Scope 3 Data for CSRD: Challenges and Solutions

Dec 21, 2025

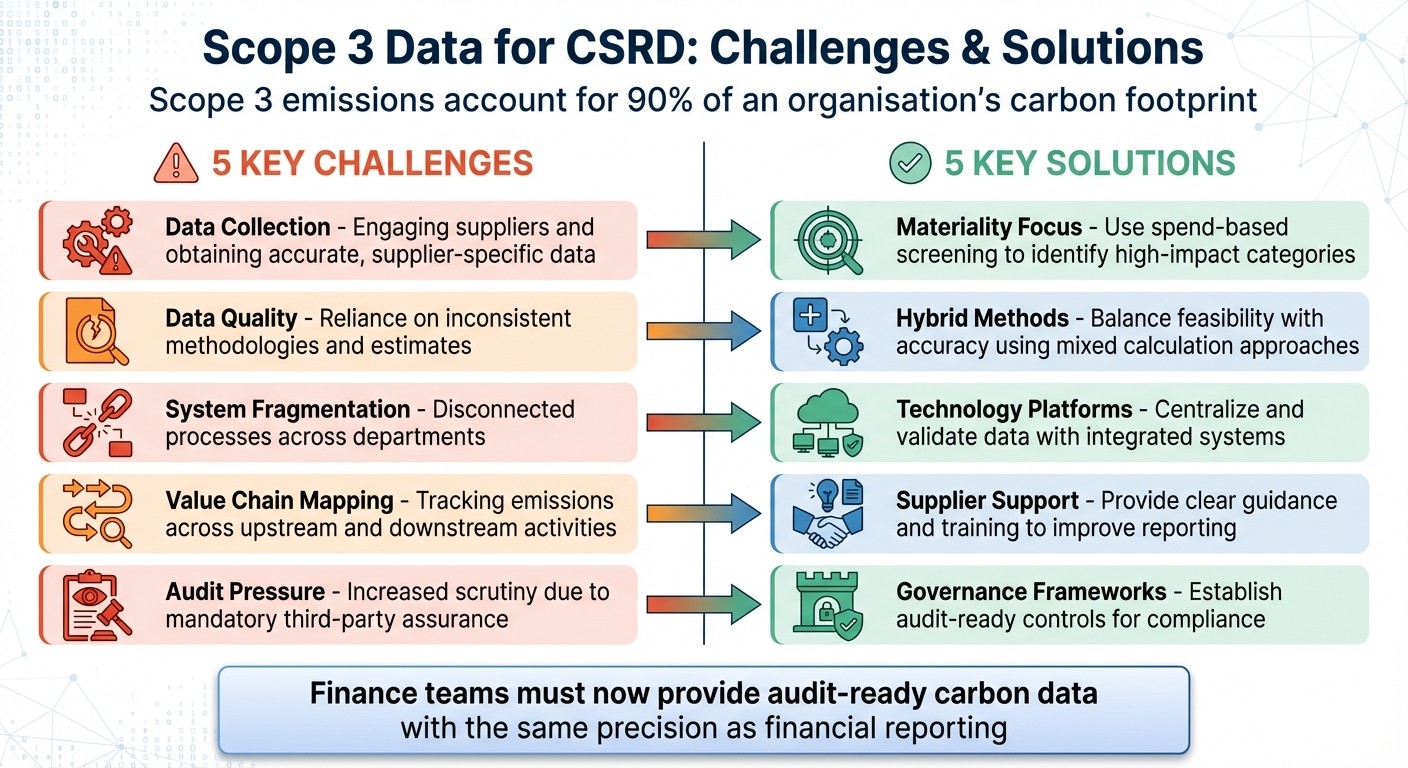

How finance teams can collect, validate and audit Scope 3 emissions for CSRD compliance using materiality, supplier engagement, hybrid methods and integrated tech.

Scope 3 emissions, which often account for 90% of an organisation's carbon footprint, are now a key focus under the Corporate Sustainability Reporting Directive (CSRD). These emissions, spanning an organisation’s entire value chain, are challenging to measure and report due to their indirect nature. Finance teams must now provide audit-ready, detailed data that meets the same precision as financial reporting.

Key challenges include:

Data collection: Engaging suppliers and obtaining accurate, supplier-specific data.

Data quality: Reliance on inconsistent methodologies and estimates.

System fragmentation: Disconnected processes across departments.

Value chain mapping: Tracking emissions across upstream and downstream activities.

