What Is Financially-Integrated Sustainability Reporting?

Jan 2, 2026

How to link sustainability metrics with financial reports for audit-ready, compliant disclosures — automated ledger mapping of Scope 1–3, improved accuracy and advisory revenue.

Financially-Integrated Sustainability Reporting (FiSR) merges sustainability data - like carbon emissions and climate-related expenses - with financial reporting. It ensures that sustainability metrics follow the same standards of accuracy and audit-readiness as financial data. Here's why it matters:

What It Does: FiSR links sustainability metrics (e.g., carbon pricing and climate risks) to financial disclosures, embedding them into general-purpose financial reports.

How It Works: It integrates accounting systems with sustainability platforms, automates data mapping (e.g., Scope 1, 2, and 3 emissions), and generates compliance-ready reports.

Why It’s Needed: New regulations (e.g., IFRS S1, S2, US SEC rules) demand that sustainability disclosures align with financial data for transparency and auditability.

Benefits: Saves time by automating processes, improves reporting accuracy, and opens new revenue streams for firms offering advisory and assurance services.

FiSR simplifies the complex task of combining sustainability and financial reporting, making it easier for firms to meet regulatory demands and provide reliable, actionable insights.

Perspectives series: The future of integrated reporting and integrated thinking

What Is Financially-Integrated Sustainability Reporting?

