How ESG Roadmaps Support Stakeholder Training

Dec 27, 2025

How integrating stakeholder training into an ESG roadmap builds skills, improves data quality, ensures regulatory compliance and audit readiness.

ESG roadmaps are long-term plans that integrate environmental, social, and governance priorities into business strategies. They ensure organisations move beyond basic compliance to structured, goal-oriented sustainability efforts. For UK companies, these roadmaps are essential for meeting regulatory requirements like Streamlined Energy and Carbon Reporting (SECR) and the upcoming UK Sustainability Reporting Standard (UK SRS).

Without proper training, many businesses - especially SMEs - struggle with inconsistent and reactive sustainability approaches. A well-designed ESG roadmap aligns stakeholder training with regulatory deadlines, addressing knowledge gaps across teams such as leadership, finance, operations, and suppliers, which impacts ESG audits. This ensures all stakeholders are equipped to meet evolving demands, from managing Scope 3 emissions to preparing for audits under frameworks like TCFD.

Key steps for integrating training into ESG roadmaps include:

Identifying training needs through materiality assessments and stakeholder input.

Phasing training to match roadmap milestones, from leadership alignment to audit readiness.

Embedding training responsibilities within governance structures for accountability.

Measuring training impact using metrics like engagement, compliance, and data accuracy.

Updating training to keep pace with new regulations like UK SRS and ISSB standards.

Essential Training for ESG & Sustainability Challenges

Identifying Stakeholder Training Requirements

Before rolling out any training programme, it’s crucial to pinpoint who needs to learn what. Training should be tailored to address specific knowledge gaps across various stakeholder groups - from board members to suppliers - while focusing on your organisation's core ESG challenges. Start by identifying material priorities to guide the development of targeted training efforts.

Running Materiality Assessments

Materiality assessments are your first step in setting training priorities. They help you determine which ESG topics pose the greatest financial and reputational risks to your business and which are most important to your stakeholders. By zeroing in on high-impact areas, you can prioritise training where knowledge gaps could jeopardise compliance or performance.

To identify these gaps, gather input from stakeholders through interviews, surveys, and focus groups. For instance, if your materiality assessment highlights Scope 3 emissions as a key issue but your procurement team lacks the technical expertise to collect supplier data, that’s a clear area for training. Similarly, if investors are increasingly focused on climate-related financial disclosures but your finance team isn’t well-versed in TCFD requirements, you’ve found another critical gap to address.

"Keeping up with these rapidly-evolving frameworks also means teams must continually update their expertise on obligations and implications, making it harder to define and adhere to a clear timeline for ESG reporting." – Myra Doyle, Partner, Financial Services Finance Transformation, KPMG in the UK

Materiality assessments also establish a baseline of current understanding and performance, which acts as a benchmark for evaluating the effectiveness of training programmes. For example, organisations managing Scope 3 emissions often discover that supply chain partners lack the necessary tools or expertise to report their carbon footprints. This kind of gap may require external collaboration and knowledge-sharing, not just internal training.

Mapping Stakeholders to Training Needs

Once you’ve identified key topics, the next step is to align these priorities with the specific training requirements of different stakeholders. This alignment ensures that your training efforts directly support your ESG roadmap and long-term sustainability goals. Different groups within your organisation will have varied training needs based on their roles in the ESG strategy.

The C-suite needs strategic insights and awareness of regulatory developments.

Finance teams require technical training on audit-ready ESG data systems and data controls.

Operations staff must understand data collection processes.

Suppliers need guidance on transparency and reporting standards.

Start by cataloguing current roles and competencies, noting gaps in areas like strategy, data sourcing, metrics review, and reporting. For example, in 2021, a FTSE 100 global insurance company partnered with KPMG to prepare for reasonable assurance of its TCFD statements. They developed a detailed risk and controls matrix, which clarified responsibilities and created a remediation plan for external audit readiness.

Use a functional accountability matrix to map ESG responsibilities to specific departments - such as Legal, Risk, Finance, HR, and Facilities - and assign the relevant training to each. For instance, if your Legal team oversees regulatory compliance, they’ll need training on frameworks like UK SRS. Meanwhile, Facilities teams managing energy consumption data will benefit from training in GHG inventory protocols and measurement standards.

