UK SRS Scope 3 Rules: What Accountants Should Know

Jan 29, 2026

UK SRS makes material Scope 3 reporting mandatory with phased relief from 2026–27; accountants must handle materiality, supplier data and audit‑ready evidence.

The UK’s new Sustainability Reporting Standards (UK SRS) make Scope 3 emissions reporting mandatory for large organisations starting in 2026. This marks a major shift from previous rules, where Scope 3 reporting was optional under SECR (Streamlined Energy and Carbon Reporting). Scope 3 emissions include indirect emissions across a company’s value chain, such as those from suppliers, business travel, and product use, and often represent the largest share of a company’s carbon footprint.

Here’s what you need to know:

Scope 3 is now mandatory for material categories, but businesses can defer reporting these emissions until their second year under transitional relief rules.

Materiality matters: Companies only need to report on categories that significantly impact investor decisions or reveal key risks.

Data collection is challenging: Accurate Scope 3 reporting relies on third-party data, requiring collaboration with suppliers and advanced tools for tracking emissions.

Phased implementation: Reporting starts with Scope 1 and 2 emissions in 2026–27, adds Scope 3 in 2027–28, and expands to broader sustainability risks by 2028–29.

For accountants, this means a greater focus on analysing value chain emissions, ensuring data accuracy, and documenting materiality evidence for audits. Early preparation and the use of digital tools can simplify compliance and improve reporting quality.

Big Changes Ahead: What UK SRS Means for Business Sustainability Reporting

What Are Scope 3 Emissions Under UK SRS?

Under the UK Sustainability Reporting Standards (UK SRS), Scope 3 emissions refer to indirect emissions occurring across a company’s value chain, excluding those covered under Scope 2. These emissions span activities like supplier manufacturing, employee commuting, and the use or disposal of sold products. The Greenhouse Gas (GHG) Protocol divides Scope 3 into 15 categories that cover the entire value chain: purchased goods and services, capital goods, fuel- and energy-related activities, upstream transportation and distribution, waste generated in operations, business travel, employee commuting, upstream leased assets, downstream transportation and distribution, processing of sold products, use of sold products, end-of-life treatment of sold products, downstream leased assets, franchises, and investments. This categorisation helps UK businesses identify which of these areas are most relevant to their operations.

Scope 3 emissions present unique challenges because they depend heavily on third-party data. Unlike Scope 1 emissions (direct emissions from sources a company owns, like vehicles) or Scope 2 emissions (from purchased electricity), Scope 3 requires information from external sources such as suppliers, logistics providers, customers, and waste contractors. For many organisations, Scope 3 emissions make up the largest share of their carbon footprint. To address this, the UK SRS follows a materiality-based approach, requiring businesses to report only on the most relevant Scope 3 categories, instead of mandating disclosures across all 15.

Aligned with IFRS S2, UK SRS focuses on material Scope 3 categories - those that significantly influence investor decisions or highlight key risks, such as supply chain vulnerabilities or transition risks. For more guidance on tackling these emissions, check out our detailed Scope 3 emissions guide.

Main Scope 3 Categories for UK Businesses

Not every business will need to address all 15 Scope 3 categories. For instance:

Category 1 (Purchased goods and services): Critical for service-based and financial firms.

Category 3 (Fuel- and energy-related activities): Relevant for logistics-heavy operations.

Category 6 (Business travel): Important for corporate and professional service sectors.

Category 5 (Waste generated in operations): A priority for manufacturing and food processing industries.

In financial services, Category 15 (Investments) often takes centre stage, as financed emissions can far outweigh operational emissions. Meanwhile, consumer goods manufacturers may need to focus on Category 11 (Use of sold products) and Category 12 (End-of-life treatment), especially for products with high energy consumption during use. Conducting a materiality screening can help businesses rank these categories by their relevance and pinpoint key emission hotspots.

How Materiality Affects Scope 3 Disclosures

A thorough double materiality assessment is essential for effective reporting. Businesses are required to disclose only those categories that materially impact investor decisions or reveal significant risks. This involves evaluating each category based on its emissions intensity and strategic importance - focusing on those that contribute the most to the overall carbon footprint or expose the company to transition risks or supply chain challenges.

