Ultimate Guide to Climate Risk Mitigation in Supply Chains

Jan 25, 2026

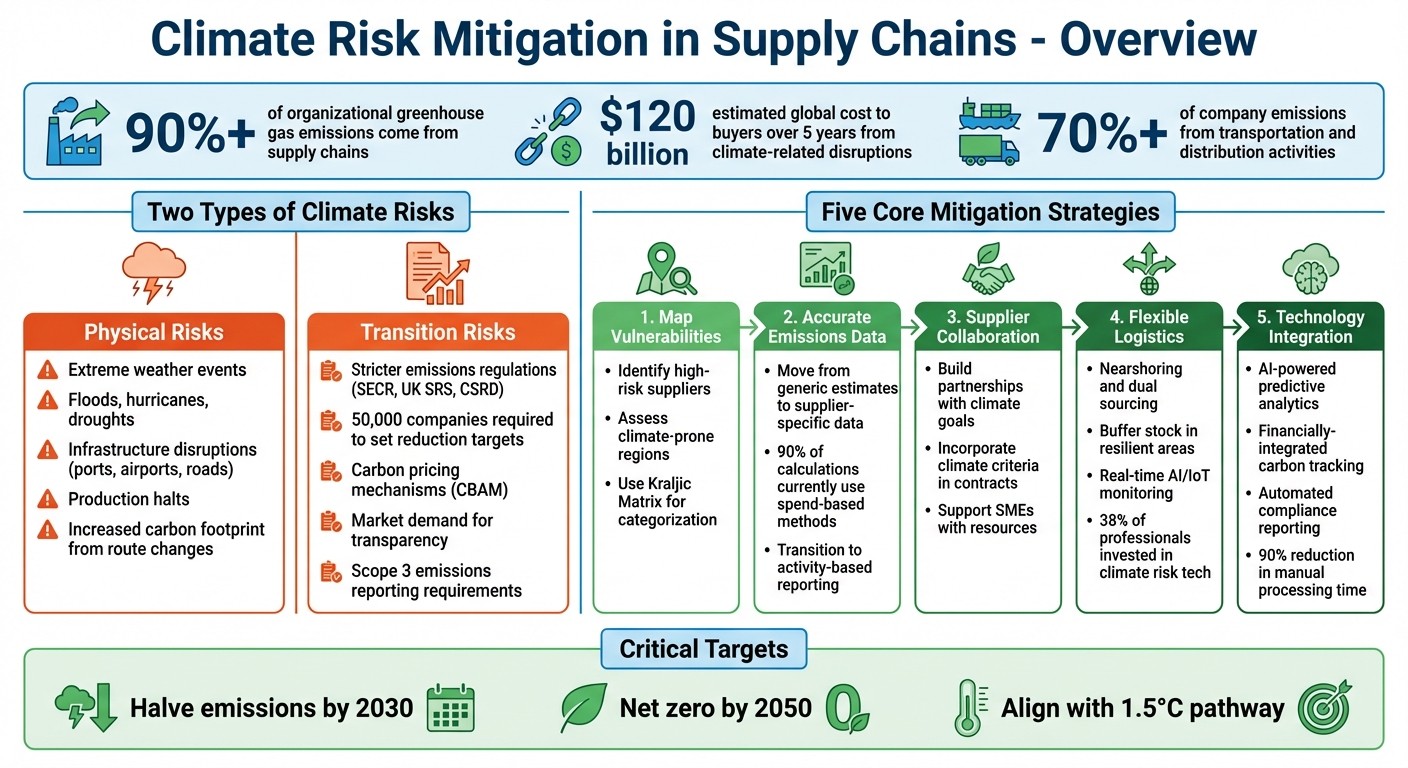

Data-driven strategies to map supplier vulnerabilities, cut Scope 3 emissions and build resilient, compliant supply chains against physical and transition risks.

Your supply chain likely accounts for over 90% of your organisation's greenhouse gas emissions. This isn't just an environmental concern - it’s a financial and operational risk. Climate-related disruptions could cost buyers an estimated $120 billion globally over five years, while stricter regulations like SECR, UK SRS, and the Corporate Sustainability Reporting Directive demand improved transparency, especially around Scope 3 emissions.