Audit pressure: Increased scrutiny due to mandatory third-party assurance.

Solutions involve:

Focusing on material categories using spend-based screening and supplier-specific data.

Using hybrid calculation methods to balance feasibility with accuracy.

Leveraging technology platforms like neoeco to centralise and validate data.

Providing suppliers with clear guidance and support to improve reporting.

Establishing governance frameworks and audit-ready controls to ensure compliance.

Accounting firms are uniquely positioned to guide businesses through this complex transition, combining financial expertise with new tools and processes to meet CSRD requirements.

5 Key Challenges and Solutions for Scope 3 CSRD Compliance

CSRD and Scope 3: Best Practices for Value Chain Reporting

Common Challenges in Collecting Scope 3 Data

Collecting Scope 3 data for CSRD compliance presents unique hurdles for accounting firms, pushing them beyond the boundaries of traditional financial reporting. Unlike financial data, this information exists outside direct control, scattered across suppliers, distributors, and end-users. Gathering emissions data often requires proactive communication with suppliers, adding layers of complexity.

The challenges can be grouped into five key areas: engaging suppliers, inconsistent data quality, disconnected systems, complex value chain mapping, and increased audit demands. These issues are deeply intertwined, creating a challenging landscape for finance teams aiming for precision and compliance.

Data Availability and Supplier Engagement

One of the biggest obstacles is simply obtaining data from suppliers. Many organisations still depend on spend-based estimates derived from Environmentally Extended Input-Output (EEIO) factors. While these estimates offer a starting point, they fail to reflect actual operational changes.

"EEIO estimates are only sensitive to changes in spending; they cannot measure or inform real emissions reduction efforts on the ground beyond reducing spend" - Michael Lengahan, Associate Director at Anthesis

Small and medium-sized enterprises (SMEs) often face the greatest difficulties. They may lack the resources - both financial and human - to handle the extensive data requirements of CSRD compliance. Even when suppliers are willing to collaborate, concerns about confidentiality, reputation, and unclear expectations can slow progress.

"Obtaining Scope 3 emissions data requires cooperation from stakeholders across the value chain, which can be challenging due to a range of factors, including concerns about confidentiality and reputation" - Deloitte

To address this, accounting firms must help suppliers build their capacity. This involves providing clear guidance, training, and sometimes even financial support to enable suppliers to develop robust reporting systems. Without these efforts, organisations remain stuck with low-quality, spend-based estimates that fail to demonstrate meaningful progress toward Net Zero goals.

Data Quality and Consistency Issues

The lack of standardised calculation methods poses another significant challenge. Companies often combine activity-based data, lifecycle analyses, and industry averages, resulting in inconsistent and unreliable inventories across the value chain.

Adding to this complexity, disclosure standards continue to evolve. Ambiguities in current guidelines mean that organisations within the same value chain might use vastly different methodologies. This leads to frequent re-statements of data as quality improves or boundaries shift - a reality that Bob Burgoyne of the Carbon Trust acknowledges:

"Emissions estimates are always that: estimates. Particularly for Scope 3 emissions, where most companies use spend as a proxy for real/actual supplier emissions... for others, it's wildly inaccurate" - Bob Burgoyne, Associate Director, the Carbon Trust

For finance teams accustomed to the precision of financial reporting, the shifting nature of carbon data creates tension. Achieving CSRD compliance while maintaining audit readiness demands a delicate balance between managing estimates and ensuring data integrity.

Fragmentation Across Systems and Processes

Scope 3 data is often scattered across various departments and systems, making it difficult to centralise and analyse. Anthesis refers to this as a "data problem", where organisations lack the actionable insights needed for effective KPI tracking and emissions reductions.

The fragmentation extends to internal processes. Procurement teams handle supplier data, finance teams oversee spending, operations track logistics, and sustainability teams try to coordinate everything. Without integrated systems, data collection becomes a time-consuming and error-prone process.

"Selecting a tool that automatically rolls this up into an interrogatable Scope 3 report is essential and will prevent you from swimming in emails and trying to make sense of various spreadsheet files"

For accounting firms, this lack of integration complicates the creation of audit trails and compliance controls required by CSRD. Transitioning clients from manual processes to streamlined systems is critical but requires significant investment in technology and process redesign - something many organisations are not yet prepared for.

Complexity in Value Chain Mapping

Mapping Scope 3 emissions across the value chain adds another layer of difficulty. Upstream, this involves engaging with a wide range of suppliers; downstream, it requires tracking emissions from product use and disposal - areas outside the direct control of the reporting company.

