CDP Questionnaire: Reporting Tips for 2025

Dec 18, 2025

Practical guidance for preparing accurate, audit-ready CDP 2025 submissions: deadlines, module changes, emissions mapping and automation tips.

CDP reporting in 2025 demands precision, transparency, and early preparation. With updates aligning the questionnaire more closely to global frameworks like IFRS S2, ESRS, and TCFD, organisations must ensure their submissions meet stricter standards. Key changes include mandatory currency reporting, refined boundaries, and simplified energy-related questions.

Key Takeaways:

Deadlines: Scoring closes on 17 September 2025; late submissions won't be scored.

Focus Areas: Accurate emissions data (Scopes 1, 2, and 3), governance documentation, and transition plans.

Tools: Automating data collection and using ledger-based platforms like neoeco simplifies compliance and reduces errors.

Start early, ensure data accuracy, and leverage tools to streamline the process. Proper CDP submissions not only meet compliance but also align with broader sustainability goals.

CDP disclosure: Key changes for 2025

How the 2025 CDP Questionnaire Is Organised

CDP 2025 Reporting Timeline and Key Deadlines

Main Sections in the Climate Change Module

The 2025 CDP corporate questionnaire continues the streamlined structure introduced in 2024. This integrated format brings together climate change, forests, water security, plastics, and biodiversity into a unified framework. Companies are required to answer questions on climate change, biodiversity, and plastics, while the forests and water modules are activated based on sector relevance, authority requests, or self-assessment.

The questionnaire is divided into 13 modules, each focusing on specific aspects of climate disclosure. Key updates include:

Module 1 (Introduction): Now includes mandatory currency reporting and refined boundaries.

Module 2: Provides clearer guidance on supplier tiers.

Module 4: Removes duplicate options for streamlined responses.

Module 5: Features updated definitions and requirements for evidence of transition plans.

Module 7: Focuses on energy-related questions, simplifies document attachment, and aligns with ICVCM standards.

For accountants, the priority is ensuring accurate and dependable greenhouse gas (GHG) emissions data. This remains a cornerstone of CDP's evaluation of an organisation's climate impact. Fortunately, data points and formats are consistent with 2024, allowing companies to build on their established processes.

How CDP Scoring Works

CDP employs a four-tier scoring system: Disclosure, Awareness, Management, and Leadership. Scores are heavily influenced by the completeness and transparency of responses, making it crucial to provide thorough answers. In 2025, companies will continue to receive individual scores for climate change, forests, and water security, while plastics and biodiversity modules remain unscored. However, reporting on these areas is encouraged as a way to demonstrate leadership.

Meeting the Essential Criteria is the baseline for achieving higher scores. Leaving questions unanswered can significantly impact results. CDP aligns with the Greenhouse Gas Protocol for emissions accounting and accepts spend-based estimates for Scope 3 emissions. That said, using more detailed, activity-based data can enhance decarbonisation efforts and improve scores. For additional guidance on managing Scope 3 emissions, refer to neoeco's resource.

Timely submissions are just as important as comprehensive answers.

