UK SRS & ESG: Aligning Roadmaps with Strategy

Dec 6, 2025

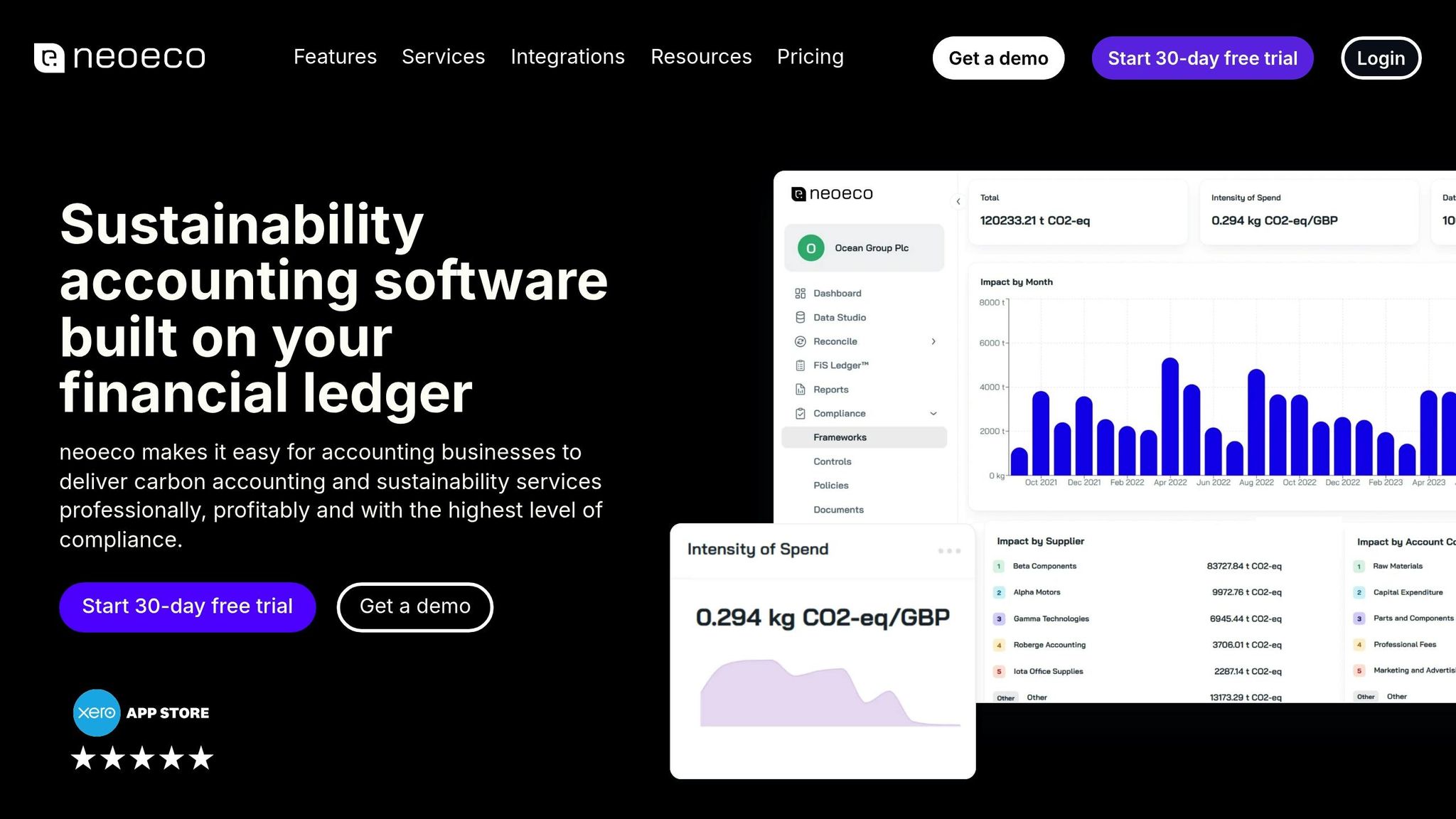

How UK SRS reshapes ESG reporting and how finance-linked tools convert ledger data into audit-ready sustainability reports, simplify Scope 3 and guide strategy.

UK businesses must now integrate the UK Sustainability Reporting Standards (UK SRS) into their operations as part of a broader ESG approach. This isn't just about meeting regulatory requirements - it’s about aligning reporting with business goals for better outcomes.

Key points:

UK SRS compliance mandates detailed disclosures on environmental and social factors, aligning with frameworks like GHGP and SECR.

Challenges include managing fragmented data, Scope 3 emissions, and ensuring audit readiness.

neoeco software simplifies compliance by integrating financial data with sustainability metrics, automating processes, and producing audit-ready reports.

