Top Tools for Analysing Supply Chain Climate Risks

Jan 4, 2026

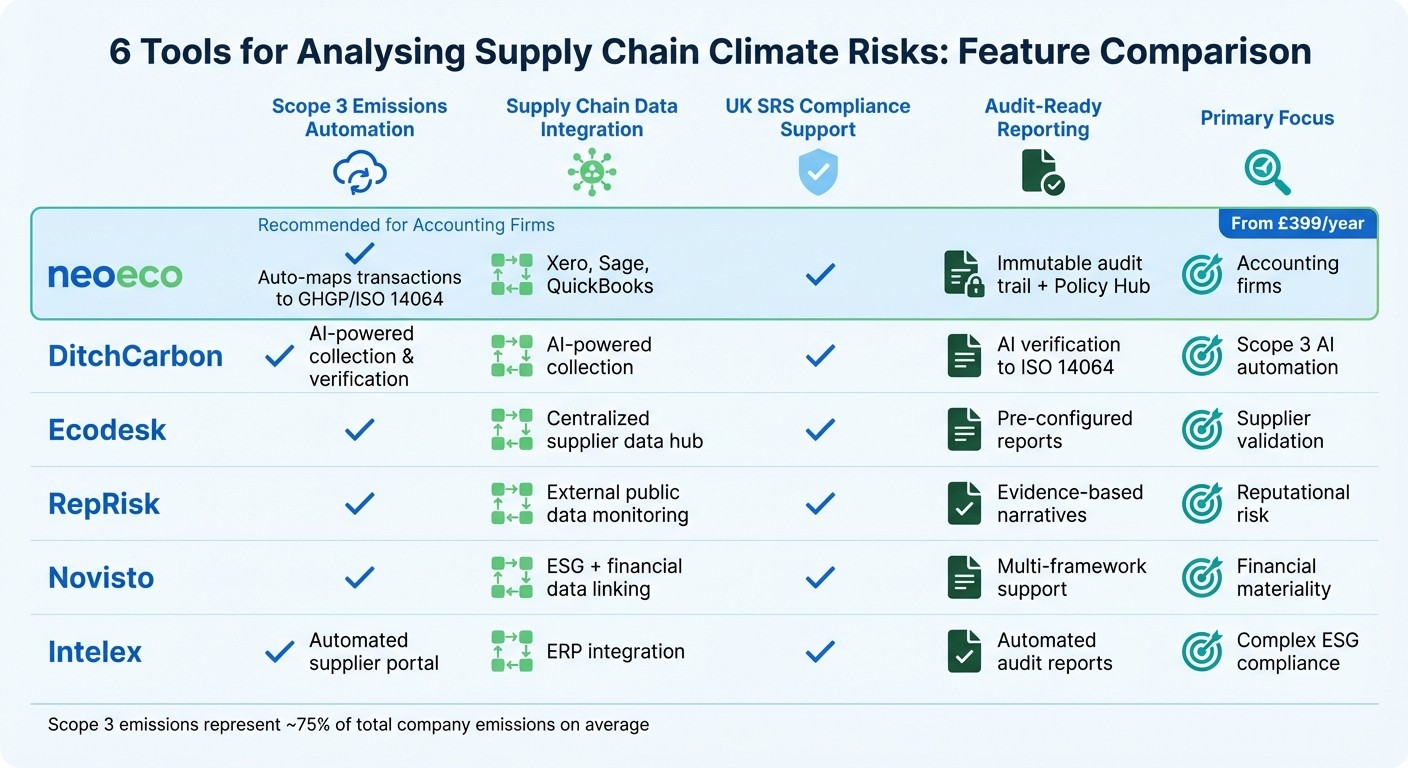

Compare six platforms that automate Scope 3 emissions, validate supplier data and produce audit-ready reports for UK sustainability standards.

In today's world, climate risks like floods, droughts, and wildfires are disrupting supply chains, increasing costs, and complicating compliance with regulations such as the UK Sustainability Reporting Standards (UK SRS). Businesses need tools to automate data tracking, improve emissions reporting, and assess risks effectively - especially as frameworks like TCFD and IFRS S2 demand detailed disclosures.

Here are six tools designed to help accountants and organisations manage supply chain climate risks and meet UK compliance requirements:

neoeco: Automates Scope 3 emissions tracking and integrates ESG data with financial systems for audit-ready reporting.

