ESG ROI: Metrics Accountants Should Track

Dec 15, 2025

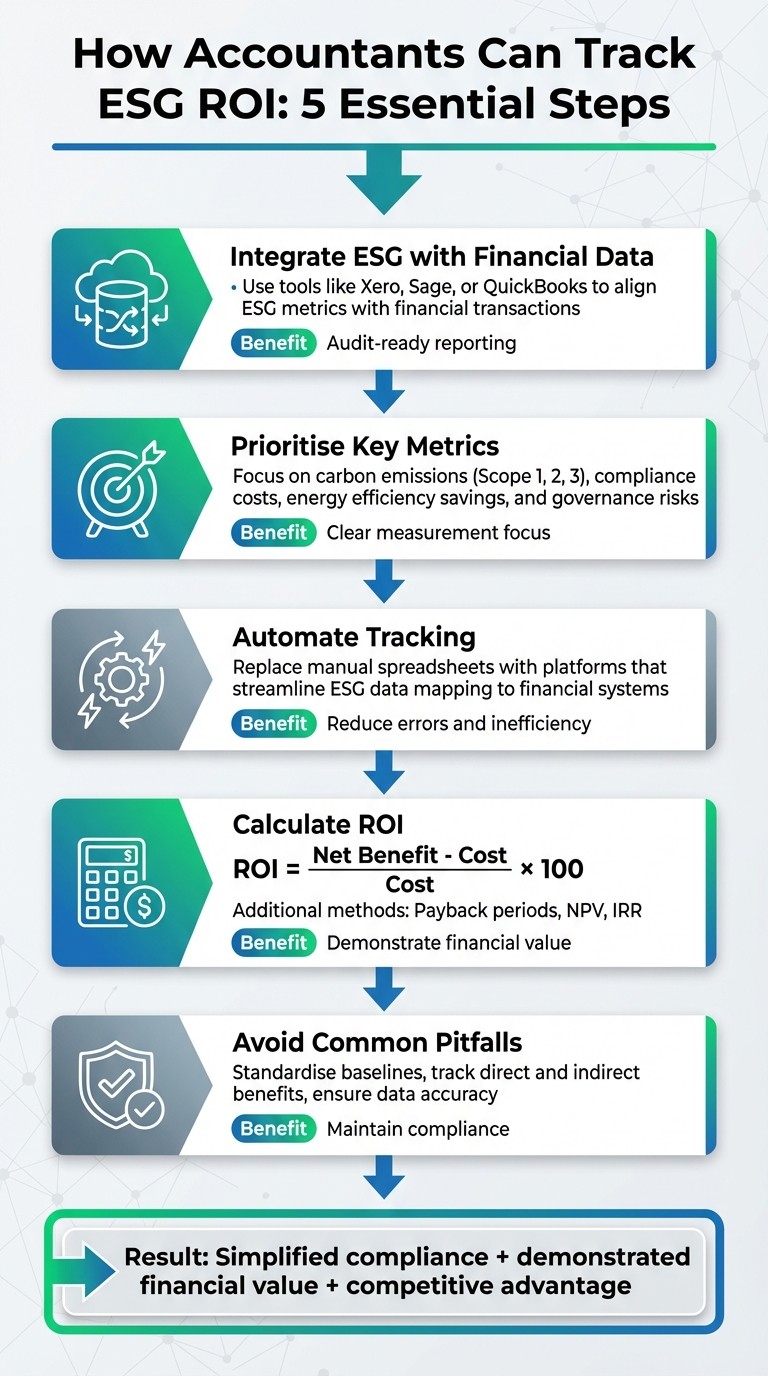

Guide for accountants to measure ESG ROI: integrate ESG with financial systems, track Scope 1–3 emissions, automate reporting and calculate simple ROI.

Accountants are now expected to measure the financial impact of ESG (Environmental, Social, and Governance) initiatives as these have moved from optional to mandatory under frameworks like SECR, UK SRS, and ISSB standards. ESG metrics directly influence financial performance by increasing revenue, cutting costs, managing risks, and improving access to capital. Here's how accountants can track ESG ROI effectively:

Integrate ESG with Financial Data: Use tools like Xero, Sage, or QuickBooks to align ESG metrics with financial transactions for audit-ready reporting.

Prioritise Key Metrics: Focus on carbon emissions (Scope 1, 2, and 3), compliance costs, energy efficiency savings, and governance-related risks.