Scope 3 Reporting Timelines and Transitional Reliefs

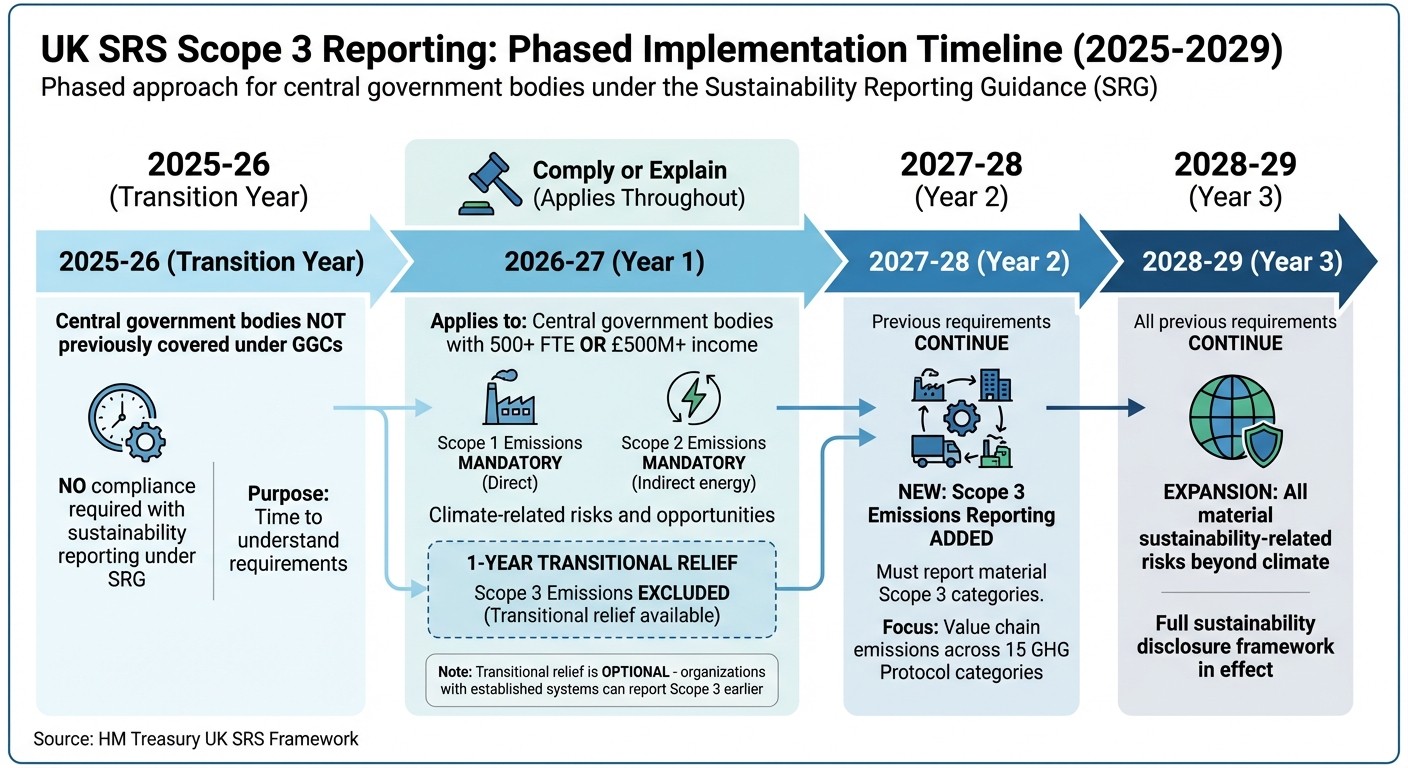

UK SRS Scope 3 Emissions Reporting Timeline and Phased Implementation 2026-2029

The UK SRS framework introduces a phased implementation to help businesses gradually develop their Scope 3 reporting capabilities. For the 2025–26 reporting period, central government bodies not previously covered under the Greening Government Commitments (GGCs) are not required to comply with sustainability reporting under the Sustainability Reporting Guidance (SRG). This transition year gives organisations time to understand the requirements before full compliance is expected.

Starting from 2026–27, central government bodies with more than 500 full-time employees (FTE) or over £500 million in income must either comply with the requirements or explain their non-compliance. Importantly, the framework offers a one-year transitional relief for Scope 3 emissions. This allows businesses to delay reporting value chain emissions until their second year of sustainability disclosures, focusing instead on delivering accurate data for Scope 1 and Scope 2 emissions in the first year.

