ISO 14064 and LCA: Aligning for ESG Compliance

Jan 3, 2026

How ISO 14064 and Life Cycle Assessment help UK firms meet CSRD, SECR and SEC rules, verify Scope 1–3 emissions and reduce greenwashing risk.

To meet stricter ESG regulations like CSRD, SECR, and SEC climate rules, UK accounting firms are adopting two key frameworks: ISO 14064 and Life Cycle Assessment (LCA). These tools aren't alternatives - they work together to ensure accurate sustainability reporting and compliance:

ISO 14064 focuses on measuring, verifying, and reporting organisational greenhouse gas (GHG) emissions. It's ideal for corporate-level reporting and aligns emissions data with financial structures.

LCA examines the entire lifecycle of a product, from raw material extraction to disposal, identifying supply chain inefficiencies and validating product-level claims and supporting Scope 3 emissions reporting.

By combining ISO 14064's structured approach with LCA's product-level insights, firms can address both organisational and supply chain impacts. This dual approach is crucial for meeting investor and regulatory demands while avoiding risks like greenwashing.

Quick Overview:

ISO 14064: Organisational focus, Scope 1-3 emissions, third-party verification, aligns with CSRD/SECR.

LCA: Product lifecycle focus, supply chain analysis, mandatory for Environmental Product Declarations (EPDs).

Both frameworks require robust data systems for accurate reporting and verification. Tools like neoeco simplify this process by linking financial data to emissions categories, ensuring compliance with evolving ESG standards.

1. ISO 14064

Scope and Boundaries

ISO 14064-1 requires organisations to clearly define their boundaries for emissions reporting. This can be done using one of two approaches: the control approach, which accounts for 100% of emissions from facilities under the organisation's control, or the equity share approach, which considers emissions proportional to the organisation's economic interest.

These boundaries help determine which emissions need to be measured. Direct emissions (Scope 1) come from sources the organisation owns or controls, such as company vehicles or on-site boilers. Indirect emissions include Scope 2 (from purchased energy) and Scope 3, which covers emissions across the value chain. Since 2019, organisations have been required to assess additional Scope 3 categories, such as transportation, product use, and downstream impacts.

For accounting firms, this means addressing financed emissions (Scope 3, Category 15), which are the emissions generated by companies or projects that receive financial backing. ISO 14064 aligns with the Partnership for Carbon Accounting Financials (PCAF) framework to help manage these emissions effectively.

Data Requirements

ISO 14064-1 sets strict guidelines for quantifying greenhouse gas (GHG) emissions, requiring the use of recognised methodologies and emission factors. Specific gases such as CO₂, CH₄, N₂O, NF₃, SF₆, and grouped categories like HFCs and PFCs must be measured separately. To ensure transparency, the standard mandates clear documentation of the criteria used to identify significant indirect emissions, along with explanations for any exclusions.

The materiality threshold for GHG verification is usually set at ±5% errors for each scope. This means data systems must be robust from the outset to avoid inaccuracies. For organisations managing ISSB reporting, implementing reliable, finance-grade data management systems early on can prevent costly adjustments during verification. Meeting these data requirements ensures smoother third-party verification processes.

Verification and Reporting

ISO 14064-3 outlines the process for third-party verification, offering two levels of assurance.

Reasonable assurance: Provides a high level of confidence, with a positive conclusion such as, "The emissions inventory is fairly stated."

Limited assurance: Offers a more moderate level of confidence, typically expressed as, "Nothing has come to our attention suggesting material misstatement".

The certification process usually takes between three and six months. Organisations are advised to start with reasonable assurance for their baseline year to establish credibility, then switch to limited assurance for interim annual reports to balance cost and reliability. Verified data from this process is essential for meeting ESG compliance and adhering to strict regulatory standards.

ESG Alignment

ISO 14064 serves as a structured framework that aligns with key ESG regulations, such as the EU Corporate Sustainability Reporting Directive (CSRD), the SEC's climate disclosure rules, and the UK's Streamlined Energy and Carbon Reporting (SECR). Although technically voluntary, ISO 14064 is increasingly becoming a prerequisite in supplier contracts and tenders, as organisations face growing pressure to validate their climate commitments.

For UK accounting firms, emissions data verified under ISO 14064 directly supports compliance with CSRD, SECR, and similar regulatory frameworks, ensuring they meet both domestic and international standards.

