ESG Ratings Regulation: Impact on UK and Australian Firms

Dec 20, 2025

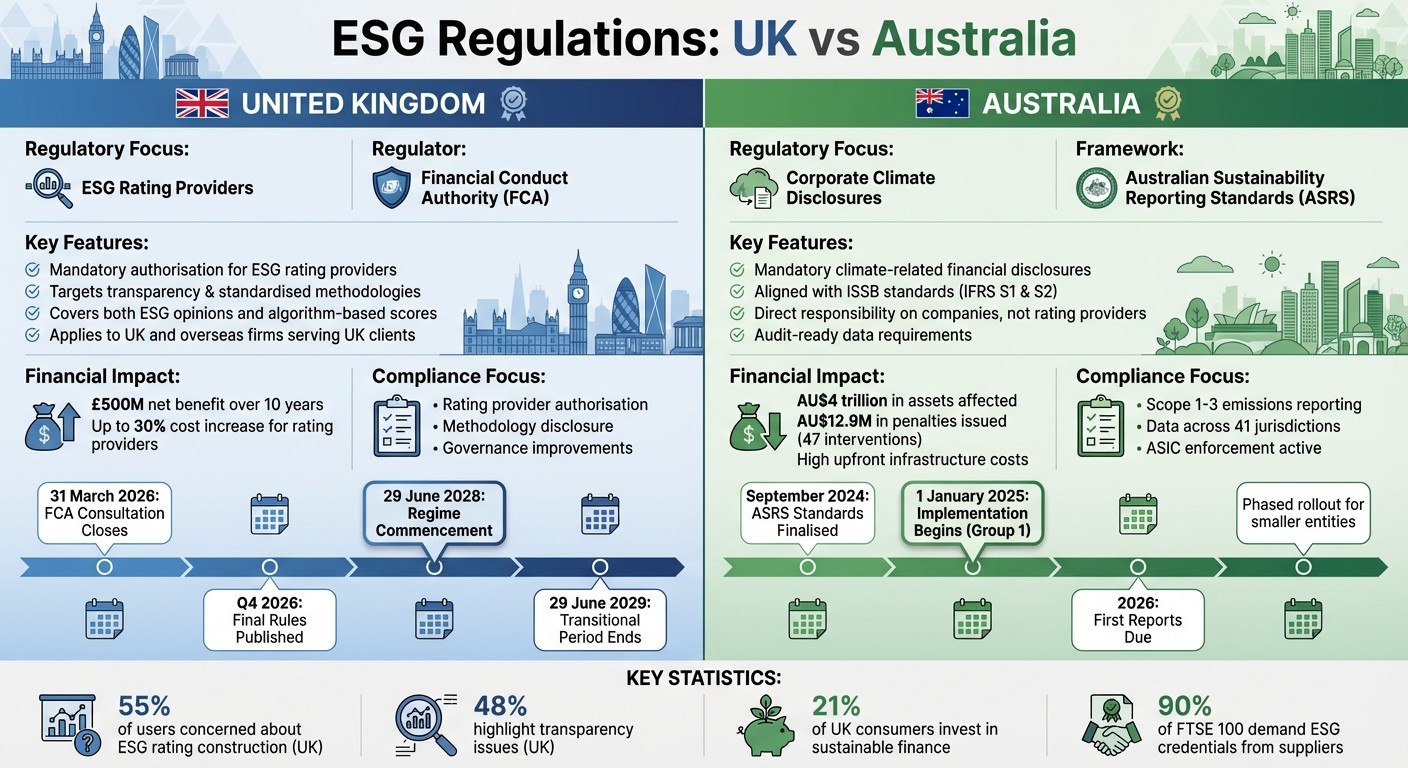

Compare UK rules requiring FCA authorisation for ESG ratings with Australia’s ISSB-aligned mandatory climate disclosures — timelines, investor impacts and compliance risks.

ESG regulations are reshaping how businesses in the UK and Australia report and manage sustainability data. Both countries have adopted distinct approaches, creating new compliance challenges and opportunities for firms operating in these regions.

UK Focus: From 29 June 2028, ESG rating providers must be authorised by the Financial Conduct Authority (FCA). This regulation targets transparency, standardised methodologies, and governance improvements. Firms will have until 29 June 2029 to fully comply.

Australia’s Approach: Mandatory climate-related disclosures began on 1 January 2025 for large companies, aligned with ISSB standards. Businesses must produce audit-ready data and meet strict reporting requirements.

