Ultimate Guide to Supplier ESG Metrics

Dec 23, 2025

Practical guide to measuring supplier environmental, social and governance performance—Scope 3 emissions, core KPIs, frameworks and data collection best practices.

Supplier ESG metrics are essential for evaluating how your suppliers perform on environmental, social, and governance standards. These metrics help businesses comply with regulations, manage risks, and meet sustainability goals. Here's what you need to know:

What They Measure:

Environmental: Supplier emissions (Scope 3), energy use, waste, and water usage.

Social: Labour standards, diversity, and employee wellbeing.

Governance: Anti-corruption policies, board diversity, and transparency.

Why They Matter:

Regulatory frameworks like UK SRS and SECR demand Scope 3 emissions reporting.

ESG issues can pose financial and reputational risks if neglected.

Investors and customers increasingly prioritise ESG performance.

How to Track Them:

Use financial transaction data and supplier questionnaires for accuracy.

Automate data collection with tools like neoeco to save time and ensure audit readiness.

Focus on high-impact suppliers and set SMART goals for improvement.

ESG Value in Supply Chains: A Deep Dive

Core Supplier ESG Metrics and KPIs

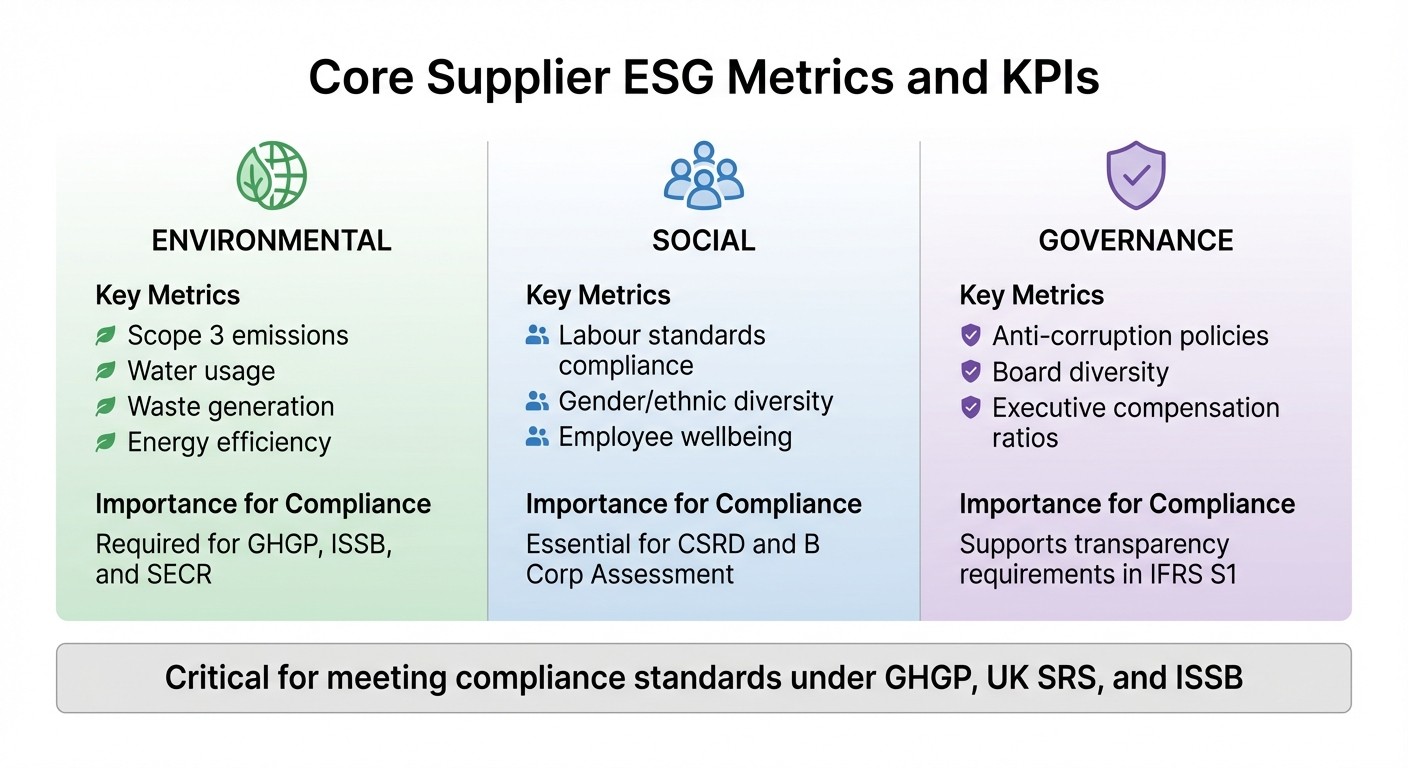

Core Supplier ESG Metrics by Category: Environmental, Social, and Governance

Supplier ESG metrics are grouped into three main categories - environmental, social, and governance - each serving a distinct purpose in compliance efforts and risk management. For accountants helping clients with ISSB reporting or UK SRS disclosures, knowing which metrics to prioritise ensures you gather the right data and avoid wasting time on irrelevant details.

Here’s a breakdown of the core supplier metrics by category:

Category | Key Metrics | Importance for Compliance |

|---|---|---|

Environmental | Scope 3 emissions, water usage, waste generation, energy efficiency | Required for GHGP, ISSB, and SECR |

Social | Labour standards compliance, gender/ethnic diversity, employee wellbeing | Essential for CSRD and B Corp Assessment |

Governance | Anti-corruption policies, board diversity, executive compensation ratios | Supports transparency requirements in IFRS S1 |

These metrics are critical for meeting compliance standards under frameworks like GHGP, UK SRS, and ISSB.

Environmental Metrics

Environmental metrics zero in on the carbon footprint and resource usage of suppliers, offering a clearer picture of their environmental impact. For instance, Scope 3 emissions - which cover emissions from purchased goods and services - are vital for compliance with GHGP and ISO 14064. These can be calculated using supplier-provided data or industry averages.

