ERP vs Standalone Tools for Carbon Accounting

Dec 11, 2025

Standalone carbon tools beat ERPs for most accounting firms — cheaper, quicker to deploy and better at SME Scope 3 mapping.

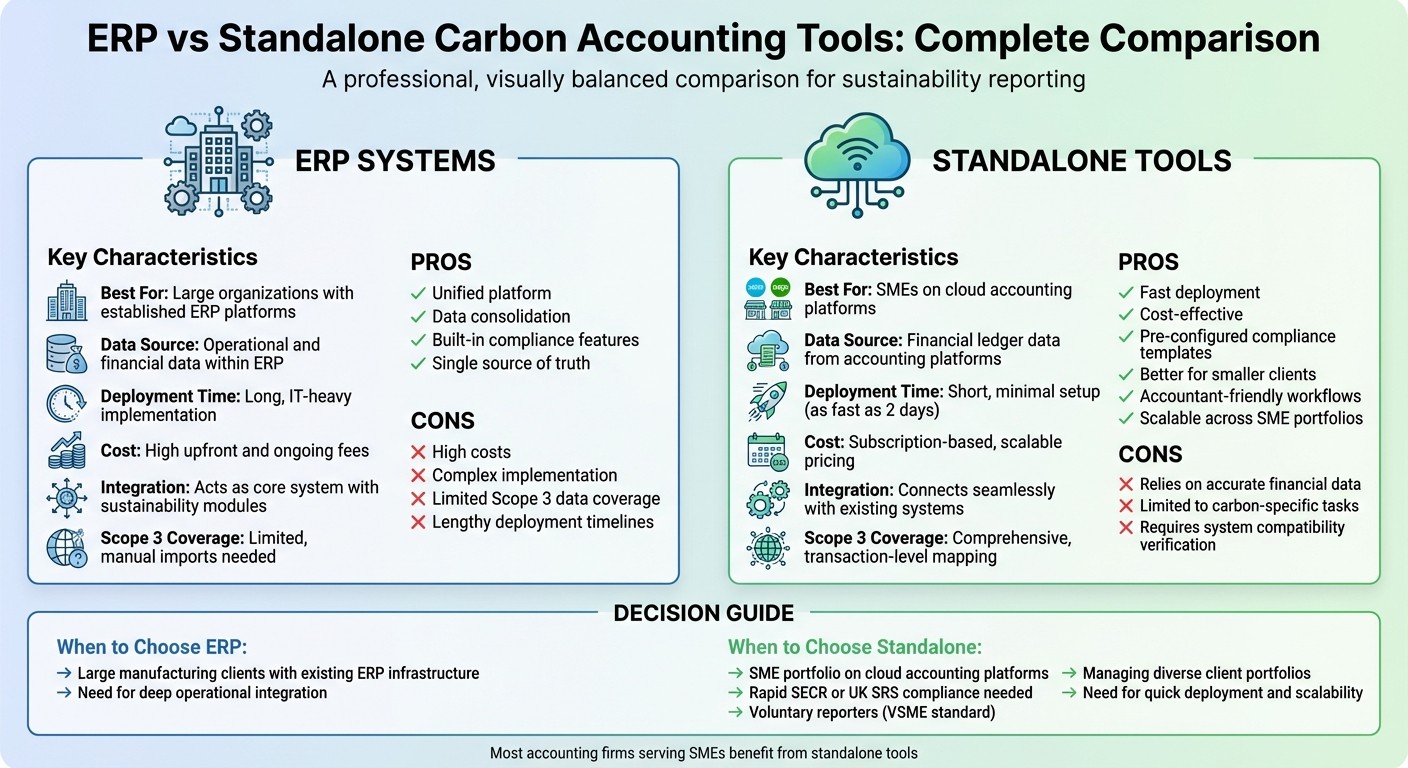

When deciding between ERP systems and standalone tools for carbon accounting, the choice depends on your firm's needs and the clients you serve. Here’s a quick breakdown:

ERP systems integrate carbon tracking into broader business processes, leveraging existing operational and financial data. They are ideal for large organisations with established ERP platforms but can be costly and time-intensive to implement.

Standalone tools focus solely on carbon accounting, connecting directly to financial systems like Xero, Sage, or QuickBooks. They are easier to deploy, more flexible for SMEs, and better suited for firms managing diverse client portfolios.