"Often lies in trying to understand and mitigate against emissions that do not fall directly under the reporting company's control" - Anthesis

Accounting firms must guide clients through double materiality assessments, a requirement under CSRD, to define boundaries that are both comprehensive and defensible. Without a clear map of the value chain, organisations risk either incomplete disclosures or wasted efforts on irrelevant data.

Understanding how emissions flow through these complex networks requires expertise that bridges finance, operations, and sustainability. Many firms are still developing this multidisciplinary capability.

Assurance and Audit Pressure

The challenges of data quality, system fragmentation, and value chain complexity all converge when it comes to audits and assurance.

The shift from voluntary to mandatory reporting brings new third-party assurance requirements. While the initial focus is on "limited" assurance, future cycles are expected to demand "reasonable assurance." This raises the bar for data traceability, transparency, and control robustness.

The global accounting and audit sector, worth around £180 billion, now faces the task of delivering audit-ready carbon data. However, the systems to support this level of scrutiny are often immature. Frequent re-statements, inconsistent methodologies, and data gaps create friction when auditors expect the same level of rigour applied to financial statements.

To meet these demands, accounting firms must implement governance frameworks and audit-ready controls from the start, treating Scope 3 reporting not just as a sustainability exercise but as a core compliance requirement. The next section will delve into practical strategies to tackle these challenges.

Solutions for Scope 3 Data Collection and Management

Accounting firms face a unique challenge when it comes to managing Scope 3 emissions data. To tackle these hurdles effectively, firms need strategies that prioritise data availability, accuracy, and audit readiness - key elements for meeting CSRD compliance requirements.

Materiality-Driven Category Selection

Improving data quality starts with narrowing the focus to the most impactful emission categories. By using Environmentally Extended Input-Output (EEIO) emission factors alongside spend-based data, firms can create a "heat map" of their client's value chain. This method highlights areas with the highest emissions.

The Task Force on Climate-Related Financial Disclosures (TCFD) suggests reporting Scope 3 emissions when they account for 40% or more of an organisation's total greenhouse gas inventory. However, the importance of Scope 3 emissions varies by industry. For instance, in financial services, these emissions can exceed 99% of the total, while in the cement industry, they may only make up 16%. Recognising these sector-specific differences allows firms to set realistic and relevant boundaries for their clients.

Mapping emissions across the value chain also helps identify where clients have the most influence. This process involves distinguishing between upstream emissions (e.g., suppliers, raw materials, transport) and downstream emissions (e.g., product use, disposal). When combined with double materiality assessments, this approach ensures that reporting focuses on categories that hold both financial and environmental importance.

Hybrid Calculation Approaches

The GHG Protocol advocates for a hybrid approach to emissions calculations, balancing precision with practicality. This involves using spend-based estimates for less critical categories while applying activity-based or supplier-specific data for significant ones.

Spend-based methods are a good starting point but only reflect financial changes, not actual emissions reductions. For material categories, firms must guide clients towards primary, supplier-specific data to measure genuine progress against Net Zero goals.

Method | Data Source | Best Use Case |

|---|---|---|

Spend-based | Financial data + industry factors | Initial screening and identifying high-impact areas |

Activity-based | Operational data (litres, kWh) | High-accuracy tracking of direct activities |

Hybrid Method | Combination of spend and activity | Balances accuracy with feasibility, per GHG Protocol |

Supplier-specific | Direct data from vendors | Tracks real reductions and supplier performance |

This phased method ensures reports are audit-ready while gradually improving data quality.

Using Technology for Data Integration and Validation

Fragmented systems often lead to errors and inefficiencies.

"Selecting a tool that automatically rolls this up into an interrogatable Scope 3 report is essential and will prevent you from swimming in emails and trying to make sense of various spreadsheet files".

To overcome these challenges, accounting firms need platforms that automate data collection, validate inputs against recognised standards, and produce audit-ready reports. neoeco is one such solution. It integrates directly with financial systems like Xero, Sage, or QuickBooks, mapping transactions to emissions categories under frameworks like GHGP, ISO 14064, SECR, and the UK SRS. This eliminates manual data conversions and ensures accurate, finance-grade outputs.

The platform provides clear audit controls, showing what’s complete, what’s missing, and what requires review. For firms managing Scope 3 data across multiple clients, this level of automation is crucial for meeting CSRD assurance standards. Additionally, the technology facilitates the shift from secondary (spend-based) data to primary, supplier-specific data, enabling more precise tracking of reduction efforts.

