Canada ESG Disclosure: Key 2025 Requirements

Dec 28, 2025

Overview of Canada’s CSDS 1 & 2 (from Jan 2025): voluntary, climate-first disclosures; Scope 1–2 required now, Scope 3 after a three‑year transition; align with financials.

Canada's ESG reporting landscape is evolving, with new standards introduced for 2025. Here's what you need to know:

New Standards: The Canadian Sustainability Standards Board (CSSB) launched CSDS 1 and CSDS 2, effective from 1 January 2025. These align with global ISSB frameworks (IFRS S1 and S2) and focus on financial materiality.

Voluntary Adoption: For now, these standards are optional for most organisations, but regulators like the CSA and OSFI are likely to make them mandatory soon.

Key Requirements: Companies must disclose climate-related risks, Scope 1 and 2 emissions immediately, and Scope 3 emissions after a three-year transition period. Transitioning to activity-based data can help ensure accuracy during this period. Sustainability disclosures must align with financial statements.

Transition Relief: Organisations can prioritise climate-related disclosures until 2028 and have extended timeframes for Scope 3 reporting and scenario analysis.

Current Obligations: Federally regulated financial institutions must comply with OSFI Guideline B-15, while diversity and anti-greenwashing rules apply under the CBCA and Competition Act.

The new framework challenges organisations to integrate sustainability into financial reporting, offering a clear path for aligning with global expectations while preparing for stricter regulations. Early adoption can streamline processes and improve investor confidence.

Embracing Canada's New Sustainability Disclosure Standards | Episode 131

Canadian Sustainability Disclosure Standards (CSDS) Explained

The Canadian Sustainability Disclosure Standards Board (CSSB) has introduced CSDS 1 and CSDS 2, creating a framework that aligns with the ISSB global baseline while addressing the specific needs of Canadian organisations. Based on IFRS S1 and S2, these standards allow Canadian entities to meet international capital market expectations.

The framework revolves around four key pillars: Governance, Strategy, Risk Management, and Metrics and Targets. Information is deemed material if its omission or misrepresentation could reasonably influence decisions made by investors or other users of financial reports.

Organisations adopting these standards in 2025 will benefit from transition relief. For the first two reporting periods, they can focus exclusively on climate-related disclosures, with broader sustainability topics deferred until 2028. Additionally, there is a three-year relief period for Scope 3 emissions reporting and the quantitative aspects of climate-related scenario analysis. Notably, the CSSB extended the Scope 3 relief period from two years to three in the final draft. These measures aim to provide a structured yet flexible approach to sustainability reporting, detailed further in the individual standards.

CSDS 1: General Requirements

CSDS 1 lays the groundwork for reporting sustainability-related risks and opportunities that could impact an organisation's cash flows, access to financing, or cost of capital. It requires companies to evaluate their entire value chain, covering both upstream and downstream activities. A key requirement is that sustainability disclosures must be ""linked" to financial statements, often included in the Management Discussion and Analysis or Annual Report, ensuring they reflect real financial impacts. Materiality assessments must be conducted at the information level, identifying specific data points that influence investor decisions.

CSDS 2: Climate Disclosures

CSDS 2 zeroes in on climate-related risks, both physical and transitional, and mandates disclosures on greenhouse gas emissions and climate resilience strategies. Organisations must report Scope 1 and Scope 2 emissions immediately, with Scope 3 disclosures required after the three-year transition period. The standard also calls for the development of climate transition plans and scenario analyses to illustrate how businesses are preparing for various climate scenarios.

Following the structure of the Task Force on Climate-related Financial Disclosures (TCFD), CSDS 2 is built around the same four pillars. While quantitative scenario analysis benefits from a three-year relief period, qualitative analysis is expected to be implemented sooner. For organisations reporting under ISSB standards in multiple jurisdictions, CSDS 2 offers a Canadian-specific approach that balances global alignment with practical transition measures.

