UK vs Australia: ESG Reporting by Sector

Dec 29, 2025

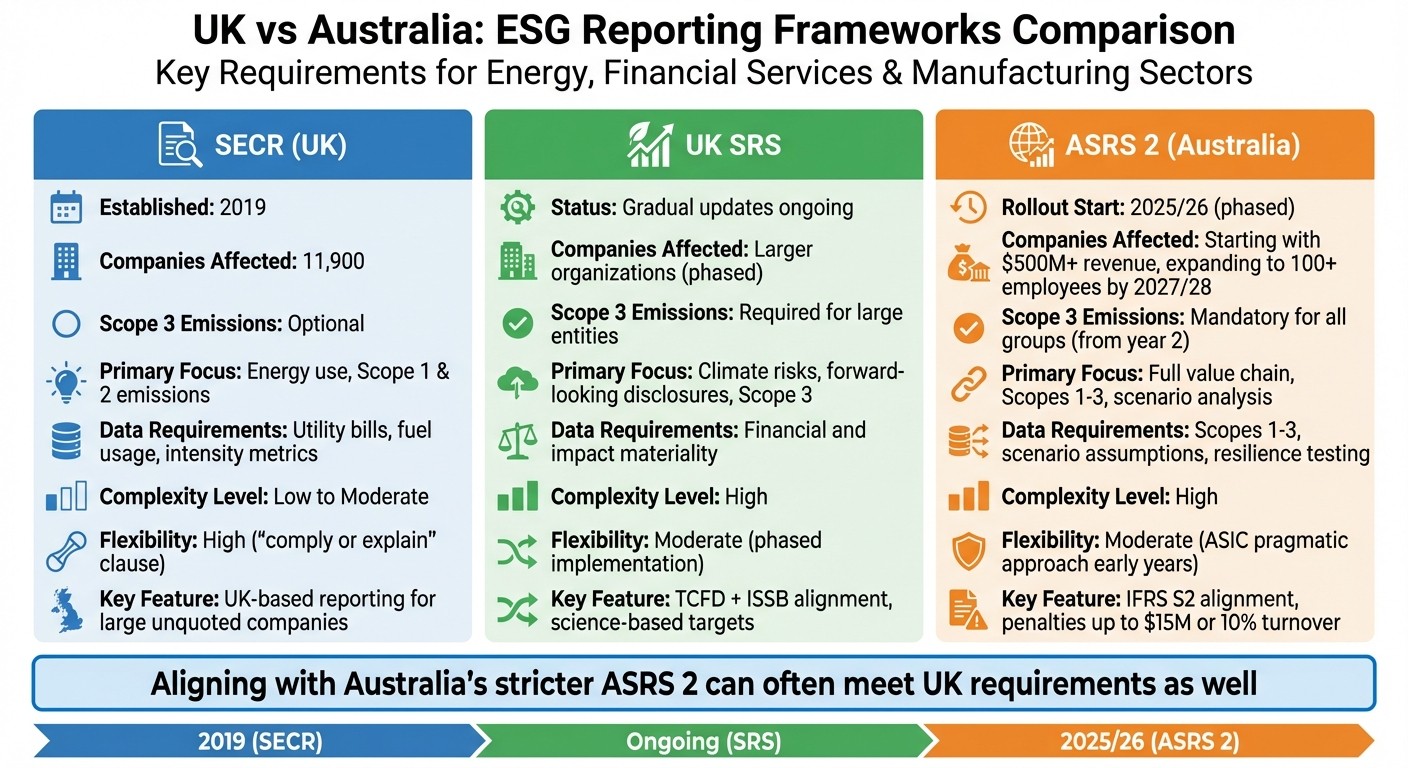

Compare UK SECR/SRS with Australia’s ASRS 2 — key differences in Scope 3, sector impacts, timelines and data needs to plan cross‑border ESG reporting.

If you’re advising clients in both the UK and Australia, understanding their ESG reporting obligations is key. While the UK’s SECR framework focuses on energy use and Scope 1 and 2 emissions, Australia’s ASRS 2 demands more detailed disclosures, including mandatory Scope 3 emissions and climate scenario analysis. The UK’s SRS builds on SECR, incorporating TCFD and ISSB standards, with stricter requirements for larger organisations.

Key Points:

UK SECR: Focuses on energy use; Scope 3 reporting is optional. Applies to 11,900 companies meeting size thresholds.

Australia ASRS 2: Requires Scope 1–3 emissions, climate scenario analysis, and resilience testing. Phased rollout starts with large entities in 2025/26.

UK SRS: Expands on SECR with forward-looking climate risks, mandatory Scope 3 for larger firms, and TCFD alignment.

