CSRD Compliance Trends in Retail and Consumer Goods

Dec 25, 2025

How CSRD affects retail and consumer goods: Scope 3, double materiality, assurance and data challenges, with practical steps to integrate ESG into finance.

The Corporate Sustainability Reporting Directive (CSRD) is reshaping how businesses report on sustainability and financial risks. For retail and consumer goods companies, this means stricter rules on supply chain transparency, emissions reporting, and independent assurance of sustainability data. Key challenges include:

Double Materiality: Companies must report how sustainability impacts their finances and how their operations affect people and the planet.

Scope 3 Emissions: Retailers and manufacturers face pressure to disclose emissions across entire value chains, often requiring advanced data systems.

Independent Assurance: Sustainability reports now require audit-level scrutiny, starting with limited assurance and progressing to reasonable assurance.

Key Stats:

78% of CFOs face sustainability demands from multiple stakeholders, but only 22% feel prepared to meet reporting standards.

55% of companies have automated ESG data collection to comply with CSRD requirements.

Non-compliance can lead to fines of up to €75,000 and reputational damage.

Despite these challenges, aligning financial and sustainability goals offers growth opportunities. Companies that integrate sustainability into their strategies have seen revenue gains of up to 15 percentage points higher than peers. Retailers focus on consumer safety and supply chain due diligence, while manufacturers tackle lifecycle reporting and pollution management. Both sectors must prioritise digital tools, cross-functional collaboration, and robust data controls to meet CSRD standards and stay competitive.

1. Retail Sector

Risk Exposure

Retailers face considerable risks when it comes to maintaining transparency in their supply chains and addressing Scope 3 emissions. With sprawling global networks crossing numerous jurisdictions, they must not only disclose how sustainability challenges impact their financial performance but also account for the effects their operations have on people and the environment. In France, failing to comply can result in fines of up to €75,000 and even imprisonment for corporate directors. Beyond legal penalties, the damage to a company’s reputation is a significant concern - 81% of organisations not yet required to follow CSRD regulations are voluntarily complying to meet stakeholder expectations and safeguard their brand image.

The retail sector’s direct connection to consumers heightens scrutiny over issues like product safety, packaging waste, and labour practices throughout the supply chain. Anti-greenwashing regulations are also tightening, especially after the FCA’s May 2024 rule mandating that all sustainability claims be both accurate and verifiable. Without strong data controls, retailers risk regulatory penalties and consumer backlash. These risks are central to the CSRD reporting requirements for the retail industry.

CSRD Reporting Requirements

While all European Sustainability Reporting Standards (ESRS) apply when deemed material, retailers often encounter heightened materiality for ESRS S4 (Consumers and End-Users) and ESRS E5 (Resource Use and Circular Economy). These standards require detailed reporting on product safety, packaging waste, and broader lifecycle impacts. Additionally, ESRS S2 (Workers in the Value Chain) calls for thorough due diligence reporting on human rights and fair labour practices across global supply chains.

One of the biggest challenges lies in the full disclosure of Scope 3 emissions, as purchased goods and services typically account for the largest share of retail carbon footprints. The 2025 "Simplification Omnibus" proposal has delayed compliance deadlines for some companies: large undertakings in the second wave now report in 2028, while listed SMEs will report in 2029. This revision narrows the scope to companies with over 1,000 employees and €450 million in EU net turnover, exempting about 80% of the companies initially included under the regulations.

Financial Risk Strategies

Leading retailers are approaching CSRD compliance as a strategic opportunity rather than a mere regulatory requirement. However, readiness remains a challenge - only 22% of CFOs feel equipped to report on climate risks while securing external assurance at the same time. To address this gap, companies are aligning their finance and sustainability teams, ensuring non-financial metrics are treated with the same precision as financial data.

Some retailers are leveraging predictive analytics and AI to pinpoint ESG-related financial risks before they escalate into compliance issues. Others are exploring Digital Product Passports (DPPs) to enhance product traceability and manage supply chain accountability. By shifting their perspective, these companies are turning compliance pressures into opportunities for competitive advantage, aligning with the broader industry shift towards integrating financial and sustainability management.