To mitigate these risks and build resilience, you need to address two primary challenges: physical risks (extreme weather disrupting transport and operations) and transition risks (changing regulations and market demands). The solution? A data-driven approach that focuses on:

Mapping vulnerabilities: Identify high-risk suppliers and regions prone to climate issues.

Accurate emissions data: Move from generic estimates to supplier-specific information.

Supplier collaboration: Build stronger partnerships with clear climate goals.

Flexible logistics: Adopt nearshoring, dual sourcing, and real-time monitoring.

Technology integration: Use AI and financially-integrated tools to automate compliance and reporting.

Businesses that act now can reduce exposure to carbon pricing, improve operational continuity, and meet growing regulatory demands. This guide explains how to implement these strategies effectively and ensure long-term supply chain resilience.

Climate Risk Types and Mitigation Strategies for Supply Chains

Resilience in the Storm: Adapting to Severe Weather in Supply Chains | Beyond The Box Podcast

Types of Climate Risks in Supply Chains

Supply chains face two primary types of climate risks: physical risks and transition risks. Physical risks are tied to the direct effects of extreme weather and environmental changes, while transition risks stem from regulatory and market changes that alter business operations. Recognising and addressing these risks is essential for creating a resilient procurement strategy. Let’s break down how these risks unfold in real-world scenarios.

Physical Risks: Extreme Weather and Natural Disasters

Physical risks can wreak havoc on supply chains by disrupting critical transport infrastructure. Ports, airports, and local roads are particularly vulnerable to events like floods, hurricanes, droughts, and extreme temperatures. These disruptions can delay shipments, halt production, and sever access to essential services.

In the UK, the government offers specific guidance on conducting climate change risk assessments. These assessments help organisations evaluate vulnerabilities across various transport modes and prioritise areas for adaptation.

"Climate change risk assessments are used to help organisations understand: the current and future effects of climate change [and] how to prioritise climate change adaptation." - Department for Transport

Extreme weather doesn’t just delay operations - it can also increase your company’s carbon footprint. Transportation and distribution activities, which are often highly susceptible to climate events, typically account for over 70% of a company’s total emissions. When disruptions force the use of less efficient transport methods or longer routes, both operating costs and emissions can spike.

Transition Risks: Regulatory and Market Shifts

Transition risks arise as governments tighten emissions regulations and customers demand greater transparency. Frameworks like SECR, UK SRS, and the Corporate Sustainability Reporting Directive now require detailed reporting on Scope 3 emissions, with nearly 50,000 companies expected to set reduction targets under these new standards. Without accurate supplier emissions data, businesses face compliance risks and potential damage to their reputation.

Procurement decisions are evolving. Emissions performance is now weighed alongside traditional factors like price and quality. To adapt, companies must move beyond spend-based accounting methods, which rely on industry averages and financial data. These methods, used in about 90% of carbon calculations, often fail to capture the actual performance of individual suppliers.

Transition risks also include financial exposure to carbon pricing mechanisms, such as the Carbon Border Adjustment Mechanism (CBAM), and costs associated with emissions trading. Reliable supplier data is critical for forecasting Scope 3 emissions and managing these costs effectively. For more on this, you can explore managing Scope 3 emissions in a financially integrated way.

Mapping Supply Chain Vulnerabilities

To address these risks, visibility across the supply chain is crucial. Start by looking beyond Tier-1 suppliers and categorising them based on risk. The Kraljic Matrix is a useful tool for this, as it classifies suppliers by supply risk and profit impact, helping you focus on the most critical areas.

Mapping supplier locations adds another layer of insight. Analysing where suppliers operate - especially in regions prone to extreme weather, water scarcity, or regulatory uncertainty - sharpens your risk assessments.

Accurate data collection is key to this process. Moving from generic estimates to supplier-specific data improves your ability to assess risks and identify which partners contribute most to Scope 3 emissions . This means requesting precise details like energy usage, production volumes, and transport distances. Using standardised frameworks such as the Greenhouse Gas Protocol or ISO 14064 ensures consistency and comparability across your supply chain.

