CSRD and Double Materiality: What Accountants Should Know

Dec 19, 2025

How CSRD's double materiality affects accountants and how to integrate ESG into financial systems for audit-ready, compliant sustainability reporting.

The Corporate Sustainability Reporting Directive (CSRD) is a major EU regulation requiring businesses to report Environmental, Social, and Governance (ESG) data alongside financial statements. Even UK firms are affected due to cross-border operations or EU-linked clients. At its core is double materiality, which combines two perspectives:

Financial materiality: How sustainability risks affect the company’s financial health.

Impact materiality: How the company’s activities affect society and the environment.

Accountants face challenges like fragmented data, lack of standardised workflows, and a skills gap in sustainability reporting. To address these, firms must integrate ESG metrics into financial systems, establish consistent processes, and utilise technology to ensure compliance and accuracy. By doing so, they can turn compliance into an opportunity to offer new services while meeting CSRD’s stringent requirements.

It takes two - Understanding the CSRD’s double materiality

Understanding CSRD and Double Materiality in Practice

How to Conduct a CSRD Double Materiality Assessment: 5-Step Process for Accountants

CSRD Reporting Requirements Accountants Need to Know

The Corporate Sustainability Reporting Directive (CSRD) raises the bar for sustainability disclosures, demanding the same level of precision as financial statements. This means accountants need to ensure data is audit-ready and backed by strong controls. Initially, the directive calls for limited assurance, but this will evolve into reasonable assurance over time, making it crucial to establish solid processes from the beginning.

A key technical challenge is integrating sustainability metrics with financial systems like Xero, Sage, QuickBooks, or enterprise solutions such as SAP and Microsoft Business Central. This integration ensures sustainability data is seamlessly tied to financial ledgers. Another essential step is maintaining a centralised hub for policies and evidence, where all verification files are stored. This allows auditors to directly access reports and supporting documentation, avoiding the inefficiencies of back-and-forth emails. Modern platforms simplify this process with features like smart matching, which automatically links transactions, reducing the risk of errors. These tools also set the foundation for conducting double materiality assessments more efficiently.

neoeco highlights this integration by stating, "The only platform that connects financials to sustainability with LCA-level accuracy".

For organisations aiming to comply with multiple frameworks, understanding how ISSB reporting integrates with financial strategies can provide clarity on meeting various standards simultaneously.