Data and Systems Integration

Retailers are rapidly moving away from manual processes and embracing automation for ESG data collection - 55% of companies have already automated their data capture. Building a strong digital foundation using cloud and AI technologies is critical for handling the massive amounts of unstructured sustainability data required under CSRD. Cross-functional collaboration ensures this data is accessible across all business units, rather than isolated in specific departments.

To meet requirements under ESRS S2 and E1, establishing robust data-sharing agreements with upstream suppliers is essential. Retailers must implement audit-ready controls that align with financial reporting standards, as sustainability reports now require at least "limited assurance" from statutory auditors or independent providers. By adopting financially-integrated sustainability management, companies can tie non-financial metrics directly to financial reporting systems, transforming raw data into actionable insights. This not only ensures compliance but also helps identify growth opportunities and improve operational efficiency. Such integration prepares retailers to tackle the challenges unique to the consumer goods sector.

2. Consumer Goods Sector

Risk Exposure

Manufacturers in the consumer goods sector face significant challenges due to the environmental impact of their production processes. Pollution from air, soil, and water contamination, along with waste generated throughout product lifecycles, are key concerns. Additionally, raw material extraction contributes to biodiversity loss, and production often involves high water usage. These issues are addressed under ESRS E2 (Pollution), ESRS E4 (Biodiversity and Ecosystems), and ESRS E5 (Resource Use and Circular Economy). Unlike retailers, consumer goods companies bear direct responsibility for the environmental consequences of their production facilities, intensifying their exposure to stakeholder pressures.

Human rights risks in supply chains also demand attention. Companies must ensure fair labour practices and prevent human trafficking, as outlined in ESRS S2 (Workers in the Value Chain). While retailers primarily oversee third-party supplier relationships, manufacturers are directly accountable for conditions within their own facilities and Tier 1 suppliers. This dual responsibility increases operational risks and calls for transparent and thorough reporting.

CSRD Reporting Requirements

For consumer goods manufacturers, key reporting areas include ESRS E1 (Climate Change), ESRS S1 (Own Workforce), and ESRS G1 (Business Conduct). Companies are required to disclose Scope 1, 2, and 3 emissions and develop transition plans aligned with the Paris Agreement. The British Retail Consortium highlights the importance of measuring and reporting greenhouse gas emissions across the value chain, a principle that applies equally to manufacturers. By 2025, companies must engage Tier 1 suppliers to collect accurate emissions data.

The March 2025 "Simplification Omnibus" proposal has altered compliance requirements. Now, mandatory reporting applies only to firms with over 1,000 employees and €450 million in EU net turnover, potentially exempting 80% of previously covered companies. This change aims to reduce administrative costs by an estimated €4.4 billion annually. The European Commission is focusing on quantitative data and has reduced the number of mandatory disclosures. Despite these adjustments, all sustainability reports must meet at least "limited assurance" standards, ensuring non-financial data holds the same credibility as financial statements. These rigorous requirements highlight the need for tailored risk management strategies for manufacturers.

Financial Risk Strategies

Leading consumer goods companies are beginning to see CSRD compliance as an opportunity rather than a burden. This shift in perspective is yielding results - 38% of organisations are investing in sustainability initiatives to enhance financial performance. For manufacturers, the direct responsibility for production processes makes compliance more complex compared to retailers, but it also opens doors for improving operational efficiency and market positioning.

Despite these advancements, many companies still face readiness challenges. Only 22% of CFOs feel adequately prepared to report on climate-related risks while seeking external assurance. To address this, businesses are fostering cross-functional expertise: finance teams are gaining ESG knowledge, and sustainability teams are building financial skills to better quantify risks. Predictive analytics are also being employed to assess future risks rather than relying solely on historical data. Some firms are introducing internal carbon pricing to drive decarbonisation efforts. By integrating ESG metrics into financial planning, companies can better align sustainability goals with overall business strategies.

Data and Systems Integration

To tackle these challenges, consumer goods manufacturers are turning to advanced digital solutions. Currently, 55% of companies in the sector have automated their ESG data collection processes. Leveraging technologies like cloud computing and AI is critical for handling the large volumes of unstructured sustainability data required under CSRD. Léon Wijnands, Head of Sustainability at ING Netherlands, underscores this point:

"To truly incorporate sustainability into your business, it must be integrated throughout. We have an integrated strategy that includes both financial and concrete ESG KPIs…".