Automate Tracking: Manual spreadsheets are error-prone and inefficient. Platforms like neoeco streamline compliance by automating ESG data mapping to financial systems.

Calculate ROI: Use a simple formula: ROI = (Net Benefit - Cost) / Cost × 100. Tailor methods like payback periods, NPV, or IRR for specific ESG projects.

Avoid Common Pitfalls: Standardise baselines, track both direct and indirect benefits, and ensure data accuracy to avoid compliance issues.

Switching to financially-integrated sustainability systems not only simplifies compliance but also helps demonstrate the financial value of ESG efforts. Firms that adopt these practices can offer new services, strengthen client relationships, and stay ahead in a rapidly evolving market.

5-Step Framework for Tracking ESG ROI in Accounting

Connecting ESG to Financial Performance

ESG Value Pathways

Environmental, Social, and Governance (ESG) initiatives can directly influence financial performance through four main avenues: cost reduction, revenue growth, risk mitigation, and better access to capital. These pathways show how sustainability efforts translate into measurable financial outcomes.

For instance, tracking carbon emissions alongside financial transactions can reveal inefficiencies that not only harm the environment but also inflate operational costs. Revenue growth often comes from appealing to eco-conscious customers and entering markets that require strong ESG credentials. Meanwhile, reducing risks - like avoiding fines, supply chain disruptions, or reputational damage - adds another layer of value. Strong ESG performance can also attract sustainability-focused investors, leading to improved lending terms and reduced capital costs.

To make these connections clear, accountants must integrate ESG data with financial systems such as Xero, Sage, or QuickBooks. This approach avoids creating separate reporting processes, ensuring that sustainability metrics directly influence financial decision-making.

ESG Frameworks for Accountants

Once the value pathways are established, standardised frameworks help accountants integrate ESG metrics into financial reporting. These frameworks ensure that sustainability data aligns with the rigour required for financial statements.

The Greenhouse Gas Protocol (GHGP) is a key tool, breaking down emissions into three categories: Scope 1 (direct emissions), Scope 2 (emissions from purchased energy), and Scope 3 (value chain emissions). For international standards, ISO 14064 provides guidelines for quantifying and reporting greenhouse gas emissions. In the UK, compliance frameworks like SECR (Streamlined Energy and Carbon Reporting) and the UK Sustainability Reporting Standard (UK SRS) set specific requirements for organisations.

These frameworks don’t just sit alongside financial reporting - they integrate into it. This ensures that sustainability data is as reliable and audit-ready as any financial statement, bridging the traditional gap between ESG reporting and financial performance tracking.

Financially-Integrated Sustainability Management

Taking this integration a step further, Financially-Integrated Sustainability Management (FiSM) embeds ESG considerations into core accounting practices. Instead of treating sustainability as a separate task, FiSM uses existing financial data to monitor environmental, social, and governance impacts. Every invoice, payment, and transaction contains critical insights into resource use, supply chain dynamics, and operational activities - all of which are essential for ESG metrics.

This method has two major benefits. First, it removes the need for manual data collection and spreadsheet-based calculations, streamlining the process. Second, it ensures ESG metrics are maintained with the same accuracy and audit standards as financial data. For example, carbon emission data can be extracted directly from financial transactions, making it easier to reconcile and produce audit-ready reports. By embedding ESG into regular accounting workflows, FiSM transforms sustainability from a compliance task into a core element of financial management.

Key ESG ROI Metrics Accountants Should Track

Environmental Metrics

When it comes to environmental metrics, carbon emissions stand out as a priority for accountants assessing ESG ROI. Monitoring a client’s carbon footprint - across Scope 1, Scope 2, and Scope 3 emissions - provides a direct link between environmental performance and factors like operational costs, compliance requirements, and long-term financial health. By aligning carbon data with financial transactions in existing ledgers, accountants can identify inefficiencies that drive up operational expenses.

Precise carbon accounting is also crucial for meeting standards like GHGP, SECR, and UK SRS. Staying compliant with these frameworks not only helps businesses avoid fines and legal challenges but also supports the development of carbon reduction strategies that can streamline operations and cut costs.

Governance and Risk Metrics

While environmental metrics address tangible cost drivers, governance metrics uncover less obvious financial risks.

Tracking governance and risk metrics helps quantify the financial fallout of compliance failures, data breaches, and supply chain issues. For example, monitoring compliance-related incidents and their associated costs gives accountants a clearer understanding of governance quality. Data breaches, in particular, can lead to severe GDPR fines, harm a company’s reputation, and diminish customer trust - ultimately impacting share value.

