Top 5 Materiality Assessment Templates for 2025

Dec 10, 2025

Five top materiality templates that actually balance double materiality, audit readiness and reporting — from Excel tools to ledger-integrated platforms.

Finding the right materiality assessment template can save you time and ensure compliance with 2025's reporting standards like CSRD, ESRS, ISSB, UK SRS, and SECR. These templates help accountants identify key ESG topics, align with double materiality, and produce audit-ready reports. Here's a quick overview of the top options:

Consultport Double Materiality Risk Matrix: A simple Excel-based template for assessing financial and societal impacts. Requires manual customisation.

IFRS SASB Materiality Finder: Focuses on financial materiality but lacks features for impact materiality and stakeholder input.

OpinionX Survey Framework: A survey-based tool, but limited public details on its materiality scoring features.

Good Lab ESG Tool: Combines surveys and workshops for a UK-specific approach, offering clear visual outputs and stakeholder engagement.

neoeco Ledger-Integrated Template: Automatically links financial data to sustainability metrics for audit-ready assessments and double materiality compliance.

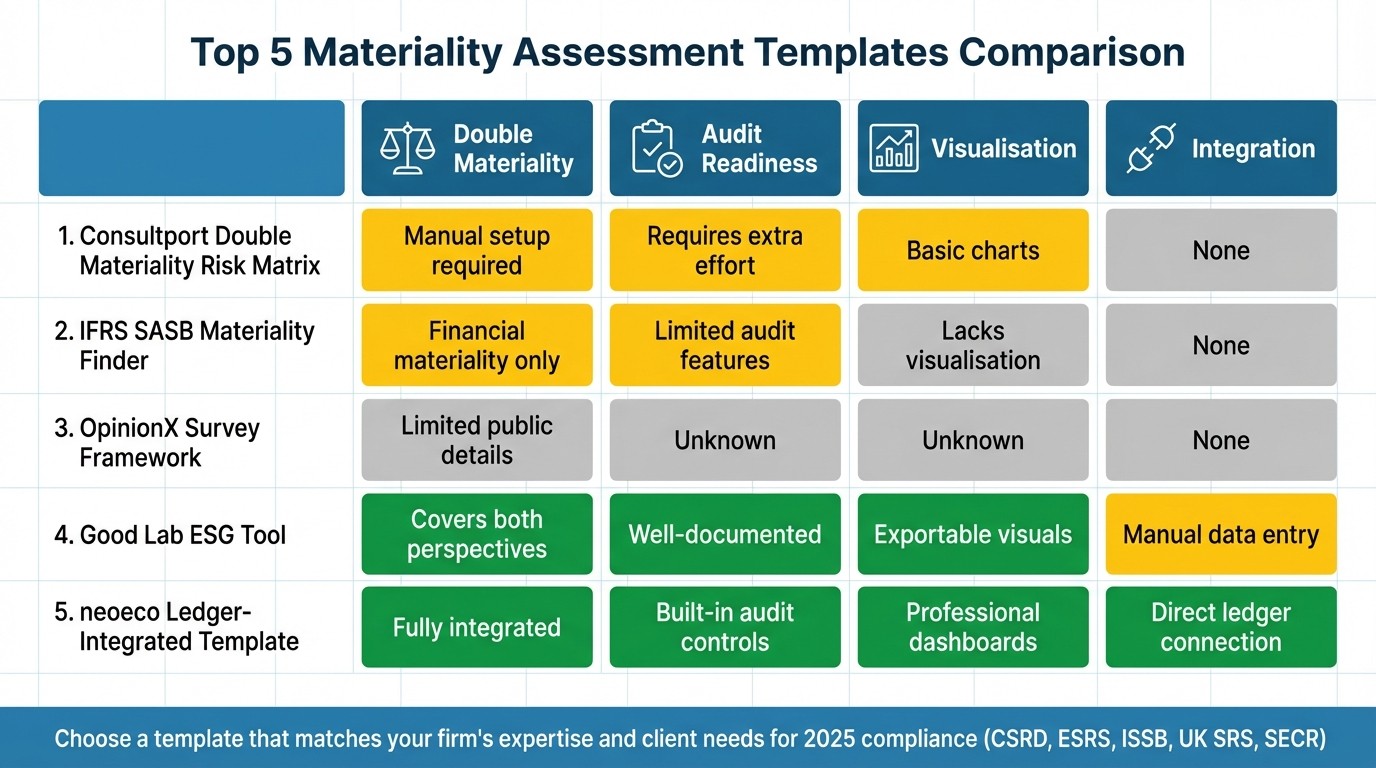

Quick Comparison

Template | Double Materiality | Audit Readiness | Visualisation | Integration |

|---|---|---|---|---|

Consultport | Manual setup required | Requires extra effort | Basic charts | None |