Finally, consider the broader implications. Two-thirds of investors now factor ESG performance into their decisions, and 53% of employees take sustainability efforts into account when choosing where to work. This means training isn’t just about meeting compliance requirements - it’s about preparing your stakeholders to meet the expectations of investors, employees, and customers alike.

Building Training Modules Around Roadmap Milestones

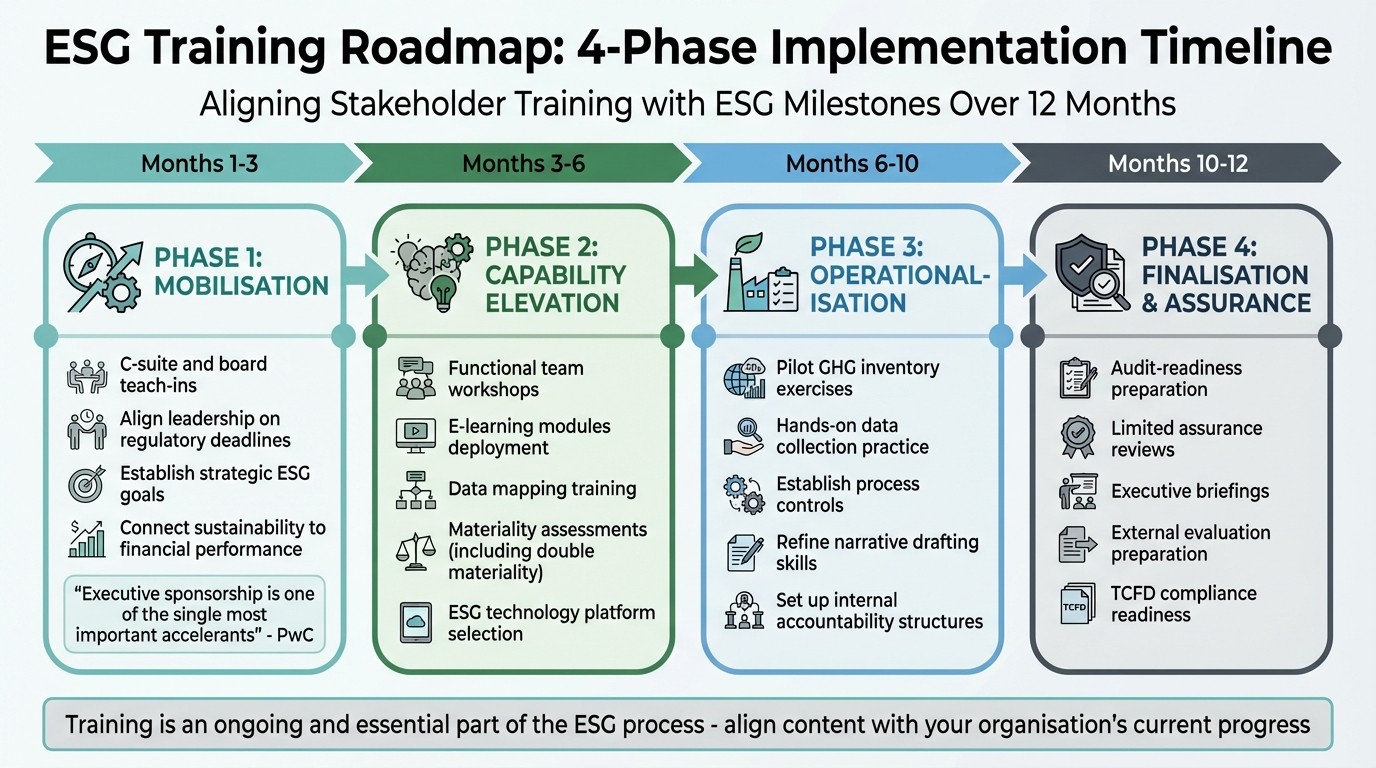

4-Phase ESG Training Roadmap Timeline with Milestones

Designing training modules in sync with roadmap milestones ensures that every stakeholder gains the skills needed to support strong ESG performance. Once you've identified training needs, align your sessions with the distinct phases and milestones of your ESG roadmap. Think of training as an ongoing and essential part of the process.