Integrating ESG: Best Practices and Innovations

1. UK SRS

The UK SRS (Sustainability Reporting Standards) is reshaping how organisations approach environmental and social disclosures, pushing for a more integrated ESG (Environmental, Social, and Governance) strategy. For companies aiming to go beyond mere compliance and craft a well-rounded sustainability plan, understanding how UK SRS aligns with other key frameworks is crucial.

Compliance Alignment

UK SRS works in tandem with frameworks like the Greenhouse Gas Protocol (GHGP) and Streamlined Energy and Carbon Reporting (SECR). However, this interconnectedness also brings challenges. Each framework has its own set of requirements, timelines, and reporting formats, making it essential for businesses to coordinate their efforts across multiple systems rather than treating them as isolated tasks.

For example, GHGP provides the methodology for calculating emissions across Scopes 1, 2, and 3, while SECR mandates energy and carbon reporting for qualifying organisations. UK SRS builds on these by requiring disclosures that encompass a broader ESG scope. To streamline compliance, businesses can adopt an integrated approach - mapping out data requirements, identifying shared metrics, and setting up unified processes. This reduces duplication, simplifies reporting, and ensures consistency in how sustainability efforts are measured and communicated.

Data Integration

No sustainability framework can succeed without reliable, accessible data. UK SRS compliance depends heavily on integrating financial records, operational data, and supply chain information - often scattered across various systems. This is where linking sustainability metrics to financial data becomes a game-changer.

By automating the mapping of financial transactions to emissions categories, businesses can eliminate manual spreadsheets, improve accuracy, and create an audit trail. This approach not only satisfies both financial and sustainability assurance requirements but also simplifies the complex task of managing Scope 3 emissions, capturing the full impact of the value chain without requiring separate data collection efforts.

"neoeco keeps up with GHGP, SECR and UK SRS, and more so you never have to learn new frameworks." - neoeco

This highlights a key advantage: businesses don’t need to master every framework when the right systems can manage the technical complexities and deliver actionable insights. Strong data integration also lays the foundation for effective governance.

Governance and Assurance

Under UK SRS, sustainability disclosures are no longer optional or secondary - they face the same level of scrutiny as financial statements. This means organisations need robust internal controls, clear accountability, and processes that can withstand external audits.

A critical step is determining who within the organisation owns sustainability data. Increasingly, finance teams are taking on this role due to their expertise in data management and reporting. This alignment with financial accounting ensures that sustainability reporting is grounded in rigorous controls.

Assurance requirements under UK SRS demand that businesses demonstrate not only what they are reporting but also how the data was derived. This involves documenting methodologies, tracking assumptions, and maintaining clear audit trails. Version control and transparent processes are essential to meet external assurance standards.

At the board level, directors need a clear view of sustainability performance, risks, and opportunities. Reporting systems should translate technical data into insights that inform strategic decisions, showing how sustainability efforts impact financial outcomes and competitive positioning.

Business Strategy Impact

The influence of UK SRS extends far beyond compliance. How a business addresses these requirements reflects its broader commitment to sustainability and ESG integration. Companies that see UK SRS as merely a reporting obligation risk missing out on significant opportunities.

When integrated with ESG strategies, UK SRS can uncover ways to improve efficiency, reduce risks, and even create new revenue streams. For instance, detailed carbon accounting might highlight energy inefficiencies that, once addressed, cut both emissions and costs. Similarly, greater supply chain transparency could reveal risks that prompt diversification, enhancing resilience. Improved communication with stakeholders - such as investors and clients - becomes another advantage, as businesses are increasingly judged on their sustainability credentials. Reliable, integrated data systems are key to delivering credible disclosures and making informed strategic decisions.

2. neoeco (sustainability accounting software)

For accounting firms grappling with the complexities of UK SRS and broader ESG commitments, the real challenge lies in managing the data effectively - not just understanding the frameworks. neoeco offers a streamlined solution by integrating directly with financial ledgers, eliminating the hassle of juggling spreadsheets and manual processes.

Compliance Alignment

neoeco is designed to meet the requirements of UK SRS, SECR, GHGP, and ISO 14064 without requiring firms to have in-depth expertise in each framework. The software automatically maps financial transactions to recognised emissions categories, ensuring reports align with the specific standards. Plus, its templates are regularly updated to reflect changes in regulations. This means firms can produce compliance-ready reports for SECR or UK SRS in just minutes, all from a single, unified data set. No need for separate systems, and no risk of inconsistencies between financial and sustainability disclosures.

For firms working with SMEs or larger private companies, this streamlined process is especially helpful. Many clients lack the resources to keep up with regulatory updates, so offering up-to-date, compliance-ready reports positions firms as reliable advisers. This seamless compliance also lays the groundwork for efficient data integration.

Data Integration

One of neoeco's standout features is its ability to integrate with popular financial systems like Xero, Sage, and QuickBooks. By pulling data directly from financial ledgers, neoeco eliminates the need for fragmented spreadsheets and manual data entry - issues that often plague traditional sustainability reporting.