DitchCarbon: Uses AI to collect and verify Scope 3 emissions data, simplifying compliance with UK SRS.

Ecodesk: Focuses on supplier data validation to improve climate risk assessments.

RepRisk: Tracks reputational and conduct risks using public data to complement internal ESG metrics.

Novisto: Links ESG metrics with financial data for efficient reporting across multiple frameworks.

Intelex: Automates ESG data collection and reporting, tailored for UK SRS compliance.

Each tool offers unique features, from emissions automation to supplier risk analysis, helping businesses streamline climate risk management and regulatory reporting.

Resilience in the Storm: Adapting to Severe Weather in Supply Chains | Beyond The Box Podcast

1. neoeco

neoeco is a software solution designed for UK and Australian accounting firms to simplify sustainability accounting. It works directly with client financial ledgers and integrates seamlessly with platforms like Xero, Sage, and QuickBooks. By automating carbon accounting and reporting, neoeco eliminates the need for manual data entry and spreadsheets.

Scope 3 Emissions Automation

neoeco automatically maps financial transactions to established emissions categories based on frameworks like the GHGP, ISO 14064, and UK-specific standards such as SECR and UK SRS. This automated mapping of purchase ledger data ensures accurate Scope 3 emissions management. With UK SRS S2 gradually requiring firms to include Scope 1, 2, and 3 emissions, neoeco allows businesses to start building a reliable history of value chain emissions from day one.

Supply Chain Data Integration

The platform integrates ESG data directly into existing accounting systems, offering a comprehensive view of sustainability risks. This approach ensures ESG data is treated with the same level of precision as financial data, which is particularly crucial during disruptions caused by extreme climate events.

UK SRS Compliance Support

neoeco assists firms in adhering to the UK Sustainability Reporting Standards by focusing on the financial implications of ESG factors. By linking ESG data directly to financial records, the platform helps accountants meet the high standards of decision-useful information that investors require.

Audit-Ready Reporting

The software includes built-in controls, a policy hub, and secure auditor access, ensuring robust audit trails. It aligns with frameworks such as the GHG Protocol, TCFD, and IFRS S2. Firms can quickly produce compliance-ready reports for SECR, UK SRS, and other frameworks, with all supporting documents stored centrally. This setup simplifies audits or assurance processes under standards like ISO 14064 or ISSA 5000.

Next, we’ll look at other tools that offer complementary features for analysing supply chain climate risks.

