks.

This scalable design makes Sustaira particularly well-suited for accounting firms looking to adapt to varied client needs while maintaining efficient ESG reporting practices.

How to Choose the Right ESG Tool for Your Firm

Selecting the right ESG solution goes beyond basic features - it's about ensuring compliance, audit readiness, and seamless integration with your existing systems.

Start by choosing tools that align with your clients' compliance needs and your firm's operational requirements. With over 100,000 companies now subject to mandatory ESG disclosures under frameworks like CSRD and SECR, it's essential to find software that meets current demands while staying adaptable to future regulatory changes.

Tailoring Tools to Reporting Needs

Understanding your clients' reporting frameworks is key. For UK SMEs handling SECR or larger firms transitioning to ISSB reporting, prioritise platforms that integrate directly with accounting software like Xero, Sage, or QuickBooks. This eliminates the need for manual data entry and ensures sustainability metrics align with financial statements - a critical consideration given that, while 90% of S&P 500 companies now issue ESG reports, many still struggle to connect these to financial performance.

For firms undergoing audits, tools with built-in evidence hubs and timestamped trails can be a lifesaver during reviews like ISO 14064 or ISSA 5000. Platforms offering pre-built templates for frameworks such as GHGP and SECR allow you to generate reports in minutes instead of days.

Addressing Scope 3 Challenges

With 75% of companies unprepared for Scope 3 emissions disclosures, automation is a game changer. Look for tools that streamline supply chain data collection or estimate emissions from financial transactions, covering both upstream and downstream impacts. For firms managing intricate vendor networks, supply chain trackers may be the better option. For others, financially integrated platforms that estimate Scope 3 emissions via purchase ledgers offer quicker setup and implementation. These features are summarised in the table below.

Comparison Table of ESG Tools

Feature | neoeco | Snowkap | Sustaira |

|---|---|---|---|

Financial Integration | Direct ledger (Xero, Sage, QuickBooks) | Limited | Manual data entry |

Compliance Coverage | GHGP, ISO 14064, SECR, UK SRS, ASRS 2 | BRSR, PCAF, CBAM, GHG Protocol | GRI, TCFD |

Audit Readiness | Evidence Hub with ISO 14064/ISSA 5000 support | AI-powered validation | Pre-built disclosure templates |

Scope 3 Tracking | Transaction-based estimation | Supply chain focus with vendor monitoring | Modular goal tracking |

Pricing | From £34/month per company | Custom pricing | Modular pricing |

Best For | UK/AU accounting firms serving SMEs to large private companies | Clients with complex supply chains | Firms managing diverse frameworks |

Practical Implementation Tips

Beyond features, the ease of implementation can make or break your ESG tool adoption.

Financially integrated platforms like neoeco often require minimal onboarding, while supply chain-focused solutions may need more extensive vendor training. Allocate time for setup, staff training, and initial testing before rolling the tool out to clients.

Direct ledger integration simplifies data migration by automatically importing historical transactions. For platforms that rely on manual uploads, extra resources may be needed to clean and format data from spreadsheets or legacy systems. Securing leadership support early in the process can also help align your finance, risk, and sustainability teams.

Finally, opt for scalable solutions that can grow with your needs. With 25% of UK businesses already receiving carbon data requests from customers or investors, it's smart to choose tools with modular pricing and the flexibility to expand capabilities as your requirements evolve.

Conclusion

Tracking ESG milestones effectively hinges on using tools that seamlessly integrate with financial software like Xero, Sage, and QuickBooks. This eliminates the need for manual data entry and ensures sustainability metrics are directly aligned with financial records.

Solutions such as neoeco take this a step further by automating compliance processes for frameworks like GHGP, SECR, and UK SRS. With audit-ready ESG data systems, these tools turn ESG reporting into a scalable and profitable service for businesses.

As the demand for carbon data and mandatory disclosures grows, financially integrated ESG tracking tools enable faster, more precise, and audit-ready reporting - whether for SMEs or larger organisations.

To get started, focus on aligning the tool’s features with the specific compliance requirements of your clients. A phased approach, combined with centralised evidence storage and modular pricing, can help avoid last-minute audit stress while supporting long-term growth.

FAQs

How do ESG tools work with accounting software like Xero or QuickBooks?

ESG tools work hand-in-hand with accounting software like Xero and QuickBooks by linking financial data directly to sustainability metrics. For instance, platforms such as neoeco integrate smoothly with systems like Xero, Sage, and QuickBooks, automating the process of mapping financial transactions to emissions categories.

This automation removes the hassle of manual data entry or juggling spreadsheets, making it easier for businesses to produce precise, audit-ready sustainability reports. It also helps organisations stay aligned with frameworks like the GHGP and SECR, while offering real-time updates that simplify carbon accounting and ESG reporting.

What are the advantages of using compliance-ready templates for ESG reporting?

Compliance-ready templates bring a host of practical advantages to ESG reporting, making the process smoother and more reliable. They ensure your reports align with regulatory standards, whether it's the UK's SECR guidelines or international frameworks like ISSB and ISO 14064. This reduces the risk of falling short on compliance and avoids the penalties that can come with it.

These templates also save you a significant amount of time and effort. With pre-structured, audit-ready formats, you don’t need to manually organise data, which can be both time-consuming and error-prone. Plus, they improve accuracy and maintain consistency across all your reports. This ensures every necessary disclosure is included, helping to build transparency and trust among your stakeholders.

By simplifying the reporting process and ensuring everything complies with regulations, compliance-ready templates give businesses the ability to produce professional, trustworthy ESG disclosures with ease and confidence.

How can accounting firms ensure they are audit-ready with ESG tracking tools?

To stay prepared for audits, accounting firms should consider using ESG tracking tools that simplify compliance and ensure records are accurate and easy to verify. Modern platforms like neoeco take the hassle out of the process by automating tasks such as linking transactions to recognised emissions standards (like SECR, UK SRS, or ISO 14064) and creating detailed reports that are ready for audits. By cutting down on manual work, these tools enable firms to maintain dependable, finance-grade data while keeping up with changing regulations.

Key features, including automated data mapping, real-time dashboards, and centralised record-keeping, enhance transparency and make audit preparation less of a burden. With specialised tools like neoeco, accounting firms can handle ESG reporting with confidence, minimise mistakes, and ensure audits run smoothly.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.