Top Tools for Stakeholder Data Segmentation

Dec 13, 2025

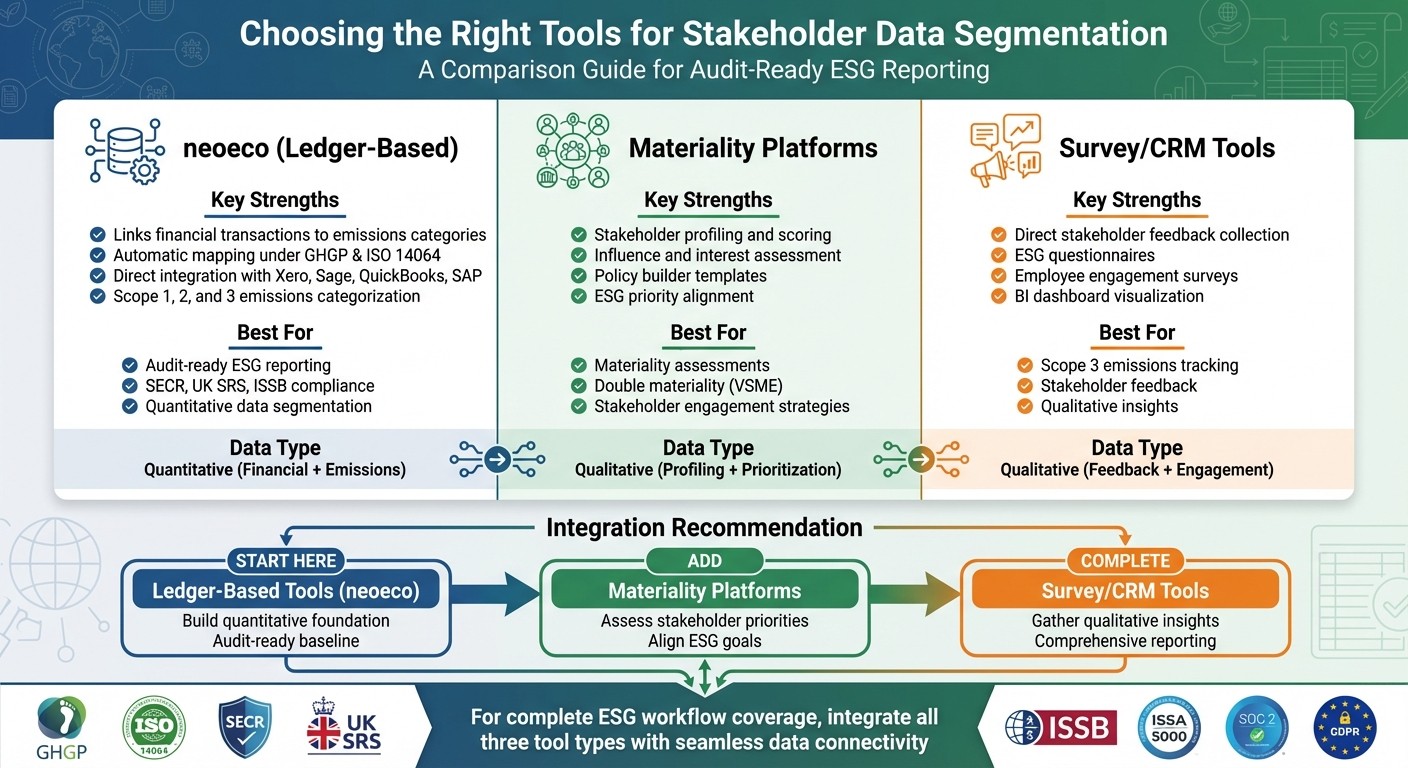

Compare ledger-based, materiality and survey tools to segment stakeholders by emissions, link with accounting systems and maintain audit‑ready ESG evidence.

Stakeholder data segmentation connects groups like investors, suppliers, and customers to emissions and financial data, ensuring audit-ready ESG reporting. It’s a key process for accounting firms to meet frameworks like GHGP, SECR, and ISSB while simplifying materiality assessments and compliance.