The platform centralises all client data in one place and uses smart matching to automatically link ledger entries to Scope 1, 2, and 3 emissions categories. This not only speeds up the reporting process but also reduces the chances of human error, improving accuracy.

Real-time dashboards provide instant insights into emissions performance, allowing firms and their clients to monitor progress continuously rather than relying on static, periodic reports. Additionally, neoeco cleans and organises uploaded data, even when records are incomplete or inconsistent, ensuring the final outputs meet audit standards. For firms looking to manage Scope 3 emissions more effectively, neoeco’s transaction-level approach demonstrates how value chain impacts can be captured without the need for separate data collection efforts.

Governance and Assurance

UK SRS holds sustainability reporting to the same high standards as financial statements, and neoeco is built to meet those expectations. The platform includes audit-ready controls, a central evidence hub, and easy access for auditors - features that are difficult to replicate with manual systems.

The reporting process is tracked through a live checklist, showing what is complete, what is missing, and what’s ready for review. This transparency strengthens internal governance, allowing finance teams or sustainability leads to oversee the process without getting bogged down in every detail. It also simplifies external assurance, giving auditors direct access to the evidence they need within the platform.

neoeco also prioritises data security, being SOC 2 and GDPR compliant, while allowing firms to maintain full control over reconciliation, calculations, and reporting. For those pursuing ISO 14064 or ISSA 5000 assurance engagements, neoeco provides structured documentation and evidence management, ensuring consistency in data verification and audit trails. This robust governance framework helps firms turn compliance into a strategic advantage.

Business Strategy Impact

neoeco goes beyond compliance, helping firms weave sustainability into their broader business strategies. With the ability to create professional reports - complete with charts, figures, and commentary - in just minutes, firms can shift their focus from "what to report" to "what these numbers mean for the business."

Custom-branded client reports allow firms to present insights in a way that reflects their own identity, positioning them as strategic partners rather than just compliance providers. By presenting sustainability data alongside financial performance, firms can help clients see the connections between emissions, costs, and operational efficiency.

Since sustainability reporting requires regular updates, neoeco is designed to manage data across multiple clients efficiently, track progress over time, and deliver consistent, high-quality outputs without increasing internal workloads. By turning raw data into actionable insights, neoeco bridges the gap between compliance and strategic planning.

The software also keeps firms aligned with evolving UK and Australian standards automatically, removing the need for manual updates. This ensures both the practice and its clients remain prepared for future regulatory changes. For those considering ISSB reporting, neoeco shows how financial and sustainability data can coexist within a single, unified system.

Advantages and Limitations

Expanding on the earlier discussion about frameworks and software integration, here's a closer look at the benefits and challenges of each approach.

The UK SRS establishes reporting standards, while neoeco simplifies compliance and data management processes.

Aspect | UK SRS | neoeco |

|---|---|---|

Compliance Requirements | Offers a mandatory framework for qualifying entities, ensuring legal clarity but demanding significant technical expertise to implement. | Adapts to frameworks like GHGP, SECR, and UK SRS with built-in audit-ready controls and compliance templates, reducing reliance on internal regulatory expertise. |

Data Management | Requires firms to create their own systems for data collection, often resulting in fragmented spreadsheets and manual workflows. | Seamlessly integrates with accounting tools like Xero, Sage, and QuickBooks, centralising client data and using smart transaction mapping to link ledger entries with carbon categories. |

Governance Processes | Establishes stringent standards for reporting and external assurance, comparable to financial statements, but can be resource-heavy for smaller practices. | Features a policy and evidence hub with live checklists and secure auditor access, enabling firms to maintain control over reporting and reconciliation while staying compliant. |

Business Strategy Integration | Promotes transparency through mandatory disclosures but lacks tools for ongoing monitoring or strategic decision-making. | Offers real-time dashboards and branded client reports, helping firms act as strategic advisers. This turns compliance into a recurring revenue opportunity but requires firms to develop advisory expertise. |

Scalability | Applies uniformly across entities of all sizes, potentially placing higher compliance costs on smaller organisations while benefiting larger ones through standardisation. | Designed for managing multiple clients from a single platform, making it ideal for practices serving SMEs and growing client portfolios. Available on a flexible monthly subscription model with no long-term commitment. |

The UK SRS outlines what needs to be reported and sets quality standards, while neoeco focuses on how firms can meet these requirements effectively. Firms must still understand the principles behind UK SRS to make informed decisions about materiality, boundary setting, and disclosure quality. While neoeco automates many technical aspects - like transaction mapping, emissions calculations, and report generation - professional judgement remains essential.