Energy efficiency is another key factor, measured by total energy consumption (in kWh) and the percentage of energy derived from renewable sources. For industries like manufacturing or agriculture, waste generation and water usage are equally important. Metrics here include total waste produced (in tonnes), recycling rates, and water withdrawal versus replenishment volumes. For businesses subject to SECR or UK SRS, these metrics are essential for reporting Scope 3 emissions and tracking progress toward net-zero goals.

Social Metrics

Social metrics evaluate how suppliers treat their workforce and uphold ethical labour practices. Labour standards compliance ensures fair wages and safe working conditions. A recent example underscores its importance: in early 2024, Volkswagen faced a supply chain issue when U.S. Customs detained vehicles due to a sub-component allegedly sourced from a supplier using forced labour. The company had to replace the part at the port, illustrating the financial and reputational risks of neglecting Tier 2 supplier ESG oversight.

Metrics on diversity and inclusion focus on gender and ethnic representation across all levels of the workforce, including leadership. This includes tracking the gender pay gap, the percentage of women and minorities in senior roles, and employee turnover rates. Employee wellbeing is also critical and can be assessed through TRIR (Total Recordable Incident Rate) and human rights reports. Frameworks like CSRD mandate such disclosures, making these metrics essential for demonstrating ethical supplier practices and minimising supply chain disruptions.

Governance Metrics

Governance metrics delve into the ethical standards and transparency of suppliers. Anti-corruption policies are a top priority, often measured by the percentage of supplier employees completing anti-corruption training and the number of reported compliance violations. Another key area is board diversity, which tracks the percentage of independent directors and the representation of women and minorities on supplier boards.

Transparency is a recurring theme here, with metrics like executive compensation disclosures, whistleblower policies, and adherence to regulatory standards. These governance metrics play a crucial role in ensuring supplier integrity. For firms advising clients on Scope 3 emissions, they help identify high-risk suppliers and ensure ESG data is audit-ready.

Frameworks and Standards for Supplier ESG Assessments

Choosing the right ESG framework depends on factors like industry specifics, stakeholder needs, and regulatory requirements. Frameworks outline what needs to be reported, while standards explain how to report it. For accountants, understanding this distinction is vital when guiding clients on the best approach to take.

Below is a breakdown of the key frameworks shaping supplier ESG reporting.

Common Frameworks Overview

The Global Reporting Initiative (GRI) is the most widely adopted framework globally, with an 81% adoption rate in the Asia Pacific region. GRI emphasises a company’s environmental, social, and economic impact, making it suitable for organisations with diverse stakeholders. It requires both qualitative and quantitative metrics, offering a comprehensive view of ESG responsibilities.