2. Life Cycle Assessment (LCA)

Scope and Boundaries

LCA takes a "cradle-to-grave" approach, analysing the entire lifecycle of a product - from raw material extraction to its disposal. This differs from ISO 14064, which focuses on organisational control. Instead of looking at ownership or equity share, LCA examines the physical cause-and-effect relationships across a product's supply chain.

This approach can sometimes obscure the true environmental impact when production is outsourced. For example, an organisation might report lower emissions under ISO 14064-1 by outsourcing production, even if the product's total lifecycle emissions actually increase. To address this gap, ISO 14072:2024, introduced in October 2024, connects organisational boundaries with product lifecycle impacts. This distinction highlights why LCA is vital for understanding the broader environmental footprint.

Data Requirements

LCA demands detailed data to assess the full lifecycle impact of a product. This involves building a Life Cycle Inventory (LCI), which tracks all resource inputs and outputs across the supply chain. Unlike organisational inventories, LCA goes beyond the immediate operations of a company, covering upstream suppliers, transportation, product use, and end-of-life disposal.

For companies managing Scope 3 emissions, having strong data systems is critical. These systems not only support LCA but also help avoid costly verification delays when reporting Scope 3 emissions.

Verification and Reporting

ISO 14064-3 provides a shared verification framework for both organisational emissions inventories and product carbon footprints developed through LCA. The same verification methods - whether offering reasonable or limited assurance - apply to corporate emissions and product-level carbon footprints under ISO 14067.

While ISO 14044 requires a 'critical review' for public claims, ISO 14064-3 ensures structured third-party verification for ESG disclosures, such as those required by the CSRD or SEC. Additionally, ISO 14066 stipulates that verification teams must have technical expertise in LCA methodology. This ensures that LCA data included in ESG reports meets the same rigorous standards as organisational emissions inventories.

ESG Alignment

LCA works alongside ISO 14064 to uncover environmental "hotspots" across the value chain that might be missed when focusing solely on organisational boundaries. As Decerna aptly noted:

"A company's operational emissions inventory looks nothing like the life cycle footprint of what it produces."

This distinction is increasingly important for accounting firms advising clients on ISSB reporting. Investors are no longer just interested in an organisation's internal operations - they want to understand the complete environmental impact of the products and services they support.

The release of ISO 14072:2024, priced at CHF 132, marks a shift towards applying LCA principles at the organisational level. This move bridges the gap between product-specific impacts and company-wide ESG reporting. Together with ISO 14064, LCA provides a robust framework that meets the growing demand for transparency and accountability across the entire value chain. This integration helps firms deliver a clearer, more comprehensive picture that aligns with both regulatory requirements and stakeholder expectations.