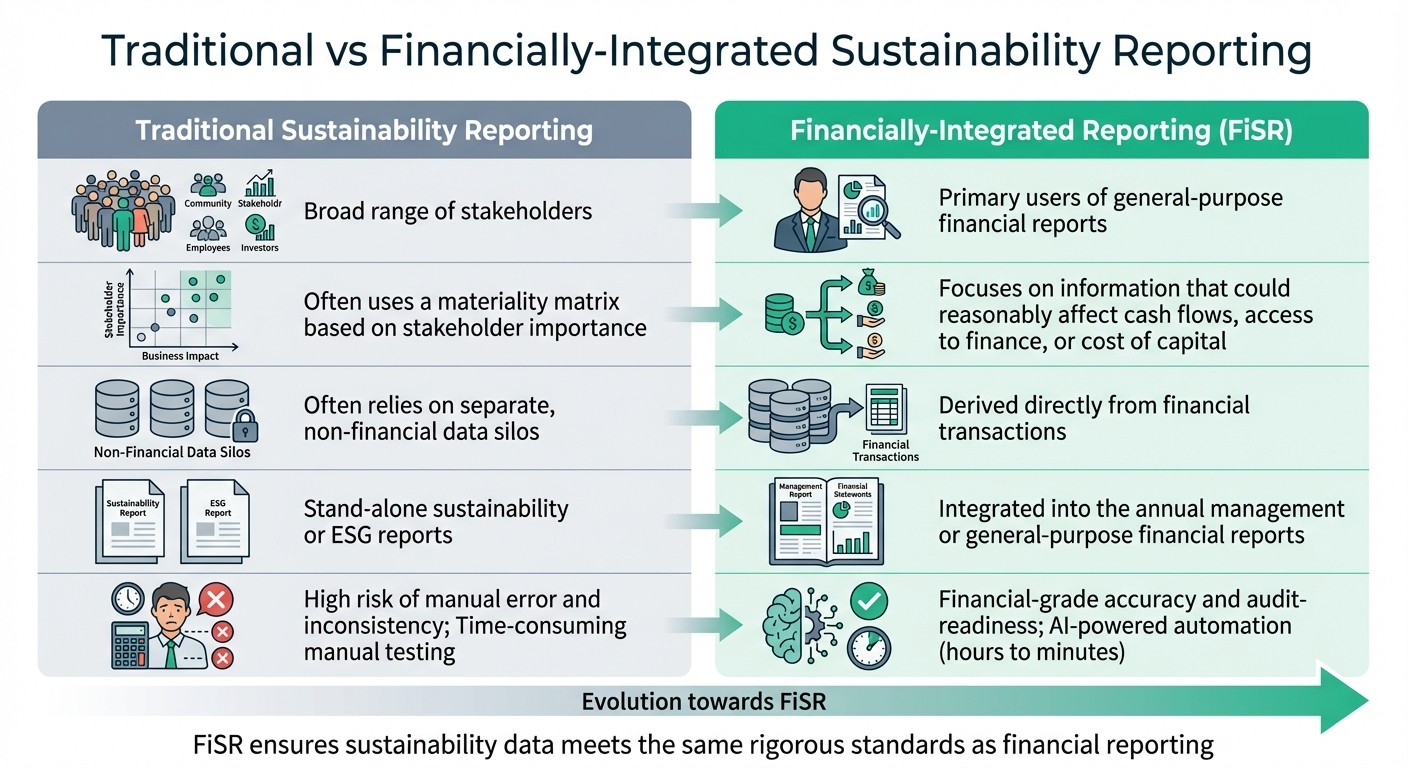

Traditional vs Financially-Integrated Sustainability Reporting Comparison

Definition of FiSR

Financially-Integrated Sustainability Reporting (FiSR) combines sustainability metrics with financial data, embedding governance, strategy, and risk management into standard financial reports.

In practice, FiSR includes elements like carbon pricing within inventory valuations, climate-related expenses detailed in financial notes, and asset impairments linked to environmental risks. All of this is subjected to the same level of audit scrutiny as traditional financial data.

Feature | Traditional Sustainability Reporting | Financially-Integrated Reporting (FiSR) |

|---|---|---|

Primary Audience | Broad range of stakeholders | Primary users of general-purpose financial reports |

Materiality | Often uses a materiality matrix based on stakeholder importance | Focuses on information that could reasonably affect cash flows, access to finance, or cost of capital |

Data Source | Often relies on separate, non-financial data silos | Derived directly from financial transactions |

Report Structure | Stand-alone sustainability or ESG reports | Integrated into the annual management or general-purpose financial reports |

FiSR is implemented through a broader framework known as Financially-integrated Sustainability Management (FiSM).

How Financially-integrated Sustainability Management (FiSM) Works

FiSM builds on FiSR by embedding sustainability considerations into the core of enterprise operations. It examines how an organisation's various business units interact with the different forms of capital it relies on - whether financial, human, or natural - while integrating sustainability metrics into enterprise systems and aligning them with financial and ESG data.

The process follows a logical sequence rooted in financial analysis. It starts with identifying risks in the Management's Discussion and Analysis (MD&A) section, progresses to recognising key judgements in the financial notes, and ultimately leads to financial impacts - like asset impairments or liability provisions - being reflected on the balance sheet. For example, a water scarcity analysis affecting manufacturing risks might first appear in the MD&A, later be flagged as an estimation uncertainty in financial notes, and finally result in a liability entry on the balance sheet.

This approach also incorporates the concept of double materiality. This means assessing not only how business activities impact the environment but also how sustainability issues influence a company's enterprise value. Learn more about how FiSM principles shape modern sustainability accounting and why this integrated approach is gaining traction among UK accounting firms.

The trend towards financially-integrated reporting is already visible. Currently, 90% of S&P 500 companies publish ESG reports, though many still lack clear links to financial outcomes. Additionally, 81% of lenders state that a company’s ESG performance - or its ability to transition to net zero - will increasingly affect lending decisions in the near future. FiSM bridges this gap by ensuring sustainability data matches the reliability and transparency of traditional financial information.

Key Principles of Financially-Integrated Sustainability Reporting

These principles aim to give sustainability metrics the same level of reliability and strategic importance as traditional financial data, cementing the role of FiSR in modern accounting practices.

Automated Sustainability Data Collection

FiSR leans heavily on automated systems to streamline the process of linking financial transactions from existing ledgers to emissions categories defined by frameworks like IFRS S2 and ISO 14064-1:2018. This eliminates the need for manual data entry and spreadsheets, ensuring that sustainability disclosures align seamlessly with financial reports. For instance, IFRS S2 mandates the measurement of Scope 1, 2, and 3 emissions following the Greenhouse Gas Protocol (GHGP).

Automation ensures that sustainability data is inherently connected to financial reporting. This means disclosures are either prepared on the same basis or can be easily reconciled with financial statements. For accounting firms, this simplifies the management of Scope 3 emissions, as the focus shifts to categorising transactions by emissions type rather than laboriously gathering data. Platforms built on FiSM principles, like neoeco, automatically map ledger entries to emissions categories under frameworks such as GHGP, ISO 14064, and national standards like SECR and UK SRS. This eliminates manual conversions and reduces the likelihood of human error.

This automated integration provides a solid foundation for the rigorous data standards discussed in the next section.

Financial-Grade Accuracy and Audit Readiness

FiSR doesn’t stop at efficient data collection - it also requires sustainability data to meet the same standards of accuracy and audit readiness as financial data. IFRS S1 was developed in response to extensive stakeholder feedback, with 735 comment letters calling for "more consistent, complete, comparable and verifiable sustainability-related financial information". This underscores the importance of using the most current data available and addressing any gaps transparently.