The Sustainability Accounting Standards Board (SASB) takes a different approach, focusing on financially material ESG issues across 77 industries. This framework is particularly relevant for clients targeting investors. SASB’s Materiality Finder tool helps identify industry-specific financial drivers.

For climate-specific reporting, the Task Force on Climate-related Financial Disclosures (TCFD) is indispensable. As regulatory mandates grow, TCFD has become central to climate reporting. It focuses on governance, strategy, risk management, and metrics related to climate risks and opportunities.

In the UK, Streamlined Energy and Carbon Reporting (SECR) is mandatory for large organisations. It requires disclosures on energy consumption, greenhouse gas emissions (Scope 1 and 2), and energy efficiency measures, which must be included in annual reports. Meanwhile, the ISSB standards (IFRS S1 and S2) provide a global baseline for sustainability-related financial disclosures, aligning closely with TCFD.

The GHG Protocol is the go-to method for accounting for value chain (Scope 3) emissions. It breaks down Scope 3 emissions into 15 distinct categories, such as purchased goods, business travel, and end-of-life treatment of products. For supplier assessments, Category 1 (purchased goods and services) often accounts for the largest share of emissions.

This summary provides a foundation for comparing these frameworks side by side.

Framework Comparison

The table below highlights the focus, data requirements, and reporting frequency for each framework or standard:

Framework/Standard | Focus Areas | Data Requirements | Reporting Frequency |

|---|---|---|---|

GRI | Economic, environmental, and social impacts | Qualitative and quantitative metrics | Annual |

SASB | Industry-specific financial materiality | 77 sets of industry-specific KPIs | Annual |

TCFD | Climate-related financial risks/opportunities | Governance, strategy, risk management, metrics | Annual |

ISSB (IFRS S1/S2) | Global financial market disclosures | Sustainability and climate-related financial data | Annual |

SECR (UK) | Energy use and carbon emissions | GHG emissions (Scope 1 & 2), energy efficiency measures | Annual (with financial report) |

GHG Protocol | Greenhouse gas accounting (Scopes 1, 2, 3) | Activity-based or spend-based emission factors | Annual |

When advising clients, begin by determining materiality. Tools like SASB’s Materiality Finder can help, especially for clients focused on investors (who often prefer SASB or ISSB) versus broader stakeholders (who may lean towards GRI). For UK-based clients, compliance with SECR is mandatory for large organisations, while voluntary reporters might consider aligning with ISSB to stay ahead of future requirements. Platforms such as neoeco simplify the process by mapping transactions to recognised emissions categories under frameworks like the GHG Protocol, ISO 14064, and SECR, ensuring accurate and audit-ready reporting.

How to Implement Supplier ESG Metrics

To effectively implement supplier ESG (Environmental, Social, and Governance) metrics, you need a structured approach that ties sustainability data directly to your clients' financial systems. The aim is to create a process that is precise, easy to audit, and sustainable over the long term - all without adding unnecessary manual work.

Data Collection and Integration

The most trustworthy data comes from financial transactions. By integrating directly with accounting software such as Xero, Sage, or QuickBooks, you can anchor sustainability reporting in verifiable financial records. This ensures ESG data is seamlessly linked to financial ledgers, making reports audit-ready.

Start by mapping financial transactions to recognised emissions categories. For Scope 3 emissions, AI-driven tools can automatically align supplier spending with relevant carbon data points and Life Cycle Assessment (LCA) categories. Platforms like neoeco simplify this by embedding these capabilities directly into the financial ledger. They automate the mapping of transactions to frameworks like GHGP, ISO 14064, and SECR. For businesses with complex supply chains, this level of automation is essential - check out this guide on managing Scope 3 emissions for more details.

If suppliers provide their own ESG data, structured questionnaires or audits can be used to collect key metrics. These could include environmental data (e.g., carbon emissions, waste), social metrics (e.g., labour practices, diversity), and governance measures (e.g., transparency, compliance). Store all evidence in a centralised repository to simplify audits and demonstrate a methodical approach.

Once you have robust data collection in place, the next step is setting up a system for ongoing monitoring.

Setting Up a Monitoring System

With accurate data at hand, the focus shifts to continuous monitoring. Start by segmenting suppliers based on their material impact. Tools like SASB's Materiality Finder can help identify which suppliers or sectors require the most attention. For instance, high-impact suppliers in industries like manufacturing or logistics should take precedence over low-impact ones, such as office supplies.