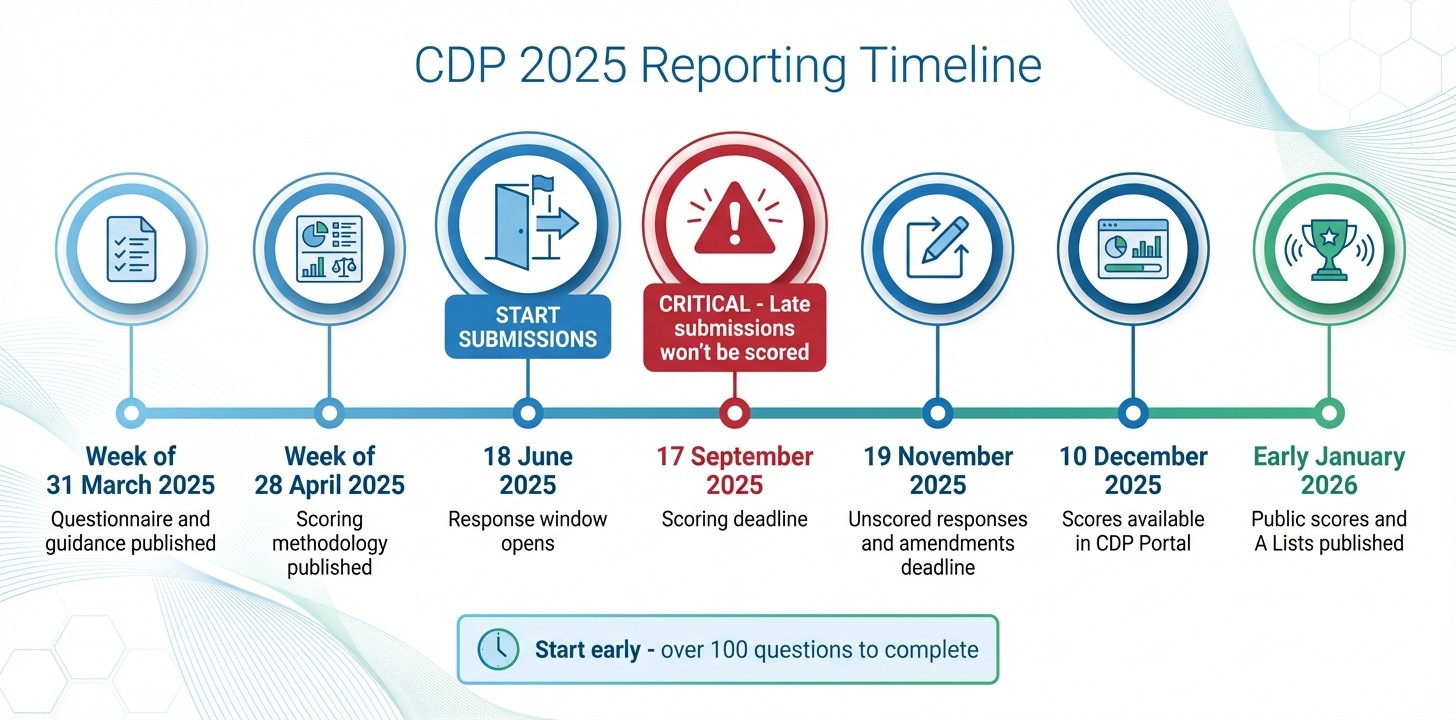

2025 Deadlines and Planning Timeline

With the structure and scoring criteria firmly established, sticking to the timeline is critical. The 2025 response period opened on 18 June 2025, with the scoring deadline set for 17 September 2025. Responses submitted after this date will not be scored, which could affect a company's reputation. The deadline for unscored responses and amendments is 19 November 2025. Scores will be available to disclosers and stakeholders via the CDP Portal on 10 December 2025, with public scores and A Lists published on the CDP website in early January 2026.

Early preparation is key. Even the most straightforward questionnaire requires responses to over 100 questions. Accountants should begin gathering data well in advance to ensure there’s enough time for data collection, strategy development, stakeholder discussions, and multiple review rounds.

"CDP reporting framework's 2025 questionnaire brings only minor refinements, but these targeted updates are designed to improve clarity, usability and alignment with global standards - making it essential for companies to stay informed and prepared." - Cesar Carreño, Climate Associate Director

Milestone | Date |

|---|---|

Questionnaire and guidance published | Week of 31 March 2025 |

Scoring methodology published | Week of 28 April 2025 |

Response window opens | 18 June 2025 |

Scoring deadline | 17 September 2025 |

Unscored responses and amendments deadline | 19 November 2025 |

Scores available in CDP Portal | 10 December 2025 |

Public scores and A Lists published | Early January 2026 |

Preparing Audit-Ready Data for CDP Reporting

Accurate data preparation is a key step in aligning with the structure of the CDP questionnaire.