Quick Comparison:

Feature | SECR (UK) | UK SRS | ASRS 2 (Australia) |

|---|---|---|---|

Scope 3 Emissions | Optional | Required for large entities | Mandatory for all groups |

Focus | Energy use, Scope 1 & 2 | Climate risks, Scope 3 | Full value chain, Scope 1–3 |

Rollout Timeline | Established in 2019 | Gradual updates ongoing | Starts 2025/26, phased rollout |

For businesses operating in both regions, aligning with Australia’s stricter ASRS 2 can often meet UK requirements as well. Automated tools like neoeco simplify compliance by mapping transactions to emissions categories, reducing manual work and ensuring readiness for audits.

Navigating these frameworks requires careful planning, especially for firms managing complex supply chains or large portfolios. Early preparation for Scope 3 reporting and scenario analysis can help meet obligations and avoid penalties.

UK vs Australia ESG Reporting Frameworks Comparison: SECR, SRS, and ASRS 2

1. SECR (UK)

Energy Sector Reporting

The SECR framework requires quoted companies to disclose their global energy use, while large unquoted companies are only obligated to report UK-based consumption of gas, electricity, and transport fuel. This distinction is crucial for advising energy-intensive businesses. For instance, a quoted energy supplier must account for emissions across all international operations, whereas a large unquoted manufacturer focuses solely on UK activities.

SECR applies to approximately 11,900 companies, with an exemption for those consuming less than 40 MWh annually. To encourage energy efficiency, companies must include at least one intensity ratio - such as emissions per employee or per £m turnover - and provide a narrative detailing measures taken to improve energy efficiency during the reporting period. For energy sector clients, this means outlining specific actions taken to enhance efficiency, which are then documented in the Directors' Report.

Financial Services Climate Disclosures

SECR also extends to financial services, but the requirements differ. Quoted financial institutions, including major banks and insurers, must disclose global Scope 1 and 2 emissions, while large unquoted firms are limited to reporting UK-based figures. This discrepancy can complicate advisory work for businesses with international operations.

Notably, Scope 3 emissions reporting remains voluntary under SECR, even though these often account for the majority of a financial institution's carbon footprint. For example, in 2022, UK fintech company Wise (formerly TransferWise) demonstrated how fintech firms can streamline emissions reporting. Wise used automated software to format emissions data for inclusion in its annual reports.

For accounting firms handling multiple financial services clients, platforms like neoeco can simplify compliance. These tools automate the mapping of transactions to recognised emissions categories, eliminating manual processes and ensuring SECR compliance while also aligning with emerging frameworks such as the UK SRS.

Manufacturing Scope 3 Reporting

Manufacturers face unique challenges under SECR, particularly regarding Scope 3 emissions. Utilizing LCA for Scope 3 reporting can help these firms establish the necessary data accuracy. While reporting on material Scope 3 sources is strongly encouraged, it is not mandatory. This voluntary approach often leaves companies unprepared for the more rigorous value-chain accounting required under frameworks like Australia's ASRS 2 or the EU's CSRD. Without a standard methodology, organisations must rely on the GHG Protocol and ensure their reporting meets the expectations of the Financial Reporting Council.

Complex supply chains add another layer of difficulty. Many manufacturers lack visibility into upstream emissions from raw materials or downstream impacts from product use and disposal. However, some companies are beginning to adopt Scope 3 mapping in anticipation of future alignment with global standards like ISSB or CSRD. For advisers, this presents a chance to help clients develop Scope 3 accounting systems now, avoiding the rush to comply when regulations inevitably tighten.

2. UK SRS (UK)

Energy Sector Reporting

The SDR framework builds upon the SECR system by incorporating TCFD and ISSB standards, introducing forward-looking climate risk disclosures. For energy companies, this means addressing future climate scenarios and transition risks in their reporting.

Publicly traded energy firms now face a dual reporting obligation. They must continue to provide historical data under SECR while also meeting the SDR's forward-looking requirements. These include science-based targets and expanded Scope 3 emissions reporting. This approach aligns with the UK's goal of harmonising international standards, making it easier for companies to navigate cross-border compliance. These changes in the energy sector are setting the stage for similar advancements in financial services reporting.

Financial Services Climate Disclosures

In the financial services sector, the SDR framework builds on TCFD by requiring firms to disclose climate risks linked to their investment portfolios, lending activities, and long-term strategies. This includes calculating the carbon intensity of financed emissions, which goes beyond operational Scope 1 and 2 metrics.

For accounting firms handling multiple financial services clients, tools like neoeco simplify compliance. These platforms automate the categorisation of transactions into recognised emissions categories, following standards like GHGP and ISO 14064, ensuring alignment with both SECR and UK SRS requirements.