Key Considerations:

ERP Pros: Unified platform, data consolidation, built-in compliance features.

ERP Cons: High costs, complex implementation, limited Scope 3 data coverage.

Standalone Pros: Fast deployment, cost-effective, pre-configured compliance templates, better for smaller clients.

Standalone Cons: Relies on accurate financial data, limited to carbon-specific tasks.

Quick Comparison:

Aspect | ERP Systems | Standalone Tools |

|---|---|---|

Deployment Time | Long, IT-heavy | Short, minimal setup |

Cost | High upfront and ongoing fees | Subscription-based, scalable |

Scope 3 Coverage | Limited, manual imports needed | Comprehensive, transaction-level mapping |

Client Fit | Large firms with ERP systems | SMEs on cloud accounting platforms |

For most accounting firms serving SMEs, standalone tools offer a practical and efficient solution for delivering carbon accounting services. However, firms with larger clients or complex needs may benefit from ERP integrations.

ERP vs Standalone Carbon Accounting Tools Comparison Chart

ERP Systems with Carbon Accounting Features

How ERP Systems Handle Carbon Accounting

ERP systems integrate carbon accounting directly into existing financial workflows, using smart matching to automatically connect transactions with recognised emissions categories. These modules are part of larger enterprise platforms like Microsoft Business Central or SAP, which rely on financial and operational data as the backbone for emissions calculations.

What makes this approach seamless is that carbon data moves through the same governance and approval processes as traditional financial information. This integration not only simplifies data collection but also ensures that carbon accounting becomes a natural part of established workflows, reducing the need for separate systems or manual intervention.

Benefits of ERP Systems for Carbon Accounting

One major benefit of using ERP systems for carbon accounting is the consolidation of data. By housing sustainability metrics alongside procurement, inventory, and financial reporting, organisations can achieve a single, unified source of truth for both financial and carbon data. This eliminates the complexity of reconciling information across different platforms, saving time and reducing errors.

ERP systems also offer built-in features like audit trails, user permissions, and approval workflows, ensuring data integrity and security. Moreover, many ERP modules support multiple reporting frameworks, enabling organisations to comply with varying regulatory requirements all within one system.

Limitations of ERP Systems for Accounting Firms

While ERP systems bring clear advantages, they often focus on integration benefits without addressing the unique challenges faced by accounting firms. Before adopting an ERP solution, it's essential to carefully assess whether it aligns with your clients' specific operational needs. The key is to determine if the system's integrated approach can effectively support your firm's carbon accounting goals without compromising on functionality or accuracy.

Standalone Carbon Accounting Tools

What Are Standalone Carbon Accounting Tools?

Standalone carbon accounting tools are platforms specifically designed to measure, manage, and report an organisation's carbon footprint. Unlike ERP systems, which incorporate sustainability tracking into broader business processes, these tools focus solely on carbon accounting, offering a streamlined and dedicated approach.

These tools connect directly to financial systems like Xero, Sage, and QuickBooks (e.g. neoeco), leveraging reliable transaction data to calculate emissions in line with recognised frameworks such as the GHGP, ISO 14064, SECR, and UK SRS. The idea is straightforward: start with the data you already have. By using existing financial records, these platforms eliminate the need for spreadsheets, manual data entry, and duplicate systems. Advanced matching technology automatically assigns transactions to the correct emissions categories, ensuring both speed and precision.

This focused functionality offers specific benefits for accounting firms, making them an attractive option for delivering carbon accounting services.

Benefits of Standalone Tools for Accounting Firms

Standalone carbon accounting tools bring several advantages that align well with the operational needs of accounting firms.

One major advantage is quick deployment. These tools integrate seamlessly with existing financial systems, enabling firms to start offering carbon accounting services without lengthy implementation processes or extensive staff training. For instance, neoeco is described as "intuitive, quick to deploy, and accountant-first", with some firms achieving initial emissions calculations in just two days.

Accountant-friendly workflows are another key feature. These platforms centralise client data and offer full oversight of reconciliation, calculation, and reporting. They also enforce secure access controls, streamlining the process for accounting professionals.

To simplify compliance, these tools provide templates for sustainability reporting. They stay updated with evolving regulations like the GHGP, SECR, and UK SRS, allowing accounting firms to focus on delivering quality service rather than mastering every new framework.