Key Takeaways:

UK: ESG ratings providers face stricter oversight, improving trust in methodologies but increasing compliance costs.

Australia: Companies bear direct responsibility for climate disclosures, with penalties for non-compliance already enforced.

For firms active in both regions, understanding these frameworks is crucial to avoid regulatory risks and maintain investor confidence.

UK vs Australia ESG Regulations Comparison: Key Differences and Timelines

1. UK ESG Ratings Regulations

Scope and Mandates

Starting 29 June 2028, any organisation producing ESG ratings in the UK will need authorisation from the Financial Conduct Authority (FCA). This rule applies not only to UK-based providers but also to overseas firms offering services to UK clients in exchange for payment – whether that’s a fee, commission, or any other economic benefit.

The regulation covers both ESG opinions (analytical assessments) and ESG scores (algorithm-based evaluations) that influence investment decisions through established methods and ranking systems. However, certain exclusions apply. These include intra-group ratings, custom assessments for individual entities, and ratings created for journalism, academic research, or charitable purposes. Ratings integrated into other regulated activities, such as credit ratings or benchmarks, are also excluded unless provided as standalone services.

Disclosure Timelines

The new rules come with clear timelines for implementation. The Financial Services and Markets Act 2000 (Regulated Activities) (ESG Ratings) Order 2025 was introduced in Parliament in October 2025. The FCA’s consultation (CP25/34) remains open until 31 March 2026, with final regulations expected by late 2026. Firms already providing ESG ratings will have a one-year transition period ending on 29 June 2029.

Milestone | Date |

|---|---|

FCA Consultation Closes | 31 March 2026 |

Final Rules Published | Q4 2026 |

Regime Commencement | 29 June 2028 |

Transitional Period Ends | 29 June 2029 |

Impact on Investor Relations

This regulation is designed to improve transparency, governance, conflict management, and stakeholder engagement. A key focus is the mandatory disclosure of methodologies, aimed at curbing greenwashing and strengthening investor trust. With clearer insights into how ratings are developed, investors will be better equipped to compare them, assess their assumptions, and make informed decisions about capital allocation and portfolio strategies.

For companies managing investor relations, the shift means sustainability data will now be held to the same high standards as financial reporting. As frameworks like ISSB reporting become more integrated into standard disclosures, firms will face mounting pressure to ensure their ESG credentials are audit-ready and can withstand detailed scrutiny.

Compliance Challenges

While these regulations promise greater clarity, they also bring notable compliance hurdles. The broad definition of "ESG rating" may now include products previously not considered ratings, prompting firms to conduct thorough reviews of their offerings. Overseas providers must determine whether their UK activities require a physical presence or local authorisation. Additionally, firms operating across borders will need to address differences between the UK regime and the EU ESG Ratings Regulation to remain compliant in both jurisdictions.

With 55% of users expressing concerns about how ESG ratings are constructed and 48% highlighting transparency issues, providers are under growing pressure to strengthen governance and improve documentation processes. The projected net benefit of £500 million over the next decade underscores the scale of change ahead - and the opportunities for firms that adapt swiftly and effectively.

2. Australian ESG Ratings Regulations

Scope and Mandates

Australia has taken a distinct approach to ESG regulations compared to the UK, shifting its focus to corporate climate disclosures rather than directly regulating ratings providers. The Treasury Laws Amendment (Financial Market Infrastructure and Other Measures) Act 2024 introduced mandatory climate-related financial disclosures aligned with the International Sustainability Standards Board (ISSB) guidelines. This framework is supported by the Australian Sustainability Reporting Standards (ASRS), finalised in September 2024, which align with the IFRS S1 and S2 standards. Implementation began on 1 January 2025 for Group 1 entities, which include ASX 200 companies, with their first reports due in 2026. Subsequent groups, including smaller entities, will follow in the years to come, marking a significant shift in reporting responsibilities to accounting teams.

Disclosure Timelines

The new mandates have pushed firms to adapt quickly to meet the strict reporting deadlines. Large companies and financial institutions had to establish robust governance frameworks and sustainability record-keeping systems well before the 1 January 2025 deadline. Kate O'Rourke highlighted the importance of early preparation:

"Large businesses and financial institutions should ensure that they implement appropriate governance arrangements and sustainability record-keeping processes ahead of the mandatory climate reporting requirements taking effect from 1 January 2025".