Current ESG Reporting Requirements in Canada

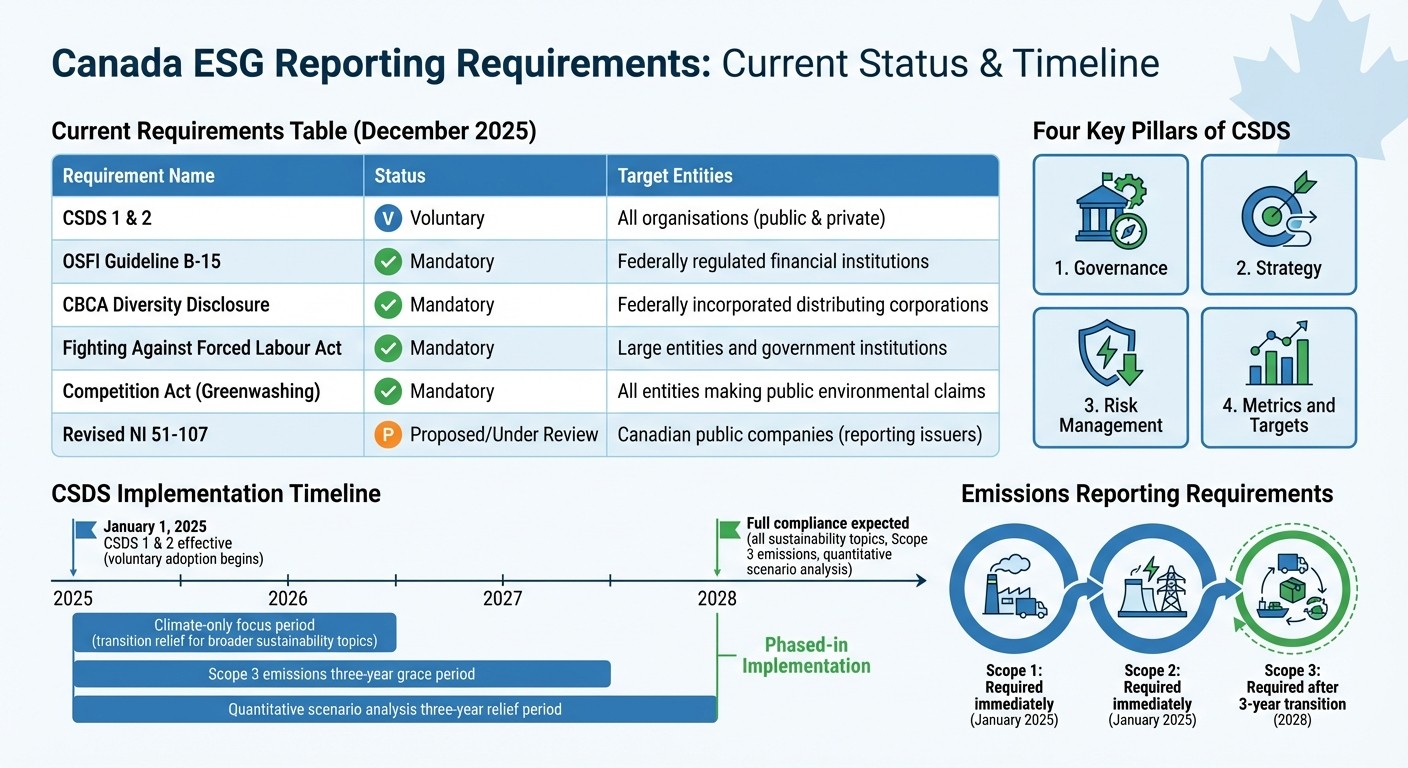

Canada ESG Reporting Requirements Status and Timeline 2025-2028

Requirements for Public and Large Organisations

By December 2025, Canada requires specific ESG disclosures for public and large organisations, though CSDS 1 and CSDS 2 remain optional. Federally regulated financial institutions must comply with OSFI Guideline B-15 for climate reporting, while the Canada Business Corporations Act (CBCA) enforces diversity disclosures. Additional obligations arise from the Fighting Against Forced Labour and Child Labour in Supply Chains Act and amendments to the Competition Act under Bill C-59, which introduce strict anti-greenwashing rules. These rules carry heavy penalties for non-compliance, setting the groundwork for further regulatory alignment under the Canadian Securities Administrators (CSA).