"By jumping right to individual suppliers as a data source, many ignore where their biggest impact actually lies... In terms of data quality, the minimum approach you should take is a spend-based method, in the absence of better data." - Position Green

An example of effective supply chain mapping comes from River Island, which implemented Segura’s platform in September 2025. This allowed the company to link supply chain transparency directly to purchase orders, achieving real-time visibility down to Tier-4 and beyond. Their Ethical Trade Manager used this tool to identify upstream risks more effectively. While not every organisation may require such detailed mapping immediately, deeper visibility often uncovers vulnerabilities that simpler assessments might overlook.

How to Conduct Climate Risk Assessments

To start your climate risk assessment, focus on identifying Scope 3 emissions hotspots throughout your supply chain. Since these emissions often make up over 70% of a company’s total carbon footprint, pinpointing where they are concentrated helps you direct your efforts where they’ll have the most impact.

Next, prioritise which suppliers to evaluate in greater depth. Consider factors like their emissions volume, potential for decarbonisation, overall importance to your business, and exposure to climate risks. This way, you can allocate resources effectively, concentrating on the suppliers that have the greatest influence on your climate goals.

Begin with a spend-based approach to get broad estimates of emissions. Then, transition to an activity-based method using detailed supplier-specific data, such as energy consumption and production volumes, for more accurate and audit-ready reporting . As Position Green explains, "your suppliers' real emissions help you make purchasing decisions based on facts, not estimates".

Using Climate Data and Analytics

To meet regulatory requirements like ESRS E1, replace generic emission factors with supplier-specific data. This deeper level of detail - covering expenses like fuel, repairs, and taxes - provides clarity on emission sources and supports targeted reduction strategies. For example, Position Green’s database offers access to over 10,000 emission factors, showcasing the granularity now achievable in spend-based carbon accounting.

When collecting supplier data, ensure its accuracy by using third-party verification and strong internal controls. Position Green warns that "poor data is poor data, regardless of its source... poorly documented supplier data can introduce new uncertainty". Proper validation not only reduces audit risks but also builds investor trust, especially as expectations for precise, verifiable data increase.

Data Type | Description | Accuracy Level | Use Case |

|---|---|---|---|

Generic/Secondary | Industry averages from lifecycle databases | Low | Initial mapping |

Spend-Based | Financial expenditure multiplied by emission factors | Moderate | 90% of initial calculations |

Supplier-Specific | Primary data from supplier operations | High | Audit-ready reporting |

Once you’ve gathered precise data, the next step is to plan for long-term risk mitigation through scenario planning.

Scenario Planning and Long-Term Forecasting

To align procurement with the 1.5°C pathway, plan for strategies like substituting inputs and sourcing materials closer to your markets. Achieving this alignment requires halving greenhouse gas emissions by 2030 and reaching net zero by 2050. Scenario planning can also prepare you for future challenges, such as carbon pricing, border adjustments like the Carbon Border Adjustment Mechanism, and emissions trading costs. Identifying carbon-intensive inputs early allows you to address these risks proactively.

For example, nearly 8,000 suppliers collectively estimated that climate-related risks could increase costs to their buyers by US $120 billion over five years. This underscores the importance of scenario planning in anticipating financial exposure.

Set clear interim targets leading up to 2030 to track progress and make adjustments as needed. These targets build on your supplier prioritisation efforts, ensuring consistent alignment across your supply chain. Encourage your key suppliers to establish their own science-based Scope 1, 2, and 3 targets, creating a unified approach to climate scenario planning. This shared framework not only supports long-term planning but also helps you evaluate whether emission reductions are grounded in actual value chain changes rather than estimates.

For insights on integrating emissions data into financial strategies, explore how ISSB reporting fits into a financially-integrated strategy.