To achieve audit readiness, companies must establish clear "process disclosures" that detail the measures taken to ensure the integrity of their reports. These measures might include internal audits, external assurance providers, and oversight by board committees. For UK accounting firms, this has taken on added importance with the introduction of FCA requirements. Enhanced SMCR firms must publish their first sustainability entity reports by 2nd December 2025, while firms managing assets of £5 billion or more are required to do so by 2nd December 2026.

Compliance with Sustainability Frameworks

FiSR also supports alignment with multiple reporting standards at the same time. Key frameworks include IFRS S1 for general sustainability disclosures, IFRS S2 for climate-related information, and ISO 14064-1 for greenhouse gas quantification. These operate alongside jurisdiction-specific requirements like SECR, UK SRS, and ASRS 2. It’s worth noting that ISO 14064-1:2018 was reviewed and reaffirmed as current in 2024, highlighting its ongoing relevance for GHG reporting.

"The objective of IFRS S2 Climate-related Disclosures is to require an entity to disclose information about its climate-related risks and opportunities that is useful to primary users of general purpose financial reports." – International Sustainability Standards Board (ISSB)

For firms aiming to implement ISSB reporting effectively, understanding the connections between these frameworks is crucial. When sustainability data is derived from financial records, it must be easily traceable back to the entity's financial statements to ensure audit readiness.

How Financially-Integrated Sustainability Reporting Works in Practice

Financially-Integrated Sustainability Reporting (FiSR) follows a three-step approach: linking financial systems with sustainability platforms, translating ledger transactions into emissions categories, and producing compliance-ready reports. This process reshapes how accounting firms handle carbon accounting by ensuring sustainability disclosures align seamlessly with the same financial records that underpin financial statements. Let’s break down each step.

Connecting Financial Ledgers with Sustainability Software

The first step is to integrate accounting tools like Xero, Sage, or QuickBooks with sustainability platforms designed around FiSM principles. This integration creates a unified data source for both financial and sustainability reporting.

In the UK, this step addresses a significant challenge: 71% of business decisions are made without "complete and reliable" information, often due to fragmented non-financial data. By directly linking financial records to sustainability platforms like neoeco, firms eliminate the need for separate data collection efforts, creating a single, reliable source of truth. These platforms extract financial information directly, simplifying processes and ensuring consistency.

This setup also makes it easier to pinpoint material expenditures linked to climate-related actions, such as mitigation and adaptation efforts, which are often already recorded in financial statements.

Once the systems are connected, the next phase involves transforming financial data into measurable emissions figures.

Mapping Transactions to Emissions Categories

This step assigns carbon values to financial transactions. For instance, payments to electricity providers are automatically classified as Scope 2 emissions, while fuel purchases for company vehicles fall under Scope 1.

Under the IFRS S1 vs. S2 standards, organisations must disclose total greenhouse gas emissions in metric tonnes of CO2 equivalent, divided into Scope 1, 2, and 3 categories. Platforms built on FiSM principles use automated systems to cross-check financial data with sustainability disclosures, minimising errors and ensuring reports are audit-ready.

Scope 3 emissions, which often represent the bulk of an organisation's carbon footprint, require a different approach. Instead of manually gathering data from various sources, these platforms categorise transactions by emissions type using activity-based data. Tools like neoeco streamline this process by automatically mapping ledger entries to the 15 Scope 3 categories outlined in the Greenhouse Gas Protocol Corporate Value Chain Standard. This ensures alignment with ISSB reporting requirements while maintaining the precision auditors demand. The end result? A carbon inventory that ties directly back to the company’s financial records, meeting both regulatory and internal control standards.

With emissions data organised, the final step is creating reports that meet compliance standards.

Creating Compliance-Ready Reports

The last step focuses on generating audit-ready reports that adhere to regulatory frameworks like SECR, UK SRS, and ASRS 2. These reports must present accurate emissions data while also including narrative explanations that clarify the links between sustainability efforts and financial performance.

To meet compliance standards, these reports must include process disclosures - details about measures taken to ensure data integrity, such as board oversight and the roles of internal and external auditors.

Platforms built on FiSM principles simplify this process by offering compliance-ready templates with digital tagging (XBRL) for automated machine reading. This ensures the reports are either prepared on the same basis as, or easily reconcilable with, published financial statements - a key requirement for audit readiness. For firms managing Scope 3 emissions across multiple clients, this automation turns a traditionally time-consuming, year-end task into a smooth and repeatable workflow.