Supply chain vulnerabilities, such as supplier failures or ethical violations, further expose businesses to financial risks through operational disruptions and potential liabilities. By integrating sustainability data with financial records, accountants can track expenses tied to audits, compliance efforts, and risk management. This approach not only reduces the time and costs associated with compliance but also helps minimise financial penalties.

Together, these metrics provide a comprehensive view of how ESG factors influence financial outcomes.

How to Calculate ESG ROI Using Accounting Data

Building an ESG ROI Model

To calculate ESG ROI, use this formula: ROI = (Net Benefit from ESG Investment - Cost of ESG Investment) / Cost of ESG Investment × 100. This gives a percentage return that's straightforward for clients and boards to interpret.

Different types of projects require tailored evaluation methods. For example, energy efficiency upgrades are often assessed using payback periods. If a £50,000 investment saves £10,000 annually, the payback period is five years. For projects with longer timelines, Net Present Value (NPV) analysis is more suitable. Internal Rate of Return (IRR) is another helpful tool, allowing you to compare ESG initiatives with other investments by determining whether they meet the required hurdle rate for returns.

The real challenge is gathering dependable data and isolating the specific impacts of ESG initiatives. This is where financially-integrated sustainability management becomes essential. Once a clear framework is in place, having precise financial data ensures accurate ESG calculations.

Using Financial Data for ESG Metrics

Your general ledger is a treasure trove of reliable, reconciled data. Every transaction is already recorded and categorised, making it an ideal starting point for building accurate ESG metrics. This eliminates the need for separate data systems that can quickly fall out of sync.

Platforms like neoeco simplify this process by integrating with tools such as Xero, Sage, and QuickBooks. They automatically map transactions to emissions categories under frameworks like GHGP, SECR, and UK SRS. This automation avoids the hassle of manual conversions by using smart matching to link transactions directly to carbon data.

"We evaluated multiple ESG tools and felt more confused each time. neoeco cut through the noise - the only platform that connects financials to sustainability with LCA-level accuracy."

With built-in audit-ready controls and a centralised hub for policies and evidence, neoeco enables you to produce SECR-compliant reports in minutes instead of weeks. Auditors can directly access reports and supporting documentation, streamlining what is often a time-consuming process. After setting up your system, focus on establishing robust baselines and effective attribution methods to pinpoint ESG impacts.

Setting Baselines and Attribution

When establishing baselines to measure ESG impact, choose a year that reflects normal operations, steering clear of periods marked by significant disruptions. While many UK frameworks suggest using 2019 or 2020 as standard baselines, the specifics of your client's business should ultimately guide your decision.

Attribution involves separating the effects of ESG investments from other factors. For instance, imagine emissions drop by 15% after installing LED lighting, but production also decreases by 10%. By calculating emissions intensity (emissions per unit produced), you can determine the true impact of the investment. Tracking financial data at the transaction level ensures that ESG-driven changes are accurately isolated from broader operational shifts.

Be mindful of double counting, particularly with Scope 3 emissions. For example, when tracking emissions from purchased goods and business travel, make sure supplier emissions are recorded in a single, recognised category. This keeps your baseline comparisons accurate and avoids inflating results.

Best Practices and Tools for ESG ROI Tracking

Common Pitfalls to Avoid

One frequent misstep for accounting firms is relying on inconsistent baselines. When firms use varying baselines or methods, it disrupts the consistency of ROI calculations. To avoid this, it’s crucial to standardise your approach and clearly document any adjustments. Another oversight is ignoring indirect benefits. While it’s easier to quantify direct savings - like reduced energy costs - softer advantages, such as improved staff retention or enhanced brand reputation, often get overlooked. By tracking both qualitative and quantitative metrics, you gain a more comprehensive understanding of ESG performance.

Manual processes also pose significant challenges. Spreadsheets, for example, can quickly become outdated, formulas might break, and version control can fail. Keeping ESG data separate from financial records not only doubles the workload but also increases the likelihood of errors - potentially eroding client trust. These common pitfalls underscore the importance of adopting fully integrated, automated ESG tracking systems.

Tools and Platforms for ESG Reporting

Platforms like neoeco help overcome these challenges by integrating directly with clients’ financial systems, including Xero, Sage, and QuickBooks. Using smart matching technology, transactions are automatically mapped to emissions categories under frameworks such as GHGP, SECR, and UK SRS. This eliminates the need for manual conversions and separate tracking, ensuring compliance with regulatory standards.