Improving Supplier Engagement

Engaging suppliers is often one of the toughest parts of Scope 3 reporting. Accounting firms can ease this process by offering suppliers clear methodology guidance and standardising data collection across the value chain.

Use electronic surveys or structured forms to ensure data arrives in a consistent, usable format.

For smaller suppliers with limited resources, provide support options like training sessions, co-funded carbon footprinting, or access to pre-approved GHG accounting providers.

Once data is submitted, validate it by comparing it to previous submissions and industry benchmarks. Implementing a "quarantine" step for new data helps catch errors early and maintain accuracy. Automated reminders for missed deadlines ensure that reporting stays on schedule without requiring manual follow-ups.

Operationalising Scope 3 Reporting for Accounting Firms

To move from strategy to execution, accounting firms need to transform their data collection processes into a fully operational, compliant reporting service. This means setting up clear governance, implementing audit-ready controls, and creating standardised workflows to ensure CSRD compliance at scale.

Establishing Governance and Roles

Carbon accounting responsibilities are shifting from sustainability teams to finance and compliance departments. This change makes sense since accountants already have the precision and scepticism needed for mandatory reporting. However, the transition isn’t without its challenges. Carbon data can fluctuate as emission factors and methodologies evolve, which can be unsettling for finance teams accustomed to working with fixed numbers.

Bob Burgoyne, Associate Director at the Carbon Trust, highlights the importance of planning:

"The transition of carbon accounting responsibility from climate teams to finance teams needs careful planning to be successful."

To establish effective governance, roles must be clearly defined across three core areas:

Finance teams focus on data accuracy and manage audits.

Sustainability teams identify reduction opportunities and lead Net Zero strategies.

Procurement teams work with suppliers to gather primary data.

Senior leadership support is crucial to ensure all departments understand their roles in climate compliance. During the first full reporting cycle, sustainability teams should stay closely involved to help finance teams adjust to the variability in carbon data. This phased approach bridges the gap between fluctuating estimates and the consistency finance professionals expect, ensuring compliance from the outset.

Implementing Audit-Ready Controls

Once roles are defined, firms need to embed controls that guarantee data integrity and compliance. CSRD assurance standards require firms to maintain clear evidence trails, showing how they’ve transitioned from spend-based estimates to supplier-specific data while improving data quality over time.

Relying on manual spreadsheets and email chains often leads to errors and complicates audits. Tools like neoeco solve this by integrating directly with financial systems, mapping transactions to emissions categories under frameworks like GHGP, ISO 14064, and UK SRS. This automation removes the need for manual conversions and ensures outputs are accurate and ready for assurance.

To streamline supplier data collection, firms should provide standardised reporting templates and recommend pre-approved GHG accounting providers. This ensures that supplier-submitted data meets audit requirements.

Standardised Workflows and Continuous Improvement

Creating a repeatable workflow is key to managing Scope 3 reporting. Start with spend-based estimates to identify high-impact areas, then transition to supplier-specific data for material categories. This phased approach balances feasibility with accuracy.

Workflow Stage | Objective | Key Action |

|---|---|---|

Initial Assessment | Identify hotspots | Use spend-based (EEIO) data to map the value chain |

Supplier Engagement | Improve data quality | Apply standardised methods discussed earlier |

Data Integration | Ensure audit-readiness | Use digital platforms to aggregate data and apply internal controls |

Continuous Improvement | Drive reductions | Transition from secondary estimates to primary, product-level data |

For smaller suppliers with limited resources, firms can advise clients to co-fund product carbon footprinting to enhance data quality. Additionally, internal carbon pricing can help clients allocate resources effectively toward impactful reduction strategies.

Finance teams should receive regular training on frameworks like CSRD and ESRS, as well as the nuances of carbon accounting. Unlike financial data, carbon baselines often require frequent updates as data quality improves - a concept sustainability teams are familiar with but finance teams may need time to adapt to.

Finally, connect compliance reporting with Net Zero transition planning. This not only ensures regulatory adherence but also highlights the strategic value of the data, positioning your firm as a trusted adviser rather than just a compliance service provider. These operational upgrades not only enhance sustainability reporting but also create lasting value for clients. For further insights, check out our approach to managing Scope 3 emissions in real-time.

