IFRS S1 vs S2: Training Focus Areas for Accountants

Dec 12, 2025

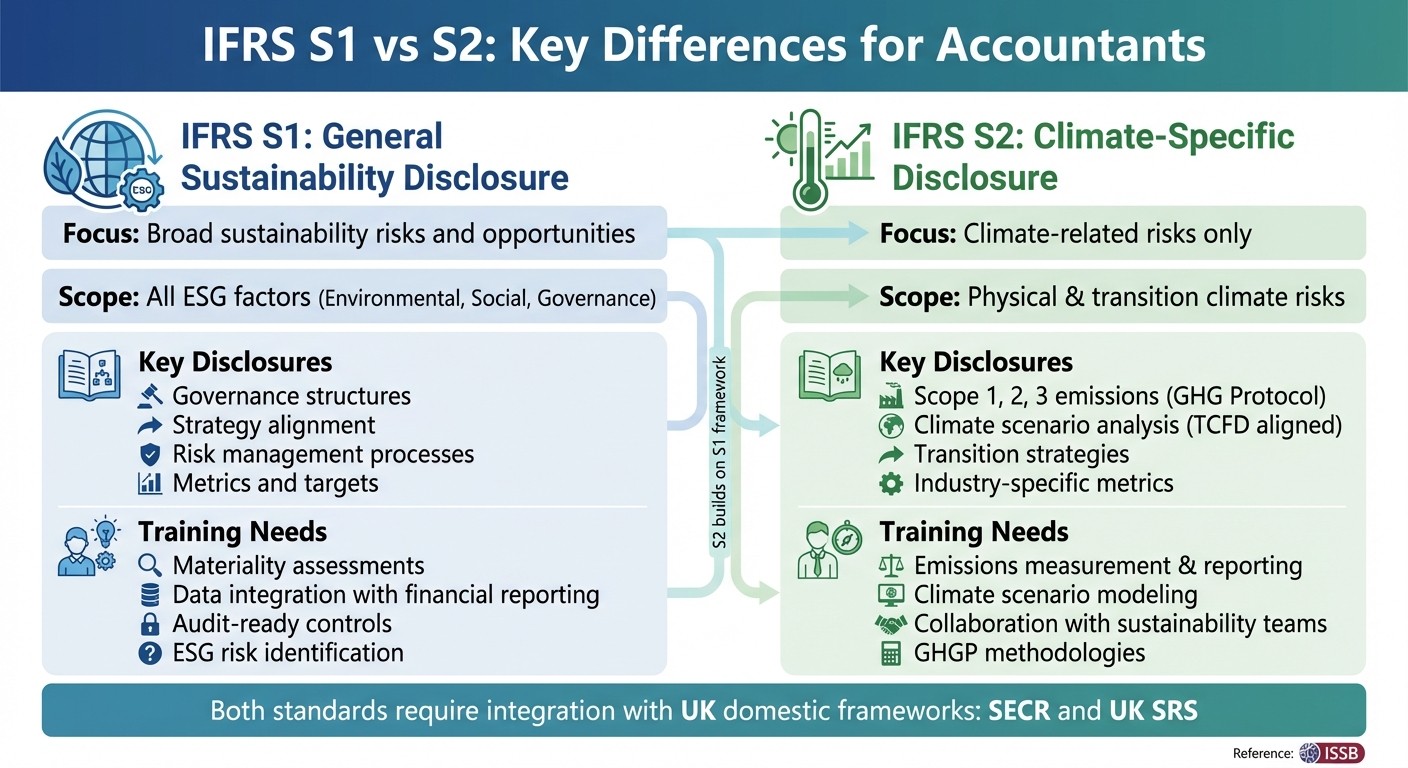

Compare IFRS S1 and S2 and learn training priorities for accountants, from materiality and data integration to emissions reporting and scenario analysis.