"There is no minimum reporting requirement for Scope 3 emissions, but entities shall report related information where these are material." - HM Treasury

The transitional relief follows a clear sequence: Year 1 (2026–27) focuses on climate-related risks and opportunities, excluding Scope 3 emissions; Year 2 (2027–28) adds Scope 3 emissions into the reporting framework; and Year 3 (2028–29) expands to include all material sustainability-related risks beyond climate. This staged approach acknowledges the challenges of collecting accurate data from third-party suppliers using primary vs secondary data and provides accountants with the time needed to establish reliable processes for Scope 3 data collection. It also highlights the growing importance of accountants in auditing Scope 3 emissions with automated audit trails.

The transitional relief is optional. Organisations with established data systems can choose to report Scope 3 emissions earlier. For those opting to use the relief, the 'comply or explain' principle applies. If certain Scope 3 categories remain unreported by the deadline, organisations must provide specific reasons for the gaps, outline planned actions to address these issues, and set a clear timeline for achieving compliance.

Data Collection and Reporting Challenges for Scope 3

Scope 3 emissions can account for as much as 90% of a company's total carbon footprint, yet gathering accurate data remains a daunting task. Most companies rely on spend-based methods, which provide rough estimates rather than precise measurements. For accountants working to meet UK SRS requirements, collecting dependable data across the value chain is one of the toughest hurdles. A good starting point is to prioritise materiality by conducting a screening process. This involves mapping all 15 Scope 3 categories to pinpoint "hotspots" - areas with the highest emissions potential, such as waste from operations or fuel-related activities. Once these critical categories are identified, transitioning from generalised spend-based estimates to supplier-specific activity data can significantly enhance the accuracy and auditability of emissions reports.

Getting Emissions Data from Suppliers

One of the key steps in improving Scope 3 reporting is obtaining reliable data from suppliers. Start by focusing on suppliers with the largest environmental impact, identified during the materiality screening. Use tools like standardised questionnaires, shared emission-factor libraries, and incentives to encourage suppliers to share verifiable data. A practical example of this comes from Serious Waste Management Ltd, which, in November 2025, introduced a circular economy approach for disposing of fats, oils, and grease (FOG). By using recovery hubs, the company moved away from assumptions and instead relied on activity-based data to generate auditable CO₂-savings reports for Scope 3 disclosures.

To ensure the data's quality, evaluate it based on factors like how recent it is, its geographic relevance, its technological accuracy, and the strength of the supplier's internal controls. Digital tools can also play a vital role. Implementing systems like real-time metering, verified records, and digital mass-balance checks helps replace guesswork with measurable outcomes. David Corbett, Head of SHEQ & Operations at Metro Rod Ltd, highlighted the potential impact of such advancements:

"From our perspective in the drainage industry, having a reliable and environmentally responsible outlet for FOG waste would be a game-changer".

These improvements in data collection lay the groundwork for more efficient reporting methods, especially through automation.

Using Automation for Scope 3 Reporting

Automation offers a practical solution to the inefficiencies of manual data collection. Traditional methods often rely on cumbersome processes, but tools like neoeco can transform the way companies manage Scope 3 reporting. By automatically mapping financial transactions to recognised emissions categories under frameworks like GHGP, ISO 14064, and UK SRS, neoeco streamlines the process. The platform integrates directly with financial software such as Xero, Sage, and QuickBooks, eliminating the need for manual data conversions and ensuring audit-ready, finance-grade accuracy.

Neoeco centralises all client data, applies transaction-level mapping to capture impacts across the value chain, and includes features like evidence hubs, live checklists, and secure auditor access. By doing so, it removes the administrative burden of spreadsheets and simplifies compliance, making Scope 3 reporting far more manageable.

Accountants' Role in Scope 3 Audit and Assurance

After overcoming the hurdles of data collection and reporting, accountants now face the critical task of ensuring Scope 3 data is ready for audit from the outset. This growing responsibility comes as the UK government, in its call for evidence on Scope 3 reporting, received 184 responses, with most stakeholders agreeing that the advantages of reporting outweigh the associated costs. Yet, with only 15% of companies currently reporting Scope 3 emissions, as highlighted in Deloitte's 2024 Sustainability Action Report, accountants must take the lead in establishing and maintaining rigorous controls.

