US SEC Materiality: Key Differences from UK SRS

Jan 30, 2026

Compare SEC and UK SRS materiality rules for climate and sustainability reporting: thresholds, Scope 1-3, assurance and filing deadlines.

US SEC and UK SRS materiality standards differ significantly, impacting how businesses disclose financial and sustainability information. Here's a quick breakdown:

US SEC: Uses fixed numerical thresholds (e.g., 1% of pretax income) to determine materiality, focusing on investors' needs. Climate-related risks like physical and transition risks must be disclosed, with strict deadlines and mandatory third-party assurance for emissions data.

UK SRS: Relies on judgement-based assessments aligned with ISSB standards (IFRS S1/S2). Disclosure covers governance, strategy, risk management, and emissions, with a "comply or explain" approach. Integration of financial and sustainability reporting is required.

Key Differences

Materiality Definition: SEC uses investor-focused thresholds; UK SRS applies principles and broader judgement.

Emissions Reporting: SEC mandates Scope 1 and 2 (if material); UK SRS makes Scope 1 and 2 mandatory and includes Scope 3 if relevant.

Deadlines: SEC aligns with Form 10-K filings; UK SRS ties to annual financial reporting.

Assurance: SEC requires phased third-party assurance; UK SRS is still developing its oversight framework.

These frameworks reflect differing priorities and methods, posing challenges for firms operating in both regions. Understanding these systems helps ensure compliance and accurate reporting.

US SEC Materiality: How It Works

How US SEC Defines Materiality

The SEC follows the U.S. Supreme Court's materiality test: an omission is considered material if a reasonable investor would find it important when making decisions. Often called the "total mix" test, this standard means information is material if its absence would significantly alter the overall mix of information available.

Unlike frameworks that prioritise immediate impacts, the SEC requires companies to evaluate both short-term and long-term effects on their strategy, operational results, and financial condition when determining materiality. This investor-focused approach suggests that even risks, such as climate-related issues, that could influence investment decisions far into the future may need to be disclosed. This framework underpins the SEC’s detailed disclosure requirements.

What Must Be Disclosed

Companies are required to classify material climate-related risks into two categories: physical risks (e.g., extreme weather events) and transition risks (e.g., regulatory changes). They must also explain how these risks impact their business strategies.

For financial statements, the SEC uses bright-line thresholds to determine disclosure requirements. For instance:

Losses or expenses from severe weather must be disclosed if they meet or exceed 1% of the absolute value of pretax income or loss, with a minimum threshold of £100,000.

Capitalised costs related to severe weather require disclosure if they meet or exceed 1% of the absolute value of stockholders' equity or deficit, with a minimum threshold of £500,000.

Additionally, large accelerated filers and accelerated filers must disclose Scope 1 and Scope 2 greenhouse gas emissions if these are deemed material. These rules aim to provide a clearer picture of climate-related risks.

Governance and Compliance Deadlines

The SEC also requires companies to disclose how their board and management oversee climate-related risks. This includes identifying the board committee responsible, detailing how the board is kept informed, and describing management's expertise in handling these risks. These governance disclosures must appear in registration statements and annual reports, such as Form 10-K.

Large accelerated filers are expected to start providing certain climate-related disclosures for the fiscal year ending 31 December 2025. Greenhouse gas emissions data must be submitted by the deadline for Form 10-Q for the second fiscal quarter. Although the SEC paused implementation in April 2024 pending judicial review, it has stated its intent to "vigorously defend" the rules, so firms should continue preparing for a 2025 rollout.

Financial statement disclosures will require auditing and must be included in management's assessment of internal control over financial reporting (ICFR). Over time, both accelerated and large accelerated filers will need to secure independent third-party assurance for material Scope 1 and Scope 2 emissions, beginning with limited assurance and eventually moving to reasonable assurance.

The SEC's final rules on climate-related disclosures are set to have a broad impact on registrants.

UK SRS: How It Works

How UK SRS Defines Materiality

The UK Sustainability Reporting Standards (UK SRS), which align with ISSB standards (IFRS S1 and IFRS S2), define materiality as information that, if omitted or misstated, could influence decisions made by primary users. This approach, known as single materiality, focuses solely on financial impacts - similar to the SEC's investor-focused standard. However, UK SRS places a strong emphasis on integrating financial and sustainability reporting, requiring both to be published simultaneously to enable direct comparison.

Mark Carney, former Governor of the Bank of England, explained the importance of this integration:

The right information allows investors to assess which companies and assets are most exposed to climate-related risks and which are best placed to seize the opportunities from a low-carbon economy.

What Must Be Disclosed

Under UK SRS, companies are required to provide detailed disclosures across four key areas: governance, strategy, risk management, and metrics and targets. These disclosures must cover board oversight, the business impact of sustainability issues, and progress against established targets.