How to Conduct a Double Materiality Assessment

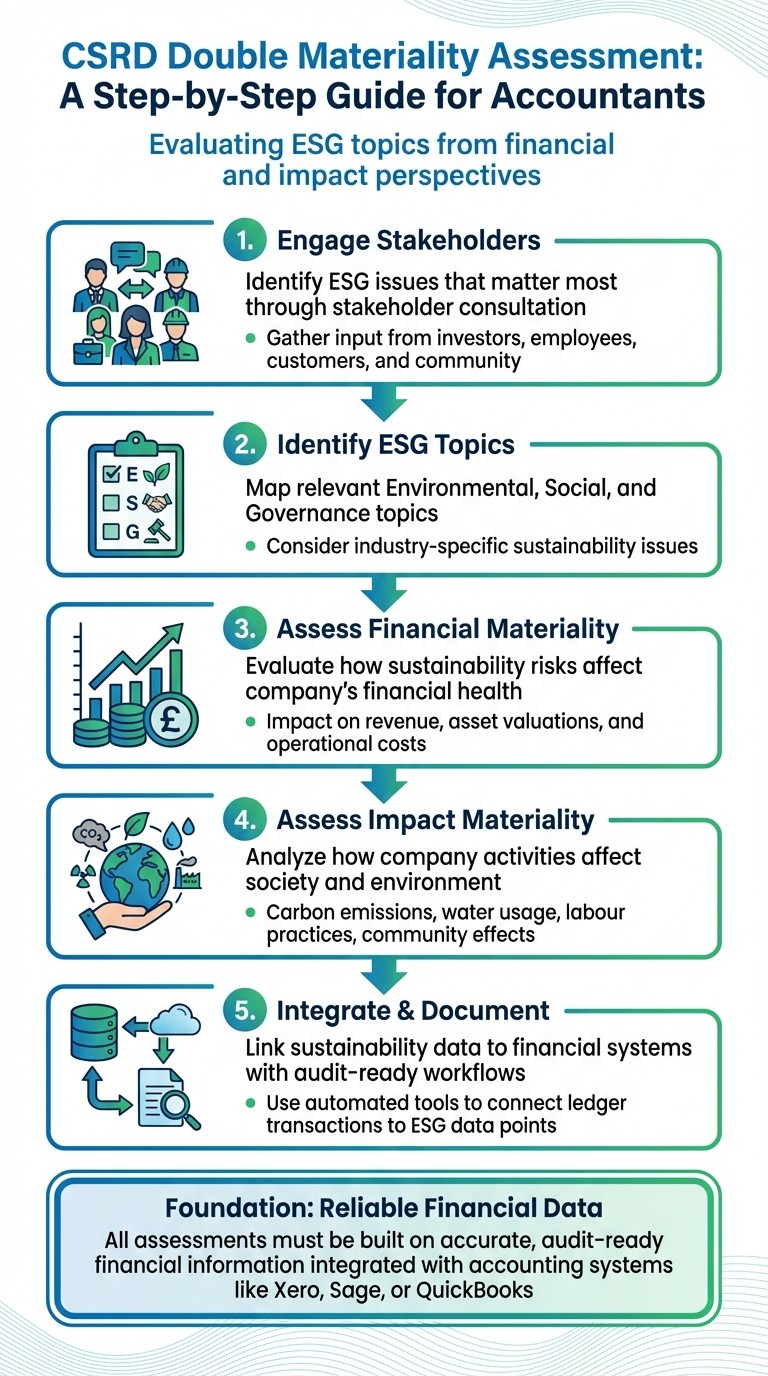

Under the CSRD framework, accountants are now tasked with conducting double materiality assessments - a practical approach to evaluating Environmental, Social, and Governance (ESG) topics. This involves analysing sustainability issues from two perspectives: how they impact the company financially and how the company affects the environment and society. Reliable financial data forms the backbone of this analysis.

The process begins with engaging stakeholders to identify the ESG issues that matter most. From there, accountants systematically evaluate financial and environmental risks. To ensure the assessment meets professional standards, audit-ready workflows should be implemented, complete with checklists to track progress.

Jennifer Kaplan, a Sustainability Manager, shares her experience: "I found the Policy Builder extremely useful at our stage because having a template of a well-conceived policy helps in the standardisation of new practices and ensure that written guidelines are best-in-class".

Automation plays a critical role in effective assessments. Tools that link ledger transactions directly to carbon and ESG data points minimise manual errors while maintaining the level of accuracy required in financial reporting. This approach streamlines the impact assessment process without compromising on precision.

Financial Materiality vs Double Materiality: What's the Difference?

Accountants working under the CSRD framework must balance financial and impact risks at the same time. Financial materiality focuses on climate risks that could influence a company’s revenue, asset valuations, or operational costs. In contrast, double materiality broadens the scope to include the company’s environmental and social impacts - such as carbon emissions, water usage, labour practices, and community effects - whether or not these directly affect financial performance.

To achieve this, sustainability data must match the accuracy and auditability of financial data. This is where financially-integrated sustainability management comes into play, allowing ESG metrics to flow through the same systems accountants use for traditional reporting. By eliminating fragmented spreadsheets, this approach creates a unified, auditable trail from individual transactions to final disclosures.

Main Challenges Accountants Face with CSRD and Double Materiality

Fragmented ESG Data and Audit Issues

A key challenge accountants face is the scattered nature of sustainability data, often stored in isolated spreadsheets rather than integrated with the financial systems they use daily. This separation creates lengthy and frustrating auditor interactions, especially when trying to provide evidence for non-financial disclosures. Without a centralised platform linking ESG metrics to trusted financial tools like Xero, Sage, or QuickBooks, the verification process becomes a maze of email threads and manual checks. Additionally, because sustainability data sits outside the financial ecosystem, it misses out on the rigorous reconciliation processes applied to financial figures. This gap leaves ESG data prone to errors and inconsistencies, complicating audits and creating unreliable assessments.

