Sector-Specific Carbon Accounting: Financial Services

Dec 26, 2025

Financed emissions define banks' carbon footprints — accurate PCAF-based accounting, improved data quality and new UK disclosure rules are essential for credible reporting.

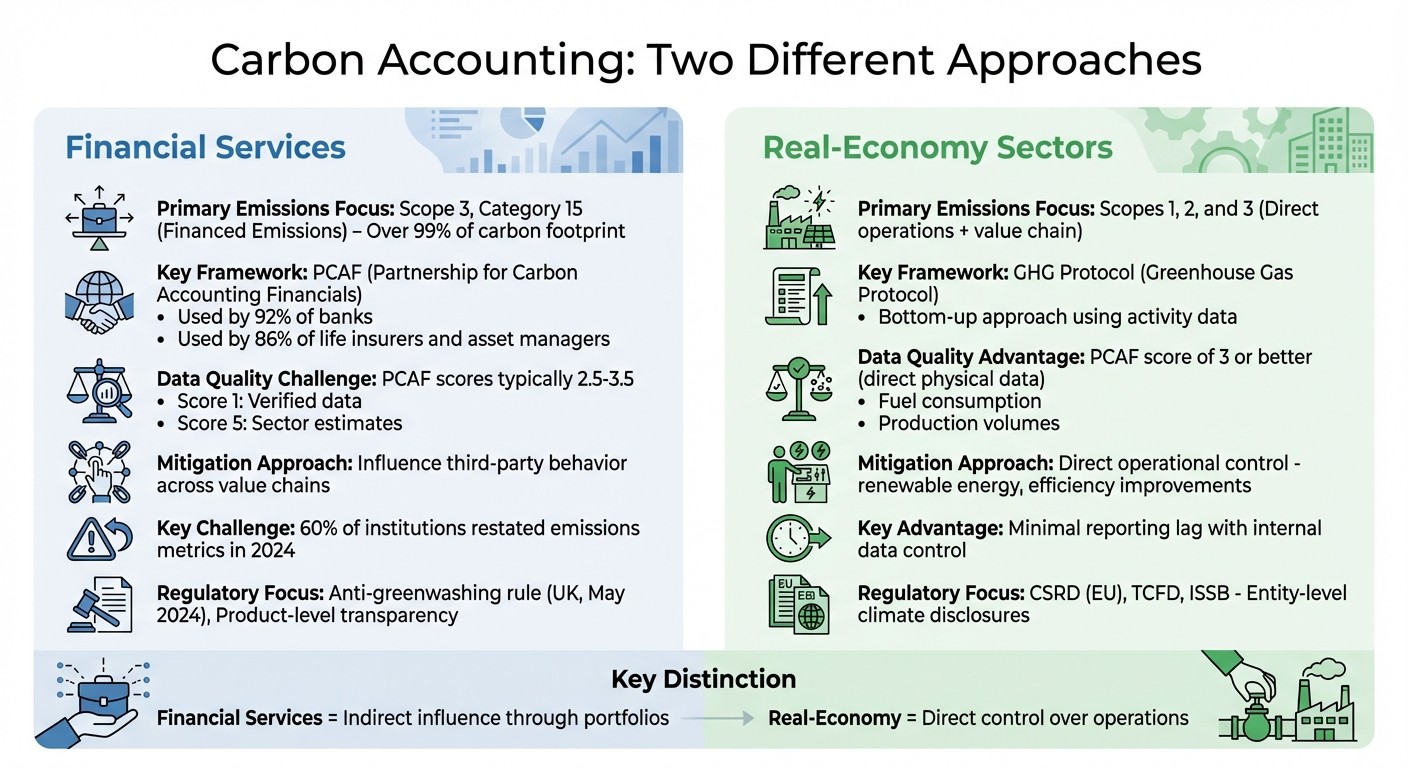

Carbon accounting helps organisations measure and manage greenhouse gas (GHG) emissions. Financial services differ from other industries because their main emissions come from financed activities - loans, investments, and underwriting - classified as Scope 3, Category 15 under the Greenhouse Gas Protocol (GHGP). Following GHG Protocol compliance best practices is essential for accurate categorization. These emissions make up over 99% of the sector's carbon footprint.