Reporting Element | Purpose for Compliance | Source of Data |

|---|---|---|

Financial Capital | Explains funds available for value creation | General Ledger / Balance Sheet |

Climate Risks | Discloses material impacts on financial condition | Risk Management / MD&A |

GHG Inventory | Quantifies Scope 1, 2, and 3 emissions | ISO 14064-1 Methodologies |

Process Disclosures | Ensures integrity and audit-proof validation | Internal Audit / Board Oversight |

Benefits of Financially-Integrated Sustainability Reporting for Accounting Firms

The framework of Financially-Integrated Sustainability Reporting (FiSR) offers accounting firms a host of advantages that go far beyond meeting compliance requirements. By bridging financial and sustainability data, FiSR enhances efficiency, creates new revenue streams, and strengthens client relationships. It positions firms as proactive advisors in a regulatory environment that continues to evolve.

Streamlined Carbon Accounting Without Spreadsheets

Traditional sustainability reporting often involves juggling spreadsheets, manual data entry, and fragmented processes. These outdated methods not only waste time but also increase the risk of errors. FiSR changes the game by directly linking financial ledgers to emissions categories, making sustainability reporting faster, more accurate, and less labour-intensive.

With FiSR, financial data is automatically mapped to recognised emissions categories, such as those under the GHG Protocol and ISO 14064. Tools like neoeco integrate seamlessly with platforms like Xero, Sage, or QuickBooks, creating a single, reliable source of truth. This eliminates the need for manual data conversions and reconciliations, saving hours of work. For firms managing multiple clients, this automation provides a scalable and repeatable workflow, reducing assurance costs while maintaining the precision required for audits.

By automating data collection and classification, FiSR not only saves time but also ensures that sustainability data meets the same rigorous standards as financial reporting. This approach simplifies processes, allowing firms to focus on delivering value rather than managing spreadsheets.

Expanding Revenue with Sustainability Services

FiSR opens the door to new revenue opportunities for accounting firms, especially as businesses increasingly seek guidance on sustainability practices. The rising demand for assurance services and specialised advice offers firms a chance to broaden their service offerings.

"Auditors have extensive education requirements, adhere to strict independence rules, and possess a holistic view of an organisation's business, processes, and risk profile. That makes them ideal candidates to perform sustainability assurance engagements." – Sue Coffey, CEO–Public Accounting, Association of International Certified Professional Accountants

Beyond assurance, firms can dive into advisory services, helping clients with carbon footprint analysis, waste management, and resource efficiency. By leveraging data already available in clients' financial systems, accountants can provide actionable insights without requiring additional data collection efforts. Moreover, as frameworks like CSRD and ISSB reporting become mandatory, firms can offer compliance management services to help clients navigate these requirements.

Another growing area is advising clients on green funding opportunities, such as grants, renewable energy financing, and sustainability-linked loans with lower interest rates. These services not only generate revenue but also strengthen client loyalty by delivering measurable financial benefits.

The numbers speak for themselves: 70% of UK business leaders believe high-quality non-financial data helps win new business, and 57% of senior executives say integrated reporting improves their ability to raise capital. For accounting firms, this translates into higher client retention and increased fees for advisory services that add tangible value.

Enhanced Compliance and Audit Confidence

FiSR also boosts confidence in compliance and audit processes by aligning sustainability disclosures with financial reporting standards. Frameworks like IFRS S1, IFRS S2, and the European Sustainability Reporting Standards (ESRS) now require "connected information", ensuring that sustainability and financial data are presented consistently.

This integration strengthens compliance in several ways. First, quantitative disclosures, such as costs linked to severe weather events, are drawn from the same robust systems used for financial data. Second, it mandates transparency around processes, including the roles of internal audits, board committees, and external assurance providers. Finally, it aligns sustainability and financial reporting into a cohesive narrative, as highlighted by KPMG's Global Head of Audit, Larry Bradley:

"There will be true connectivity when investors can recognise the same business model and strategy through all three windows [financial statements, sustainability disclosures, and MD&A] – and when there is a consistent narrative that connects the dots."

For firms managing Scope 3 emissions across various clients, this integration is invaluable. Adhering to standards like ISO 14064-1:2018 ensures GHG quantification meets audit requirements, producing reports that withstand regulatory scrutiny. This positions firms as trusted advisors capable of navigating the complexities of compliance.