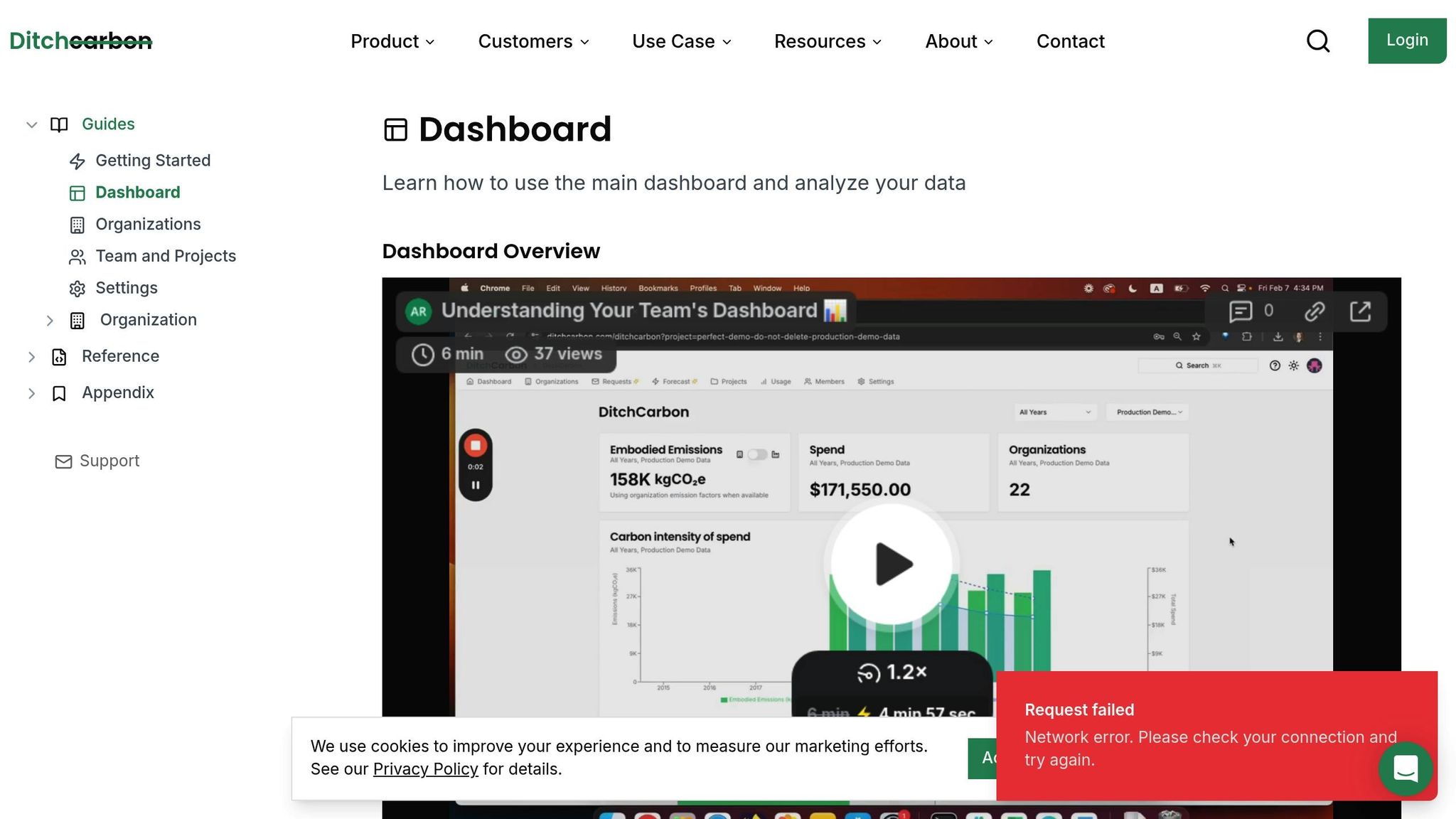

2. DitchCarbon

DitchCarbon, based in London, is a platform designed to tackle the complexities of managing Scope 3 emissions. Using AI, it identifies, collects, and verifies emission data from suppliers and investments, addressing one of the toughest challenges in sustainability reporting. Its automated approach streamlines emissions tracking, making the process more precise and efficient.

Scope 3 Emissions Automation

DitchCarbon's use of AI transforms how data is gathered and verified across entire value chains:

"DitchCarbon was born in London with a very specific goal: manage Scope 3 emissions across value chains, one of the most challenging areas in sustainability reporting." – Dcycle

By automating these processes, the platform ensures more accurate and dependable data compared to traditional manual methods. This is especially beneficial for companies preparing to meet UK SRS S2 requirements, where Scope 3 reporting becomes mandatory starting in the second year of disclosure.

UK SRS Compliance Support

The platform simplifies compliance with the UK Sustainability Reporting Standards by integrating a phased approach that combines climate goals with long-term financial planning. This makes indirect emissions reporting less daunting for businesses.

Audit-Ready Reporting

DitchCarbon's AI-powered verification ensures robust audit trails, meeting ISO 14064 standards and providing dependable metrics for second-year UK SRS compliance. This level of reliability helps organisations confidently meet regulatory demands.

3. Ecodesk

Ecodesk, working alongside Achilles Analytics, is designed to streamline supplier data management while improving climate risk assessments. Rather than just monitoring emissions, it focuses on validating supplier data on a larger scale.

Supply Chain Data Integration

Ecodesk acts as a central hub for supplier data, offering a single, reliable source that can be exported in CSV or XLS formats. This makes it easy to integrate with other analytical tools, ensuring a smooth workflow.

Audit-Ready Reporting

The platform delivers pre-configured reports that meet global regulatory standards, providing validated supplier data that's ready for audits without extra preparation.

Ecodesk stands out by zeroing in on supplier data, offering a focused solution to tackle climate risks in supply chains more effectively.

4. RepRisk

RepRisk zeroes in on external reputational and conduct risks by analysing public data. It tracks news, media, and other publicly available sources to flag sustainability risks that might affect your business. This external perspective complements the internal data offered by other platforms, giving you a broader risk assessment.