Establishing strong internal controls for non-financial data is essential. These controls should match the rigour of financial reporting to ensure audit readiness, with cross-functional collaboration enabling seamless data sharing across business units. Digital Product Passports (DPPs) are becoming a valuable tool for manufacturers, offering a centralised record of technical and environmental data that enhances product traceability and risk management. By connecting non-financial metrics directly to financial reporting systems, companies can turn raw data into actionable insights, improving both compliance and competitive positioning. This integrated approach is particularly useful for addressing Scope 3 emissions reporting, especially when working with suppliers to gather accurate value chain data.

How CSRD Compliance Creates Value Beyond Reporting | Cority Insights

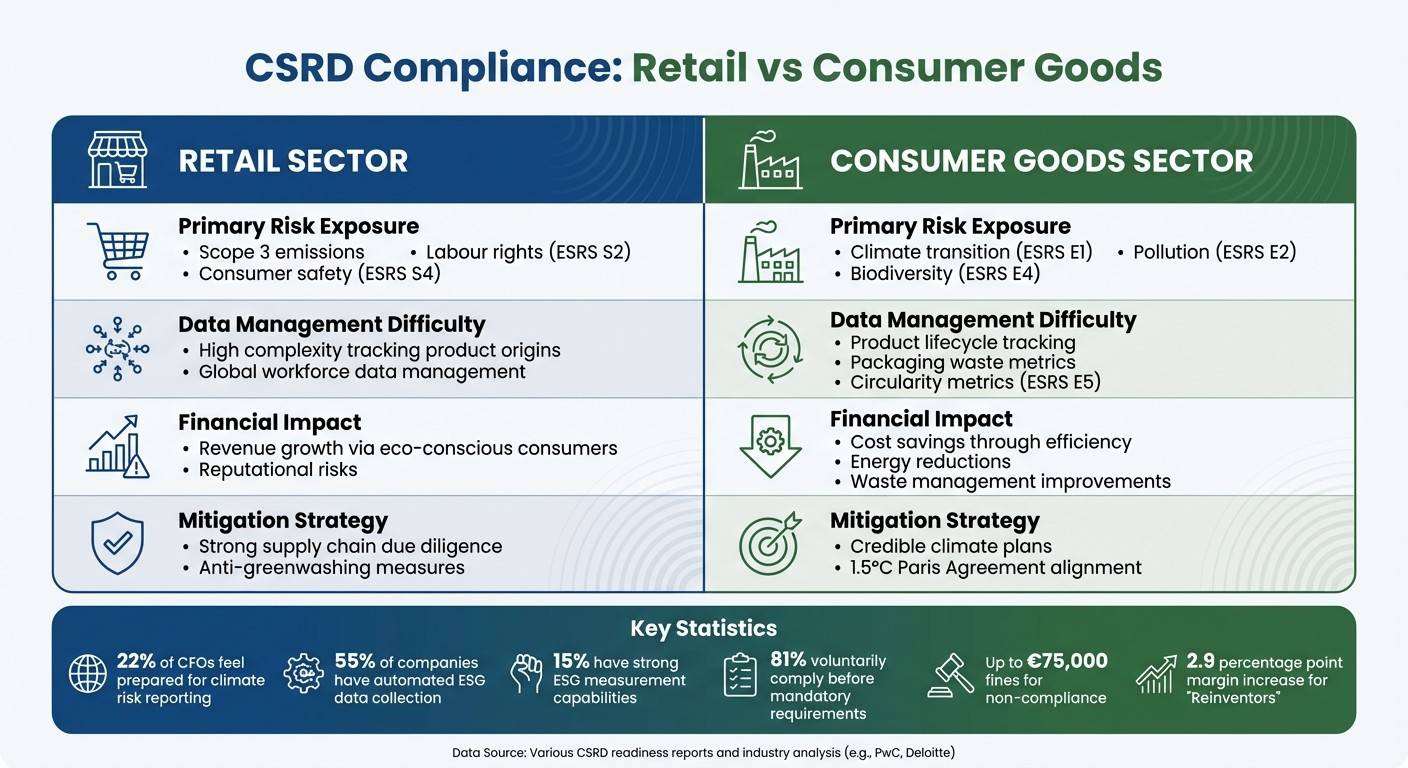

Strengths and Challenges by Sector

CSRD Compliance: Retail vs Consumer Goods Sector Comparison

Looking at the earlier sector-specific breakdowns, some interesting differences and challenges emerge when comparing retail and consumer goods industries. Retailers, for instance, face unique hurdles tied to their operational models. They often grapple with managing reputational risks while struggling to track Scope 3 emissions effectively. On the other hand, consumer goods manufacturers, while benefiting from tighter oversight of their production processes, encounter more intricate challenges. These include measuring pollution, biodiversity impacts, and circular economy metrics across entire product lifecycles.