"Companies that make progress more quickly will not only accelerate the needed transition but can also create significant competitive advantage and enhance their own long-term resilience." - 1.5°C Supplier Engagement Guide

Practical Strategies for Mitigating Climate Risks

After identifying climate risks and evaluating supplier vulnerabilities, it’s time to implement measures that reduce exposure and build resilience. These strategies weave climate preparedness into procurement, supplier relationships, and logistics, ensuring resilience becomes a natural part of your operations rather than an isolated effort.

Diversifying Suppliers and Sourcing Locations

Relying on a single supplier increases vulnerability to extreme weather and regulatory changes. By adopting nearshoring and dual-sourcing, businesses can cut transport emissions and reduce the risk of disruptions in global transit. Shorter, more varied supply chains are less likely to suffer production halts during extreme events.

Consider this: climate-related disasters led to over £250 billion in global economic losses in 2023, while third-party failures accounted for 9.3% of all supply chain disruptions in the year leading up to 2025. These numbers highlight the critical need for geographic diversification. Segmenting suppliers by their risk levels allows for prioritised climate assessments.

Diversification doesn’t just spread risk - it also lays a foundation for stronger supplier collaboration.

Building Stronger Supplier Partnerships

Resilient supplier relationships thrive on shared accountability. Incorporate climate criteria into contracts, RFIs, RFPs, and Supplier Codes of Conduct to make resilience a priority. Work closely with high-impact suppliers and equip procurement teams with clear decarbonisation goals. For smaller suppliers, point them to resources like the SME Climate Hub, and incentivise transparency with perks like better payment terms, long-term contracts, or funding for decarbonisation projects.

"We investigate our suppliers' business continuity plans. A few years ago, you might have said, 'Yes, we have a plan,' and that would have been enough. Now companies want to see your plan, evidence of testing, and audits. It's no longer just trust; we need guarantees because we're so reliant on different suppliers." – Practitioner, BCI Horizon Scan Report 2025

Make climate performance a regular part of business reviews, alongside traditional metrics like cost and quality. To link supplier emissions data to financial systems, tools for managing Scope 3 emissions in real time can be invaluable. Implementing traceability systems for Scope 3 can further enhance this data accuracy.

Once supplier partnerships are fortified, agile logistics can further strengthen operational resilience.

Creating Flexible and Low-Carbon Logistics

Flexible logistics not only lower emissions but also reduce disruption risks. Modular designs - where products and processes allow for adjustments during supply chain shocks - can keep operations running when suppliers face climate-related delays. Storing buffer stocks in climate-resilient areas ensures continuity during crises.

Real-time monitoring powered by AI and IoT provides early warnings for extreme weather, helping businesses act before shipments are delayed. In fact, 38% of supply chain professionals have invested in technology to identify climate risks and improve resilience, while 54% of organisations use automation to enhance supply chain visibility. Tools like the EPA’s SmartWay programme can help benchmark and improve freight efficiency by identifying the most effective transport modes and carriers.

Financially-integrated carbon tracking is another game-changer. By linking carbon data to financial systems like Xero, Sage, or QuickBooks, businesses can automate Scope 3 emissions reporting and ensure audit-ready data without relying on manual spreadsheets. This approach reflects the rise of Financially-Integrated Sustainability Management (FiSM), which blends carbon accounting with financial workflows to eliminate data silos. Explore more about how FiSM connects finance and sustainability.

Here’s a quick look at how these strategies address specific climate risks:

Strategy | Primary Benefit | Climate Risk Addressed |

|---|---|---|

Nearshoring | Reduced lead times & emissions | Transport disruptions & carbon footprint |

Dual Sourcing | Redundancy | Regional extreme weather events |

Buffer Stocking | Operational continuity | Sudden supply shocks/infrastructure failure |

AI/IoT Monitoring | Predictive agility | Acute physical risks (hurricanes, floods) |

FiSM Integration | Regulatory compliance | Transition risks (carbon pricing/reporting) |

These strategies provide a solid foundation for integrating advanced technologies and improving reporting frameworks, paving the way for a more resilient supply chain.

Technology for Climate Risk Management

Technology is reshaping climate risk management, moving it from a reactive approach to a proactive one. By predicting potential disruptions, automating compliance processes, and connecting carbon data with financial systems, organisations can stay ahead of climate-related challenges.