One area where this distinction becomes critical is Scope 3 reporting. UK SRS mandates comprehensive value chain disclosure. neoeco's transaction-level approach simplifies Scope 3 emissions tracking by leveraging financial data, but firms still need to determine which categories are material and how to address any limitations in their reporting.

neoeco also offers tools like its evidence hub and live tracking, which create audit-ready documentation. This streamlines the assurance process, making it less time-consuming and disruptive.

"We evaluated multiple ESG tools and felt more confused each time. neoeco cut through the noise - the only platform that connects financials to sustainability with LCA-level accuracy." - neoeco

From a business perspective, UK SRS provides the regulatory push for sustainability reporting, while neoeco delivers the operational tools to make it both efficient and profitable. Firms treating compliance as merely an expense may struggle, regardless of their tools. On the other hand, those who see sustainability as a growth opportunity can leverage neoeco to build recurring revenue streams while ensuring compliance.

However, it's worth noting some limitations. neoeco relies on compatible accounting platforms like Xero, Sage, or QuickBooks, and assumes a certain baseline of financial data quality. For clients with poor bookkeeping practices, even automated systems might not produce reliable sustainability reports.

Conclusion

The UK SRS outlines the regulatory framework for sustainability reporting but stops short of addressing how to manage data collection, workflows, or strategic integration. That’s where neoeco steps in, filling the operational gap.

For UK businesses and the accounting firms that support them, the challenge isn’t just about ticking boxes for disclosure requirements. The real task lies in creating an ESG roadmap that links financial performance with sustainability goals, supports informed decision-making, and scales efficiently across multiple clients - all without relying on manual processes.

By integrating seamlessly with financial systems like Xero, Sage, and QuickBooks, neoeco uses ledger data to automatically map transactions to emissions categories under GHGP and UK SRS. This ensures consistent, audit-ready reporting without the need for separate data streams or rough estimations. Essentially, the same data powering financial statements is now driving sustainability reporting too.

This integration transforms sustainability reporting from a compliance headache into a process deeply tied to financial operations. Firms can monitor carbon performance alongside financial metrics, pinpoint material risks in real time, and offer clients actionable insights - not just retrospective data. For companies dealing with the complexities of Scope 3 emissions across intricate value chains, this transaction-level clarity is a game-changer. On the compliance side, neoeco simplifies the process with its policy and evidence hub, live checklists, and secure auditor access, ensuring everything is centralised, traceable, and aligned with ISSB reporting standards.

However, while neoeco automates the technical aspects, strategic insights still require the expertise of professionals. Technology can handle the heavy lifting, but it’s the firms that interpret the data, define materiality, set boundaries, and advise on how sustainability impacts business outcomes. This is where firms can position themselves as trusted advisers, using neoeco’s capabilities to deliver real value.

FAQs

How does neoeco help streamline Scope 3 emissions reporting for UK SRS compliance?

neoeco takes the hassle out of Scope 3 emissions reporting by automatically linking financial transactions to recognised emissions categories under the UK SRS framework. This means no more juggling spreadsheets or dealing with complex data conversions – the process becomes streamlined, delivering precise, audit-ready carbon data.

By connecting directly to clients' financial ledgers, neoeco offers a smooth and efficient solution tailored for accounting firms. This integration not only ensures compliance with ease but also saves valuable time and resources, allowing firms to focus on what matters most.

What challenges do UK businesses face when integrating UK SRS requirements into existing ESG frameworks like GHGP and SECR?

Integrating the UK's SRS requirements with established ESG frameworks like the GHGP and SECR can be a tricky task for businesses. The challenge lies in aligning multiple compliance standards while ensuring the data is consistent, precise, and ready for audits. This becomes even more complicated when companies rely on manual processes or disconnected systems, which can lead to inefficiencies and errors.

Another hurdle is mapping financial transactions to the recognised emissions categories under frameworks like GHGP and SECR. This step often demands specific expertise and tools to ensure compliance without sacrificing operational efficiency. Using finance-integrated solutions can simplify this process, delivering accurate data and minimising potential mistakes.

How can aligning UK SRS compliance with an ESG strategy unlock new revenue opportunities for businesses?

Aligning UK SRS compliance with a business's ESG strategy can do more than just tick regulatory boxes - it can help unlock new revenue opportunities. By strengthening an organisation's reputation and making it more appealing to sustainability-focused investors and customers, businesses can position themselves as forward-thinking and trustworthy. These qualities are highly valued by stakeholders who prioritise environmental and social responsibility.

On top of that, embedding compliance into ESG strategies can streamline operations. For instance, initiatives like reducing energy use or cutting waste not only contribute to sustainability goals but also lower costs and improve profit margins. Tools such as neoeco, which automate carbon accounting and sustainability reporting, make it easier for businesses to meet compliance standards while showcasing their commitment to sustainability. This proactive approach not only ensures businesses stay compliant but also helps them stand out and thrive in an increasingly eco-conscious and competitive market.