Impact on Investor Relations

The Australian framework has significantly heightened the demands on investor relations teams. With AU$4 trillion in assets affected, companies must now produce audit-ready sustainability disclosures as investors increasingly incorporate climate risk into their valuation models. These disclosures, now mandatory and subject to audit assurance, are no longer optional narratives but critical components of investor communications. Any inconsistencies in sustainability data can severely undermine a company’s credibility, as noted by Stephen Pell, Co-founder and CEO of neoeco:

"Where sustainability data is fragmented, inconsistent or disconnected from financials, it damages credibility".

This shift requires sustainability data to meet the same rigorous standards as financial statements, adding pressure on firms to ensure their reporting is both accurate and transparent.

Compliance Challenges

Compliance with the stringent Australian regulations goes beyond just meeting disclosure requirements. The Australian Securities and Investments Commission (ASIC) has intensified enforcement efforts, with 47 interventions and penalties totalling AU$12.9 million targeting misleading climate disclosures.

To meet these challenges, firms must move away from outdated tools like Excel spreadsheets and manual surveys, adopting integrated systems capable of handling audit scrutiny. Sustainability KPIs must be explicitly tied to corporate performance metrics, and climate risk disclosures must be backed by robust financial models linked to enterprise risk registers. For accounting firms supporting their clients, tools like neoeco streamline compliance by mapping transactions to recognised emissions categories, ensuring data is both audit-ready and financially integrated.

ESG ratings: the good, the bad and the ugly

Advantages and Disadvantages

Building on the earlier discussion of regulatory frameworks, this section examines the benefits and challenges posed by ESG regulations in the UK and Australia. Both countries have introduced rules that reshape how sustainability data is managed and communicated to investors, but their approaches come with distinct trade-offs. In the UK, the focus is on regulating ESG rating providers through mandatory authorisation by the Financial Conduct Authority (FCA). Meanwhile, Australia has prioritised mandatory climate reporting for large corporations, impacting AU$4 trillion in assets and placing the compliance responsibility directly on businesses rather than rating agencies.

The advantages differ between the two jurisdictions. In the UK, firms benefit from standardised methodologies and greater transparency. ESG rating providers must disclose their data sources and methodologies, reducing the risk of greenwashing and building trust in the market. This transparency aligns with consumer and corporate behaviour, where 21% of UK consumers invest in sustainable finance products, and 90% of FTSE 100 companies demand ESG credentials from suppliers. In Australia, firms gain credibility by adhering to climate reporting aligned with ISSB reporting standards, meeting investor expectations for integrating climate risks into financial models.

However, the financial and operational challenges are significant. Compliance costs are a major concern in both markets. In the UK, ESG rating providers face increased expenses for authorisation and governance systems, with estimates suggesting costs could rise by as much as 30%, potentially being passed on to clients. In Australia, the challenges are even more complex. Companies must collect detailed data across 41 jurisdictions under strict tax disclosure laws while managing Scope 1–3 emissions reporting. The transition from voluntary to mandatory metrics has left many firms underprepared, especially those still relying on outdated tools like spreadsheets instead of integrated systems capable of meeting audit requirements.

Aspect | United Kingdom | Australia |

|---|---|---|

Primary Advantage | Standardised rating methodologies enhance investor trust and reduce greenwashing. | Climate disclosures aligned with ISSB standards boost credibility with institutional investors. |

Key Disadvantage | Rating providers face up to a 30% rise in costs, which may be passed on to clients. | Detailed reporting across 41 jurisdictions creates a heavy data collection burden. |

Compliance Focus | Mandatory authorisation and improved governance for ESG rating agencies. | Corporate climate reporting aligned with ISSB standards. |

Investor Impact | Greater comparability in the ESG investment market, projected to exceed US$53 trillion. | Mandatory disclosure requirements address investor demands. |

Implementation Cost | UK: £500m net benefit over 10 years. | Australia: High upfront infrastructure costs. |

For multinational firms operating in both regions, the differing regulatory approaches add layers of complexity. The UK’s clearly defined regulatory framework provides legal certainty for rating providers. In contrast, Australian firms must navigate staggered implementation timelines, with mandatory disclosures set to begin in FY2025. While both markets aim to improve transparency and bolster investor confidence, the question remains whether these benefits will outweigh the considerable compliance costs for businesses.