IFRS SASB Finder | Financial materiality only | Limited audit features | Lacks visualisation | None |

OpinionX | Limited public details | Unknown | Unknown | None |

Good Lab ESG Tool | Covers both perspectives | Well-documented | Exportable visuals | Manual data entry |

neoeco Ledger-Integrated | Fully integrated | Built-in audit controls | Professional dashboards | Direct ledger connection |

Choose a template that matches your firm's expertise and client needs. Templates like neoeco, which integrate directly with financial systems, can reduce manual work and improve accuracy.

Materiality Assessment Templates Comparison: Features and Capabilities 2025

8 Steps to Conducting an ESRS Double Materiality Assessment

What To Look For In A Materiality Assessment Template

Picking the right materiality assessment template means focusing on three key factors: double materiality, visual clarity, and audit readiness. These elements are essential for comparing the capabilities of different templates.

Double materiality alignment is crucial because it ensures the template addresses two perspectives: financial materiality (how environmental, social, and governance (ESG) issues impact your client's business) and impact materiality (how your client's operations affect society and the environment). A template that doesn't incorporate both perspectives risks leaving your assessment incomplete.

Audit readiness is another vital factor that separates professional tools from basic alternatives like spreadsheets. Audit-ready templates come with built-in controls, centralised compliance documentation, and easy auditor access, eliminating the need for endless email exchanges. Some templates even link directly to financial ledgers, creating a verifiable data trail. For accountants, understanding how financially-integrated sustainability management boosts audit confidence can help in choosing a tool that meets high professional standards.

Matrix visualisation is all about simplifying complex data into actionable insights. Look for tools that generate polished reports with charts, numerical data, and comments, along with live dashboards that update in real time. Adding your firm's branding - like logos and colours - can also elevate the professionalism of client presentations.

Here’s a breakdown of how different types of templates perform across these key criteria:

Criteria | Excel-Based Templates | Survey Frameworks | Ledger-Integrated Platforms |

|---|---|---|---|

Double Materiality Alignment | Manual setup required | Limited framework support | Built-in CSRD/ESRS compliance |

Matrix Visualisation | Manual chart creation | Basic visualisation tools | Professional dashboards and reports |

Audit Readiness | Requires extensive documentation | Limited audit trail | Full audit controls and evidence hub |

Financial Data Integration | None | None | Direct ledger connection |

1. Consultport Double Materiality Risk Matrix Excel Template

The Consultport Double Materiality Risk Matrix Template helps organisations evaluate ESG issues from two angles: financial impact and broader societal or environmental impact. Designed to align with sustainability reporting standards like the Corporate Sustainability Reporting Directive (CSRD), this template provides a simple framework for accounting professionals to identify and assess key ESG topics.

At its core, the template illustrates the principles of double materiality, which we’ve discussed in detail earlier. However, it relies on manual data entry, requiring users to tailor the input to suit specific sector needs.

While the template offers a foundational structure for assessing materiality, it does demand additional customisation to ensure it meets the requirements for audit preparation.

2. IFRS SASB Materiality Finder

The IFRS SASB Materiality Finder, developed by the IFRS Foundation, is designed to help organisations pinpoint financially material sustainability topics. Based on the SASB framework, it maps environmental, social, and governance (ESG) issues across 77 industries, offering a structured starting point. However, it’s important to consider how its focus aligns with both financial and impact materiality.

Alignment With Financial Materiality

The tool primarily concentrates on financial materiality - how sustainability issues can influence enterprise value. However, it doesn’t address impact materiality, which examines how an organisation affects the environment and society. This narrower focus means it only partially aligns with double materiality frameworks like the CSRD. For accountants working with clients who need a full double materiality assessment, the tool will need to be supplemented with additional analysis to cover the broader scope.