Key highlights:

Financial services focus on financed emissions, unlike manufacturing or energy sectors that prioritise direct (Scope 1) and energy-related (Scope 2) emissions.

The Partnership for Carbon Accounting Financials (PCAF) provides a standardised method to calculate financed emissions, using data like loan amounts and enterprise valuations.

Data quality is a challenge. Many institutions rely on proxies or sector averages, graded on a 1-5 scale by PCAF.

UK regulations, including the anti-greenwashing rule (effective May 2024), now mandate accurate emissions disclosures for financial institutions.

In contrast, real-economy sectors like manufacturing and transport focus on direct emissions and operational changes, such as adopting renewable energy or improving efficiency. While these sectors can act directly to reduce emissions, financial institutions must influence third-party behaviours across value chains.

Understanding these differences is crucial for accurate carbon reporting and aligning with evolving regulatory standards.

Carbon Accounting: Financial Services vs Real-Economy Sectors Comparison

1. Carbon Accounting in Financial Services

Emissions Profiles

Financial institutions have a unique emissions profile, with their climate impact almost entirely tied to Scope 3, Category 15. This category covers emissions linked to their loans, investments, and underwriting activities.

It's important to distinguish between two types of financed emissions: on-balance sheet emissions, such as those from business loans, and off-balance sheet emissions, like those from capital markets underwriting. To avoid double-counting, the Partnership for Carbon Accounting Financials (PCAF) assigns a weighting of 33% to facilitated emissions.

Methodological Frameworks

PCAF has become a key reference for emissions accounting, guiding 92% of banks and 86% of life insurers and asset managers. Based on the GHG Protocol's Scope 3, Category 15 framework, PCAF helps financial institutions calculate their share of a client’s emissions using an attribution factor. This factor is determined by the ratio of the institution's outstanding financing to the client’s total enterprise value.

However, data quality remains a challenge. PCAF uses a scoring system from 1 to 5, where Score 1 indicates verified emissions data, and Score 5 relies on sector-based estimates. Most leading banks achieve average scores between 2.5 and 3.5 for major sectors. In February 2024, HSBC refined its approach by adopting a "company value waterfall" methodology. This prioritises Enterprise Value Including Cash (EVIC) for listed companies and total assets for private firms, sourcing data from vendors like Bloomberg, Refinitiv, and S&P Trucost.

These frameworks underline the importance of accurate data for reliable emissions calculations.

Data and Tools

To accurately account for financed emissions, institutions must combine their internal financial data (such as loan amounts or transaction volumes) with external counterparty data (like reported emissions or production volumes). With the complexity of Scope 3 calculations, many financial institutions now rely on automated carbon accounting tools to meet regulatory expectations.

For organisations lacking direct counterparty data, the PCAF Emission Factor Database offers sector-specific emission factors. Despite these tools, 60% of financial institutions restated at least one financed or operational emissions metric in 2024 due to better data quality and evolving methodologies. Additionally, 64% of institutions sought external assurance for their emissions reporting in the same year, reflecting the growing need for accuracy and credibility.

These data-driven efforts are critical for meeting regulatory standards, as described below.

Regulatory Landscape

The UK's regulatory framework is evolving, moving from voluntary to mandatory emissions disclosure. Under the Financial Conduct Authority's anti-greenwashing rule, effective from 31st May 2024, all sustainability claims must be fair, clear, and not misleading. Additionally, the UK Sustainability Reporting Standards (UK SRS), aligned with IFRS S1 and S2, will require qualifying entities to disclose their financed emissions. Financial institutions must also prepare for ISSB reporting, which aims to standardise climate-related financial disclosures across jurisdictions.

PCAF Data Quality Score | Data Type | Description |

|---|---|---|

1 | Verified Reported | Verified GHG emissions data from the counterparty |

2 | Unverified Reported | Unverified GHG emissions data reported by the counterparty |

3 | Activity-based | Emissions calculated using primary physical activity data and specific factors |

4 | Economic Activity-based | Emissions estimated using revenue-based sector emission factors |

5 | Asset-based | Emissions estimated using outstanding loan amounts and sector-based proxies |

2. Carbon Accounting in Real-Economy Sectors

Emissions Profiles

While financial services focus almost entirely on Scope 3, Category 15 emissions, real-economy sectors like manufacturing, energy, and transport take a more comprehensive approach. These sectors combine emissions from direct operations with those from their value chains.