Specific requirements include:

Scope 1 and Scope 2 emissions: Mandatory for all entities.

Scope 3 emissions: Required only if deemed material.

Financial institutions: Additional reporting on financed emissions, including methodologies and data limitations.

Transition plans: Companies must outline their strategies for moving towards a low-carbon economy, including any material expenditures linked to these plans.

The framework operates on a "comply or explain" basis, where companies must either meet the disclosure requirements or provide clear reasons and timelines for non-compliance. For UK central government bodies, reporting becomes mandatory if they meet thresholds of over 500 full-time equivalent staff or £500 million in operating income or grant funding.

To simplify compliance, firms managing clients subject to UK SRS can use platforms like neoeco. These platforms automatically map financial transactions to recognised emission categories, such as those outlined by GHGP, ISO 14064, and UK SRS.

Governance and Compliance Deadlines

UK central government entities that meet the reporting thresholds must comply starting from 2025–26, with other organisations following in 2026–27. On 25 June 2025, the UK government released three consultations addressing transition planning, UK SRS, and assurance oversight.

The UK has opted for a "climate-first" approach, prioritising climate-related disclosures (UK SRS S2) before expanding to other sustainability topics. This phased rollout aims to give organisations time to develop their capabilities and improve the quality of their data. However, concerns about potential delays have been raised. The ICAEW has highlighted the risk of the UK falling behind other countries, stating:

the lack of visibility on the timing of UK SRS implementation is contributing to concern that the UK is falling behind its international peers, undermining its position as a global leader in corporate reporting and sustainable finance.

Even organisations below the reporting threshold should involve their audit committees to determine whether sustainability information is material to their specific context. As UK SRS continues to evolve, accounting firms will need to assist clients in navigating multiple frameworks, such as SECR and TCFD, while ensuring alignment with CSRD and ISSB reporting standards. Unlike the US SEC framework, which applies fixed thresholds, the UK SRS adopts a more phased and adaptable approach.