Practical Fit for Accountants

From a practical perspective, the tool offers a useful reference for identifying relevant topics, particularly with its traceability to SASB standards. This helps accountants justify topic selection. However, it lacks certain features that would streamline the process, such as matrix visualisations or audit-ready export options. As a result, users must manually integrate the findings into their documentation. While helpful for research, it falls short as a standalone solution for meeting ISSB reporting requirements or preparing for external assurance.

Stakeholder Input Limitations

Another limitation is the absence of features for gathering stakeholder feedback or scoring materiality. While the tool provides a list of industry-standard topics, it leaves accountants responsible for prioritising and validating these topics through their own stakeholder engagement processes. This adds an extra layer of work for professionals aiming to ensure their assessments are both thorough and aligned with stakeholder expectations.

3. OpinionX Survey Framework for Materiality Scoring

The OpinionX Survey Framework offers a distinct approach compared to traditional templates. However, there isn't any publicly verified information available regarding its application for materiality scoring. To get the most accurate and up-to-date details, accountants are encouraged to reach out to OpinionX directly.

4. Good Lab ESG Materiality Assessment Tool Template

The Good Lab ESG Materiality Assessment Tool provides a UK-specific framework for conducting environmental, social, and governance (ESG) assessments. Designed with first-time users in mind, this tool combines structured survey data with interactive workshop discussions, offering a more dynamic approach than purely quantitative templates.

Alignment with Double Materiality

At its core, the tool uses a two-axis matrix to evaluate ESG topics. One axis measures impact materiality - how a company’s actions affect people, the planet, and society. The other axis assesses financial materiality - the risks and opportunities these topics pose to a company’s value. By integrating clear definitions, prompts, and examples, the tool reduces subjectivity and creates a direct link between material topics and financial disclosures. This structure simplifies the process of connecting ESG issues to financial statement items and risk disclosures, which is critical for audit trails and compliance with ISSB reporting requirements.

Support for Stakeholder Input

The framework is designed to incorporate diverse stakeholder perspectives, including those of investors, employees, customers, management, and NGOs. Through surveys and workshop questionnaires, it gathers input using Likert-scale scoring and weighted contributions from both internal and external stakeholders. The tool also provides guidance on creating stakeholder maps, determining minimum sample sizes, and documenting response rates. This ensures that stakeholder engagement is well-documented, offering solid evidence for audit purposes and assurance engagements.

Matrix Visualisation and Exportable Outputs

One of the standout features is its ability to visually map ESG topics on a double-axis matrix, aligning with common CSRD visualisation standards. High-priority topics - those exceeding set thresholds - are clearly highlighted. The tool’s outputs can be exported in multiple formats, including PNG images, PowerPoint-ready graphics, and Excel data tables. These outputs are particularly useful for accountants, as they can be seamlessly integrated into sustainability reports, management presentations, and audit documentation, ensuring transparency and traceability.

Practical Fit for Accountants

Good Lab’s tool is tailored for accountants, offering a structured, evidence-based approach. It includes fields for documenting assumptions, data sources, stakeholder groups, and scoring justifications for each ESG topic. This level of detail supports audit trails and external assurance. The framework references key concepts from CSRD/ESRS and aligns with UK-specific requirements like TCFD climate disclosures and anticipated UK Sustainability Reporting Standards. This consistency across reporting regimes helps accountants streamline processes.

The tool’s manual data entry and reliance on spreadsheets, however, can be a drawback. While effective, it is more time-consuming and prone to errors compared to integrated platforms like neoeco, which automate processes such as mapping transactions to emissions categories and scaling carbon accounting. For organisations seeking a more technology-driven approach, such solutions may offer a more efficient alternative.

5. neoeco Materiality-Driven Template Built On The Ledger

neoeco simplifies materiality assessments by directly connecting them to clients' financial ledgers - no more manual data entry or juggling spreadsheets. By integrating with platforms like Xero, Sage, and QuickBooks, neoeco automatically links financial transactions to carbon data and sustainability metrics. This approach ensures that materiality assessments are built on solid, verifiable financial data, complete with audit trails.

Alignment with Double Materiality

neoeco tackles double materiality by addressing both financial and environmental dimensions through its seamless financial integration. For financial materiality, it connects sustainability metrics to trusted financial records, helping accountants spot risks and opportunities that could impact business value. On the impact materiality side, the platform calculates environmental impacts - such as carbon footprints - directly tied to financial activities. These calculations use lab-grade precision to measure how operations influence society and the environment.