For industries such as Power and Utilities or Cement, the primary focus is on Scopes 1 and 2, which cover emissions from direct production and manufacturing processes. In contrast, sectors like Automotive and Oil & Gas must also account for Scope 3 emissions to capture the environmental impact of their products during use. This means tracking emissions across operations and supply chains.

"Production intensity in Oil & Gas is limited by the fuel-based nature of the industry." - PwC

This difference influences how targets are set. For example, financial institutions use production intensity metrics (like emissions per megawatt-hour) for Power sectors, while absolute emissions targets are applied to Oil & Gas. This is because fuel-based industries have less flexibility to lower emissions intensity through technological advancements.

Methodological Frameworks

Real-economy sectors primarily use the Greenhouse Gas Protocol (GHGP) to measure emissions, relying on activity data such as fuel consumption or electricity usage. This stands in contrast to the financial services sector, which uses the Partnership for Carbon Accounting Financials (PCAF) to link emissions from real-economy sectors to investment portfolios.

Real-economy accounting typically involves a bottom-up approach, gathering data directly from operations. On the other hand, financial services assign emissions based on their share of investments. Conglomerates operating across diverse sectors, such as those involved in both cement and power, present unique challenges for setting sector-specific targets. These companies are often excluded from target-setting frameworks until more tailored methodologies are developed. This highlights the need for precise, data-driven tools to ensure accurate measurement.

Data and Tools

To achieve accurate emissions measurements, real-economy sectors rely on primary data, such as production volumes or fuel usage, paired with emission factors. This method often results in a PCAF score of 3 or better.

However, collecting this data can be labour-intensive. For example, emissions from project finance may require manual extraction if vendor data is unavailable. To streamline this process, many companies are moving away from spreadsheets and adopting automated carbon accounting platforms that comply with standards like the GHGP and ISO 14064.

Assigning emissions responsibility within complex value chains - whether upstream, midstream, or downstream - requires expert judgement and detailed revenue data.

Regulatory Landscape

Like financial services, real-economy sectors are adapting to increasingly stringent regulatory requirements. The EU's Corporate Sustainability Reporting Directive (CSRD) will soon require around 50,000 companies to disclose their Scopes 1, 2, and 3 emissions. This marks a shift from voluntary reporting to mandatory compliance.

In the UK, businesses are prioritising climate-related disclosures before expanding to broader sustainability topics, reflecting a climate-first regulatory approach. As reporting standards converge, real-economy companies are being held to the same level of scrutiny in emissions reporting as they are in financial audits. This shift underscores the growing complexity and importance of emissions data management across industries.

Explained | The Partnership for Carbon Accounting Financials (PCAF) for Financed Emissions

Advantages and Disadvantages

Here's a comparison of the main strengths and challenges in carbon accounting for financial services versus real-economy sectors:

Aspect | Financial Services | Real-Economy Sectors |

|---|---|---|

Primary Strength | The PCAF framework promotes consistent measurement across asset classes and regions. | Direct operational control allows for immediate action, such as improving efficiency or adopting renewable energy sources. |

Data Quality | Relies heavily on counterparty disclosures and proxies, with PCAF scores often ranging between 3 and 5. | Uses direct physical data, like fuel consumption or production volumes, typically achieving a score of 3 or better. |

Mitigation Complexity | Highly challenging, as it involves influencing third-party behaviour across entire value chains. | Easier to address through operational changes and technological upgrades. |

Reporting Lag | Faces significant delays due to dependence on investee disclosure timelines. | Experiences minimal lag since data is internally generated and controlled. |

Strategic Value | Facilitates portfolio-wide risk assessments and alignment with net-zero goals, driving systemic change. | Provides direct cost savings through reduced energy use and operational efficiency gains. |

Regulatory Focus | Emphasis on product-level transparency and anti-greenwashing regulations (e.g., UK SDR). | Focused on entity-level climate disclosures under TCFD and CSRD vs ISSB standards. |

The PCAF framework's standardisation simplifies data sharing across the financial sector. However, financial institutions face the unique challenge of dealing with emissions that predominantly fall under Scope 3, where they lack direct control. This creates complex strategic decisions around how to influence emissions reductions indirectly.