Mark Lumsdon-Taylor, Partner and Head of ESG at MHA, underscored the importance of trust and leadership in this area:

"I think that, if accounting firms are not navigating and showing the transparency of their journey... then clients that we are tendering for... will challenge our credibility, because we should be leading the way."

To meet these growing expectations, accountants need to create strong evidence trails. This starts by documenting the data source for each Scope 3 category, following the hierarchy outlined in the GHG Protocol: prioritise supplier-specific activity data, use hybrid methods where necessary, and compare activity-based vs spend-based emission methods to determine the best approach. Supporting documentation - such as invoices, supplier questionnaires, emission-factor references, and any assumptions made - should be meticulously retained. Rachael Dagger, National ESG Manager at MHA, highlighted the importance of teamwork in this process:

"It is essential that whoever's collating the data has strong relationships with IT, finance, facilities, HR, marketing, etc – all of those central operations teams who are integral to getting that data collected accurately."

Beyond evidence gathering, aligning with established frameworks is essential. Accountants should ensure their clients' Scope 3 reporting aligns with standards such as the UK SRS, GHG Protocol, and ISO 14064. This alignment enhances consistency and defensibility, which in turn boosts audit credibility. For instance, since 2021, the UK government has mandated that suppliers bidding for contracts over £5 million publish Carbon Reduction Plans, covering five specific Scope 3 categories: business travel, employee commuting, waste, and upstream/downstream transportation.

To simplify this complex process, tools like neoeco offer valuable support. These tools centralise evidence - such as invoices, questionnaires, and emission factors - while providing secure auditor access and integrating directly with financial systems. This not only improves data accuracy but also ensures the documentation is audit-ready, streamlining the entire process.

UK SRS Scope 3 Rules vs SECR and CSRD

For accountants navigating the UK's changing carbon reporting rules, understanding how Scope 3 requirements vary across frameworks is crucial. The shift from SECR’s voluntary approach to the UK SRS’s mandatory disclosure marks a major change in how firms must guide their clients. Here’s a closer look at the differences between these frameworks and what they mean for accountants.

Under SECR (Streamlined Energy and Carbon Reporting), since April 2019, large companies meeting specific thresholds have been required to report Scope 1 and 2 emissions. However, Scope 3 reporting remains optional. This has allowed many organisations to avoid addressing emissions from their supply chains, keeping their focus on direct emissions.

The UK SRS (Sustainability Disclosure Standards) changes this approach. Based on IFRS S1 and S2, these standards make Scope 3 reporting mandatory for material impacts, though companies can defer this requirement for one year, starting from their second year of reporting. Expected to be available for voluntary adoption in early 2026, the UK SRS focuses on financial materiality - assessing risks that could influence a company’s financial position - and aligns with the ISSB’s global baseline. As the Department for Energy Security and Net Zero has stated, "some of the largest organisations in the UK are currently required to disclose their Scope 1 and Scope 2 emissions... but Scope 3 emissions remain largely voluntary". The UK SRS aims to address this gap.

Meanwhile, the EU’s CSRD (Corporate Sustainability Reporting Directive) takes a wider approach. It applies the concept of double materiality, evaluating both financial risks and environmental impacts. For UK firms operating in the EU, this means Scope 3 reporting becomes mandatory if it is deemed material under either perspective. The CSRD also introduces limited assurance requirements starting in 2024.

While both UK SRS and SECR focus on financial materiality, the CSRD’s double materiality approach requires a broader assessment. Accountants should start analysing their clients’ Scope 3 emissions now, using the GHG Protocol’s 15 categories to identify those with the most significant financial relevance. Tools like neoeco's Scope 3 solution can assist firms in prioritising these categories, ensuring clients are ready for the mandatory disclosures set to take effect by 2026.

Comparison Table: UK SRS vs SECR vs CSRD

Framework | Mandatory Scope 1 & 2 | Scope 3 Required | Reporting Timeline | Assurance Requirements |

|---|---|---|---|---|

UK SRS | Yes | Mandatory (after 1-year relief) | Phased (post-2026) | Voluntary (initially) |

SECR | Yes | Voluntary (Recommended) | Current compliance | Not mandatory |

CSRD | Yes | Mandatory (Double Materiality) | 2024 onwards (Large) | Mandatory (Limited/Reasonable) |

The key difference lies in how materiality is assessed. UK SRS and SECR centre on financial materiality, while CSRD requires a double materiality approach. This distinction will shape how accountants manage data collection, work with stakeholders, and develop disclosure strategies for each framework.