Create a baseline by compiling existing data to establish a snapshot of current performance. This serves as the starting point for tracking improvements. Set SMART goals - specific, measurable, achievable, realistic, and timely - and divide objectives into two categories: "Maintain" for high-performing areas and "Improve" for weaker ones. Real-time dashboards can then provide insights, such as emissions trends and supplier risk scores, allowing clients to track progress without relying on manual reporting cycles.

Preparing for Audits

Once a monitoring system is in place, focus on ensuring audit readiness. This involves maintaining well-organised, secure documentation that supports a clear audit trail. Store all compliance-related materials - such as supplier questionnaires, audit reports, and policy documents - in a centralised hub. Providing direct access for auditors eliminates the need for endless email threads and ensures transparency.

Specialised platforms can streamline this process with automated audit controls. For example, neoeco offers audit-ready reports that comply with ISO 14064 and SECR standards. Their live checklist highlights what’s complete, missing, or ready for review, ensuring alignment with frameworks like ISSB reporting requirements. This makes it easier for clients to prepare for assurance engagements under standards such as ISSA 5000.

Feature | Manual Methods | Specialised Platforms (e.g., neoeco) |

|---|---|---|

Data Source | Manual entry from various sources | Direct integration with financial ledgers |

Accuracy | Prone to human error and version control issues | High accuracy through automated transaction matching |

Audit Readiness | Requires extensive manual preparation | Automated audit controls with secure evidence access |

Compliance | Manual updates for new standards | Automatic updates for frameworks like ISSB, SECR, and CSRD |

Common Challenges and Solutions

To effectively manage supplier ESG metrics, it's crucial to address three key challenges: data gaps, supplier resistance, and the complexities of Scope 3 emissions tracking. These hurdles can hinder progress, but with the right strategies and tools, they can be navigated successfully.

Dealing with Data Gaps and Inaccuracies

One of the biggest obstacles in tracking ESG metrics is inconsistent reporting. Suppliers often rely on different frameworks - some might use the GHGP framework, while others adhere to local standards. Additionally, organisations frequently lack data on areas like community initiatives, employee wellbeing, and local engagement efforts.

To tackle this, start by establishing a baseline and focusing on suppliers with the highest impact. Tools like neoeco can help automate transaction mapping to recognised emissions categories, ensuring you work with reliable, finance-grade data from the beginning. As the British Business Bank explains:

"Accurate emissions measurement is the cornerstone of any strategy to reduce your environmental impact. Start with reliable baseline data - inaccurate measurements can derail progress."

Once data gaps are addressed, the next challenge involves overcoming supplier reluctance to share ESG information.

Overcoming Supplier Resistance

Suppliers may hesitate to provide ESG data, often due to concerns about resource demands or potential scrutiny. However, demonstrating the benefits of ESG compliance can help ease these concerns. For instance, two-thirds of investors now consider ESG performance in their decision-making, and over 75% of customers prefer to buy from companies that prioritise ESG issues.

To build trust and cooperation, engage suppliers directly through interviews and discussions, incorporating their feedback into your ESG strategy. When suppliers see that robust ESG reporting can increase their appeal to both investors and customers, their resistance often diminishes.

Simplifying Scope 3 Emissions Tracking

Even with supplier engagement, tracking Scope 3 emissions remains a daunting task. These emissions, which can account for 70–90% of an organisation's total carbon footprint, are particularly challenging to monitor when supplier data is incomplete or inconsistent.

To simplify this process, adopt the GHG Protocol's hybrid method for categories like "Purchased Goods and Services." This method combines supplier-specific data with secondary industry averages to address gaps in primary data. Standardising supplier requests using globally recognised methods can also improve consistency. Platforms like neoeco further streamline the process by automating mapping to Scope 3 categories, ensuring audit-ready data with minimal manual effort.

Feature | Manual Spreadsheets | Specialised Platforms (e.g., neoeco) |

|---|---|---|

Data Source | Manual entry from various sources | Direct integration with financial ledgers |

Automation | Low (manual entry/calculation) | High (automated transaction mapping) |

Accuracy | Prone to human error | High accuracy via robust methodologies |

Audit Readiness | Requires extensive manual preparation | Automated audit controls and secure access |

Compliance | Manual updates required | Automatic updates for regulatory frameworks |

Conclusion

Supplier ESG metrics play a critical role in meeting regulations, attracting investors, and strengthening supply chains. With two-thirds of investors factoring ESG performance into their decisions and 53% of workers considering sustainability when selecting employers, the importance of tracking these metrics is undeniable.