On the other hand, real-economy sectors benefit from more accurate data collection through direct metering and activity logs. While this improves precision, these sectors must bear the direct costs of decarbonisation, which financial institutions can only influence indirectly. For organisations managing diverse emissions portfolios, understanding these trade-offs highlights the importance of sector-specific carbon accounting approaches, as outlined earlier.

Conclusion

Carbon accounting in financial services takes a different path compared to real-economy sectors, focusing on financed emissions rather than direct operational emissions. While industries like manufacturing and utilities calculate their emissions based on fuel consumption and energy use, banks and asset managers must account for the emissions of their entire investment and loan portfolios. Their carbon footprint is only as accurate as the reporting provided by the borrowers.

This unique approach calls for customised methodologies. Real-economy sectors have the advantage of direct control over their operations - they can adopt renewable energy or upgrade equipment to reduce emissions immediately. In contrast, financial institutions must influence the behaviour of third parties across intricate value chains. They rely on attribution and emission factors, such as loan amounts relative to company valuations, to calculate their share of emissions responsibility.

These tailored methods are critical not only for precise measurement but also for effective risk management and regulatory compliance. Frameworks like PCAF offer standardised attribution methods for various asset classes. Additionally, sector-specific data requirements ensure industries like Oil and Gas include downstream fuel use (Scope 3), while Power and Utilities focus on emissions from generation and transmission (Scopes 1 and 2). This level of detail helps financial institutions evaluate transition risks and direct investments towards a low-carbon future.

For accounting firms working across both financial services and real-economy sectors, recognising these differences is essential. Financed emissions present unique challenges, such as data quality issues, reporting delays, and complex attribution methods, which require specialised technical solutions. Platforms like neoeco address these challenges by integrating with financial ledgers and mapping transactions to established emissions categories under frameworks like GHGP and ISO 14064. This ensures audit-ready outputs, even for the most complex sectors, and highlights the need for automating Scope 3 emissions mapping within financial data.

FAQs

What is the PCAF framework, and how does it help financial institutions calculate financed emissions?

The PCAF framework gives financial institutions a clear, standardised way to measure and report the greenhouse gas (GHG) emissions linked to their financing activities. Aligned with the GHG Protocol, it provides specific guidance tailored to various asset classes, including listed equity, corporate bonds, loans, real estate, mortgages, and sovereign debt.

By adopting PCAF, institutions can achieve consistent and transparent reporting, thanks to its well-defined rules for data attribution and calculation. This approach not only improves their understanding of financed emissions but also helps them comply with sustainability reporting obligations more efficiently.

What makes it challenging for financial services to obtain accurate emissions data?

Financial services often struggle to access precise emissions data because the critical information is typically managed by the companies or projects they finance, rather than being directly available to the lenders. Many of these investees either fail to disclose emissions data or provide figures that are inconsistent and incomplete - this is especially true for Scope 3, Category 15 emissions. As a result, financial institutions are often left to rely on estimates or proxy models, which can compromise the reliability of their data.

The Partnership for Carbon Accounting Financials (PCAF) points out that different asset classes - like corporate bonds, business loans, real estate, and mortgages - each require tailored methodologies and attribution factors. This challenge is made even more complex by gaps in emissions inventories and the absence of a universally agreed-upon reporting framework. Financial institutions frequently need to navigate multiple standards, including the GHG Protocol, ISSB, and UK SRS, which adds to their costs, increases manual workload, and intensifies regulatory demands for finance-grade, audit-ready carbon data.

How will the UK's anti-greenwashing regulations affect emissions reporting in financial services?

The UK's anti-greenwashing regulations are designed to promote transparency and accuracy in sustainability claims, bringing notable changes to how emissions are reported within the financial services sector. For financial institutions, this means placing greater emphasis on the precise disclosure of financed emissions - the emissions tied to their investments, loans, and other financial activities.

To meet these requirements, firms will need to implement strong carbon accounting practices and utilise tools that align with established frameworks like the Greenhouse Gas Protocol (GHGP) and relevant national standards. This approach not only helps organisations stay compliant but also strengthens stakeholder trust and minimises potential reputational risks.