The platform also provides audit-ready controls, featuring live checklists that show what’s complete, what’s missing, and what needs attention. All compliance files and supporting evidence are securely stored in one place, making them easily accessible for audits. Additionally, real-time dashboards offer instant insights into emissions trends and intensity, simplifying periodic reviews.

For firms working with SMEs or larger private companies, neoeco’s branded reporting feature allows you to create professional, customised reports with your firm’s logo and colours. These reports can be generated quickly, freeing up time for more strategic advisory work. Plus, the platform automatically keeps up with changes in UK regulations, so you don’t have to worry about updating templates manually.

Adding ESG Metrics to Client Services

Once robust ESG tracking systems are in place, firms can leverage these metrics to deliver greater value to clients. Offering ESG ROI tracking as a service isn’t just about meeting compliance requirements - it’s about providing strategic insights that help clients make smarter investment decisions. When clients can clearly see the financial and environmental benefits of their ESG efforts, the conversation shifts from meeting obligations to creating tangible value.

This service can also strengthen client relationships. Many SMEs struggle with the resources to tackle sustainability challenges on their own, and by addressing this need, you position your firm as an essential partner. It’s a way to stand out from competitors who treat sustainability as an afterthought. Start by offering ESG ROI tracking to clients already involved in carbon reporting, build case studies that highlight demonstrated ROI, and expand the service across your portfolio. For firms looking to fully integrate sustainability into their advisory model, financially-integrated sustainability management offers a unified approach to tracking both financial and environmental performance.

The ROI of Sustainability ft. Tensie Whelan, NYU Stern Center for Sustainable Business

Conclusion

Tracking ESG ROI isn't just about ticking compliance boxes; it's about delivering measurable value that aligns with your firm's strategic goals. By linking sustainability metrics to financial outcomes, you can cut costs, manage risks, and strengthen stakeholder trust. Moving from outdated spreadsheets to financially-integrated systems not only simplifies processes but also ensures your ESG data is audit-ready.

For accounting firms, the opportunity is undeniable. Sustainability is emerging as a key growth area, yet many firms are held back by fragmented tools that fail to integrate smoothly with existing workflows. Adopting integrated systems allows your firm to meet the rising demand for sustainability-focused services head-on.

If you're ready to step into this space, the roadmap is clear: begin with clients already involved in carbon reporting, create case studies that highlight tangible ROI, and gradually scale these efforts across your client base. By using tools that bridge finance and sustainability - such as those aligned with financially-integrated sustainability management - you'll not only secure your clients' futures but also your firm's.

The real question isn't whether ESG will become a necessity - it’s whether your firm will take the lead or play catch-up.

FAQs

What is the best way for accountants to integrate ESG metrics with financial data?

Accountants can seamlessly combine ESG metrics with financial data by using tools designed to automate data collection and directly connect sustainability metrics to financial records. This approach not only enhances consistency and transparency but also ensures compliance while cutting down on manual tasks.

Take, for instance, specialised software like neoeco. It links financial transactions to recognised emissions categories using frameworks such as GHGP and ISO 14064. The result? Precise, audit-ready reports that make it easier for accountants to align ESG metrics with financial performance. These tools empower firms to deliver high-quality sustainability reports and models, keeping their clients compliant and prepared for the future.

What environmental metrics should accountants track to measure ESG ROI?

To gauge the return on investment (ROI) for ESG initiatives, accountants should pay close attention to critical environmental indicators. These include the total carbon footprint (CO₂e emissions), emissions linked to purchased goods and services, and operational emissions stemming from energy consumption in buildings and transportation. It's also important to track the use of carbon offsets, which can offer valuable insight into sustainability efforts.

By keeping a close eye on these metrics, businesses can accurately assess their environmental impact. This not only supports the alignment of financial objectives with sustainability goals but also ensures the organisation can provide clear and compliant ESG reports.

Why should accountants automate ESG tracking?

Automating ESG tracking plays a key role for accountants by ensuring precise and efficient data collection, all while cutting down on the time-consuming manual tasks. It enables the preparation of audit-ready reports that are fully aligned with compliance requirements and financial records.

With automation in place, accountants can reliably meet regulatory expectations, make more informed decisions, and provide clients with actionable sustainability insights. This shift doesn’t just streamline operations - it also helps firms stand out as forward-thinking leaders in sustainable financial practices.