Key Takeaways:

Challenges: Fragmented data, evolving frameworks, and lack of in-house expertise make segmentation complex.

Critical Features: Tools should allow tagging stakeholders by emissions impact, integrate with accounting systems (e.g., Xero, Sage), and offer audit-ready evidence management.

Top Tools:

neoeco: Links financial transactions to emissions data for precise, audit-ready segmentation.

Materiality Platforms: Focus on profiling stakeholders and aligning ESG priorities.

Survey/CRM Tools: Add qualitative insights, like feedback from suppliers or employees.

Quick Comparison:

Tool | Strengths | Use Case |

|---|---|---|

neoeco | Links financial data to emissions categories | Audit-ready ESG reporting and compliance |

Materiality Tools | Stakeholder profiling and engagement | Materiality assessments |

Survey/CRM Tools | Collect qualitative insights | Stakeholder feedback and Scope 3 tracking |

Next Steps: Start with ledger-based tools like neoeco for quantitative segmentation, then add materiality and survey tools for a complete ESG reporting workflow.

Stakeholder Data Segmentation Tools Comparison for ESG Reporting

What to Look for in Stakeholder Data Segmentation Tools

Segmentation and Categorisation Features

A good tool should allow you to tag, categorise, and score stakeholders based on their influence, interest, and impact on sustainability goals. For example, you might need to identify high-carbon suppliers or service providers linked to Scope 1, 2, and 3 emissions. Without these functions, you’re left with generic lists that don’t provide the depth needed for effective materiality assessments or targeted decarbonisation strategies.

It’s worth choosing a platform that supports flexible categorisation aligned with frameworks like GHGP and ISO 14064. If it links stakeholder segments directly to financial transactions, it adds a layer of credibility by anchoring categorisation in verifiable ledger data.

Integration with Accounting and ESG Systems

Once you’ve segmented your stakeholders, seamless integration with accounting systems is a must. Tools that work directly with platforms like Xero, Sage, QuickBooks, Microsoft Business Central, and SAP eliminate the need for manual data transfers. This not only reduces the risk of errors but also ensures consistency across your financial and sustainability reporting.

When tools automatically link financial transactions to sustainability metrics - such as carbon emissions - you achieve both efficiency and accuracy. This setup allows you to build on your existing workflows to meet ISSB reporting requirements and other sustainability standards without starting from scratch.

Audit-Ready Features and Evidence Management

Being audit-ready means having strong controls and a reliable way to manage evidence. The right tool should offer clear progress indicators for compliance and an integrated hub to store key files, such as policies, evidence, and supporting documents. This ensures you’re always prepared for audits or assurance engagements under standards like ISO 14064 or ISSA 5000.

Features like version control, exportable data, and instant sharing options can make it easier to provide auditors with access to reports and evidence directly within the platform. Security is equally important - ensure the tool complies with SOC 2 and GDPR to protect sensitive stakeholder and financial data.

Top Tools for Stakeholder Data Segmentation

neoeco: Ledger-Based Stakeholder Segmentation

neoeco takes a unique approach by using your clients' financial ledgers to build detailed stakeholder segmentation. It connects directly with platforms like Xero, Sage, and QuickBooks, automatically mapping transactions to recognised emissions categories under GHGP and ISO 14064. This means every supplier payment, energy bill, or service contract becomes a valuable data point for segmentation and analysis.

What sets neoeco apart is its ability to link financial flows to specific stakeholders - such as high-carbon suppliers or operations - and categorise them according to Scope 1, 2, and 3 emissions. The result? Audit-ready segmentation that aligns with sustainability reporting requirements.

The platform integrates seamlessly into existing workflows, allowing firms to extend their usual transaction reconciliation processes to support sustainability goals. It supports compliance with frameworks like SECR, UK SRS, and ISSB reporting. Additional features include a policy and evidence hub for storing compliance files, tools for tracking progress on tasks, and secure auditor access, all designed to meet ISO 14064 and ISSA 5000 standards. Unlike materiality tools that focus on qualitative profiling, neoeco’s ledger-based approach delivers precise, data-driven insights.