Feature | Traditional Sustainability Reporting | Financially-Integrated Reporting (FiSR) |

|---|---|---|

Data Source | Siloed spreadsheets and manual entries | Integrated enterprise systems and financial ledgers |

Accuracy | High risk of manual error and inconsistency | Financial-grade accuracy and audit-readiness |

Efficiency | Time-consuming manual substantive testing | AI-powered automation (hours turned into minutes) |

Decision Making | Often based on gut instinct or incomplete data | Based on complete, decision-ready data insights |

Reporting Format | Often a separate, standalone report | Integrated into annual management reports |

FiSR doesn't just improve processes - it transforms how accounting firms operate, making them more efficient, profitable, and indispensable to their clients. By integrating sustainability with financial reporting, firms can deliver insights that are both actionable and aligned with the highest standards of accuracy.

How to Implement Financially-Integrated Sustainability Reporting

Financially-Integrated Sustainability Reporting (FiSR) bridges the gap between financial data management and the rising demand for reliable, audit-ready sustainability disclosures. Research indicates that organisations new to integrated reporting generally achieve full compliance with the Integrated Reporting Framework within three to four reporting cycles. This makes the transition manageable for most firms.

The process involves three key steps: linking financial systems, aligning transactions with sustainability metrics, and producing compliance-ready reports. These steps establish a workflow that seamlessly integrates financial data with sustainability disclosures.

Step 1: Connect Financial Systems

The backbone of FiSR lies in connecting financial ledgers directly to sustainability reporting platforms. This eliminates the need for separate data collection and ensures disclosures are rooted in the same robust systems used for financial reporting.

Start by integrating your existing accounting tools - such as Xero, Sage, or QuickBooks - with sustainability-focused platforms like neoeco, which automatically pull transaction data into a unified system. Before doing so, identify any data silos in your current processes. The US SEC requires that quantitative climate data be drawn directly from a company’s books and records, so ensuring traceability from the outset is essential. This also satisfies IFRS S1 and ESRS 1 requirements, which mandate firms to explain how sustainability issues connect to financial statements.

Step 2: Map Transactions to Sustainability Metrics

Once systems are connected, the next step is automating the mapping of financial transactions to recognised emissions categories. This is where FiSR truly shines, turning what used to take hours of manual work into a task completed in minutes.

FiSR tools can automatically classify ledger entries based on frameworks like GHGP and ISO 14064-1:2018. For instance, a fuel purchase logged in the general ledger is automatically linked to Scope 1 emissions, while electricity invoices are categorised under Scope 2. For Scope 3 emissions - which often represent the largest share of a company’s carbon footprint - supplier invoices and procurement data are mapped to appropriate upstream or downstream categories.

Transparency is critical here. Any data gaps or methodological assumptions should be clearly documented. If data is unavailable, firms can use proxies or assumptions, provided they explain the methodology and its limitations. Larry Bradley, Global Head of Audit at KPMG, emphasises this need for consistency:

"There will be true connectivity when investors can recognise the same business model and strategy through all three windows [financial statements, sustainability disclosures, and MD&A] – and when there is a consistent narrative that connects the dots."

Clearly define time horizons - short, medium, and long-term - aligning them with the strategic planning frameworks your clients already use. This ensures sustainability metrics reflect the same forward-looking approach as financial forecasts.

With this mapping complete, you’re ready to move on to report generation.

Step 3: Generate and Review Reports

The final step is creating reports that meet audit and regulatory standards. With financial and sustainability data now integrated, generating reports becomes a streamlined process rather than a manual, time-consuming task.

Platforms like neoeco offer pre-built templates for frameworks such as SECR, UK SRS, and ASRS 2, automatically populating them with mapped transaction data. Reports should align with, or be easily reconcilable to, the organisation’s financial statements, ensuring consistency across disclosures.

Establish a review process similar to financial audits. Each sustainability data point should have a clear chain of custody, much like revenue reporting, to meet third-party assurance requirements. This includes documenting any reliance on third-party data and explaining deviations in methodology.

For firms considering an expansion into sustainability assurance services, this audit-ready approach positions you to meet the growing demand for credible ESG reporting. By integrating financial and sustainability disclosures, you ensure that sustainability reports are as rigorous and dependable as traditional financial statements.

To understand how ISSB reporting fits within a financially-integrated approach, consider how these steps align with the broader goal of creating a unified narrative between financial and sustainability data.