Key Takeaways for Accountants

Navigating the UK SRS Scope 3 rules may seem complex, but breaking it down into manageable steps can help accountants stay ahead. The framework introduces a phased approach to Scope 3 reporting, giving firms time to adapt. Here's how it works: Year 1 focuses on climate-related risks (excluding Scope 3), Year 2 incorporates Scope 3 emissions, and Year 3 broadens the scope to include all sustainability-related risks and opportunities.

Start by conducting a materiality screen of the 15 Scope 3 categories outlined by the GHG Protocol. Rank these categories based on their financial significance. This approach ensures resources are directed where they matter most, avoiding unnecessary effort on less impactful areas. Prioritise categories that could influence your client’s financial outcomes over the short, medium, or long term.

Once materiality is clear, shift your focus to gathering reliable, activity-based data. Move away from generic spend-based estimates and instead seek supplier-specific, activity-driven data, which is the most accurate under the GHG Protocol's four calculation methods. Tools like real-time metering and digital mass-balance checks can provide an auditable trail, ensuring compliance with future assurance standards.

Technology is a game-changer for Scope 3 reporting. Platforms like neoeco integrate seamlessly with accounting software such as Xero, Sage, or QuickBooks. They automatically map transactions to recognised emissions categories under GHGP, ISO 14064, and UK SRS, providing finance-grade carbon data and audit-ready reports that align with the phased reporting timeline.

Feedback from the UK government's call for evidence - based on 184 responses - revealed that most investors and stakeholders see the benefits of Scope 3 disclosure as outweighing the costs. Firms that begin engaging suppliers and setting up robust data systems now will be well-positioned for voluntary adoption in early 2026 and mandatory compliance for listed and economically significant entities thereafter.

These steps highlight your critical role in helping clients achieve accurate, compliant Scope 3 reporting as the regulatory environment continues to evolve.

FAQs

What are the main challenges in gathering accurate Scope 3 emissions data?

Gathering reliable Scope 3 emissions data can be a tough challenge for organisations. One of the biggest hurdles is securing dependable information from suppliers and other partners throughout the value chain. Often, companies encounter inconsistent data quality, a lack of primary data, and fragmented systems, all of which make it tricky to create a complete picture of emissions.

On top of that, the lack of standardised methodologies and the sheer complexity of supply chains can lead to errors and discrepancies in estimations. Organisations also have to juggle limited resources while trying to align their reporting with frameworks like the GHG Protocol or UK SRS standards. With regulations evolving and mandatory disclosures becoming more likely, improving the accuracy and consistency of data is crucial - not just for compliance, but also for meeting stakeholder expectations.

What are the key reporting timelines under the UK SRS phased implementation?

The phased rollout of the UK SRS brings in new sustainability reporting requirements, with full compliance set for accounting periods starting on or after 1 January 2026. Organisations should begin preparations early to stay on track and meet these deadlines.

This gradual timeline gives businesses the opportunity to adjust to the new standards while establishing reliable systems for tracking and reporting Scope 3 emissions data and other sustainability metrics. Starting early and using effective tools, like neoeco, can simplify the process and ensure reports are ready for audits.

Why is identifying material emissions important for Scope 3 reporting?

Identifying material emissions plays a critical role in Scope 3 reporting, allowing organisations to zero in on the most impactful sources of indirect emissions. Frameworks like the GHG Protocol and the UK’s SECR encourage companies to prioritise categories that contribute significantly to their overall carbon footprint - think emissions from suppliers or across the value chain. This approach ensures reporting efforts are both targeted and efficient.

By focusing on material emissions, companies can streamline data collection while improving transparency. This, in turn, helps build trust with stakeholders by emphasising the areas that matter most. With UK regulations increasingly requiring detailed disclosures, grasping the concept of materiality is becoming essential. It not only aids compliance but also ensures resources are managed wisely and sustainability goals align seamlessly with broader business strategies.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.