Audit readiness is built into the process. Features like live checklists track progress, highlight missing elements, and flag items ready for review. Secure hubs for policies and evidence ensure that supporting documentation is well-organised, while auditor access features eliminate the need for cumbersome email exchanges.

Perhaps most importantly, standalone tools allow firms to scale services across SME clients. They enable professional carbon accounting for a broad client base, not just large corporations with dedicated sustainability teams. This scalability creates new revenue opportunities and strengthens client relationships.

For a deeper dive into how these tools fit into broader sustainability strategies, the Financially-integrated Sustainability Management manifesto on neoeco's website offers valuable insights.

Limitations of Standalone Tools

While standalone tools have clear benefits, there are some challenges that accounting firms need to consider.

The most critical factor is the quality of underlying data. Since emissions calculations rely on financial and operational records, any inaccuracies - such as incomplete transaction details, miscategorised expenses, or gaps in records - can compromise the accuracy of the carbon accounts. Ensuring clients maintain accurate and detailed bookkeeping is essential to mitigate this risk.

System compatibility is another consideration. Firms using less common or customised platforms should verify that their chosen carbon accounting tool can integrate smoothly with their existing systems.

Finally, standalone tools are designed specifically for carbon accounting and sustainability reporting. They may not address broader enterprise needs, such as supply chain management or product lifecycle analysis. For clients requiring carbon data to integrate with these wider systems, additional workflows or software might be necessary. While this limitation is unlikely to affect firms serving SMEs with straightforward requirements, those working with larger, more complex organisations should evaluate whether standalone tools alone can meet their needs or if supplementary solutions are required.

SAP Runs SAP Green Ledger: ERP Software for Carbon Accounting | Demo

ERP vs Standalone Tools: Side-by-Side Comparison

Let’s take a closer look at how ERP systems and standalone tools compare, especially for accounting firms managing diverse client portfolios.

Feature Comparison Table

Here’s a breakdown of how ERP systems stack up against standalone carbon accounting tools across key areas:

Aspect | ERP Systems | Standalone Tools |

|---|---|---|

Data Source Focus | Primarily operational and financial data within the ERP | Financial ledger data from platforms like Xero, Sage, and QuickBooks |

Implementation Effort | Requires significant IT customisation and extended deployment timelines | Quick to deploy - some users calculate emissions in just two days |

Scope 3 Coverage | Limited, often needing manual imports for external data | Comprehensive, including small suppliers through transaction-level mapping |

Cost Profile | High upfront costs with ongoing licence and customisation fees | Scalable, subscription-based pricing with no long-term commitments |

Integration Approach | Acts as the core system, with optional sustainability modules | Designed to connect seamlessly with existing systems like Xero, Business Central, and SAP |

Compliance Support | Varies by vendor; often requires manual configuration for frameworks like SECR and UK SRS | Pre-configured templates for frameworks such as GHGP, SECR, UK SRS, and ASRS 2, with automatic updates |

Audit Readiness | Relies on manual evidence collection and coordination with auditors | Includes built-in audit controls, policy hubs, and secure access for auditors |

neoeco's FiSM approach bridges carbon data with financial strategy, making it easier to align sustainability goals with financial objectives.

Which Option Fits Your Clients?

The table below outlines scenarios where each solution might be the better choice, depending on client needs and infrastructure.

Scenario | ERP Better Fit | Standalone Better Fit |

|---|---|---|

Large manufacturing client with existing ERP infrastructure | Yes | No |

SME portfolio on cloud accounting platforms | No | Yes |

Rapid SECR or UK SRS readiness | No | Yes |

Voluntary reporters under VSME standard | No | Yes |

Clients requiring integration with existing ERP systems (e.g., Business Central, SAP) | Potentially | Yes - standalone tools can connect to major ERPs |

Firms managing diverse client portfolios with varied systems | No | Yes |

Standalone tools like neoeco excel in flexibility, allowing firms to integrate directly with clients' financial systems without the need for large-scale system replacements or complex IT projects. This adaptability makes it easier to scale carbon accounting services across a wide client base.

"We evaluated multiple ESG tools and felt more confused each time. neoeco cut through the noise - the only platform that connects financials to sustainability with LCA-level accuracy."

– neoeco website

For firms working with clients that have intricate supply chains, understanding Scope 3 emissions is critical. Standalone tools provide the detailed mapping needed to capture these emissions more effectively than most ERP systems.