Manufacturing Scope 3 Reporting

SDR introduces more forward-looking requirements than SECR, particularly for manufacturers. Companies should start developing detailed methodologies to monitor both upstream and downstream emissions, preparing for future regulations akin to ASRS 2 and the EU's CSRD.

The framework includes a "comply or explain" clause, which allows companies to omit specific data if collection is too difficult - provided they explain why and outline plans for improvement. Establishing thorough value chain reporting practices now can make it easier to meet future compliance demands across different jurisdictions.

3. ASRS 2 (Australia)

Energy Sector Reporting

Australia's mandatory climate reporting rules adopt a phased rollout, beginning with companies earning over $500 million in revenue for the 2025 financial year. For energy companies, this means closely monitoring metrics like fleet performance and carbon emissions for each business unit or carrier. Unlike the UK's SECR, which allows large unquoted companies to limit reporting to domestic energy use, Australia's framework demands a thorough evaluation of emissions across all operations. This detailed approach in the energy sector sets a strong foundation for equally stringent financial disclosures.

Financial Services Climate Disclosures

Financial institutions managing $5 billion or more in assets must comply with ASRS 2. This aligns with the global trend towards transparent, ESG-focused financial reporting, complementing similar requirements in the UK. Under this framework, institutions must disclose financed emissions - those indirect Scope 3 emissions linked to lending and investment activities - alongside their climate strategies.

"Scope 3 emissions... cover indirect emissions related to your organisation's value chain and financing or investment activities." - Pauline Ledermann and Amy Quinton, Consultants, Anthesis Group

For accounting firms handling financial services clients in both regions, neoeco simplifies the process by automating transaction categorisation into recognised emissions categories under GHGP and ISO 14064. This automation replaces manual spreadsheet tracking - still used by nearly 50% of businesses - and delivers audit-ready outputs for both frameworks.

Manufacturing Scope 3 Reporting

In manufacturing, ASRS 2 also requires Scope 3 emissions reporting but offers a one-year grace period, making it mandatory from the second reporting year. Manufacturers must account for their entire supply chain footprint, including emissions from upstream material sourcing, logistics, and downstream product use. Group 1 entities - those with 500+ employees, over $1 billion in assets, or $500 million in revenue - will begin reporting on 1 January 2025, with Scope 3 disclosures following in 2026.

Failure to comply can result in fines of up to $15 million or 10% of annual turnover, with directors potentially held personally liable. To make the most of the relief period, manufacturers should immediately map out key Scope 3 emission sources and establish reliable Scope 3 tracking systems before the disclosures become compulsory.

Current developments in climate risk and ESG related disclosures in Australia, UK and EU

Pros and Cons

Choosing the right framework depends heavily on your industry, company size, and operational reach. SECR keeps things relatively simple by focusing on energy usage and Scope 1 and 2 emissions. This makes it a practical choice for UK businesses with fewer resources dedicated to sustainability. The "comply or explain" clause also provides flexibility when certain data is hard to gather. However, this simplicity has its drawbacks - SECR doesn't require Scope 3 reporting, leaving supply chain emissions largely unaccounted for unless companies choose to disclose them voluntarily.

On the other hand, ASRS 2 offers a far more detailed approach. It aligns with the ISSB's IFRS S2 standard, demanding climate-related financial disclosures, including mandatory Scope 3 emissions, scenario analysis, and resilience testing. This creates a considerable data challenge, necessitating robust systems for tracking emissions across the value chain. Gavien Mok from Seneca ESG highlights this point:

"Scope 3 emissions, often the largest share of corporate footprints, are explicitly required. This will compel Australian firms to develop comprehensive value chain accounting systems".

ASRS 2 positions Australian companies to meet international investor standards and align with global expectations.

UK SRS, meanwhile, takes a middle-ground approach. It adopts much of the ISSB baseline while gradually introducing stricter requirements for larger organisations. The focus shifts from just energy reporting to include broader climate-related financial risks. However, with this broader scope comes increased complexity. For firms operating across jurisdictions, managing differing thresholds, timelines, and data requirements can be a significant challenge. For example, SECR applies to approximately 11,900 UK companies, while ASRS 2 will eventually cover Australian firms with as few as 100 employees by 2027/28, casting a much wider net.

Feature | SECR (UK) | UK SRS | ASRS 2 (Australia) |

|---|---|---|---|

Compliance Complexity | Low to Moderate | High | High |

Data Requirements | Utility bills, fuel usage, intensity metrics | Financial and impact materiality | Scopes 1–3, scenario assumptions, resilience testing |

Reporting Flexibility | High; "comply or explain" for missing data | Moderate; phased implementation | Moderate; ASIC takes a "pragmatic" approach in early years |

Scope 3 Mandate | Voluntary | Required for larger entities | Mandatory for all groups |

These variations highlight the difficulty in standardising ESG reporting across different countries. For firms juggling clients in multiple sectors, tools like neoeco can simplify the process by automating transaction categorisation in line with frameworks like GHGP, ISO 14064, SECR, UK SRS, and ASRS 2. This ensures audit-ready outputs, no matter which framework applies.