Conclusion

Financially-Integrated Sustainability Reporting (FiSR) is reshaping the way accounting firms handle sustainability disclosures. Instead of treating environmental and social data as separate entities, FiSR merges these with financial reporting, offering the audit-ready precision that clients expect. This unified approach ensures investors can see a consistent business model and strategy reflected across financial statements, sustainability disclosures, and management commentary, creating a cohesive narrative throughout.

FiSR also opens up new avenues for accounting firms. With standards like IFRS S1 and S2 requiring businesses to connect sustainability matters with financial data, accountants are well-positioned to lead this integration. Embracing FiSR principles allows firms to expand their service offerings, enhance recurring revenue, and strengthen client relationships - all while delivering compliance-ready reports that meet regulatory requirements. By aligning financial and sustainability data, FiSR ensures seamless, audit-ready reporting that supports a unified business story.

Adopting FiSR is more straightforward than it might seem. Studies suggest that organisations new to integrated reporting typically achieve full compliance with the Integrated Reporting Framework within three to four reporting cycles. Tools like neoeco simplify the process further by automatically linking financial transactions to recognised emissions categories under GHGP and ISO 14064, removing the need for spreadsheets and manual data handling.

FiSR prepares firms and their clients for the future. As reporting standards continue to align around connectivity and integrated thinking, firms that bridge the gap between finance and sustainability today will be better equipped to meet tomorrow’s demands. To see how FiSM principles can transform your practice, consider how your current financial systems can serve as a foundation for sustainability services, supported by tools like neoeco. This integration enhances your firm’s strategic importance.

Now is the time to align sustainability reporting with financial data and establish your position as a leader in this rapidly changing regulatory environment.

FAQs

What is Financially-Integrated Sustainability Reporting (FiSR) and how does it enhance sustainability reporting accuracy?

Financially-Integrated Sustainability Reporting (FiSR) combines sustainability data with financial reporting to offer a clear, unified picture of an organisation's environmental and financial performance. By directly linking sustainability metrics to financial data, FiSR ensures consistency and transparency while adhering to established standards such as the GHGP, ISO 14064, and frameworks like SECR and UK SRS.

One of the key benefits of FiSR is its ability to eliminate manual processes like spreadsheet management or data conversions. This not only reduces the risk of errors but also enhances the accuracy and reliability of carbon accounting and sustainability reports. Tools such as neoeco, tailored for accounting firms in the UK and Australia, streamline this process by automatically linking financial transactions to emissions categories. The result? Audit-ready, finance-grade data that aligns with all relevant reporting standards.

What are the advantages of linking sustainability metrics with financial data?

Integrating sustainability metrics with financial data creates a comprehensive picture of an organisation’s overall performance. It helps stakeholders see how sustainability-related risks and opportunities influence value creation. This approach is in line with the International Integrated Reporting Framework, which aims to provide investors with higher-quality information and foster a more streamlined corporate reporting process.

For accounting firms, this integration brings several benefits. It boosts transparency, cuts down on repetitive work, and makes it easier to comply with sustainability reporting standards such as SECR, UK SRS, and ASRS 2. Tools like neoeco simplify this process by automatically linking financial transactions to recognised emissions categories. The result? Precise, audit-ready carbon data - no manual input needed. This enables firms to confidently deliver carbon accounting services that are both efficient and profitable.

How can accounting firms effectively implement financially-integrated sustainability reporting (FiSR)?

To effectively implement financially-integrated sustainability reporting (FiSR), accounting firms in the UK need to focus on aligning with national standards, seamlessly integrating sustainability data into financial systems, and strengthening governance frameworks.

The first step is adopting the UK Sustainability Reporting Standards (UK SRS), set to replace SECR in 2026. These standards mandate that sustainability data - such as Scope 1, 2, and 3 emissions - be reported alongside financial statements. To ensure compliance and consistency, firms should align their reporting with established frameworks like the GHG Protocol (GHGP) and ISO 14064.

Equally important is integrating sustainability data directly into financial systems. Tools like neoeco can streamline this process by mapping general-ledger transactions to recognised emissions categories. This eliminates the need for manual data conversions or reliance on spreadsheets, ensuring that carbon reporting is as precise and dependable as traditional financial reporting.

Lastly, embedding sustainability into governance and audit processes is crucial. Firms should designate sustainability leads, establish internal controls for emissions data, and provide staff training on standards such as UK SRS and IFRS S1/S2. By treating sustainability metrics as an integral part of financial reporting, firms not only ensure compliance but also open doors to new advisory services and opportunities.