ISO 14064-1:2018 Greenhouse Gas Quantification and Reporting

Pros and Cons

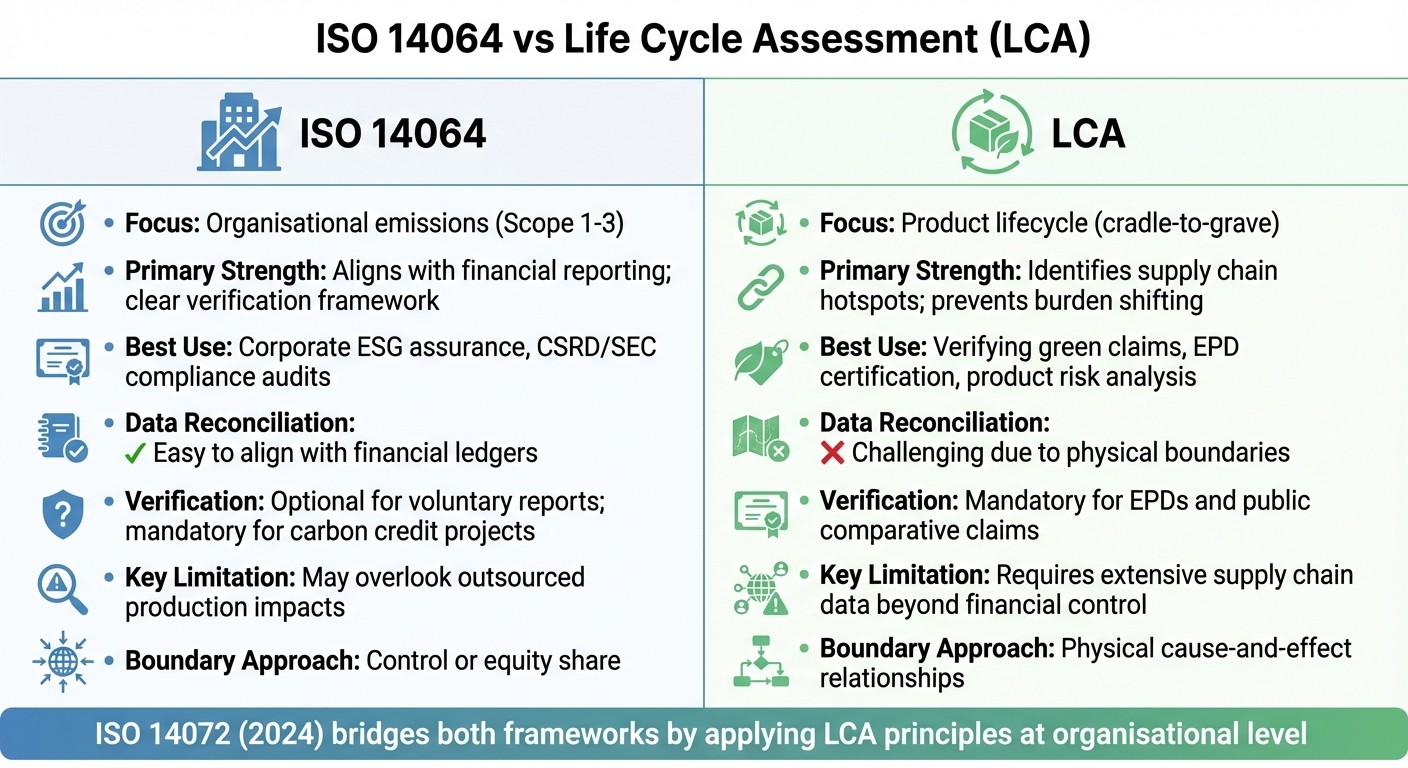

ISO 14064 vs LCA Framework Comparison for ESG Compliance

This analysis explores how ISO 14064 and Life Cycle Assessment (LCA) frameworks address various ESG challenges faced by accounting firms, highlighting their strengths and limitations.

ISO 14064 is particularly effective for aligning carbon reporting with financial structures. By using control or equity share approaches to define boundaries, it makes it easier to reconcile emissions data with a client's financial statements. This is especially useful for UK firms assisting clients with SECR compliance or preparing for investor-grade disclosures. Another advantage is its clear third-party verification process through ISO 14064-3, which offers either reasonable or limited assurance. Kristina Beadle, ESG Director at Inspired PLC, explains:

"ISO standards are optional, and they don't need to be completed for compliance purposes. However, they are internationally recognised as best practice and help organisations to better manage and control their business processes".

However, ISO 14064 has a narrower focus on organisational boundaries, which can overlook the broader environmental impact of products and services. This is where LCA becomes essential, as it examines environmental impacts across the entire supply chain - from raw material extraction to disposal. It is also mandatory for Environmental Product Declarations (EPDs), helping firms guard against greenwashing risks.

That said, LCA's complexity can be a challenge. It requires detailed supply chain data, which can make it difficult to integrate with financial records. For accounting firms, the choice between these frameworks often depends on client needs: ISO 14064 is ideal for corporate-level assurance, while LCA is better suited for product-level validation. Increasingly, firms are finding value in combining both approaches. Tools like neoeco simplify this process by automatically mapping financial transactions to ISO 14064 categories, streamlining data collection for SECR or UK SRS compliance.

Aspect | ISO 14064 | Life Cycle Assessment (LCA) |

|---|---|---|

Primary Strength | Aligns with financial reporting; clear verification framework | Identifies supply chain "hotspots"; prevents burden shifting |

Best Use for Firms | Corporate ESG assurance, CSRD/SEC compliance audits | Verifying green claims, EPD certification, product risk analysis |

Data Reconciliation | Easy to align with financial ledgers | Challenging due to physical boundaries |

Verification Requirement | Optional for voluntary reports; mandatory for carbon credit projects | Mandatory for EPDs and public comparative claims |

Key Limitation | May overlook outsourced production impacts | Requires extensive supply chain data beyond financial control |

The upcoming 2024 release of ISO 14072 (priced at CHF 132) aims to bridge the gap between these frameworks by applying LCA principles at the organisational level. By combining ISO 14064's financial alignment with LCA's comprehensive supply chain analysis, firms can offer a well-rounded ESG compliance strategy. This dual approach provides the transparency and accountability that investors and regulators are increasingly prioritising, supporting clients in meeting ISSB reporting requirements and adapting to evolving ESG standards.