IFRS S1 and S2 are the new sustainability reporting standards introduced by the International Sustainability Standards Board (ISSB). Here's what you need to know:

IFRS S1: Focuses on general sustainability disclosures, covering governance, strategy, risk management, and metrics for all sustainability-related risks and opportunities.

IFRS S2: Focuses specifically on climate-related disclosures, requiring data on emissions (Scope 1, 2, and 3), climate risks, and scenario analysis.

Key Differences

Scope: S1 addresses a wide range of sustainability issues, while S2 is climate-specific.

Purpose: S1 sets a broad framework; S2 adds detail for climate-related risks and strategies.

Training Needs: S1 requires skills in materiality assessments and integrating sustainability data into financial reporting. S2 demands expertise in emissions reporting, climate scenario analysis, and collaboration with sustainability teams.

Quick Comparison

Aspect | IFRS S1 | IFRS S2 |

|---|---|---|

Focus | General sustainability risks | Climate-specific risks |

Key Disclosures | Governance, strategy, risk, metrics | Emissions, scenario analysis |

Scope | Broad ESG factors | Climate-related issues only |

Training Needs | Materiality assessments, data integration | Emissions reporting, scenario analysis |

Accountants in the UK must align with both international (IFRS S1/S2) and domestic standards (SECR, UK SRS). Leveraging tools like neoeco can simplify compliance by integrating sustainability and financial data into a single system. Focus your training on mastering these standards to meet evolving regulatory demands.

IFRS S1 vs S2 Standards Comparison for Accountants

IFRS S1 & S2 Sustainability reporting Standards

IFRS S1: General Sustainability Disclosure Requirements

IFRS S1 introduces a structured framework for reporting sustainability risks and opportunities that may influence financial performance. It demands the same level of diligence as traditional financial reporting, ensuring that investors are equipped with reliable, decision-useful information. This standard centres on financial materiality, focusing on sustainability issues that could realistically impact an organisation’s financial position, performance, or cash flows. For accountants in the UK, this means handling sustainability data with the same accuracy and audit-readiness as financial data. Existing UK frameworks like SECR and UK SRS further emphasise the importance of integrating sustainability into financial reporting.

With this foundational purpose in mind, IFRS S1 outlines specific areas for disclosure.

What IFRS S1 Covers

IFRS S1 addresses all significant sustainability risks and opportunities that meet materiality criteria. Its scope spans environmental, social, and governance (ESG) matters, not limiting itself to climate-related issues. The standard is organised around four key disclosure pillars: governance, strategy, risk management, and metrics and targets.

Governance: Focuses on oversight and organisational structures related to sustainability.

Strategy: Explores how sustainability risks and opportunities influence business models and strategies.

Risk Management: Looks at how organisations identify, assess, and manage sustainability-related risks.

Metrics and Targets: Requires quantifiable data and forward-looking commitments to measure progress.

This comprehensive structure ensures that sustainability disclosures align with financial reporting practices, making comparisons between organisations more straightforward for investors.

Training Requirements for IFRS S1

Accountants need to acquire new skills to meet IFRS S1’s requirements effectively. A critical starting point is identifying key sustainability risks - understanding which environmental, social, or governance factors could influence financial results. This involves conducting materiality assessments that extend beyond traditional financial analyses. Training should include reconciling, calculating, and reporting sustainability data, as well as implementing audit-ready controls to ensure data reliability.

Platforms like neoeco can simplify this process by integrating sustainability reporting directly into financial systems, removing the need for separate platforms while maintaining the same level of precision as financial statements. For UK firms, it’s equally important to align with local requirements, such as SECR and UK SRS, to ensure compliance with both international and domestic standards. These training efforts lay the groundwork for tackling the climate-specific demands of IFRS S2.

IFRS S2: Climate-Specific Disclosure Requirements

IFRS S2 zeroes in on climate-related risks and opportunities, building on the broader sustainability framework established by IFRS S1. While IFRS S1 addresses a wide range of sustainability issues, S2 narrows its focus to climate - an area of pressing financial significance for many organisations. It requires businesses to report on physical risks (like extreme weather events and supply chain disruptions) and transition risks (such as policy changes, carbon pricing, technological advancements, and shifting market dynamics). For accountants in the UK, this means integrating climate data into financial impact assessments.

