Understanding ESRS S3: A Guide for Accountants

Jan 1, 2026

ESRS S3 guidance for accountants on double materiality, community disclosures, governance, data collection and preparing audit-ready CSRD reports.

ESRS S3, under the Corporate Sustainability Reporting Directive (CSRD), focuses on how businesses impact local communities. It requires companies to disclose both positive and negative effects of their operations, using a double materiality approach. This means organisations must evaluate their impact on communities (inside-out) and how community-related risks affect their financial performance (outside-in).

Key points for accountants include:

Who needs to comply? Large companies meeting at least two of these: over 250 employees, €40m+ turnover, or €20m+ in assets. Smaller companies have limited initial requirements.

Core areas of disclosure: Policies, engagement processes, grievance mechanisms, actions on material impacts, and performance tracking.

Accountant's role: Conduct materiality assessments, link social risks to financial data, and ensure audit-ready documentation.

Timeline: Reporting began in 2025 for the 2024 financial year.

This standard integrates sustainability with financial reporting, making it essential for accountants to align both seamlessly.

Educational session on draft ESRS S2, S3 & S4

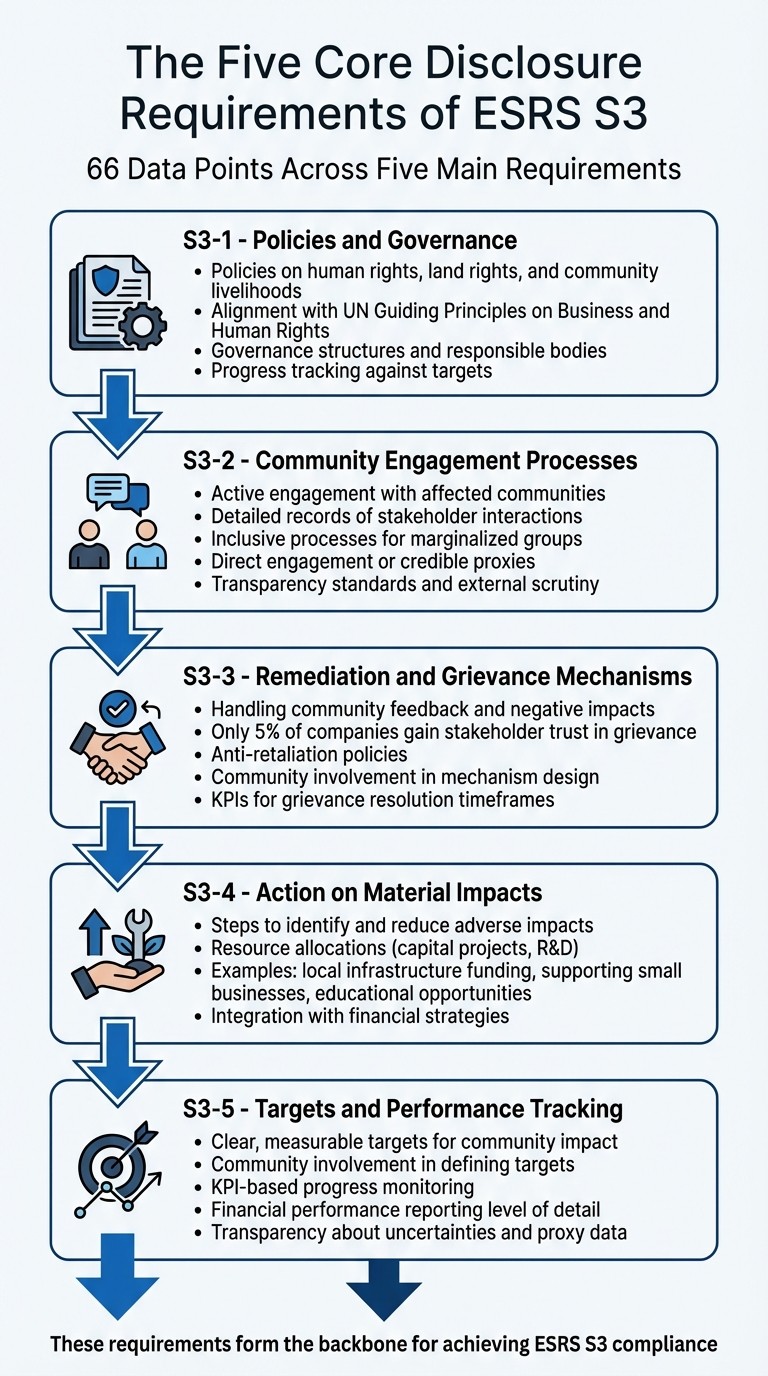

The Five Core Disclosure Requirements of ESRS S3

ESRS S3 Five Core Disclosure Requirements for Community Impact Reporting

ESRS S3 outlines 66 data points divided across five main requirements. Knowing the specifics of each is crucial for preparing audit-ready documentation and ensuring compliance with CSRD obligations. These requirements serve as the backbone for achieving ESRS S3 compliance.