OSFI Guideline B-15, specifically targeting federally regulated financial institutions like banks and insurers, requires climate-related disclosures starting in 2024/2025. Updated in February 2025, the guideline aligns with CSDS and IFRS S1 vs. S2, making it one of the few compulsory climate reporting measures currently enforced. The CBCA also mandates that federally incorporated distributing corporations report on the diversity of their boards and senior management teams.

In October 2024, the federal government announced plans to extend mandatory climate-related financial disclosures to large, federally incorporated private companies. This signals a broader shift towards expanding reporting requirements beyond public companies and financial institutions.

CSA's Regulatory Changes

The CSA is actively revising its rules to align with the evolving CSDS standards. Initially, the CSA proposed NI 51-107, which underwent significant public consultation. However, on 23 April 2025, the CSA paused the implementation of this rule to reassess and align it with the newly released CSDS standards. This delay also affected new diversity disclosure rules as regulators benchmarked international frameworks, including those of the U.S. SEC and the EU CSRD.

"The CSA continues to work towards a revised climate‐related disclosure rule that will consider the CSSB Standards and may include modifications considered appropriate for the Canadian capital markets." (Canadian Securities Administrators)

The CSA plans to release a revised version of NI 51-107 for public comment, aiming for a mandatory "climate-first" approach that prioritises CSDS 2 standards. In the meantime, organisations are encouraged to voluntarily adopt the CSDS framework. This transitional period allows public companies to prepare for eventual mandatory adoption while taking advantage of transition relief under the CSDS, including a three-year grace period for Scope 3 emissions reporting.

Below is a summary of the current ESG reporting requirements for Canadian entities:

Requirement | Status (Dec 2025) | Target Entities |

|---|---|---|

CSDS 1 & 2 | Voluntary | All organisations (public & private) |

OSFI Guideline B-15 | Mandatory | Federally regulated financial institutions |

CBCA Diversity Disclosure | Mandatory | Federally incorporated distributing corporations |

Fighting Against Forced Labour and Child Labour in Supply Chains Act | Mandatory | Large entities and government institutions |

Competition Act (Greenwashing) | Mandatory | All entities making public environmental claims |

Revised NI 51-107 | Proposed / Under Review | Canadian public companies (reporting issuers) |

Materiality and Who Must Comply with CSDS

What Materiality Means in ESG Reporting

Under CSDS 1, materiality focuses on information that could influence investor decisions if left out or misrepresented. This is distinct from the European Union's double materiality model, which requires companies to disclose not only how environmental, social, and governance (ESG) factors impact the business but also how the business affects society and the environment. In Canada, the focus is solely on financial materiality.

"Materiality for sustainability-related financial disclosures is defined in a similar way as matter as financial statement materiality: a singular financial materiality approach is followed, as opposed to the double materiality approach under the ESRS." – EY Canada

CSDS emphasises the need for companies to conduct detailed assessments that identify specific data points rather than offering broad generalisations. This understanding of materiality is crucial for determining which organisations and reporting periods are subject to these standards.

Who Should Adopt CSDS and When

With materiality established, organisations can evaluate their reporting responsibilities under CSDS. Starting 1 January 2025, CSDS 1 and CSDS 2 will remain voluntary for most organisations unless mandated by specific regulators or government authorities. Public companies should note that while the current guidance is optional, regulators are expected to refine and implement mandatory requirements over time. Federally regulated financial institutions, however, must adhere to OSFI's Guideline B-15, updated in February 2025 to align with CSDS, with phased-in reporting beginning in 2025.