Supply Chain Data Integration

RepRisk keeps a close eye on external opinions about supplier sustainability practices. By integrating smoothly with existing reporting tools, it adds depth to your ESG risk assessments. This approach goes beyond what suppliers disclose themselves, offering a clearer picture of your supply chain.

UK SRS Compliance Support

The platform is designed to align with the UK Sustainability Reporting Standards, which centre on financial risks. It helps identify risks and opportunities that could impact your company's value, making it a useful tool for explaining potential financial vulnerabilities.

Audit-Ready Reporting

RepRisk provides evidence-based, audit-ready risk narratives sourced from external data. This ensures that your climate risk assessments aren't solely reliant on supplier self-reports. It also offers the documentation needed for ISSB reporting, giving regulators and investors confidence in your risk management processes.

5. Novisto

After RepRisk's focus on external risk evaluation, Novisto turns its attention inward, specialising in managing internal data and integrating compliance processes. This ESG data management platform connects sustainability metrics with financial data, making financial materiality analysis under the UK Sustainability Reporting Standards (UK SRS) more efficient and actionable.

Supply Chain Data Integration

Novisto simplifies supply chain climate risk management by creating a centralised dataset. This helps identify regional climate vulnerabilities across the network. This dataset not only captures key risk data but also allows seamless distribution across various regulatory frameworks. The result? Reduced administrative overhead and consistent, streamlined disclosures.

UK SRS Compliance Support

Novisto stands out as a go-to tool for UK SRS compliance. By linking ESG metrics with financial data, it highlights how climate-related factors influence a company's financial performance. This capability makes it especially valuable for UK businesses preparing for the 2026 reporting requirements.

Audit-Ready Reporting

The platform supports reporting across multiple frameworks, including UK SRS, IFRS, CSRD, and GRI. This versatility helps organisations make informed strategic decisions, manage risks effectively, and communicate transparently with investors. By bridging the gap between sustainability and finance, Novisto equips companies with the tools they need to grow and remain resilient in the long term.

6. Intelex

Intelex is an ESG and compliance platform designed to handle complex reporting needs, including specialised tools for UK SRS reporting. It simplifies ESG data management by automating data collection and generating reports tailored for regulators, auditors, and investors.

Streamlining Scope 3 Emissions Data

Intelex takes the hassle out of collecting Scope 3 emissions data by automating the process. Through a supplier portal, it gathers energy use and activity-based data directly from vendors, cutting down on manual input. The platform’s Data Hub integration layer connects with existing ERP and supply chain systems, pulling procurement data from various sources into one centralised view. This consolidated approach ensures that organisations have the data they need for UK SRS reporting without unnecessary complexity.

Built for UK SRS Compliance

The platform is designed to support UK SRS compliance across industries such as manufacturing and financial services. Its workflow automation and tailored reporting tools keep data audit-ready at all times. For businesses gearing up for the 2026 UK SRS requirements, Intelex integrates ESG data directly into corporate IT systems, bridging the gap between ESG metrics and financial or operational platforms. This eliminates the inefficiency of managing data in isolated spreadsheets and aligns organisational processes with UK SRS standards.

Ready-to-Go Audit Reports

Intelex transforms collected data into structured, audit-ready reports. By linking ESG metrics to financial systems, it ensures that climate-related disclosures - covering physical risks, transition risks, and climate resilience strategies - meet the standards of UK SRS, including IFRS S1 and S2. This seamless integration allows environmental data to flow smoothly from operational systems to financial reporting, making compliance more straightforward and efficient.

Feature Comparison

Supply Chain Climate Risk Tools Comparison: Features and Capabilities

Here's a quick look at why neoeco stands out as the go-to tool for accounting firms tackling climate risk analysis.

The right solution depends on your firm's specific needs - how you handle data, the compliance frameworks you follow, and whether you prioritise automating Scope 3 emissions or maintaining audit-ready processes. neoeco is designed with accountants in mind, especially those navigating supply chain climate risks. Check out the table below for a summary of its standout features:

Feature | neoeco |

|---|---|

Scope 3 Automation | Automatically maps transactions to GHGP and ISO 14064 categories directly from the financial ledger (more details) |

Data Integration | Seamlessly connects with Xero, Sage, and QuickBooks |

Compliance Templates | |

Audit-Ready Controls | Offers an immutable audit trail, live checklist, and a dedicated Policy & Evidence Hub |

Pricing | Starts at £399/year (carbon-only plan) |

Conclusion

Understanding and addressing climate risks in the supply chain is key to maintaining financial stability and ensuring operations are prepared for future challenges. The right tools can bridge the gap between financial data and sustainability reporting, turning procurement and asset information into actionable insights. With Scope 3 emissions making up around 75% of a company's total emissions on average - and upstream Scope 3 emissions being 26 times higher than direct operational emissions - automation becomes a necessity.