S3-1: Policies and Governance

This section focuses on the policies that address significant community impacts. Companies must disclose their policies on human rights, land rights, and safeguarding community livelihoods. These policies should align with established international frameworks, such as the UN Guiding Principles on Business and Human Rights.

Your task is to confirm these policies are embedded within the organisation's governance structures and communicated through official channels. Additionally, identify the management or administrative bodies responsible for overseeing community-related issues and document how they track progress against their targets.

S3-2: Community Engagement Processes

Beyond having policies in place, companies must actively engage with affected communities and incorporate their feedback. This involves maintaining detailed records of stakeholder interactions that directly shape business decisions.

Best practices include ensuring these processes are inclusive, particularly of marginalised groups, and documenting whether engagement was direct or involved "credible proxies" to represent community perspectives. As part of your role, you should audit these records to ensure they meet transparency standards and can withstand external scrutiny.

S3-3: Remediation and Grievance Mechanisms

This requirement focuses on how companies handle community feedback and address any negative impacts. Research shows that only 5% of companies gain stakeholders' trust in their grievance systems.

You’ll need to assess the effectiveness of these mechanisms, including whether anti-retaliation policies exist and if community members were involved in their design. Establish clear KPIs, such as the percentage of grievances resolved within a set timeframe, and ensure remediation costs are appropriately linked to financial provisions or legal reserves.

S3-4: Action on Material Impacts

Organisations are expected to disclose the steps they take to identify and reduce adverse impacts on communities. This includes detailing resource allocations, such as investments in capital projects or R&D, tied to mitigation efforts.

Examples of such actions might involve funding local infrastructure, supporting small businesses, or enhancing educational opportunities. These resource allocations should be documented with the same precision as financial planning, ensuring they are fully integrated into broader financial strategies.

S3-5: Targets and Performance Tracking

Companies must set clear, measurable targets for community impact and monitor their progress over time. Reporting should include whether affected communities were involved in defining these targets and how performance is tracked.

This requires the same level of detail as financial performance reporting. Develop reliable data systems to measure progress using KPIs and ensure disclosures are transparent about any uncertainties or the use of proxy data.

How to Conduct a Double Materiality Assessment for ESRS S3

Double materiality helps filter disclosures by evaluating both the impact on communities and the financial effects of those impacts. It requires companies to report on two dimensions: Impact Materiality (how the company’s actions affect communities) and Financial Materiality (how community-related issues influence the company’s financial performance). If neither dimension is deemed material, ESRS S3 disclosures can typically be omitted.

This assessment is necessary regardless of the organisation’s size or reporting schedule. The process begins with IRO-1 (Impact, Risk, and Opportunity management) from ESRS 2, which involves documenting how material impacts, risks, and opportunities are identified. Materiality can change over time, so any updates compared to previous reporting periods must also be disclosed. Below, we break down how to assess both impact and financial materiality.

Assessing Impact Materiality

Impact materiality takes an inside-out approach, focusing on how the organisation’s operations directly or indirectly affect communities, including through its value chain. Both actual and potential impacts must be considered.

Start by mapping the value chain to identify community impacts that may require disclosure. This involves examining every stage - from suppliers and manufacturing to distribution and product disposal. Each impact should be evaluated based on its severity (scale, scope, and whether the harm is irreversible) and likelihood. For instance, a mining company might directly affect indigenous land rights, while a retailer’s impacts could occur upstream in garment production facilities.

Engaging with stakeholders is a key part of this process. Analysing the perspectives of affected communities ensures a thorough understanding of how operations influence community health, livelihoods, or cultural heritage. If primary data isn’t available, you can use industry averages or proxies, but you must disclose the preparation methods and any limitations in accuracy.

Another important step is to define time horizons for assessing impacts. Community-related effects often unfold differently from typical financial cycles. For example, a factory closure might immediately affect jobs but have long-term consequences for local economic development.

Financial Materiality and Community Impacts

Financial materiality, on the other hand, takes an outside-in perspective, focusing on how community-related issues could impact the company’s financial performance, cash flow, or access to funding. This perspective is particularly important for investors and lenders evaluating long-term risks and opportunities. While impact materiality measures effects on communities, financial materiality quantifies how these effects translate into financial outcomes.