For accountants, this presents both challenges and opportunities. Clients require precise, audit-ready data that integrates seamlessly with their financial reporting systems. While the frameworks outlined earlier provide a roadmap, the key to success lies in effectively integrating ESG data into existing processes. The integration strategies discussed earlier form the backbone of this effort.

Start by establishing a baseline using financial data and setting SMART goals - Specific, Measurable, Achievable, Realistic, and Timely - to drive immediate progress. Prioritise materiality by identifying the most relevant metrics for your clients’ industries, using widely recognised frameworks like SASB or GRI. Once these steps are in place, accountants can confidently navigate the technical challenges ahead.

Tracking supplier ESG metrics, particularly for Scope 3 emissions, can seem daunting. However, tools like neoeco simplify the process by automating transaction mapping to standard emissions categories. This eliminates manual spreadsheet work and delivers finance-grade, audit-ready carbon data. By aligning sustainability reporting with financial systems from the outset, platforms like these ensure ESG tracking becomes a seamless part of your clients’ reporting strategies.

FAQs

How can businesses ensure supplier ESG data is accurate and reliable?

To make sure supplier ESG data is reliable, start by setting up a solid governance framework. Assign clear responsibilities to relevant teams - whether that's procurement, finance, or sustainability - and align your efforts with recognised standards like the GHG Protocol's Scope 3 guidance. Engage suppliers early in the process and request primary data (specific figures based on actual activities) whenever possible. This type of data is far more dependable and ready for audits compared to secondary estimates. For smaller suppliers or those that are harder to reach, secondary data can serve as a starting point but should be replaced with primary data as relationships and processes mature.

Equally important is thorough documentation and verification. Keep a detailed audit trail that includes information on data sources, dates, and methodologies. Cross-check this information with supplier reports or certifications to ensure accuracy. Automating these processes with sustainability accounting software can also help reduce manual errors, align emissions data with recognised frameworks, and generate reports that are ready for audits. By integrating strong governance practices, fostering supplier collaboration, and leveraging automation tools, businesses can greatly enhance the reliability and trustworthiness of their ESG metrics.

What are the benefits of using specialised platforms for ESG reporting?

Specialised ESG reporting platforms bring a host of benefits to accounting firms, primarily by automating intricate processes and ensuring alignment with ever-changing standards. These platforms can directly connect with a client’s financial ledger, mapping transactions to recognised emissions frameworks such as GHGP, ISO 14064, and UK SECR. This eliminates the hassle of managing manual spreadsheets, saving time while boosting accuracy and traceability.

Equipped with features like audit-ready reporting and simplified compliance checks, these platforms transform raw financial data into dependable, finance-grade ESG metrics. This not only speeds up reporting cycles and minimises the chances of errors but also provides a solid foundation for sustainability claims. Such capabilities help build stakeholder trust and position accounting firms as reliable advisors in a world that increasingly values transparent ESG data.

By leveraging these tools, firms can deliver carbon accounting and sustainability services with greater efficiency, professionalism, and profitability - meeting the expectations of both regulators and clients alike.

How can companies address supplier resistance to sharing ESG data?

To overcome supplier resistance, businesses should treat ESG data collection as a well-organised, collaborative effort instead of a last-minute request. Begin with internal planning - identify key departments like procurement and sustainability to spearhead the initiative, align it with existing programmes, and set up a clear system for managing data. When reaching out to suppliers, be transparent about why the data is needed, how it will be used, and what’s in it for them. Benefits like enhanced market reputation or access to green contracts can make participation more appealing.

To ease the process, provide straightforward templates, offer training sessions, and set achievable deadlines. For suppliers who are reluctant, consider starting with secondary, industry-average data to create a basic benchmark. Then, focus on engaging suppliers with the greatest impact for more detailed insights. Offering incentives such as extended contracts, co-branding opportunities, or small financial rewards can also encourage cooperation.

Leveraging automation tools like neoeco can make the process much smoother. These tools map financial transactions directly to recognised emissions categories, cutting out the need for manual spreadsheets. This not only improves data accuracy but also reduces the workload for suppliers. Over time, this approach fosters trust and helps build a dependable ESG dataset for the supply chain.