Conclusion

Scope 3 emissions account for a staggering 88% to 90% of most organisations' total carbon footprint, making them a critical focus for compliance with the Corporate Sustainability Reporting Directive (CSRD). However, tackling these emissions is far from straightforward. Organisations face hurdles such as fragmented data systems, inconsistent supplier reporting, and the intricate task of mapping value chain categories. Firms that view this as just another compliance task may find themselves struggling, whereas those adopting structured approaches - like materiality assessments, phased data transitions, and audit-ready controls - can position themselves as key advisers in this space.

Technology is the bridge between ambition and action. With neoeco, financial data is seamlessly converted into audit-ready emissions reports that align with recognised standards such as the Greenhouse Gas Protocol (GHGP), ISO 14064, and UK SRS. This eliminates the heavy administrative workload finance teams often face, all while maintaining data accuracy and reliability throughout the process.

But technology alone isn't enough. Swift changes in governance and processes are now essential. The move from voluntary reporting to mandatory CSRD disclosures demands immediate attention. As Bob Burgoyne from the Carbon Trust aptly puts it:

"The transition of carbon accounting responsibility from climate teams to finance teams needs careful planning to be successful."

Organisations that act now - by implementing strong governance frameworks, standardised workflows, and digital tools - will be better equipped to deliver CSRD-compliant reports. On the other hand, delays could lead to regulatory penalties and reputational risks.

To sum it up, Michael Lengahan, Associate Director at Anthesis, offers an important reminder:

"You can't manage what you can't measure."

FAQs

What are the key challenges in gathering Scope 3 emissions data for CSRD compliance?

Collecting Scope 3 emissions data for CSRD compliance comes with its fair share of challenges. To start with, gathering reliable data can be tricky because Scope 3 emissions occur outside a company’s direct operations. This often means relying on suppliers for information, who may either be uncooperative or simply lack the necessary data. As a workaround, many organisations turn to secondary data or industry averages. While these are easier to obtain, they tend to be less precise and can complicate the auditing process.

Another layer of complexity lies in the sheer scope of Scope 3 reporting. It covers up to 15 categories, spanning both upstream and downstream activities, each with its own data requirements and emission factors. This makes the task of mapping, compiling, and verifying data a time-consuming and resource-heavy endeavour. On top of that, incomplete or low-quality data can compromise the creation of audit-ready, finance-grade reports.

Then there’s the challenge of integrating Scope 3 data into existing financial systems. Many finance teams aren’t equipped to handle carbon data effectively, and ensuring compliance with frameworks like the GHGP, ISO 14064, and national standards calls for robust, automated tools. Solutions such as neoeco, which combine sustainability reporting with financial data, can simplify these processes and help organisations meet compliance requirements with greater ease.

How can platforms like neoeco enhance the accuracy and reliability of Scope 3 emissions data?

Platforms like neoeco bring a new level of precision and dependability to Scope 3 emissions reporting by integrating emissions data directly with a company’s financial ledger. This approach eliminates the hassle of juggling manual spreadsheets, consolidating everything into one easily traceable source. By automating the process of matching transactions to established emissions categories, neoeco enables detailed, activity-specific calculations while minimising errors and reducing the reliance on rough estimates.

What’s more, neoeco includes built-in audit trails that track every change, ensuring data aligns seamlessly with CSRD and ISSB standards. This means businesses get audit-ready documentation without the need for laborious manual reconciliation. By embedding sustainability metrics directly into financial records, accounting firms can confidently deliver accurate, compliant, and polished Scope 3 emissions reports.

Why is it important to engage suppliers for accurate Scope 3 emissions reporting?

Engaging suppliers is a critical step in achieving accurate Scope 3 emissions reporting. This is because the majority of a company’s carbon footprint originates from its value chain - areas that the company doesn’t directly manage. Without supplier collaboration, businesses often resort to using generic industry averages, which can compromise accuracy and obscure the main opportunities for reducing emissions.

By collaborating with suppliers, companies can gather primary data - detailed, traceable information tied directly to specific activities - rather than relying on less reliable secondary estimates. This not only boosts the credibility of emissions disclosures but also ensures alignment with frameworks like CSRD. Additionally, it helps pinpoint the most effective ways to lower emissions. Beyond data collection, engaging suppliers can inspire them to adopt their own sustainability initiatives, creating a chain reaction of carbon reductions throughout the supply network.

For accounting firms, tools like neoeco make supplier collaboration much easier. These platforms automatically link client transactions to recognised emissions categories, doing away with the need for manual spreadsheets. This streamlines data collection, ensures audit-ready Scope 3 reports, and supports both firms and their clients in meeting compliance requirements while contributing to meaningful climate efforts.