Linking Financial Accounts to Emissions Categories

The foundation of reliable CDP reporting lies in mapping financial transactions to recognised emissions categories, such as those outlined by the Greenhouse Gas Protocol (GHGP) and ISO 14064. This involves linking routine expenses - like energy bills, fuel, travel, and procurement - to their corresponding Scope 1, 2, and 3 emissions. Essentially, this process transforms general ledger data into carbon accounts that are ready for audit.

The CDP 2025 questionnaire offers clearer guidance on reporting boundaries, especially when they differ from financial statements, as well as improved instructions for energy-related queries. Consistency across all modules is essential, particularly in reporting boundaries and currency disclosures. Data can be drawn from primary activity data (e.g., kWh consumed), spend-based calculations derived from financial accounts, or published assumptions. To ensure accuracy, emission factors - used to convert raw activity data into CO2e - must be region-specific and regularly updated. With the likelihood of Scope 3 emissions being included in SECR legislation, ensuring precise data collection is becoming increasingly important.

For companies aiming to integrate sustainability reporting into their financial systems, neoeco’s approach to financially-integrated sustainability management showcases how ledger-based carbon accounting can simplify compliance efforts.

Gathering Required Documentation

CDP submissions go beyond just emissions data. You’ll need to provide board papers that highlight governance oversight, climate risk assessments, energy bills, supplier information, and evidence of transition plans. The CDP 2025 questionnaire has introduced updated definitions and clearer requirements for transition plans, along with a more user-friendly document attachment process.

Centralising data collection is crucial. Automated carbon accounting software can help create a reliable and centralised data source. Identify material Scope 3 categories and track down their data within accounting, logistics, or operational systems. Allow time for thorough internal reviews and, if necessary, third-party verification. Securely store all evidence and calculations in a central repository that is ready for audits.

Using integrated tools can make these tasks significantly more manageable.

Streamlining Data Preparation with neoeco

neoeco operates directly on clients’ financial ledgers, automatically mapping transactions to emissions categories under frameworks like GHGP, ISO 14064, SECR, UK SRS, and ASRS 2. By eliminating the need for spreadsheets and manual conversions, the platform ensures seamless integration with financial data. It also provides access to continuously updated emission factor databases, enabling transparent and accurate calculations. Audit-ready reports are generated with secure storage for all supporting evidence, simplifying the verification process for assurance providers.

For accountants handling multiple clients, neoeco’s dashboard offers a live progress tracker, highlighting completed tasks, missing elements, and items ready for review. Branded client reports can be created in minutes, and auditors can securely access the necessary evidence without the back-and-forth of emails. This streamlined approach transforms CDP data preparation from a laborious task into a professional service, enabling accounting firms to deliver compliance with confidence and efficiency.

Completing Key CDP Climate Sections

Once you've gathered your audit-ready data, the next step is completing the key sections of the CDP Climate Change questionnaire. These sections are structured into distinct modules, each demanding specific documentation and evidence. By understanding the requirements for each module, you can ensure your submission is both thorough and score-ready.

Governance and Oversight

The Governance section plays a pivotal role in your CDP submission. According to the Essential Criteria guidelines, failing to meet even one criterion can limit your score to the previous level, regardless of the quality of your other disclosures.

Here’s how scoring works at different levels:

Awareness (C): Show that you have a process for identifying, assessing, and managing climate risks and opportunities, with clear accountability at the board level.

Management (B): Detail how often environmental issues are discussed at board or equivalent governing body meetings.

Leadership (A): Provide comprehensive, board-approved climate strategies.

To meet these requirements, document the roles and expertise of those responsible for climate oversight, as well as how often these issues are reviewed. Use evidence like board papers, committee terms of reference, and meeting minutes. If climate performance is tied to executive remuneration, include the metrics and methods used to measure it. Conducting a gap analysis early in the year can help you identify any missing processes or documentation needed to meet the Essential Criteria.