By mapping transactions to established emissions standards like GHGP, ISO 14064, SECR, and UK SRS, neoeco ensures sustainability topics are assessed with the same rigour as financial statements. This dual approach supports ISSB reporting requirements, allowing accountants to create robust materiality assessments that address both financial and environmental dimensions - all within a single, integrated tool.

Practical Fit for Accountants

neoeco’s design is tailored for accountants, putting a strong focus on audit readiness. It includes controls to monitor task progress and flag missing data, with an integrated checklist to ensure nothing is overlooked. A secure policy and evidence hub stores all compliance files, and auditors can be given direct access to reports and supporting documentation. Thanks to smart matching, ledger entries are automatically linked to the relevant carbon data, removing the need for manual reconciliation and reducing the risk of errors common with spreadsheets.

The platform is SOC 2 and GDPR compliant, operates on a simple monthly subscription model with no long-term contracts, and offers a 30-day free trial with full access to all features. For firms managing Scope 3 emissions across multiple clients, neoeco’s automation streamlines processes, making it a far more efficient option than traditional spreadsheet-based methods.

Conclusion

Navigating today's complex regulatory environment requires precision, and a well-structured materiality assessment template can help ensure your evaluations meet current standards while preparing your firm for future obligations.

But these templates do more than just tick compliance boxes - they transform the way accountants deliver sustainability insights. By leveraging tools built on financial ledgers, firms can eliminate manual reconciliation errors, avoid spreadsheet mishaps, and maintain auditor-ready controls with clear documentation. This evolution towards financially-integrated sustainability management allows materiality assessments to be rooted in reliable financial data, offering both accuracy and efficiency.

What’s more, integrated templates open doors for firms to expand into sustainability services. Templates that sync seamlessly with platforms like Xero, Sage, or QuickBooks reduce setup time and deployment headaches. They also enable the creation of professional, accurate reports, turning sustainability from a compliance task into a lucrative service offering.

The options available range from simple Excel-based frameworks to advanced platforms integrated directly with ledgers. Whether you're tackling your first materiality assessment or scaling sustainability services for multiple clients, the key is to select a tool that aligns with your firm's expertise, meets client expectations, and supports your growth plans. A strong template should provide structure, align with regulations, and deliver actionable insights that drive meaningful results.

FAQs

What is double materiality, and why does it matter for 2025 reporting standards?

Double materiality is a key concept in sustainability reporting that looks at material issues through two lenses: financial materiality and impact materiality. Financial materiality considers how environmental, social, and governance (ESG) factors influence an organisation's financial outcomes. On the other hand, impact materiality evaluates how an organisation's actions affect the environment and society.

As we approach 2025, double materiality becomes even more critical due to updated frameworks like the ISSB and CSRD. These standards require businesses to evaluate and disclose both financial and non-financial effects. This dual perspective promotes greater transparency, giving stakeholders a clearer view of a company's broader responsibilities and the risks it faces in striving for sustainable growth.

What are the benefits of using ledger-integrated templates over Excel for audit readiness?

Ledger-integrated templates bring a game-changing approach to audit readiness by directly tying sustainability data to financial records. This connection ensures precision, uniformity, and alignment with recognised standards, all while automating calculations and documentation tasks.

In contrast to Excel-based templates - which often demand manual updates and are susceptible to errors - these tools simplify the entire process. They offer real-time validation and make generating audit-ready reports a breeze. By minimising the chance of mistakes, they save both time and effort for accounting teams managing intricate sustainability data.

Why is it important for accountants to include stakeholder input in materiality assessments?

Including the perspectives of stakeholders in materiality assessments is essential for capturing the priorities and concerns of those who are impacted by or have an influence on the organisation. This process helps accountants pinpoint the most relevant environmental, social, and governance (ESG) issues that the business should address.

When stakeholders are actively engaged, accountants can produce sustainability reports that are more thorough and trustworthy. These reports go beyond simply ticking compliance boxes - they help foster confidence among clients, investors, and regulators. By integrating financial objectives with sustainability goals, this approach ensures a balanced focus on long-term value for everyone involved.