Conclusion

The UK and Australia have taken notably different paths in regulating ESG ratings. In the UK, the Financial Conduct Authority (FCA) will directly oversee ESG rating providers, with mandatory authorisation coming into effect on 29 June 2028. This approach focuses on ensuring transparency, standardised methodologies, and managing conflicts of interest effectively. Meanwhile, Australia has introduced stringent climate disclosure rules for businesses, requiring them to produce audit-ready data under the Australian Sustainability Reporting Standards, effective from 1 January 2025. Here, the compliance responsibility lies heavily on companies, demanding precise and verifiable data to meet rigorous disclosure requirements. These differing frameworks mean that businesses operating in both regions must adapt quickly to stay compliant.

For companies navigating both markets, these regulatory differences present unique challenges. UK firms need to focus on documenting their ESG rating methodologies and governance structures thoroughly. In Australia, however, businesses are under immediate pressure to collect and verify Scope 1–3 emissions data, adhering to strict assurance protocols. Multinational organisations face the added complexity of aligning with global standards like ISSB while also meeting local requirements, including the UK Sustainability Reporting Standards and ASRS 2.

Adapting to these challenges requires a significant overhaul of data management systems. Sustainability data now needs to meet the same rigorous standards as financial reporting. As Stephen Pell, Co-founder and CEO of neoeco, puts it:

"The message is clear: sustainability data must now be treated with the same professional scrutiny and discipline as financial data".

Outdated tools, such as spreadsheets, can no longer provide the accuracy and traceability regulators and investors demand. This shift highlights the importance of adopting integrated solutions that combine sustainability and financial reporting seamlessly.

Tools like neoeco offer a way forward. They automatically map transactions to recognised emissions categories under frameworks like GHGP, ISO 14064, SECR, the UK SRS, and ASRS 2. By eliminating manual data conversions, these tools generate audit-ready, finance-integrated reports, boosting transparency and building investor trust through reliable sustainability data.

FAQs

How do ESG regulations in the UK and Australia affect multinational companies?

The United Kingdom is gearing up to regulate ESG ratings as a financial activity under the Financial Services and Markets Act 2025. Starting from 29 June 2028, firms that provide ESG scores will need approval from the FCA and must follow strict rules on transparency, governance, and managing conflicts of interest. Meanwhile, Australia's approach takes a different route, focusing on the Australian Sustainability Reporting Standards (ASRS). These standards align with the global ISSB S1/S2 frameworks but do not require ESG rating providers to seek regulatory approval. Instead, listed companies must produce audit-ready ESG data that complies with ASRS guidelines.

For multinational companies operating in both regions, this creates a tricky dual compliance situation. In the UK, the focus is on ensuring that ESG rating providers meet regulatory requirements. In Australia, the challenge lies in embedding ESG data collection into financial systems to meet ASRS standards. This is where integrated platforms like neoeco come into play, simplifying the process by mapping transactions to both UK and Australian regulations. Such tools ensure accurate, audit-ready reporting across multiple jurisdictions.

Although these regulatory frameworks add complexity and costs, they also offer a chance to improve consistency in ESG data collection, cut down on duplication, and make global disclosures more comparable.

What challenges do UK and Australian firms face under the new ESG regulations?

Firms in the UK are grappling with the complexities of new ESG regulations, especially those tied to ESG ratings. Starting 29 June 2028, any organisation providing ESG ratings will need authorisation from the FCA. This will require them to establish solid governance structures, implement conflict-of-interest policies, and adopt detailed methodologies to ensure their ratings are both transparent and comparable. For accounting and advisory firms, this translates into setting up fresh compliance frameworks, training their teams on ESG disclosure requirements, and keeping audit-ready records.

In Australia, the rollout of the Australian Sustainability Reporting Standards (ASRS) introduces mandatory ESG disclosures, closely resembling the UK’s regulatory direction. This brings its own set of challenges, such as gathering reliable data - particularly on Scope 3 emissions - maintaining a clear audit trail, and performing double-materiality assessments. Without automated tools to handle and map ESG data effectively, firms risk falling short on reporting obligations, missing deadlines, or even facing penalties. To navigate these hurdles, dependable data-management platforms are becoming a necessity.

How do the new ESG regulations in the UK improve transparency and investor confidence?

The United Kingdom has introduced new ESG regulations that mandate rating providers to obtain authorisation from the Financial Conduct Authority (FCA). Alongside this, they must comply with stricter guidelines, which focus on improving transparency in rating methodologies, strengthening governance and controls, and effectively managing conflicts of interest.

These measures aim to create clearer frameworks and promote greater accountability, making ESG ratings more dependable and easier to compare. The result? Increased investor confidence and better-informed decision-making.