Once you’ve addressed governance, the next step is to focus on emissions and energy reporting to support your claims.

Emissions and Energy Reporting

Module 7 centres on emissions and energy data, forming the backbone of your submission. You’ll need to report Scope 1, Scope 2, and Scope 3 emissions in line with the GHG Protocol methodology. For Scope 3, provide a breakdown across all 15 categories, and explain any exclusions. The 2025 questionnaire offers updated guidance on energy-related questions and simplifies the process of attaching verification documents.

Choose a base year for your emissions data and highlight any differences compared to your financial statements. Include intensity metrics, such as tonnes of CO₂e per £1 million revenue, to give context to your performance. If your Scope 3 data has undergone assurance, make sure to confirm this. For organisations managing supply chain emissions, understanding Scope 3 reporting requirements is crucial for aligning with CDP expectations.

Accurate emissions reporting lays the foundation for setting clear decarbonisation targets, which are essential for a strong submission.

Targets and Transition Plans

Module 5, which focuses on business strategy, is where you outline your decarbonisation targets and transition plans. The 2025 questionnaire introduces updated definitions and scenario analysis requirements, aligning more closely with ESRS and IFRS S2 standards. Report any science-based targets, including interim milestones and the methodologies used to establish them. Track your progress and address any deviations. If you’re monitoring Science Based Targets initiative (SBTi) coverage within your supply chain, include this to demonstrate your commitment to decarbonisation.

The 2025 questionnaire also clarifies that your CDP responses can serve as evidence of a transition plan. Link these plans to your resource allocation to show that climate action is embedded in your broader business strategy. Incorporating your transition plans into financial filings can further enhance credibility, demonstrating that climate initiatives are central to your organisation’s strategic direction.

Tips to Improve Your CDP Score in 2025

If you're aiming to boost your CDP score, it's all about preparation, precision, and leveraging the right tools. Here's how you can set yourself up for success.

Start Preparing Early for 2025 Changes

The 2025 CDP questionnaire brings updates that you’ll want to address well in advance. For starters, currency reporting is now mandatory in Module 1. Additionally, new guidance clarifies reporting boundaries, which may not align with financial statements. Module 5 has refined definitions for transition plans and scenario analysis, while Module 7 focuses on better energy-related questions and simplifies how you upload verification documents.

Key dates to note:

Scoring deadline: 17th September 2025

Questionnaire closing date: 19th November 2025

Late submissions won’t be scored. To avoid scrambling at the last minute, review the updated modules and ensure your documentation is complete and consistent.

Ensure Complete and Consistent Data

CDP values thoroughness and transparency above all else. If you don’t have data for a particular question, it’s better to disclose why rather than leave it blank. For Scope 3 emissions, report all fifteen categories and provide explanations for any exclusions. Consistency is critical - ensure your reporting boundaries and currency disclosures align.

If you’re using spend-based estimates for Scope 3 emissions, be upfront about your methodology. CDP accepts this under the GHG Protocol, but clarity is non-negotiable. Double-check your data before submission, as CDP may remove or disregard inaccurate information.

Use Software to Reduce Errors and Save Time

Managing carbon data manually can be both time-consuming and prone to errors. That’s where automation comes in. Sustainability accounting software can streamline the process, ensuring accurate and audit-ready data. Tools like neoeco integrate directly with financial ledgers, mapping transactions to recognised emissions categories under frameworks like GHGP and ISO 14064. They eliminate the need for spreadsheets, handle conversions, and generate reliable reports for SECR, UK SRS, and other frameworks.

For organisations with complex Scope 3 emissions, automation simplifies supplier data management and ensures calculations are verifiable. This not only enhances consistency across your CDP submission but also minimises the risk of errors that could negatively impact your score.

Key Takeaways for Accountants

CDP reporting in 2025 will require financial-grade data and proactive preparation. With more than 24,000 organisations submitting reports to CDP in 2024, the expectations for data quality are only getting stricter. Stakeholders are closely examining sustainability claims, meaning transparent and audit-ready calculations are now essential. For accountants, this translates to treating carbon data with the same precision and reliability as financial statements - ensuring it is detailed, consistent, and dependable across all reporting modules.