Conclusion

Navigating ESG reporting requirements in the UK and Australia comes with its complexities. In the UK, the SECR framework centres on energy and carbon data, offering a relatively straightforward approach. On the other hand, Australia’s ASRS 2 demands far more detailed climate-related disclosures, aligning closely with ISSB standards. Adding to the mix, the UK SRS is gradually tightening its expectations for larger organisations. For businesses operating across both regions, the challenge lies in juggling differing thresholds, data demands, and timelines – with Scope 3 emissions being a notable example: optional in the UK but mandatory in Australia.

These differences underline the value of a cohesive compliance strategy. Systems designed to meet Australia’s stringent requirements can often align with the UK’s frameworks as well. For context, around 11,900 UK companies are subject to SECR, while Australia is steadily expanding its reporting scope in phases. Investing in comprehensive data collection and management now can simplify compliance across both regions and ensure future-readiness.

For accounting firms, relying on manual spreadsheets or utility bill tracking is impractical when handling multiple clients across diverse sectors. Tools like neoeco streamline this process by automatically mapping financial transactions to emissions categories recognised under SECR, UK SRS, and ASRS 2, producing audit-ready reports with ease.

The trend towards mandatory disclosure is accelerating. Both the UK and Australia are tightening their requirements, with regulators such as ASIC adopting a measured, early approach. Taking proactive steps - particularly for Scope 3 emissions and scenario analysis - can not only secure compliance but also turn it into a strategic advantage. Investing in data readiness today can transform dual compliance from a challenge into an opportunity.

FAQs

What are the key differences between the UK's SECR and Australia's ASRS 2 reporting frameworks?

The UK's Streamlined Energy and Carbon Reporting (SECR) and Australia’s ASRS 2 (Australian Sustainability Reporting Standard – Climate-related Disclosures) take quite different approaches when it comes to scope, requirements, and who they apply to.

SECR zeroes in on energy use and greenhouse gas (GHG) emissions. Large UK companies must disclose this information alongside their financial statements. It applies to quoted companies, as well as large unquoted firms or LLPs that meet specific thresholds, such as a turnover of £36 million, a balance sheet total of £18 million, or having 250 or more employees. On the other hand, ASRS 2 adopts a broader framework aligned with the Task Force on Climate-related Financial Disclosures (TCFD). It covers areas like governance, strategy, risk management, and scenario analysis. This standard is aimed at entities governed by the Corporations Act 2001 that prepare financial statements compliant with Australian GAAP.

For SECR, disclosures are included in the Directors’ Report or a separate Energy & Carbon Report and have been mandatory for financial years starting on or after 1 April 2019. ASRS 2, by contrast, is integrated into annual financial statements under the AASB framework, with its first reporting year kicking off on 1 January 2025. While SECR homes in on energy and emissions data, ASRS 2 takes a more expansive view, encompassing various aspects of climate-related financial reporting.

How does the UK SRS framework align with global standards like TCFD and ISSB?

The UK Sustainability Reporting Standard (UK SRS) works alongside established global frameworks like the TCFD (Task Force on Climate-related Financial Disclosures) and the ISSB (International Sustainability Standards Board) guidelines. While it emphasises sector-specific reporting needs, the UK SRS aligns its principles with these international standards to promote consistency and comparability across reports.

That said, the guidance doesn't provide clear details on how the UK SRS integrates or aligns directly with the TCFD and ISSB frameworks. For the most reliable and current insights, it's best to refer to official sources or consult professionals specialising in sustainability reporting.

Why are Scope 3 emissions reporting requirements stricter in Australia compared to the UK?

In Australia, reporting on Scope 3 emissions comes with stricter regulations due to the mandatory requirements set out by the Australian Sustainability Reporting Standards (ASRS). These standards, introduced through the Treasury Laws Amendment Act 2024, align with frameworks such as ISSB and TCFD. Under these rules, organisations must account for emissions across Scopes 1, 2, and 3. This involves mapping their entire value chain, calculating emissions, and outlining related risks and opportunities. These regulations will become legally binding starting from the 2025 financial year.

Meanwhile, the UK's Streamlined Energy and Carbon Reporting (SECR) framework, in effect since 2019, primarily focuses on Scope 1 (direct emissions) and Scope 2 (energy-related emissions). Unlike Australia's requirements, Scope 3 emissions reporting is not included, making the UK's approach narrower and less focused on the full supply chain.