Accountants need reliable platforms that produce audit-ready outputs with unchangeable records, moving away from error-prone spreadsheets. Solutions like neoeco simplify the process by automating data conversions and delivering outputs ready for audits. Using a sustainability report generator can further streamline this process. This approach aligns with the principles of Financially-integrated Sustainability Management (FiSM), ensuring climate data is integrated alongside financial metrics where it can drive meaningful insights.

For UK and Australian firms, compliance with SECR, UK SRS, and ASRS 2 is essential, especially as physical climate risks could lead to £950 billion in annual costs and reduce EBITDA by up to 7% by 2035. Adopting tools that support ISSB reporting and provide scenario modelling allows businesses to assess their exposure to risks before they impact the bottom line.

This shift represents a move from simple disclosure to actionable intelligence. By integrating financial data, automating Scope 3 emissions mapping, and analysing physical risks, organisations can deliver more value to clients while reinforcing their operational resilience.

FAQs

How can tools help streamline Scope 3 emissions tracking in supply chains?

Tracking Scope 3 emissions - those indirect carbon emissions generated throughout a company’s supply chain - can be a daunting task. It’s a process that demands extensive data collection and careful categorisation. Fortunately, modern tools simplify this challenge by automating much of the work. These tools extract procurement or transaction data, apply pre-set emissions factors, and categorise activities according to GHG Protocol standards, eliminating the need for time-consuming manual spreadsheets.

For accounting firms, neoeco takes this a step further by seamlessly integrating with financial ledgers. It automatically maps transactions to recognised emissions categories under standards like GHGP and ISO 14064. The result? Audit-ready carbon reports without the hassle of additional data gathering. Scope 3 emissions are updated continuously as new transactions are logged, ensuring the process is both accurate and time-efficient. By automating these workflows, tools like these turn what used to be a laborious task into a streamlined and dependable way to analyse supply chain emissions.

What are the advantages of linking ESG data with financial systems?

Integrating ESG data into financial systems brings a host of advantages for both accountants and their clients. By directly linking emissions, climate risks, and sustainability metrics to financial ledgers, firms can produce audit-ready and regulator-compliant reports without the hassle of spreadsheets or manual data conversions. This not only boosts accuracy but also speeds up the process of disclosing Scope 1, 2, and 3 emissions.

Connecting ESG data with financial accounts also provides decision-makers with a clearer picture of the financial impact of climate-related risks - think floods, heatwaves, or carbon taxes - on cash flow and asset values. This insight empowers businesses to make smarter, risk-adjusted decisions while staying aligned with frameworks like the GHG Protocol, ISO 14064, and the UK SRS.

On top of that, automating ESG reporting cuts down on administrative tasks, improves operational efficiency, and elevates client service. Accounting firms can offer sustainability advice more profitably while delivering real-time insights that help clients navigate shifting market demands, such as the EU Carbon Border Adjustment Mechanism (CBAM).

How do these tools help ensure compliance with UK sustainability reporting standards?

Tools designed to assess supply chain climate risks are seamlessly integrated with the UK’s mandatory sustainability reporting frameworks, such as SECR, UK SRS, and the upcoming ASRS 2. These tools incorporate essential taxonomies and reporting logic directly into their systems, streamlining compliance and cutting down on manual work.

Take neoeco, for example. This platform maps transaction data from clients’ financial ledgers to established standards like GHGP and ISO 14064, producing audit-ready reports - no spreadsheets required. Similarly, solutions like EarthScan and EY Climate Analytics come with pre-built templates and modules tailored to frameworks such as TCFD and IFRS S2, ensuring that outputs align with UK regulatory standards.

Many of these tools also offer scenario analysis and stress testing, helping firms evaluate transition and physical risks in accordance with FCA guidelines. By automating data collection, adhering to UK-specific standards, and simplifying processes, these platforms give accountants an efficient and dependable way to handle sustainability reporting requirements.