It's important to match training content to your organisation's current ESG progress. For instance, a finance team just beginning to collect carbon data will need basic training before moving on to advanced assurance techniques. On the other hand, a board already committed to net-zero goals will gain more from sessions on regulatory trends and investor expectations than from introductory ESG overviews. By phasing training, you can gradually prepare each group for their evolving roles.

Dividing the Roadmap into Training Phases

Breaking your ESG roadmap into training phases allows for steady skill development, starting with leadership alignment and advancing to technical execution. Many organisations find a 12-month cycle effective, with each phase building on the previous one.

Phase 1: Mobilisation (Months 1–3)

This phase focuses on aligning leadership. Teach-ins for the C-suite and board help establish a unified understanding of regulatory deadlines, strategic goals, and the connection between sustainability and financial performance. As PwC highlights, "Executive sponsorship is one of the single most important accelerants for sustainability reporting". Without top-level support, training efforts across the organisation are likely to falter.

Phase 2: Capability Elevation (Months 3–6)

Here, the focus shifts to functional teams. Workshops and e-learning modules help team members develop skills in areas like data mapping, materiality assessments (including double materiality), and choosing appropriate ESG technology platforms. Tools such as neoeco can simplify processes like transaction mapping to standard emissions categories.

Phase 3: Operationalisation (Months 6–10)

This is the stage where theory is put into practice. Pilot exercises for GHG inventory and data collection serve as hands-on training opportunities. Teams also establish process controls, refine narrative drafting skills, and set up internal accountability structures.

Phase 4: Finalisation & Assurance (Months 10–12)

The final phase prepares teams for external evaluations. Training focuses on audit-readiness, including limited assurance reviews and executive briefings. This phase is especially critical for organisations gearing up for mandatory climate disclosures under frameworks like TCFD, which became mandatory for many UK companies on 6 April 2022.

By defining these phases, you can tailor training content to turn roadmap milestones into actionable skills.

Developing ESG Training Content

The content of your ESG training should align with both the roadmap phase and the organisation's level of experience. For beginners, focus on foundational training to explain the value of ESG integration. Meanwhile, organisations already embedding ESG into their operations will benefit from advanced topics like materiality assessments and KPI development. Teams leading the charge may require guidance on agile roadmaps and setting measurable targets.

Training should also cover essential carbon accounting topics, such as climate change fundamentals and strategies for reducing carbon footprints. Finance teams, in particular, need technical training on data controls and audit preparation - skills similar to those required for SOx compliance but applied to sustainability data. For organisations tackling Scope 3 emissions, procurement teams will need specific training on sustainable sourcing and engaging with suppliers.

It's crucial to include core regulatory frameworks like GRI, SASB, and TCFD. Smaller organisations with limited resources can benefit from external expertise through partnerships or forums, which can help prevent training from becoming an afterthought. Interactive methods such as workshops, e-learning modules with quizzes, and gamification can make complex ESG topics more engaging. The ultimate aim is to provide actionable training that stakeholders can immediately apply in their roles.

Integrating Training into ESG Governance and Execution

Incorporating training into ESG governance is crucial for achieving meaningful results. Without clear accountability and regular feedback mechanisms, even well-designed training programmes can become disconnected efforts that fail to deliver impact. The solution lies in embedding training responsibilities within your organisation’s existing governance framework, ensuring that knowledge gained translates into practical action. Let’s take a closer look at how to assign training responsibilities effectively within governance structures.

Assigning Training Responsibilities in Governance Structures

A multi-layered governance framework ensures clarity in training responsibilities at every level. Begin with an executive steering committee to oversee the process, followed by an ESG Programme Management Office (PMO) to handle day-to-day coordination. Finally, establish functional working groups to manage specific tasks. Each layer has unique training needs and must understand its role in achieving the broader ESG objectives.