Materiality Assessment and Stakeholder Engagement Platforms

Materiality platforms focus on profiling stakeholders, aligning ESG priorities with sustainability goals, and guiding engagement strategies. These tools often let you score stakeholders based on their influence and interest, helping you prioritise efforts - especially useful for UK accounting firms conducting double materiality assessments or aligning with standards like VSME.

A key feature to look for in these platforms is policy builders and standardised templates. Jennifer Kaplan, a Sustainability Manager, shared her experience:

"I found the Policy Builder extremely useful at our stage because having a template of a well-conceived policy helps in the standardisation of new practices and ensure that written guidelines are best-in-class".

While these platforms are invaluable for qualitative assessments, they work best when paired with ledger-based systems like neoeco. The combination ensures that materiality conclusions are backed by robust financial and emissions data.

Survey, CRM, and BI Tools for ESG Stakeholder Segmentation

Survey and CRM tools add a qualitative layer to stakeholder segmentation, complementing the quantitative insights provided by ledger data and materiality platforms. Surveys allow you to gather direct feedback from stakeholders, such as supplier ESG questionnaires or employee engagement surveys. Meanwhile, stakeholder-focused CRMs help manage and organise this data effectively. BI dashboards can then visualise segmentation and track response trends.

For the best results, these tools should be integrated with your accounting and sustainability systems. While standalone survey data is helpful, combining it with financial transactions and emissions data offers a more complete picture of stakeholder activities. This integrated approach is particularly important for firms managing Scope 3 emissions, as it connects stakeholder feedback with their actual impact on carbon footprints and compliance goals. By blending qualitative and quantitative data, you can create credible, audit-ready reports that reflect a comprehensive understanding of stakeholder behaviour.

How to Implement Stakeholder Segmentation in Your Firm

Building a Ledger-Based Stakeholder Database

Start by leveraging your firm's existing financial data. Use sustainability accounting software to directly connect with widely used systems like Xero, Sage, QuickBooks, Microsoft Business Central, or SAP. This integration allows the platform to automatically retrieve transaction data, turning every supplier payment, energy bill, and service contract into a segmentation data point. These are categorised by emissions impact, following standards like the GHGP and ISO 14064.

For example, neoeco operates on this principle by linking transactions to recognised carbon categories. It systematically creates stakeholder segments based on Scope 1, 2, and 3 emissions. The software also cleans and organises data during the process, eliminating the need for manual spreadsheets and ensuring the information is audit-ready. All of this data is consolidated into a single platform, offering a unified and streamlined view.

If your firm is managing ISSB reporting or complying with UK SRS requirements, this ledger-based approach ensures that segmentation aligns with established frameworks from the outset. The system simplifies tracking with checklists to show what’s complete, what’s missing, and what needs review. Additionally, a secure policy and evidence hub stores compliance files, making them easily accessible for audits.

This ledger-driven foundation is an essential first step before incorporating qualitative and workflow tools into your processes.

Combining Multiple Tools for Complete Workflow Coverage

While a ledger system provides a solid base for quantitative data, adding qualitative tools completes the picture. Pair your financial data platform with materiality assessment software to evaluate stakeholder influence and interest. Then, include survey and CRM tools to gather direct feedback. The key is ensuring these systems are interconnected - disconnected data can leave gaps that may raise concerns during audits.

For more in-depth analysis, consider integrating specialised tools into your core sustainability system. This setup allows you to progress from basic transaction-level segmentation to detailed impact modelling for specific parts of your supply chain. Look for platforms that include comprehensive audit features, such as control mechanisms, evidence management, and direct access for auditors. These features help maintain compliance across all integrated data streams.

Together, these steps enhance the segmentation process, linking financial data directly to ESG reporting standards.

Governance and Assurance Best Practices

Clearly document your segmentation methods and store them in a centralised location alongside all compliance evidence. Regularly perform data quality checks and assign clear responsibilities for managing stakeholder data workflows within your firm. Policy builder templates can help standardise new practices and ensure written guidelines meet top industry standards.