In October 2024, the federal government announced plans to mandate climate-related disclosures for large, federally incorporated private companies through amendments to the Canada Business Corporations Act. However, details such as the thresholds for defining "large" companies and the timeline for implementation have yet to be clarified. Public sector entities, including Crown corporations, will follow CSDS based on instructions from central agencies like the Treasury Board.

For early adopters starting their reporting in 2026, there will be transition relief for Scope 3 emissions and non-climate risks, with full compliance expected by the 2028 fiscal year.

How to Prepare for ESG Disclosure in 2025

Getting Ready for CSDS 1 and CSDS 2

To start, focus on identifying the data investors need to evaluate your clients' enterprise value. This begins with a materiality assessment that zeroes in on specific risks, such as the financial impact of carbon taxes or vulnerabilities in assets, rather than broad, general topics.

Once you've pinpointed these material risks, conduct a gap analysis to uncover any shortcomings in data collection and formalise governance structures. This includes documenting responsibilities, setting up reporting lines, and incorporating sustainability risks into Enterprise Risk Management (ERM) frameworks. For instance, if a client currently reports only Scope 1 emissions, the gap analysis will highlight what's needed to capture Scope 2 data and lay the groundwork for Scope 3 reporting by the 2028 fiscal year.

CSDS 2 also requires transparency on how boards oversee climate risks and how management integrates sustainability into daily operations. EY Canada emphasises:

"Sustainability reporting is more than just a disclosure exercise. It is a strategic initiative that can drive value creation, foster stakeholder trust, and mitigate risks associated with ESG factors".

Accounting professionals should also assist clients in mapping their value chain boundaries. CSDS reporting extends beyond direct subsidiaries to include upstream risks - like supply chain disruptions - and downstream opportunities, such as end-of-life product considerations. This broader perspective ensures no material risks are missed, even if they fall outside traditional financial reporting boundaries.

Collecting and Reporting Data

With a clear strategy in place, the next step is to establish reliable data collection processes. Emissions data should be gathered using the GHGP Corporate Standard. Begin with Scope 1 and 2 emissions starting 1 January 2025, while taking advantage of the three-year grace period for Scope 3 emissions. During this time, focus on qualitative scenario analysis, with plans to incorporate quantitative data by 2028.

For the 2025 and 2026 reporting periods, organisations can prioritise climate-related risks and opportunities under CSDS 2, delaying broader sustainability topics until 2027. Scenario analysis should initially explore qualitative questions - such as how the business might perform under different climate conditions (e.g., 1.5°C versus 2°C+ warming) - and later expand to include quantitative insights.

A key component of CSDS 1 is connected reporting, which integrates sustainability disclosures with financial statements. This means showing how climate risks influence financial planning, major transactions, and cash flow projections. For example, if a client faces physical risks like storm damage to assets or transition risks from new carbon taxes, these impacts should be quantified and tied to future financial outcomes.

Organisations also have some flexibility in the initial stages. In 2025, there's a nine-month extension for publishing sustainability disclosures alongside financial reports. This grace period reduces to six months in subsequent years, with full alignment required by 2027. This phased timeline allows firms to establish strong data collection systems without the pressure of meeting simultaneous deadlines for sustainability and financial reporting.

Using neoeco for Compliance

Once internal processes are set, automation tools can simplify compliance efforts. Although CSDS is a Canadian standard, firms working with clients involved in cross-border operations or aiming for global alignment can benefit from tools that support multiple frameworks. neoeco is a sustainability accounting platform tailored for accounting firms in the UK and Australia. It automatically maps transactions to recognised emissions categories under GHGP, ISO 14064, and national frameworks like SECR, UK SRS, and ASRS 2.

For international reporting, neoeco integrates with platforms like Xero, Sage, and QuickBooks, eliminating the need for manual spreadsheets and ensuring accurate, audit-ready carbon data. This aligns with the principles of Financially-integrated Sustainability Management (FiSM), which bridges the gap between finance and sustainability in line with CSDS's connected reporting approach.