To streamline this, use a functional accountability matrix. This tool assigns key ESG tasks - like strategy development, data management, and reporting - to specific teams, such as Finance, IT, Legal, or Sustainability. Finance teams, for instance, play a critical role in defining control frameworks and assessing data quality, leveraging their expertise in reporting. For organisations adhering to ISSB reporting standards, involving finance ensures ESG data meets the same level of scrutiny as financial disclosures. Smaller organisations with fewer resources can bridge training gaps by participating in external forums or collaborating with subject matter experts for knowledge sharing.

Establishing Feedback Mechanisms

Feedback systems are essential to keep training aligned with evolving goals and stakeholder expectations. Regular materiality assessments provide a structured way to gather insights from both internal and external stakeholders - such as customers, suppliers, lenders, and investors - helping to identify areas where training needs improvement. Additionally, ESG maturity assessments benchmark your organisation’s current capabilities against industry standards, pinpointing specific knowledge gaps that training programmes should address.

Independent ESG audits are another valuable tool. These audits help uncover weaknesses in data and provide actionable insights for refining training programmes. As KPMG highlights, “The emerging nature of ESG requirements means that training modules rapidly become out of date as obligations and reporting regimes continue to evolve”. To keep up, organisations must establish processes for monitoring new regulations - such as those from the ISSB or EU Taxonomy - and update training content accordingly.

Internal reporting systems also play a pivotal role. These systems track ESG compliance in real time, helping to identify resource shortages or knowledge gaps. Deloitte underscores the importance of this approach, stating, “Integrated thinking is a journey, not a destination. It is a dynamic, iterative process that requires continuous learning and improvement”. By fostering a continuous feedback loop, organisations can ensure that training evolves alongside their ESG strategies, maintaining relevance and effectiveness over time.

Measuring Training Impact on ESG Outcomes

After implementing phased training modules, the next critical step is measuring their impact. The goal is to ensure these programmes lead to visible improvements in ESG (Environmental, Social, and Governance) performance, better data quality, and stronger regulatory compliance. Clear and measurable metrics can show whether your training investments are effectively advancing your ESG roadmap.

Tracking Training Performance Metrics

Start by establishing a baseline using diagnostic sessions and stakeholder interviews. This initial assessment provides a clear starting point to track progress. Focus on four core areas: engagement, operational competency, governance clarity, and compliance readiness.

Engagement metrics evaluate how training influences organisational culture. For instance, with 53% of workers factoring sustainability into their choice of employer, it’s crucial to assess whether training aligns employees with ESG goals. Use surveys to gauge stakeholder alignment, comparing results before and after training to measure shifts in understanding and commitment.

Operational metrics measure technical proficiency. Look for reductions in reporting errors and improvements in audit-ready data, particularly for greenhouse gas (GHG) inventories. For example, in July 2022, a FTSE100 insurer collaborated with KPMG to create a climate reporting manual and a SOx-style RACM, reducing errors and clarifying ownership of processes. Enhanced data traceability, especially for Scope 3 emissions reporting, indicates that training is improving the accuracy of supply chain calculations.

Governance metrics assess whether employees grasp their ESG responsibilities. Myra Doyle, Partner at KPMG in the UK, highlights a common challenge:

"The owner of ESG reporting is often less clear... training modules rapidly become out of date as obligations and reporting regimes continue to evolve".

Track resolved control gaps and clearly defined process ownership to determine if governance training is effective.

Compliance metrics focus on readiness for mandatory reporting. Monitor timely submissions under frameworks like CSRD or TCFD and check whether external auditors provide limited or reasonable assurance. With 92% of supply chain leaders saying technology investments haven’t fully met expectations, these metrics can reveal if training gaps are slowing your progress.

Once these metrics are in place, the next step is to adapt training based on real-time feedback.

Adjusting Training Based on Feedback

Keeping training relevant requires continuous feedback loops. Use tools like Google Forms to gather employee sentiment broadly, and complement this with one-on-one interviews with key stakeholders - such as facilities managers or procurement teams - to identify practical challenges.