The financial dynamics also vary significantly between these sectors. Retailers face the dual challenge of higher costs from sustainable sourcing and the opportunity to tap into growing demand from eco-conscious consumers. Meanwhile, manufacturers often have to make larger upfront investments, particularly in R&D for transitioning to circular economy models. Interestingly, companies identified as "Reinventors" - those with high ESG and digital maturity - saw a 2.9 percentage point margin increase from 2019 to 2022. Non-compliance with regulations, however, carries steep risks for both sectors, including fines of up to €75,000 and even potential imprisonment for directors.

Data management is another area where these industries diverge. While 55% of companies have automated ESG data collection, only 15% report having strong ESG measurement capabilities. Retailers struggle to track the origins of diverse products and manage workforce data from global operations. Manufacturers, by contrast, face the daunting task of conducting lifecycle assessments that cover up to 96 impact categories under ESRS E1/E5. This complexity explains why 68% of CFOs from companies with weaker ESG capabilities report difficulties in balancing sustainability goals with profitability. For companies aiming to bridge finance and sustainability, integrated approaches - such as those detailed in neoeco's Scope 3 insights - can help turn compliance challenges into strategic opportunities.

A comparison table highlights the key differences between these sectors:

Dimension | Retail Sector | Consumer Goods Sector |

|---|---|---|

Primary Risk Exposure | Scope 3 emissions, labour rights (S2), consumer safety (S4) | Climate transition (E1), pollution (E2), biodiversity (E4) |

Data Management Difficulty | High complexity in tracking product origins and workforce data | Tracking lifecycles, packaging waste, and circularity metrics (E5) |

Financial Impact | Revenue growth via eco-conscious consumers; reputational risks | Cost savings through efficiency, energy reductions, and waste management |

Mitigation Strategy | Strong due diligence for supply chains; anti-greenwashing measures | Credible climate plans aligned with the 1.5°C Paris Agreement |

Despite these differences, both sectors share a readiness gap. Only 22% of CFOs feel prepared to report on climate-related risks while seeking external assurance. The March 2025 Simplification Omnibus has provided some relief by raising thresholds to 1,000 employees and €450 million in EU net turnover. This change could exempt up to 80% of previously covered companies. However, the requirement for "limited assurance" on sustainability reports means all companies must build internal controls with the same precision as financial reporting. This underscores the need for close collaboration between finance and sustainability teams.

Conclusion

Retail and consumer goods companies face unique challenges, but their path forward shares a common thread. The Simplification Omnibus adjustments have reshaped CSRD compliance, introducing new dynamics for organisations still within its scope. Retailers grapple with fragmented Scope 3 data across sprawling global supply chains, while consumer goods companies navigate intricate Digital Product Passport requirements and product lifecycle reporting mandates. Meanwhile, CFOs remain underprepared for climate-related risk disclosures and the demands of external assurance.

The way forward calls for collaboration, not isolation. Finance and sustainability teams must work hand-in-hand, treating ESG data with the same precision as financial reporting. Massimo Terrevazzi, Group CFO & Executive Director at Perfetti Van Melle Group, highlights that compliance isn’t just a regulatory necessity - it’s an opportunity to gain valuable insights and inspiration. Shifting the perspective from seeing compliance as a chore to recognising it as a strategic advantage can set companies apart, enabling them to strengthen margins and build resilience.

Practical actions are essential. Automating data collection and implementing robust internal controls early can reduce reliance on error-prone spreadsheets and ensure readiness for audits, as limited assurance now demands the same accuracy as financial reviews. Focused materiality assessments, guided by the simplified 2025 framework, can help avoid reporting fatigue. For businesses operating across both sectors, tools like neoeco provide solutions by directly mapping financial transactions to recognised emissions categories under GHGP and ISO 14064, delivering precise, finance-grade carbon data without manual conversions.