Conclusion

ISO 14064 provides a framework for aligning emissions data with financial reporting, giving corporations confidence in their sustainability disclosures. Meanwhile, Life Cycle Assessment (LCA) helps validate product-level claims and zero in on supply chain inefficiencies. The upcoming 2024 release of ISO 14072 takes things a step further by extending LCA principles to the organisational level, offering businesses a unified standard to integrate these two approaches effectively.

For UK accounting firms, the priority should be on establishing reliable data systems and leveraging both frameworks where applicable. For instance, clients aiming for investor-grade disclosures can benefit from the verification process outlined in ISO 14064-3. On the other hand, businesses making product-specific environmental claims need LCA to substantiate their positions and mitigate risks of greenwashing. Increasingly, firms are recognising that the most credible ESG strategies combine ISO 14064 for corporate-level reporting with LCA to monitor the environmental impacts of individual products and services.

One of the biggest hurdles remains data management. Gathering supply chain data for LCA often clashes with the structure of financial records, making integration challenging. Tools like neoeco offer solutions by automatically linking financial transactions to ISO 14064 categories, streamlining audit-ready data collection for SECR, UK SRS, and Scope 3 emissions using activity-based data. Solving these data challenges is essential for creating a cohesive and reliable ESG strategy.

FAQs

How do ISO 14064 and Life Cycle Assessment (LCA) support ESG compliance?

ISO 14064 serves as a reliable framework for tracking, reporting, and verifying an organisation's greenhouse gas (GHG) emissions. Meanwhile, Life Cycle Assessment (LCA) takes a broader view, examining the environmental impact of products and processes throughout their entire lifecycle - from raw material extraction to disposal. When combined, these approaches provide a thorough method for tackling ESG compliance, blending high-level carbon accounting with detailed lifecycle analysis.

This synergy allows businesses to create precise, audit-ready ESG reports that cover both organisational emissions and specific product-related environmental challenges. By using these methodologies together, companies can strengthen their reputation, meet regulatory requirements, and offer clear, trustworthy sustainability disclosures.

What challenges arise when aligning ISO 14064 reporting with Life Cycle Assessment (LCA) data?

Aligning ISO 14064 greenhouse gas (GHG) reporting with Life Cycle Assessment (LCA) data can be a complex task. The challenge lies in the differences in data quality and scope. ISO 14064 prioritises organisational emissions, using consistent and audit-ready datasets. On the other hand, LCA examines a product's entire life cycle, often relying on data that may be incomplete or inconsistent. These differences can lead to uncertainty and may undermine the credibility of ESG reports.

Another hurdle is reconciling system boundaries. ISO 14064 organises emissions into Scopes 1, 2, and 3, while LCA might assign the same energy flows to different stages of a product's life cycle. This can result in double-counting if not handled carefully. To avoid such issues, it's crucial to map LCA impact categories to ISO-defined scopes with precision.

Tools like neoeco can simplify this process. By integrating financial data with recognised emissions categories, neoeco automates data mapping and ensures accuracy. This helps accounting firms produce compliant and dependable ESG reports without the usual risks associated with manual data handling.

Why should accounting firms combine ISO 14064 and Life Cycle Assessment (LCA) for ESG reporting?

Combining ISO 14064 with Life Cycle Assessment (LCA) gives accounting firms a powerful method for tackling ESG reporting. ISO 14064 provides a structured framework to measure and report greenhouse gas (GHG) emissions, ensuring precision and adherence to international standards. On the other hand, LCA takes a broader view, analysing the environmental impact of a product throughout its entire lifecycle and pinpointing critical areas for improvement.

By using these tools together, firms can offer detailed and reliable ESG data that satisfies regulatory demands and strengthens stakeholder confidence. This approach allows firms to present both detailed emissions metrics and a broader perspective on environmental impacts, helping clients meet sustainability targets while staying compliant with frameworks like the GHGP, SECR, and UK SRS.