Predictive Analytics and AI for Risk Monitoring

AI-driven platforms combine physical risk data - like extreme weather patterns and rising sea levels - with transition risk indicators, such as policy changes and carbon pricing. This allows businesses to model the potential impacts of various warming scenarios. Additionally, smart matching technology links financial transactions from ERP systems directly to relevant carbon data, making it easier to pinpoint emissions hotspots and identify high-risk suppliers before any disruptions happen. The result? Automated, audit-ready accuracy.

Take ClimateAi, for instance. It provides projections under multiple warming scenarios, which are particularly valuable for managing risks in food supply chains. Similarly, S&P Global Climanomics offers economic impact models that align with IPCC standards, making them a good fit for banks and insurance firms.

To get the most out of these tools, focus on material categories by targeting AI-powered data collection efforts on suppliers and segments that contribute the most to Scope 3 emissions - like logistics or capital goods. Shifting from generic, industry-average emission factors to activity-based, supplier-specific data not only improves the reliability of decarbonisation plans but also enhances audit readiness. Platforms such as Tradeverifyd provide supplier risk monitoring and scoring, enabling procurement teams to stay ahead of climate-related vulnerabilities.

While predictive analytics lays the groundwork for proactive risk management, integrating these insights with financial systems ensures continuous and compliant reporting.

Financially-Integrated Tools for Compliance

Building on the earlier discussion about supply chain risk assessment, financially-integrated tools like neoeco streamline compliance by embedding carbon data into existing financial systems. These tools automatically categorise transactions into recognised emissions groups under frameworks such as GHGP, ISO 14064, SECR, and UK SRS. This reduces manual data entry and minimises the risk of errors.

Unlike the traditional annual or quarterly reporting cycles, these tools provide live dashboards that offer real-time oversight of supply chain risks and carbon performance. They ensure full traceability, from individual supplier transactions to final carbon calculations, and include a secure Policy and Evidence Hub where auditors can access supporting documents directly. This approach aligns with the principles of Financially-Integrated Sustainability Management (FiSM), embedding ESG impact factors into financial transactions using double-entry accounting principles.

For accounting firms working with SMEs or large private companies, platforms like neoeco significantly cut down the time needed to process supplier data and generate reports - from weeks to just a few days. By mirroring standard month-end financial procedures, these tools allow firms to offer carbon accounting services without requiring extensive new sustainability training. This makes compliance faster and more efficient while ensuring audit-readiness at every step.

Meeting Climate Reporting Requirements

Getting climate reporting right isn’t just about ticking compliance boxes - it’s also a smart way to build a more resilient supply chain. In the UK, regulations now demand organisations disclose their climate impact, with a particular focus on supply chain emissions, also known as Scope 3. These emissions make up more than 70% of a company’s carbon footprint.

To meet these requirements, reports must satisfy auditors, align with established frameworks, and eliminate time-consuming manual efforts. Procurement teams need to know which standards apply, how LCA supports Scope 3 emissions reporting, and how to automate the process without sacrificing precision. Let’s take a closer look at key reporting frameworks and methods to simplify compliance.

Key Reporting Frameworks: SECR, UK SRS, ISO 14064, and GHGP

The GHG Protocol (GHGP) is the backbone of emissions reporting. It divides emissions into three categories: Scope 1 (direct emissions), Scope 2 (indirect emissions from energy use), and Scope 3 (emissions across the value chain). This structure underpins frameworks like SECR and the UK SRS.

ISO 14064 provides a detailed methodology for calculating and verifying greenhouse gas emissions. It’s especially useful when you need supplier-specific data rather than relying on generic industry averages.

SECR (Streamlined Energy and Carbon Reporting) is a UK-specific requirement for large companies, mandating annual disclosures on energy use and carbon emissions. UK SRS (Sustainability Reporting Standard) builds on SECR by aligning with global frameworks like ISSB reporting and requiring more detailed disclosures, including Scope 3 emissions.