Webinar: Materiality and the TCFD

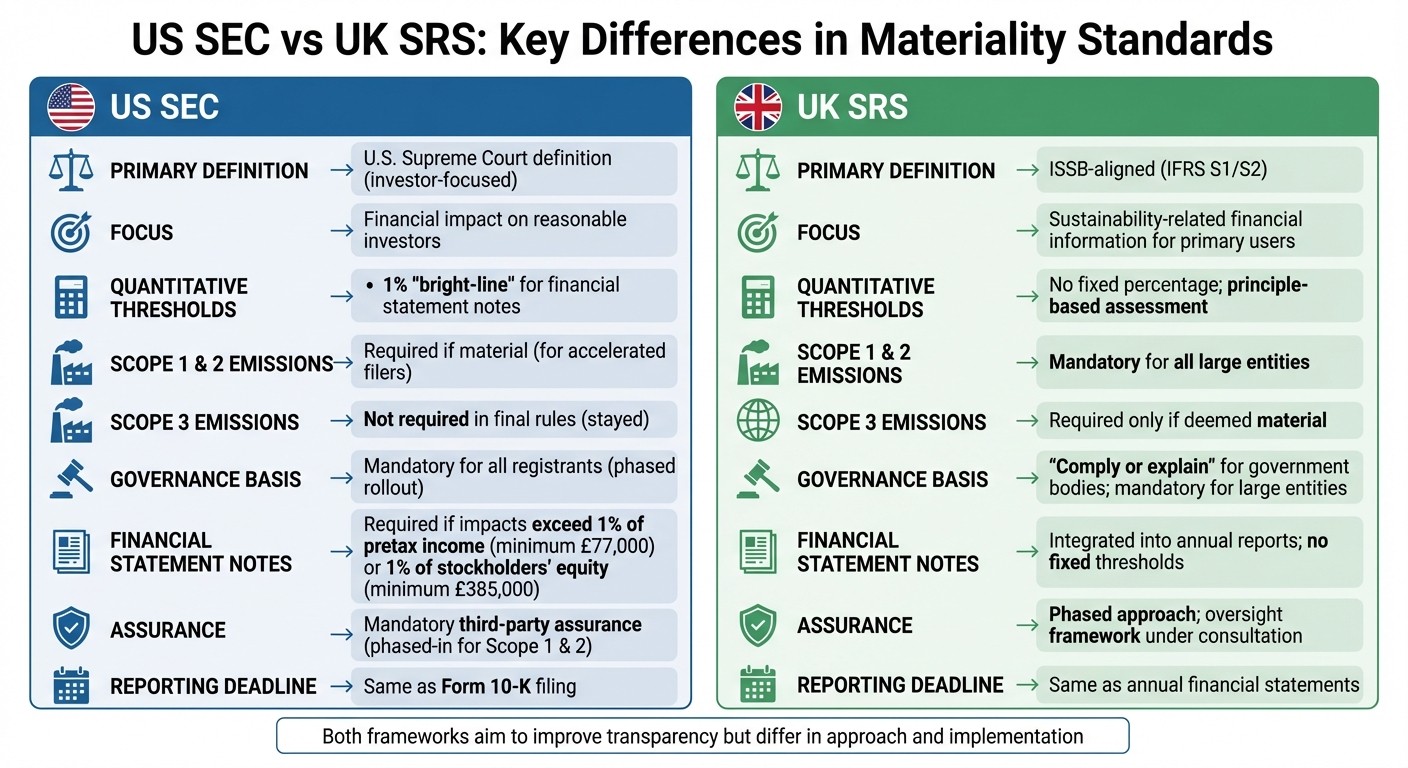

US SEC vs UK SRS: Main Differences

US SEC vs UK SRS Materiality Standards Comparison

Side-by-Side Comparison Table

Both frameworks aim to improve transparency around sustainability risks, but they differ significantly in their approaches to materiality, disclosure thresholds, and governance structures.

Feature | US SEC Materiality | UK SRS Materiality |

|---|---|---|

Primary Definition | U.S. Supreme Court definition (investor-focused) | ISSB-aligned (IFRS S1/S2) |

Focus | Financial impact on reasonable investors | Sustainability-related financial information for primary users |

Quantitative Thresholds | 1% "bright-line" for financial statement notes | No fixed percentage; principle-based assessment |

Scope 1 & 2 Emissions | Required if material (for accelerated filers) | Mandatory for all large entities |

Scope 3 Emissions | Not required in final rules (stayed) | Required only if deemed material |

Governance Basis | Mandatory for all registrants (phased rollout) | "Comply or explain" for government bodies; mandatory for large entities |

Financial Statement Notes | Required if impacts exceed 1% of pretax income (minimum £77,000) or 1% of stockholders' equity (minimum £385,000) | Integrated into annual reports; no fixed thresholds |

Assurance | Mandatory third-party assurance (phased-in for Scope 1 & 2) | Phased approach; oversight framework under consultation |

Reporting Deadline | Same as Form 10‑K filing | Same as annual financial statements |

These differences highlight how the two frameworks influence both investor decision-making and the challenges accountants face when navigating these requirements.

Investor Focus vs Financial Materiality

The SEC framework uses a definition grounded in U.S. Supreme Court rulings:

a matter is material if there is a substantial likelihood that a reasonable investor would consider it important when determining whether to buy or sell securities or how to vote, or such a reasonable investor would view omission of the disclosure as having significantly altered the total mix of information made available.

This sets a clear, investor-focused standard.

On the other hand, the UK SRS takes a broader approach aligned with ISSB standards. It mandates disclosure of sustainability-related financial information that could affect decisions by primary users, including not just equity investors but also lenders and creditors. The SEC’s rigid 1% thresholds for financial disclosures contrast with the UK’s principle-based assessments, which rely on professional judgement rather than fixed benchmarks.

What This Means for Accountants

The SEC’s fixed thresholds present a stark contrast to the UK’s flexible, judgement-based system. Accountants working across both jurisdictions must navigate these differences carefully. For example, under the SEC rules, severe weather impacts must be disclosed if they meet or exceed 1% of pretax income (with a minimum of £77,000). In the UK, however, materiality is assessed on a case-by-case basis without set thresholds.

Accountants must also ensure sustainability data is tracked in detail to meet both frameworks. For UK SRS, this includes documented materiality assessments reviewed by Audit Committees. Tools like neoeco can simplify compliance by mapping financial transactions to recognised emissions categories under both systems, reducing the need for manual reconciliation.

Additionally, accountants need to stay informed about evolving deadlines and prepare clients for integrated reporting cycles, where sustainability data is published alongside financial statements. This dual focus on financial and sustainability reporting requires a proactive approach to ensure compliance across jurisdictions.

What This Means for Accounting Firms

Managing Clients in Multiple Jurisdictions

For accounting firms working with clients subject to both SEC and UK SRS regulations, the operational hurdles are anything but simple. The SEC's strict numerical thresholds for climate-related expenditures demand highly detailed tracking systems. Firms must be able to isolate and quantify these expenditures with a level of precision that goes beyond standard data tracking methods.

On the other hand, the UK SRS introduces a unique challenge by requiring firms to restate prior-year disclosures when updated Scope 3 or financed emissions data become available. This stands in contrast to traditional financial reporting, where retrospective adjustments to estimates are rare. The ICAEW has flagged this issue, highlighting the additional strain it places on accounting teams.