A key feature of IFRS S2 is its requirement for scenario analysis, following the guidelines set by the Task Force on Climate-related Financial Disclosures (TCFD). Companies must evaluate how their operations would fare under different climate scenarios, including a 1.5°C warming scenario and a higher-temperature alternative. This process tests financial resilience, enabling businesses to assess potential impacts like asset impairments, revenue fluctuations, or rising operational costs. This emphasis on climate-specific risks highlights the need for targeted training in these areas.

What IFRS S2 Covers

IFRS S2 adapts its framework to tackle the unique challenges posed by climate change. One of its core requirements is the reporting of Scope 1, 2, and 3 emissions, as outlined by the Greenhouse Gas Protocol (GHGP). These categories cover:

Scope 1: Direct emissions from owned or controlled operations.

Scope 2: Indirect emissions from purchased energy.

Scope 3: Other indirect emissions across the value chain, often the largest and most complex to measure.

Learn more about managing Scope 3 emissions effectively.

Beyond emissions data, IFRS S2 requires organisations to disclose climate-related targets, transition strategies, and metrics tailored to their industry. For instance, energy companies may need to report carbon intensity per unit of production, while property firms might focus on energy efficiency ratings across their assets. The standard also integrates recommendations from the TCFD, ensuring alignment with established climate reporting practices.

Training Requirements for IFRS S2

Meeting the demands of IFRS S2 calls for specialised training, particularly in areas like climate scenario analysis. Accountants must be equipped to model financial impacts under various warming scenarios and translate these findings into clear, actionable disclosures. Collaboration with risk and sustainability teams is essential for this process. Training should also include emissions measurement and reporting, covering how to calculate Scope 1, 2, and 3 emissions using GHGP methodologies and ensuring the use of accurate emissions factors.

To simplify these complex tasks, tools like neoeco offer seamless integration with financial systems such as Xero, Sage, and QuickBooks, enabling precise emissions mapping. These platforms eliminate the need for manual spreadsheets, providing finance-grade accuracy. For UK firms, it’s crucial to align IFRS S2 reporting with domestic regulations like SECR and UK SRS to ensure both global and local compliance.

Key Differences Between IFRS S1 and S2

IFRS S1 and IFRS S2 are both part of the ISSB framework, but they focus on different areas. IFRS S1 addresses a wide range of sustainability risks, while IFRS S2 zeroes in on climate-related disclosures. This distinction affects how organisations approach training: S1 requires identifying various sustainability factors that could impact financial performance, whereas S2 focuses on analysing and reporting on climate-specific challenges.

To ensure reporting compliance, it's essential to align training strategies by combining broad sustainability evaluations with detailed climate-related analysis. By integrating these two areas, organisations can create a more cohesive reporting process that meets the ISSB framework's requirements. This distinction not only shapes training but also informs the implementation strategies discussed in the next section.

Learn how ISSB reporting fits into a financially-integrated strategy

Implementation and Training Strategies for Accountants

To implement IFRS S1 and S2 successfully, accountants need to merge sustainability data with financial reporting. This requires not only a grasp of sustainability concepts but also the ability to use advanced technology effectively. By building on their financial expertise, accountants can streamline this integration, reducing the learning curve and ensuring that financial and sustainability disclosures remain consistent. This alignment is key to adopting new technologies and designing effective training programmes.

Using Technology for Compliance

Modern sustainability accounting tools can simplify compliance by integrating directly with well-known financial systems like Xero, Sage, and QuickBooks. For example, neoeco connects sustainability data with financial records by automatically mapping transactions to recognised emissions categories under frameworks like the Greenhouse Gas Protocol (GHGP) and ISO 14064. This eliminates the need for manual data entry or spreadsheet calculations, producing audit-ready reports with ease. Additionally, neoeco keeps up with changing regulations, offering continuous monitoring and updates to reduce compliance challenges.