In the next section, we’ll introduce a decision framework to help you choose the right solution for your firm.

How to Choose the Right Solution for Your Firm

Key Points to Remember

ERP systems and standalone tools serve different purposes when it comes to sustainability and carbon accounting. ERP systems are designed for firms with fully integrated IT infrastructures, offering a unified platform for operations. However, these systems come with high costs and lengthy implementation timelines. While they provide deep integration, they might not have the flexibility required for detailed carbon accounting tasks.

On the other hand, standalone tools are a better fit for firms working with diverse SME portfolios on cloud platforms like Xero, Sage, or QuickBooks. These tools are quick to deploy - some can calculate emissions in as little as two days - and come with minimal IT requirements. They are particularly effective for firms supporting voluntary reporters, such as those adhering to the VSME standard, or clients needing fast compliance with frameworks like SECR and UK SRS. Additionally, standalone tools often include automatic updates to ensure alignment with compliance frameworks.

Platforms like neoeco enable hands-on control, allowing firms to reconcile, calculate, and report directly using reliable client data. This distinction between ERP systems and standalone tools provides a clear foundation for choosing the right solution.

Decision Framework for Accounting Firms

To select the best solution for your firm, consider these key factors:

Start by analysing your client base. If most of your clients use cloud accounting software and you aim to scale sustainability services efficiently, standalone tools offer a quicker and more cost-effective option.

Next, match regulatory needs with your budget. Tools that automatically update to frameworks like GHGP, SECR, UK SRS, and ASRS 2 save significant time compared to manually configuring ERP modules. For firms expanding into ISSB reporting or handling intricate supply chain emissions, features like automatic transaction mapping to recognised emissions categories are crucial. Monthly subscription models, like neoeco’s, with no long-term contracts and a 30-day free trial, lower financial risks compared to ERP systems that require substantial upfront investments.

Evaluate the level of support your firm requires. If you lack in-house sustainability expertise, prioritise platforms that offer robust customer support, including dedicated success managers, detailed knowledge resources, and round-the-clock assistance to help your team deliver high-quality services.

"neoeco cut through the noise - the only platform that connects financials to sustainability with LCA-level accuracy." – neoeco

For most accounting firms catering to SMEs and mid-market clients, standalone tools provide the scalability, control, and compliance features needed to turn sustainability into a profitable and forward-thinking service offering.

FAQs

What’s the difference between ERP systems and standalone carbon accounting tools?

ERP systems bring sustainability data into the heart of financial workflows, offering automated, finance-grade reporting that fits neatly with standard accounting practices. This integration not only streamlines processes but also delivers audit-ready outputs, cutting down on manual work. That said, these systems might not offer the specialised tools needed for detailed carbon accounting.

In contrast, standalone carbon accounting tools are designed specifically for tracking and analysing emissions. They excel at features like scenario modelling and customised reporting, giving users the ability to dive deep into emissions data. However, they often require manual data entry and don’t always integrate smoothly with financial systems.

For accounting firms in the UK and Australia, neoeco offers a distinct advantage. It blends the accuracy of finance-grade data with the focus of a dedicated carbon accounting tool, creating a platform that supports professional, compliant, and profitable carbon accounting services.

How do standalone carbon accounting tools work with financial systems like Xero or QuickBooks?

Standalone carbon accounting tools often integrate with financial systems like Xero or QuickBooks through APIs or direct connections. This setup enables smooth data transfer, automatically linking transactions to recognised emissions categories. The result? Less manual work and more precise data handling.

By drawing information straight from financial records, these tools ensure carbon reporting stays in line with established frameworks. This provides a straightforward and dependable method for tracking emissions and supporting sustainability goals.

What should accounting firms consider when deciding between ERP systems and standalone carbon accounting tools?

When choosing between ERP systems and standalone carbon accounting tools, companies should focus on how seamlessly the solution connects with their current financial systems. Two key factors to prioritise are automation and data accuracy, along with ensuring that the tool aligns with established frameworks like the GHGP and ISO 14064.

It's also important to assess the simplicity of reporting, the ability to scale for future requirements, and whether the tool delivers audit-ready outputs. Standalone tools, specifically designed for sustainability accounting, tend to offer features that are more tailored for carbon reporting. On the other hand, ERP systems might need extra configuration to fulfil these specific needs.