The platform offers a centralised dashboard for managing sustainability data, with features like smart transaction mapping to link ledger entries to Scope 1, 2, and 3 categories. It also includes compliance-ready templates, audit controls, and a hub for storing policies and supporting documents. For accounting firms looking to expand into sustainability services, neoeco provides a seamless way to deliver professional, compliant reporting across various frameworks, ensuring confidence in every disclosure.

Conclusion

Canada's ESG disclosure framework is shifting, with the voluntary adoption of CSDS 1 and CSDS 2 set to begin on 1 January 2025. While the Canadian Securities Administrators paused mandatory ESG disclosure requirements in May 2025, many leading organisations are already embracing these standards. By doing so, they’re not only preparing for eventual regulatory changes but also gaining an edge in the market and boosting investor trust. Early adoption often reveals operational improvements that can strengthen resilience. This dynamic environment highlights the importance of proactive engagement from all players in the market.

These regulatory changes are already delivering tangible benefits. According to PwC Canada:

"Leading companies are using sustainability standards to improve their internal business performance by finding operational efficiencies, generating savings, building resilience and improving their access to capital".

For Canadian businesses aiming to expand internationally, aligning with ISSB standards ensures their reporting meets the expectations of global investors. These strategic gains align with the technical advancements discussed earlier in this article.

Accounting firms, already familiar with integrated reporting, have a crucial role to play in helping clients navigate this transition. From conducting materiality assessments to embedding sustainability risks into enterprise risk management, the expertise required parallels that of financial reporting. The three-year transition period for disclosing Scope 3 emissions provides some breathing room, but firms taking a proactive approach now will avoid last-minute compliance pressures down the line.

Technology is also playing a key role in simplifying compliance. Automation tools can streamline processes and enhance service delivery. Although CSDS is tailored to Canada, firms working with clients operating internationally - or those seeking global alignment - can benefit from platforms that support multiple frameworks. For instance, neoeco offers a solution that integrates financial and ESG data, producing audit-ready reports.

While the ESG landscape will undoubtedly continue to evolve, certain principles remain constant: reliable data, clear governance, and alignment with investor expectations. Whether preparing for voluntary disclosures in 2025 or anticipating future mandates, the time to act is now.

FAQs

What distinguishes CSDS 1 from CSDS 2 in Canada's ESG disclosure requirements?

CSDS 1 lays out the core principles for reporting sustainability-related financial information, serving as the baseline for disclosure requirements. Meanwhile, CSDS 2 zeroes in on climate-related standards, covering areas like emissions, climate risk governance, and scenario analysis.

To ease the transition, CSDS 2 offers temporary relief measures. These include a short-term exemption from reporting Scope 3 emissions and quantitative scenario analysis for the first three reporting periods, providing organisations with some breathing room during the early stages of implementation.

What impact does the transition relief period have on the timeline for reporting Scope 3 emissions?

The transition relief period gives companies an extra year to start reporting their Scope 3 greenhouse gas emissions, effectively pushing the start date back by one year. This additional time is designed to help organisations get ready for the new reporting standards.

With the extended timeline, businesses can concentrate on improving their data collection methods and adjusting their reporting systems to meet the updated rules. This helps ensure their submissions are more accurate and reliable.

What are the benefits of adopting the CSDS standards early?

Adopting the Canadian Sustainability Disclosure Standards (CSDS 1 and CSDS 2) early brings a host of benefits for organisations. It enables businesses to demonstrate effective risk management while meeting the increasing demand from stakeholders for clear and reliable sustainability reporting. This not only boosts trust but can also make the organisation more appealing to investors.

Early adoption also ensures that disclosures align with consistent and comparable frameworks, leading to better data quality. Over time, this can save costs by avoiding the need for expensive adjustments to meet compliance requirements later on. Plus, transition relief measures, like extended deadlines for reporting Scope 3 emissions, make the implementation process more manageable and less rushed.

By embracing these standards ahead of the curve, companies can position themselves as leaders in sustainability, gain a competitive advantage, and be well-prepared for future regulatory changes in a market that increasingly values transparency in environmental, social, and governance (ESG) practices.