With such technology in place, accountants can focus on learning how to use these tools effectively while mastering the requirements of IFRS S1 and S2.

Training Steps for Both Standards

Training for IFRS S1 and S2 should combine financial and sustainability reporting, reflecting the ISSB's unified approach. Accountants can leverage their existing knowledge of financial data and ledger systems, with training programmes tailored to link IFRS S2’s climate-related risks and IFRS S1’s broader sustainability factors to tangible financial outcomes.

Practical, hands-on training is crucial. Accountants should practise using integrated platforms that allow them to manage data reconciliation, calculations, and reporting in one place. Resources like detailed knowledge bases, video tutorials, and dedicated customer support can help accountants adopt these systems more quickly. This equips them to focus on interpreting results, preparing for audits, and advising clients on key sustainability risks.

Conclusion

Mastering IFRS S1 and S2 has become a cornerstone of modern accounting practices. While IFRS S1 provides a comprehensive framework for disclosures, IFRS S2 zeroes in on climate-related risks. Together, these standards empower accountants to gather, analyse, and report the precise data needed to meet today’s regulatory demands.

For firms, investing in training now is more than a compliance exercise - it’s an opportunity to broaden service offerings, secure recurring revenue, and adapt to shifting regulations. Beyond meeting requirements, it’s about equipping teams to deliver the advisory support clients are increasingly seeking.

Technology plays a critical role in this evolution. Platforms like neoeco, designed specifically for accounting firms, integrate seamlessly with financial systems such as Xero, Sage, and QuickBooks. By automating emissions mapping under standards like GHGP and ISO 14064, neoeco eliminates the need for manual spreadsheets. It produces audit-ready outputs that align with frameworks like SECR and UK SRS. One user shared their experience:

"We evaluated multiple ESG tools and felt more confused each time. neoeco cut through the noise - the only platform that connects financials to sustainability with LCA-level accuracy." - neoeco user

FAQs

What are the key differences between IFRS S1 and S2, and what should accountants focus on?

IFRS S1 establishes a broad framework for sustainability reporting, addressing a wide range of environmental, social, and governance (ESG) issues. On the other hand, IFRS S2 focuses specifically on climate-related disclosures, such as greenhouse gas emissions, climate risks, and relevant metrics.

The key difference between the two lies in their scope: IFRS S1 offers a general approach to sustainability, while IFRS S2 zeroes in on climate-related matters. For accountants, this means it's crucial to gain a solid understanding of the overarching principles in S1, while also mastering the detailed climate-specific requirements outlined in S2. This dual knowledge is vital for staying compliant and producing accurate, meaningful reports for clients.

What are the best practices for integrating sustainability data into financial reporting under IFRS S1?

To incorporate sustainability data into financial reporting under IFRS S1, accountants should prioritise automating data collection, aligning sustainability metrics with financial reporting frameworks, and ensuring all records are prepared for audits.

Specialised tools, like sustainability accounting platforms, make this process more straightforward. These platforms can automatically map transactions to recognised emissions categories and produce precise, finance-grade reports. This not only supports compliance with IFRS standards but also integrates smoothly with existing financial systems.

By implementing these methods, accountants can deliver dependable and transparent insights that connect sustainability objectives with financial outcomes.

What training do accountants need to comply with IFRS S2 climate disclosure standards?

Accountants aiming to meet IFRS S2 climate disclosure standards must enhance their expertise in climate-related financial disclosures, carbon accounting, and sustainability reporting. This involves honing skills in data collection and analysis, categorising transactions under recognised emissions frameworks, and creating reports that are ready for audits.

A solid understanding of frameworks like the Greenhouse Gas Protocol (GHGP), ISO 14064, and national regulations such as SECR and the UK SRS is vital. Additionally, accountants should prioritise blending sustainability data with financial reporting to not only stay compliant but also deliver meaningful insights to clients.