Regulators are moving away from broad spend-based estimates and pushing for supplier-specific data. The Corporate Sustainability Reporting Directive (CSRD) will soon require around 50,000 companies to provide detailed emissions data. A practical approach is to begin with spend-based data to identify emission hotspots. From there, focus on key areas like purchased goods and logistics to collect more detailed, activity-based data.

With these frameworks in place, automation becomes a game-changer for managing reporting requirements.

Automating Carbon and Sustainability Reporting

Manually preparing climate reports can take six to eight months, but automation can cut this timeline down to weeks - or even days. By linking carbon data directly to financial systems, automated platforms eliminate much of the manual work. For example, tools like neoeco integrate with systems like Xero, Sage, or QuickBooks, automatically mapping transactions to emissions categories defined by GHGP, ISO 14064, SECR, and UK SRS.

Advanced features like smart matching and AI categorise financial transactions into emission groups, seamlessly blending sustainability data with financial records. This approach, built on Financially-Integrated Sustainability Management (FiSM), ensures supplier data is consistently collected and audit-ready.

Automated systems also provide a secure Policy and Evidence Hub, which tracks every step from individual supplier transactions to final carbon calculations. This transparency simplifies the external assurance process required under UK law. For accounting firms working with SMEs or larger private companies, automation significantly reduces the time spent processing supplier data and producing compliant reports - often shrinking the timeline from weeks to just a few days.

Measuring Results and Improving Over Time

Addressing climate risks is not a one-off task - it’s a continuous journey that requires precise and ongoing evaluation. Procurement teams need reliable metrics to gauge the effectiveness of their strategies and uncover potential weaknesses. The focus should be on high-quality data, emissions intensity, and physical risk indicators, which collectively highlight both progress and areas for improvement.

Key Metrics for Supply Chain Resilience

Building on earlier discussions about supplier-specific emissions, it’s crucial to zero in on metrics that strengthen supply chain resilience. Start by tracking the ratio of primary data to secondary data in your emissions calculations. Increasing the use of primary, supplier-specific data boosts accuracy and ensures your organisation is prepared for audits. As regulatory expectations grow, the demand for verifiable, supplier-level data is outpacing the reliance on broad estimates. This shift is particularly important for ensuring precision in Scope 3 emissions reporting.

It’s not just about emissions; tracking how often your supply chain faces disruptions is equally important. For instance, in 2024, nearly 80% of businesses reported at least one major supply chain disruption. By calculating Value at Risk (VaR) - a combination of the likelihood of an event and its financial impact - you can make clear comparisons across suppliers and prioritise mitigation efforts accordingly.

To further strengthen your strategy, incorporate resilience-specific metrics to evaluate how well your supply chain can withstand climate-related challenges.

Regular Risk Reviews and Strategy Updates

With these metrics in hand, regular reviews become indispensable for refining your approach. Conducting quarterly or bi-annual risk assessments ensures your mitigation strategies stay aligned with changing climate realities and regulatory requirements. Use these sessions to pinpoint "hotspots" - areas with high emissions or significant risk exposure - and channel your efforts where they’ll have the greatest effect. Advanced tools powered by AI can help identify incomplete or inconsistent supplier data, keeping your risk profile accurate over time. Automated carbon accounting platforms, for example, can cut manual data processing time by up to 90%, allowing procurement teams to focus on strategic improvements rather than administrative tasks.

Benchmarking suppliers’ emissions against their peers provides valuable context for evaluating resilience. Suppliers reporting to CDP estimate that climate-related risks could collectively add $120 billion in costs to their buyers over the next five years. Regular reviews help you anticipate and address these challenges before they escalate.

Finally, align procurement performance with climate KPIs, offering better terms to suppliers who meet their targets. As Karen Lobdell, Senior Product Manager at ONESOURCE Global Trade, aptly notes:

"You can't mitigate what you haven't identified".

Conclusion

Addressing climate risks is no longer optional - it’s a critical strategy for safeguarding your supply chain against regulatory changes, physical disruptions, and increased scrutiny from stakeholders. Over the next five years, these climate-related risks could bring significant extra costs for buyers. With greenhouse gas emissions needing to be halved by 2030 to align with the Paris Agreement’s 1.5°C target, procurement teams must act decisively to prevent financial and operational vulnerabilities.