Lack of Standardised Double Materiality Assessments

Another significant hurdle is the absence of a clear, repeatable method for conducting double materiality assessments. Many accounting firms are left improvising, which results in inconsistent quality across assessments, both within a single firm and across different clients. This lack of standardisation also raises concerns about auditability, as there’s no uniform documentation to show how materiality decisions were made. The problem is amplified for firms juggling multiple frameworks like GHGP, SECR, UK SRS, and CSRD. Without a structured approach, ensuring compliance and maintaining consistency becomes a daunting task.

ESG Risks Operating in Silos

On top of process challenges, ESG risks often remain disconnected from the financial risk frameworks accountants already use. This separation creates inconsistencies in how risks are assessed, reported, and managed within organisations. When sustainability metrics aren’t integrated with financial data, it becomes harder to evaluate how environmental or social factors impact revenue, asset values, or operational costs. The problem is compounded by the complexity of using standalone ESG tools, which makes embedding sustainability risks into existing financial processes even more challenging. To meet CSRD’s integrated reporting requirements, aligning ESG risks with financial risk management is essential.

Practical Solutions for CSRD and Double Materiality Challenges

Connecting Sustainability Data to Financial Systems

One of the smartest ways to tackle fragmented ESG data is by linking sustainability reporting directly to your financial ledger. Platforms like neoeco integrate seamlessly with accounting tools such as Xero, Sage, and QuickBooks. They automatically map transactions to recognised emissions categories like GHGP, ISO 14064, SECR, and UK SRS. This eliminates the hassle of juggling manual spreadsheets and ensures sustainability metrics are built on reliable financial data. Features like smart matching minimise errors and speed up the reporting process, while a centralised policy and evidence hub keeps compliance files organised and accessible for auditors in a secure, read-only format.

Once you’ve established a strong data foundation, the next step is to create a consistent workflow for assessments.

Creating a Standard Process for Double Materiality

Standardising double materiality assessments starts with using template-based tools to create workflows that are easy to replicate across clients. These tools, paired with audit-ready controls like centralised checklists, help track task completion and flag any missing details. Real-time dashboards make it simple to share updates with clients and adjust materiality scores as new data comes in. This ensures a consistent approach, whether you’re working within CSRD, SECR, or UK SRS frameworks.

Beyond data consolidation, there’s also an opportunity to fully integrate ESG risks into your financial risk management processes.

Integrating ESG Risks into Financial Risk Frameworks

Aligning ESG risks with traditional financial risk management requires connecting your sustainability platform directly to financial systems, such as those integrated with Xero, Sage, or QuickBooks. This creates a unified data source where environmental and social factors are assessed alongside revenue, asset values, and operating costs. Automated data uploads ensure financial information is sorted and cleaned, reducing manual errors during risk assessments. Advanced modelling tools provide ISO-compliant analysis while maintaining a direct link to financial data. This integrated approach supports ISSB reporting standards and treats ESG risks with the same diligence as traditional financial risks. Modern platforms also prioritise security, maintaining SOC 2 and GDPR compliance to protect both financial and ESG data throughout the process.

How Accounting Firms Can Implement CSRD-Aligned Double Materiality

Prioritising Clients Based on Regulatory Requirements

Start by categorising your clients based on their immediate compliance needs. Focus on those already adhering to SECR or UK SRS regulations, as these frameworks naturally complement double materiality practices. Next, identify businesses without dedicated sustainability roles - companies that often require foundational sustainability guidance. As Alix Armour, Co-Founder and Head of Sustainability, explains:

"Lots of brands don't have a role dedicated to corporate sustainability... These companies need some sort of solution, whether that's setting a foundation or corporate messaging or figuring out first steps".

For clients using platforms like Xero, Sage, or QuickBooks, their financial data can be automatically mapped to sustainability metrics. Additionally, prioritise businesses needing robust, audit-ready controls, as they will appreciate verified and complete data sets.

Once client priorities are established, the next step is to create consistent internal processes.

Building Standard Workflows and Templates

To scale CSRD-aligned services effectively, consistency is essential. Use firm-wide policy builders and templates to create uniform structures for double materiality assessments and related guidelines. A standardised policy builder simplifies the assessment process and ensures uniformity across the board. Centralised dashboards can track the progress of client projects, making it easier to identify assessments requiring additional data or those ready for review. Standardised checklists further ensure no critical steps are overlooked.

Employing technology can further enhance compliance and reporting efforts.