Automation plays a crucial role here, eliminating spreadsheet errors by automatically mapping transactions to emissions categories in line with GHGP and ISO 14064 standards. This not only simplifies the management of Scope 3 data but also prepares businesses for upcoming frameworks like CSRD and IFRS S2.

On top of these automation benefits, the neoeco platform offers even greater efficiency for firms in the UK and Australia. Tailored specifically for accountants, it integrates seamlessly with Xero, Sage, and QuickBooks, automatically mapping transactions to the appropriate emissions categories. The platform also generates audit-ready reports for compliance with SECR, UK SRS, and ASRS 2, removing the need for spreadsheets and manual data conversions. With the CDP scoring deadline set for 17th September 2025, having tools that prioritise both accuracy and efficiency is critical.

The 2025 questionnaire introduces mandatory currency reporting and refined guidance on reporting boundaries, highlighting the importance of systems that align financial and sustainability data from the start. This reflects earlier discussions on the need to synchronise financial records with sustainability metrics. By adopting financially-integrated sustainability management principles, accountants can not only future-proof their clients but also open up new revenue opportunities in carbon accounting and advisory services. This approach ensures all elements of reporting are seamlessly aligned, strengthening the overall quality of CDP submissions.

To succeed, ensure your data meets audit standards and start preparing early. CDP values transparency and thoroughness, and with the right tools, you can achieve both without overburdening your team.

FAQs

What changes should I know about in the 2025 CDP Climate Change Questionnaire?

The 2025 CDP Climate Change Questionnaire brings only a few minor updates. A notable clarification is the recognition of the European Sustainability Reporting Standard (ESRS) as an approved verification standard for Scope 1, 2, and 3 emissions, which can positively influence your scoring. Other than this, the structure and scoring methodology remain consistent with previous years.

For accounting firms aiming to simplify their reporting, tools like neoeco can be a game-changer. Designed specifically for firms in the UK and Australia, neoeco seamlessly integrates with financial data, automating carbon reporting while ensuring alignment with standards such as ESRS, SECR, and UK SRS. This makes CDP submissions easier by providing accurate, audit-ready data.

What’s the best way to ensure accurate and audit-ready data for CDP reporting?

To produce accurate, audit-ready data for CDP reporting, businesses should consider using automated sustainability accounting software that directly integrates with their financial systems. This eliminates the need for manual processes by linking transactions to recognised emissions categories, applying consistent and current emission factors, and maintaining a transparent audit trail.

These tools also simplify internal verification, ensuring greenhouse gas (GHG) data is precise and adheres to frameworks like the GHG Protocol, ISO 14064, and local regulations such as SECR and the UK SRS. By leveraging such software, companies can generate reliable, finance-grade carbon data and comprehensive reports - without relying on spreadsheets or manual calculations.

What tools can help simplify the CDP Climate Change Questionnaire process for 2025?

Completing the CDP Climate Change Questionnaire doesn’t have to be overwhelming if you have the right tools and approach. Start by getting your team acquainted with the CDP portal. This platform is crucial for uploading your data, managing requests, and keeping track of deadlines.

To save time and reduce manual effort, consider automating data collection and organisation. Tools like neoeco can directly connect with accounting systems such as Xero, Sage, and QuickBooks. These tools map financial data to emissions categories - like Scope 1, 2, and 3 - under frameworks such as GHGP and SECR. This eliminates the hassle of working with spreadsheets and ensures your reports are audit-ready.

If your company already handles SECR reporting, you’re in luck - those same datasets can often be reused for CDP submissions, making the process even simpler. Timing is everything here: the CDP questionnaire is typically released in late March, with responses opening in mid-June and the final deadline in mid-November. By planning your data collection and uploads well in advance, you can turn this into a seamless and repeatable process.