Establish mechanisms that allow clients and boards to verify that data is both complete and up to date. Maintain active oversight throughout the entire process, from reconciliation to reporting, to ensure alignment with your firm's standards. Finally, confirm that all tools and workflows meet SOC 2 and GDPR requirements.

This governance framework not only supports effective management of Scope 3 emissions but also prepares your firm for future assurance engagements under ISO 14064 and ISSA 5000. It ensures consistency with ISSB and UK SRS compliance, keeping your organisation well-positioned for evolving reporting demands.

Conclusion

Summary of Tools and Features

Achieving effective stakeholder data segmentation for ESG reporting hinges on using the right tools in harmony. Platforms like neoeco, built on ledger-based systems, simplify the process by automatically mapping financial transactions - such as supplier payments and utility bills - to emissions categories under frameworks like GHGP and ISO 14064. This eliminates the need for manual spreadsheets and ensures compliance with SECR and UK SRS, all while maintaining audit-ready records. These tools excel at converting raw financial data into structured carbon impact segments for stakeholders.

Comprehensive ESG reporting requires a blend of quantitative metrics and qualitative insights. Materiality assessment platforms help pinpoint the most critical stakeholders, while survey and CRM tools gather valuable feedback from employees, customers, and communities. Business intelligence systems then analyse this combined data to uncover trends across social and governance dimensions. Seamless integration between these tools is essential to avoid disjointed data silos that can complicate audits and reporting.

When selecting tools, prioritise those that integrate directly with accounting systems like Xero, Sage, or QuickBooks. Look for built-in audit controls and centralised evidence management to streamline workflows. Opt for platforms designed with accounting firms in mind, ensuring they align naturally with your existing processes and require minimal retraining.

These tools and strategies lay the groundwork for implementing a robust segmentation approach tailored to ESG reporting.

Next Steps for Accounting Firms

To align your firm with ESG reporting standards, consider the following actions:

Start with a ledger-based platform to automatically segment stakeholders based on their emissions impact. Connect this system to clients' financial data for an auditable baseline that meets ISSB reporting requirements from the outset.

Identify any gaps in stakeholder engagement and materiality assessments, then incorporate tools that address these needs. Ensure all platforms integrate seamlessly with your core systems.

Clearly document your segmentation methodology and establish strong governance processes.

ESG webinar: Materiality assessments and stakeholder engagement

FAQs

What should accounting firms consider when choosing tools for stakeholder data segmentation?

When choosing tools for stakeholder data segmentation, accounting firms should focus on features like automated data collection, real-time updates, and secure integration with their current financial systems. It's also important to select tools that provide customisable segmentation options, allowing firms to adapt data categories to meet specific reporting requirements. Additionally, tools with audit-ready documentation can help ensure compliance with sustainability regulations.

For those handling ESG reporting, it's crucial to use tools that seamlessly link sustainability data with financial systems. This guarantees accurate, finance-grade reporting and makes it easier to comply with frameworks such as GHGP, ISO 14064, and SECR. These capabilities enable firms to offer dependable and professional sustainability services.

How do tools like neoeco simplify ESG reporting for accounting firms?

Tools like neoeco simplify ESG reporting by seamlessly connecting to financial ledgers, removing the hassle of manual data entry. This integration not only ensures precise, real-time information but also aligns sustainability metrics with established accounting frameworks, making reports audit-ready and of a high professional standard.

By automating workflows and linking transactions to established emissions standards like GHGP, ISO 14064, and SECR, neoeco enables accounting firms to provide efficient and compliant sustainability services. This streamlined approach cuts down on complexity, saves valuable time, and delivers dependable results for clients.

Why is connecting accounting systems important for effective stakeholder segmentation?

Connecting accounting systems with stakeholder segmentation tools is a game-changer, enabling real-time, precise data integration straight from financial records. By automating this process, businesses can wave goodbye to manual data entry, cutting down on errors and saving valuable time.

This integration allows firms to effortlessly align financial transactions with established emissions categories, produce accurate, finance-grade reports, and keep audit-ready documentation at their fingertips. The result? A smoother, more dependable approach to stakeholder segmentation that helps accounting firms stay compliant while offering top-notch sustainability services.