Using Technology for Compliance and Reporting

Technology addresses common challenges like fragmented data and inconsistent assessments, making it a vital tool for streamlining CSRD-aligned double materiality practices. Platforms such as neoeco integrate directly with financial ledgers, automatically mapping transactions to recognised emissions categories under frameworks like GHGP, ISO 14064, SECR, and UK SRS. This eliminates the need for manual spreadsheets, ensuring sustainability data is built on the same reliable numbers used for financial reporting.

Additionally, a dedicated Policy and Evidence Hub securely stores compliance files, ensuring they are readily accessible for audits. The platform also offers white-labelled reports customised with your firm's branding, real-time client dashboards, and direct auditor access - removing the hassle of back-and-forth email exchanges. This approach aligns with ISSB reporting principles, helping your firm stay ahead of evolving regulations.

Conclusion: Preparing for CSRD and Double Materiality

For many UK clients, meeting CSRD requirements is not just a regulatory necessity but an opportunity for firms to create a valuable service offering. The secret lies in treating sustainability data with the same level of precision as financial data. By adopting systems that seamlessly integrate with trusted platforms like Xero, Sage, or QuickBooks, firms can eliminate the chaos of fragmented spreadsheets and manual data handling.

To ensure readiness across the board, firms need to standardise their tools and processes. Using consistent templates, maintaining centralised evidence hubs, and implementing audit-ready controls can help teams deliver a cohesive approach, regardless of a client's size or operational complexity.

Technology is another vital piece of the puzzle. Real-time dashboards and direct auditor access can simplify review processes and reduce back-and-forth communication, building trust with clients while keeping regulatory reviews efficient. These tools not only help firms meet current CSRD requirements but also prepare them for upcoming changes in the regulatory environment.

Integrating principles from ISSB reporting alongside CSRD standards is a smart move for any firm aiming to stay ahead. Start by focusing on clients already aligned with SECR or UK SRS reporting, establish streamlined workflows, and utilise technology to link sustainability metrics with the financial systems you already rely on. This approach positions your firm as a compliance expert and a strategic adviser, ready to navigate the evolving landscape of sustainability reporting.

FAQs

What are the key steps for performing a double materiality assessment under CSRD?

To navigate a double materiality assessment under the CSRD, here’s a step-by-step approach:

Pinpoint key sustainability topics: Focus on areas that matter from two perspectives - financial materiality, which examines how sustainability issues influence your company’s financial performance, and impact materiality, which looks at how your organisation’s actions affect the environment and society.

Gather and evaluate ESG data: Dive into environmental, social, and governance (ESG) factors. Integrate this data into your company’s risk and opportunity evaluations to get a clear picture of where you stand.

Prioritise critical topics: Identify the most pressing issues by weighing their significance across both financial and impact dimensions. Don’t forget to factor in stakeholder expectations and regulatory compliance.

Refine your sustainability reporting: Use these findings to improve your sustainability disclosures, ensuring they meet CSRD standards and maintain transparency.

To streamline the process, tools like neoeco can be a game-changer. They automate data collection and map transactions to recognised emissions categories, making it easier for accounting firms to stay compliant without the hassle.

How can accountants align ESG metrics with their financial systems?

Accountants can seamlessly integrate ESG metrics into financial systems by embedding sustainability data into current accounting frameworks. Tools like neoeco simplify this process by automatically mapping transactions to recognised emissions categories, generating finance-grade, audit-ready reports that align perfectly with financial statements.

By removing the reliance on manual calculations or spreadsheets, this method ensures precise reporting, adherence to standards such as GHGP and ISO 14064, and a smoother way to manage sustainability data alongside financial records. It also strengthens the long-term resilience of both clients and firms by effectively connecting financial and sustainability goals.

What are the main challenges accountants face with fragmented ESG data, and how can they address them?

Accountants frequently face challenges with fragmented ESG data, often stemming from manual workflows, inconsistent data sources, and limited automation. These hurdles can result in inefficiencies, errors, and complications in meeting compliance requirements for standards such as CSRD.

One way to tackle these issues is by leveraging automated tools that seamlessly connect with client and supplier data. These tools provide real-time updates, cutting down on manual effort and improving overall efficiency. Platforms built for audit-ready controls play a vital role here, ensuring data accuracy and compliance while streamlining complex tasks like double materiality analysis. By adopting this approach, accountants can save time and boost confidence in sustainability reporting.