Another layer of complexity comes from the differing boundaries used for emissions reporting. While a client’s greenhouse gas emissions are often calculated based on operational control, this boundary may not align with the one used in consolidated financial statements. Such discrepancies mean firms must maintain meticulous documentation to satisfy third-party assurance requirements. These challenges underscore the need for a strategic and well-coordinated approach.

How Firms Can Respond

To navigate these complexities, accounting firms need to rethink their approach. One way forward is by forming cross-functional teams that bring together expertise from finance, legal, and sustainability disciplines. These teams can help ensure that SEC filings and UK sustainability reports align, minimising the risk of conflicting disclosures. Additionally, firms should establish robust Disclosure Controls and Procedures (DCPs) specifically designed for climate-related data. This process should mirror the level of diligence seen in Sarbanes-Oxley certifications.

Technology also has a pivotal role to play. Tools like neoeco simplify the process by automating the mapping of financial transactions to recognised emissions categories under standards like GHGP, ISO 14064, SECR, and UK SRS. By eliminating manual data conversions, these platforms generate audit-ready reports for both regulatory frameworks. For firms juggling compliance across multiple jurisdictions, such automation not only reduces duplication of effort but also frees up resources for advisory services - allowing them to grow their sustainability offerings more effectively.

Conclusion

The US SEC and UK SRS frameworks approach materiality from very different angles. The SEC zeroes in on climate-related risks, using strict numerical thresholds. For example, it mandates disclosure of severe weather-related expenses exceeding 1% of pretax income or capitalised costs over 1% of stockholders' equity. On the other hand, the UK SRS, aligned with ISSB Standards S1 and S2, takes a broader view, addressing sustainability-related financial information. This requires organizations to align ESG data with ISSB standards to ensure transparency. This framework aims to create a global reporting baseline already being adopted by 17 jurisdictions, including Australia and Hong Kong.

These contrasting frameworks pose real challenges for accountants managing transatlantic reporting. A deep understanding of both systems is essential, especially for clients operating internationally. They require consistent and defensible disclosures that meet the expectations of regulators in both regions. Meanwhile, concerns have been raised about delays in the UK's implementation of the SRS.

Relying on manual processes for compliance can increase risks. Tools like neoeco help streamline the process by automating transaction mapping to recognised emissions categories under frameworks like GHGP, ISO 14064, SECR, and UK SRS. This not only produces audit-ready reports for both frameworks but also allows accountants to focus on more strategic advisory roles.

FAQs

What are the key challenges for companies complying with both US SEC and UK SRS materiality standards?

Companies often grapple with the contrasting priorities of the US SEC and UK SRS materiality standards. The US SEC leans heavily on financial materiality, requiring disclosures that focus on quantitative data - especially around climate-related risks and financial impacts that could affect investor decisions. On the other hand, the UK SRS takes a broader approach, addressing sustainability through environmental, social, and governance (ESG) factors, with a strong emphasis on transparency and engaging with a wide range of stakeholders.

These differences create a challenge for businesses trying to balance varying definitions of materiality, data requirements, and reporting scopes. Developing processes that align with both frameworks - without duplicating work or introducing inconsistencies - can demand significant resources. Companies operating in both jurisdictions need efficient systems that not only streamline compliance but also ensure their disclosures resonate with both investors and other stakeholders.

What are the key differences between the UK SRS's 'comply or explain' approach and the US SEC's disclosure requirements?

The UK SRS operates on a 'comply or explain' framework. This principles-based approach gives companies the option to either adhere to specific standards or provide a detailed explanation for any areas of non-compliance. The focus here is on transparency and adaptability, allowing organisations to shape their reporting in a way that aligns with their individual circumstances while still meeting disclosure requirements.

On the other hand, the US SEC adopts a rules-based strategy. This mandates companies to follow strict, standardised guidelines covering material climate risks, governance, mitigation strategies, and targets. The goal is to create consistency and comparability across reports, leaving little room for interpretation or discretion.

In summary, the UK SRS leans towards flexibility and explanation, while the SEC emphasises strict adherence to rules to ensure uniformity and dependability in reporting.

Why does the US SEC require third-party assurance, while the UK SRS does not yet mandate it?

The US SEC requires third-party assurance to guarantee that climate-related disclosures are reliable, precise, and comparable. This step is crucial for helping investors make well-informed decisions. Independent verification not only strengthens confidence in the data but also minimises the chance of errors, meeting investor expectations for dependable reporting.

Meanwhile, the UK SRS framework is still refining its position on assurance. Its primary focus is on embedding sustainability data into existing reporting systems and aligning with standards like the GHGP and SECR. Although third-party assurance isn't yet a requirement, the framework emphasises delivering clear, audit-ready information as assurance practices continue to evolve.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.