The urgency for action lies in adopting a data-driven approach. Success depends on three key factors: accurate data, collaborative partnerships, and integrated technology. Having precise supplier data transforms Scope 3 reporting into an opportunity rather than a burden. Tools such as neoeco streamline this process, linking financial transactions to recognised emissions categories under frameworks like GHGP, ISO 14064, SECR, and UK SRS. This eliminates the need for manual data handling, providing audit-ready reports with ease.

Building a strong foundation for risk assurance delivers long-term benefits. As GOV.UK highlights:

"Robust supply chain assurance can provide long-term value, build supply chain resilience, and attract and retain contracts and investors." – GOV.UK

Companies that integrate climate metrics into supplier evaluations, contract renewals, and payment terms are positioning themselves for more than just compliance. Transparent, data-driven reporting enhances ESG credibility, boosts credit ratings, and unlocks access to sustainable finance options. For businesses aiming to secure government contracts worth over £5 million, verified carbon reduction plans under PPN 06/21 are now a mandatory requirement.

Taking climate action isn’t just about managing costs - it’s a strategy for resilience. As the 1.5°C Supplier Engagement Guide explains:

"Companies that make progress more quickly will not only accelerate the needed transition but can also create significant competitive advantage and enhance their own long-term resilience." – 1.5°C Supplier Engagement Guide

FAQs

What’s the best way for companies to gather accurate emissions data from suppliers?

To gather precise emissions data from suppliers, having a well-thought-out strategy is key. This begins with internal preparation and working closely with suppliers. Companies should focus on identifying relevant departments, prioritising key suppliers, and establishing streamlined methods for collecting data. Involving procurement teams and aligning efforts with existing environmental goals makes the process more manageable and less taxing for suppliers.

Leveraging technology to automate data collection is another crucial step. Tools that integrate with financial systems, such as accounting software, can link transactions to emissions categories under frameworks like GHGP, SECR, or ISO 14064. This not only ensures compliance with regulations but also delivers audit-ready data. By blending careful planning, active supplier collaboration, and automation, businesses can effectively collect emissions data while enhancing their sustainability reporting efforts.

How can AI and technology help manage climate risks in supply chains?

AI and technology are transforming how businesses manage climate risks in their supply chains by boosting data accuracy and efficiency. Automated tools simplify the often complicated process of gathering and analysing greenhouse gas (GHG) emissions data, particularly Scope 3 emissions, which can be tricky due to inconsistent supplier information. These tools cut down on manual work while delivering reliable, audit-ready reports that comply with frameworks like the Greenhouse Gas Protocol (GHGP), ISO 14064, and UK-specific standards such as SECR.

In addition, these technologies improve supplier collaboration by offering real-time insights and facilitating smoother data sharing. This not only aids in better decision-making but also helps businesses meet regulatory demands and gain the trust of stakeholders. AI-powered tools can even conduct scenario analyses and climate risk assessments, helping businesses pinpoint vulnerabilities and create strategies that align with global goals like those outlined in the Paris Agreement.

By embedding sustainability data into financial processes, companies can take a proactive approach to managing risks. This ensures compliance, transparency, and a supply chain that’s better prepared for the challenges of the future.

Why is working with suppliers important for reducing climate risks in supply chains?

Collaborating with suppliers plays a key role in tackling climate risks within supply chains. It allows organisations to accurately measure and manage Scope 3 emissions, which often account for the largest share of their carbon footprint. By building strong partnerships with suppliers, businesses can gather reliable greenhouse gas data, ensuring they meet regulations like SECR and UK SRS while enhancing transparency and control.

This cooperation also helps companies align their climate goals with established frameworks such as the Science Based Targets initiative (SBTi) and the Greenhouse Gas Protocol (GHGP). Beyond compliance, engaging with suppliers encourages the development of low-carbon solutions, boosts supply chain resilience, and drives meaningful steps towards reducing emissions. In essence, working closely with suppliers is not just beneficial - it’s essential for addressing climate risks and advancing sustainability efforts.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.