These steps not only streamline processes but also align with the revised reporting timeline. Large organisations now have until 2027 to report, rather than 2025. Still, with double materiality, digital reporting, and external assurance becoming standard, 81% of organisations not yet subject to CSRD are already preparing to comply voluntarily to meet stakeholder expectations. The real question isn’t whether to prepare - it’s how quickly companies can turn compliance into a competitive edge.

While the operational realities differ between these sectors, the solution lies in integrated approaches that bring financial and sustainability goals together. Aligning ambitions early, upskilling finance teams, and engaging internal stakeholders can transform CSRD compliance from a box-ticking exercise into a strategic strength. Companies that embed sustainability into their financial processes - using frameworks like Financially-integrated Sustainability Management - will not only meet compliance requirements but also position themselves for long-term success in an increasingly ESG-driven marketplace.

FAQs

What challenges do retailers face in meeting CSRD compliance requirements?

Retailers are grappling with CSRD compliance, largely because of the sheer complexity involved in gathering and reporting sustainability data across wide-reaching, supplier-heavy value chains. One of the toughest challenges? Collecting accurate data - particularly for Scope 3 emissions. These emissions cover everything from raw material extraction to manufacturing, transport, and packaging. While they’re a critical piece of the reporting puzzle, they’re notoriously tricky to measure.

On top of that, retailers are required to conduct double-materiality assessments, which means connecting environmental and social impacts to financial risks. They also need to ensure all their data is ready for audits and that disclosures align with the European Sustainability Reporting Standards (ESRS). Meeting these demands calls for advanced technology, specialised expertise, and seamless coordination between finance and sustainability teams.

What makes this even tougher for retailers is the need to map emissions to specific products, reconcile data from countless suppliers and logistics providers, and embed sustainability metrics into their financial systems. This is where integrated ESG platforms, like neoeco, come in. By embedding carbon data directly into accounting systems, these tools are becoming indispensable for simplifying the process and ensuring precise reporting.

How can consumer goods manufacturers manage Scope 3 emissions effectively?

Managing Scope 3 emissions becomes much more manageable when you weave carbon accounting into your financial processes. Start by mapping out your entire value chain using the GHG Protocol’s 15 Scope 3 categories. This will help you pinpoint key areas such as purchased goods, logistics, product use, and end-of-life stages. To focus your efforts, conduct a double-materiality assessment. This ensures you're prioritising categories with the biggest environmental and financial impacts, keeping you aligned with CSRD requirements.

Automating your data collection is a game-changer. Tools like neoeco can link financial transactions to recognised emissions categories, eliminating the hassle of manual spreadsheets. Plus, they provide accurate, audit-ready data. Work closely with suppliers by standardising how you collect data and including emissions metrics in purchase orders. This not only ensures a reliable data trail but also makes reporting smoother and more efficient.

For high-impact categories, set science-based targets and monitor progress directly within your financial systems. Publishing your results in line with the European Sustainability Reporting Standards (ESRS) does more than meet regulatory demands - it boosts your brand's credibility, trims costs, and strengthens your long-term resilience.

What are the benefits of aligning financial and sustainability goals under the CSRD for companies?

Aligning financial and sustainability goals under the Corporate Sustainability Reporting Directive (CSRD) can provide businesses with a range of benefits. By embedding ESG data directly into financial reporting systems, companies can boost transparency for investors, suppliers, and consumers. This level of openness not only builds trust but also ensures compliance with regulatory requirements - an essential step in maintaining strong stakeholder relationships.

The CSRD’s double-materiality approach goes a step further by helping organisations evaluate both the financial and societal impacts of sustainability issues. This dual perspective enhances risk management and showcases a company’s resilience to investors and lenders. Viewing ESG reporting as more than a compliance task - as a strategic advantage - can open doors to new market opportunities and access to low-carbon incentives.

On the operational side, tools like neoeco allow businesses to map transactions to emissions categories, simplifying the reporting process by cutting out manual tasks. This not only reduces costs but also delivers audit-ready data, ensuring companies stay ahead of evolving sustainability requirements while driving long-term value.