Pilot tests can help pinpoint where employees struggle. For example, mapping data flows from source to disclosure can highlight recurring errors, signalling areas that need targeted technical training. Compare updated survey data to your baseline to track improvements in stakeholder understanding over time.

Engage with external forums and subject matter experts to benchmark your training against industry standards. This external perspective can help uncover blind spots in your internal evaluations. Regular feedback ensures your training evolves alongside stakeholder expectations and regulatory changes.

Updating Training as the ESG Roadmap Evolves

Once you've measured performance, keeping your training programme up to date is crucial to staying aligned with ever-changing ESG requirements. The landscape of ESG training is constantly shifting as new regulations and sustainability goals emerge. Myra Doyle, Partner at KPMG in the UK, aptly summarises this challenge:

"The emerging nature of ESG requirements means that training modules rapidly become out of date as obligations and reporting regimes continue to evolve".

If training isn't updated, even the best programmes can lose their relevance. The key is to embed continuous improvement into your ESG roadmap from the outset. Treat training as an ongoing capacity-building effort rather than a one-off task.

Responding to Regulatory Changes

The compliance landscape in the UK is evolving quickly. For example, the UK Sustainability Reporting Standard (UK SRS) is increasingly aligning with global frameworks like the International Sustainability Standards Board (ISSB). At the same time, requirements under SECR and ISO 14064 continue to shift.

To stay ahead, adopt horizon scanning to monitor new regulatory developments. Assign a dedicated team or working group to review updates on a quarterly basis and flag changes requiring immediate adjustments to training. A good example of this approach was seen when TCFD reporting became mandatory for many UK companies on 6 April 2022. Organisations with robust horizon scanning processes were able to update their training materials and upskill stakeholders within weeks.

When updating training, focus on three core areas. First, help stakeholders understand how different regulations interconnect. For instance, briefings for the C-suite and board can clarify the overlaps and differences between UK SRS, ISSB, and CSRD, particularly around assurance requirements. Second, revise technical training to reflect new data demands. If your ESG roadmap now includes Scope 3 emissions under updated UK SRS guidance, procurement and supply chain teams will need targeted training on tracing data from source to disclosure. Third, refresh governance training to define new roles and responsibilities. For example, in 2021, a FTSE100 global insurance company partnered with KPMG to create a detailed climate reporting manual integrated into its financial reporting. This included a SOx-style risk and controls matrix to assign clear ownership and address control gaps.

For accounting firms assisting clients with these updates, tools like neoeco can simplify the technical aspects. By automatically mapping transactions to recognised emissions categories under standards like GHGP, ISO 14064, SECR, and UK SRS, neoeco ensures client data remains audit-ready as reporting standards change.

These regulatory updates lay the foundation for ongoing improvements in training delivery.

Building in Continuous Improvement

Beyond identifying training gaps, it's important to refine your programme regularly to meet evolving expectations. Conduct roadmap reviews quarterly or biannually to assess where training may be falling short and where new competencies are required. Start each review with a gap analysis, comparing current practices against updated goals. For instance, if your roadmap now includes double materiality assessments but stakeholders struggle to grasp the organisation's impact on society and the environment, it's a clear sign that your training content needs revision.

Benchmark your training against industry best practices by engaging in forums, peer groups, or expert consultations. Use diagnostic tools like ESG maturity assessments to gauge stakeholder skills against recognised frameworks.

"Integrated thinking is a journey, not a destination. It is a dynamic, iterative process that requires continuous learning and improvement".

To ensure your training remains effective, gather feedback through surveys, interviews, and pilot tests. This continuous refinement ensures that sustainability metrics are treated with the same seriousness as financial data. Compare updated survey results to your baseline to measure improvements in stakeholder understanding and use this data to prioritise future training needs. With 98% of companies reporting they feel unprepared for mandatory requirements like CSRD, organisations that embrace continuous improvement in their training programmes will be far better equipped to meet future compliance challenges.

Conclusion

Incorporating stakeholder training into your ESG roadmap is a smart way to build the skills and knowledge needed for sustained growth. When training is woven into every phase - from materiality assessments to governance structures and continuous improvement - it creates a workforce that not only knows what to report but also understands why it matters. This foundation strengthens ESG performance in a way that appeals to both investors and stakeholders.

With mandatory frameworks like the UK SRS and ISSB now tying ESG reporting to investor trust, brand reputation, and access to capital, organisations that approach sustainability metrics with the same precision as financial performance will be far better equipped to meet these expectations. As EY puts it:

"To provide trust and confidence in ESG and sustainability responsibilities to the market and create long-term value, organisations should be managing ESG and sustainability performance with the same rigor as financial performance".

Breaking down barriers between finance, risk, and sustainability teams is critical. Training plays a key role in fostering integrated thinking, helping teams understand how ESG risks and opportunities influence value creation across the organisation. For instance, tools like neoeco simplify the technical side of compliance, enabling audit-ready stakeholder data documentation while allowing teams to focus on strategic growth.

However, training isn’t a one-and-done effort - it’s an evolving process. With 92% of supply chain leaders stating that their technology investments haven’t fully met expectations, it’s clear that technology alone isn’t the answer. Your people need the expertise and confidence to transform data into actionable insights. By aligning training with the key milestones of your ESG roadmap and adapting it as regulations shift, you can turn compliance into a strategic advantage that strengthens your organisation’s resilience.

FAQs

How do ESG roadmaps help SMEs address sustainability challenges?

ESG roadmaps offer small and medium-sized enterprises (SMEs) a clear path to transform sustainability ambitions into tangible actions. These roadmaps evaluate the company’s current ESG standing, establish measurable goals, and assign specific responsibilities. By embedding sustainability into the core business strategy, SMEs can prioritise the most pressing environmental and social issues, allocate resources wisely, and measure their progress against recognised standards. This not only helps reduce regulatory risks but also strengthens trust with key stakeholders like investors, customers, and employees.

An essential part of these roadmaps is stakeholder training, which ensures employees are equipped to handle new processes, data collection, and reporting requirements. This builds in-house expertise and addresses typical challenges SMEs encounter. Tools such as neoeco further simplify the journey by automating carbon data mapping and reporting, enabling finance teams to align sustainability targets with financial goals while staying compliant. This integration of ESG practices into everyday operations can lead to benefits like cost reductions and improved access to green finance, all without hindering business growth.

How do materiality assessments enhance ESG training for stakeholders?

Materiality assessments play a key role in helping organisations pinpoint the environmental, social, and governance (ESG) issues that matter most to their operations and stakeholders. By connecting financial data with stakeholder expectations and aligning with recognised ESG frameworks, these assessments shine a light on the areas that have the biggest influence on performance, compliance, and reputation.

This targeted approach ensures that stakeholder training zeroes in on the most relevant risks and opportunities, steering clear of generic, one-size-fits-all methods. Integrating these insights into training creates a shared understanding across teams, tying material ESG topics to reporting obligations like TCFD or the UK Stewardship Code. It also strengthens the organisation’s overall ESG strategy. The result? Greater confidence among staff, improved compliance, and better outcomes when team members contribute data or roll out sustainability initiatives.

How can organisations update ESG training to stay aligned with changing regulations?

Organisations should treat ESG training as a flexible part of their sustainability strategy, ensuring it evolves alongside changing regulatory requirements. With UK-specific standards such as Sustainable Reporting Standards (SRS), Streamlined Energy and Carbon Reporting (SECR), and mandatory TCFD disclosures, keeping training aligned with the latest rules is essential. Regular updates are key to staying compliant and effective.

Here’s how organisations can stay on top of these changes:

Assign an ESG training lead or committee: Task a dedicated person or team with tracking regulatory updates and revising training content as needed.

Incorporate scenario-based workshops: Use practical examples to show how new regulations can influence everyday decisions and strategies.

Utilise smart tools like neoeco: Platforms like neoeco combine financial data with established emissions frameworks (e.g., GHG Protocol, ISO 14064, SECR) to deliver accurate, real-time case studies for training sessions.

By weaving these updates into their ESG plans, organisations can maintain compliance, reduce risks, and demonstrate to stakeholders that sustainability is central to their mission.