Community impacts can lead to financial risks in various ways: reputational damage might reduce sales, legal disputes over land rights could increase costs, community protests might delay operations, or ESG concerns could raise the cost of capital. On the flip side, maintaining positive relationships with communities can create opportunities, such as smoother permitting processes, enhanced brand reputation, or a stronger social licence to operate.

Assessment Component | Impact Materiality (Inside-Out) | Financial Materiality (Outside-In) |

|---|---|---|

Focus | Effects on people and the environment (communities) | Effects on the company’s financial performance |

Criteria | Severity (scale, scope, irreversibility) and likelihood | Magnitude of financial impact and likelihood |

Scope | Direct operations and full value chain | Risks/opportunities affecting cash flow and capital |

Primary Goal | Transparency on external social impacts | Informing investors about financial risks/opportunities |

Where possible, connect these assessments to specific financial statement items. For instance, community grievances might require legal provisions, or the loss of a social licence could reduce asset values. Establish thresholds - whether quantitative or qualitative - to determine which risks are significant enough to disclose.

If the ESRS S3 assessment concludes that the topic isn’t material, document the reasoning and provide a forward-looking analysis to justify the omission to auditors. This explanation should reference how the assessment fits into the organisation’s broader sustainability strategy. For more on integrating sustainability with financial management, consider exploring financially-integrated sustainability management approaches.

Steps to Implement ESRS S3 Compliance

Once you've confirmed the materiality of ESRS S3, the next step is to put governance, data collection, and reporting processes into action. These processes turn insights from your double materiality assessment into practical measures. For accountants, this means aligning finance, sustainability, and operations to ensure that data on community impacts is collected accurately and consistently. This builds on the double materiality assessment discussed earlier.

Setting Up Governance and Engagement Mechanisms

Start by identifying the administrative, management, or supervisory bodies (AMSB) responsible for overseeing community impacts. Under GOV-1, you’re required to disclose the specific roles and responsibilities of the board or relevant committees in monitoring risks and opportunities related to communities. Make sure these responsibilities are clearly outlined in board mandates and terms of reference. Regular updates on the concerns and interests of affected stakeholders should also be provided to the AMSB.

Engaging with stakeholders is a key element. Under SBM-2, you must explain how the interests of affected communities shape your business model and strategy. Establish regular consultations, grievance mechanisms, and advisory panels, documenting their frequency and outcomes. For instance, if a client operates near indigenous communities, create an ongoing consultation process that directly informs strategic decisions rather than treating it as a one-off exercise.

In addition, aligning performance incentives with sustainability goals is essential. Under GOV-3, review executive remuneration schemes to include targets like community development achievements or grievance resolution rates. This not only creates accountability at the leadership level but also demonstrates that community impacts are taken as seriously as financial performance.

Collecting and Managing Community Impact Data

Once governance is in place, the focus shifts to gathering accurate data on community impacts. This includes both quantitative and qualitative data. Quantitative metrics might cover capital invested in community initiatives, the number of grievances received, or employment figures for local hires. Qualitative insights could include feedback from community surveys, employee testimonials, or records of stakeholder meetings.

It’s crucial to map the value chain to pinpoint where community impacts occur - whether in direct operations, upstream suppliers, or downstream distributors. For many companies, a significant portion of social and environmental impacts - often over 80% - originates from Scope 3 sources within the value chain. Extend data collection beyond immediate operations and, when necessary, rely on industry averages or proxies. Be transparent about the data's source, accuracy, and plans for improvement in future reporting periods.

Ensure all documentation is audit-ready. As Dan Firmager, ESG Advisor at Kreston Reeves, highlights:

"One of the key features of UK SRS is that these disclosures aren't separate, they're part of the financial statements and they need to connect to financial data".

This means aligning community impact assumptions with financial forecasts. Establishing this connection early creates a seamless process for audits.

Using neoeco to Simplify ESRS S3 Reporting

Technology can significantly streamline compliance efforts. Manual data reconciliation is time-consuming and prone to errors. A solution like neoeco simplifies the process by integrating directly with financial systems such as Xero, Sage, or QuickBooks. It automatically maps transactions to recognised sustainability categories under frameworks like GHGP, ISO 14064, SECR, and UK SRS.

While neoeco primarily focuses on carbon accounting, its financially-integrated approach offers a solid foundation for broader sustainability reporting, including ESRS S3. By working directly with financial data, neoeco ensures that sustainability disclosures meet the same high standards of accuracy expected by auditors. Designed with accounting firms in mind, neoeco’s Policy & Evidence Hub centralises supporting documentation - such as stakeholder engagement records, grievance logs, and receipts for community investments - making it easier to provide audit-ready evidence.

For firms looking to expand into sustainability services without disrupting current workflows, neoeco offers a 30-day free trial for evaluation. The software integrates seamlessly into existing practice management systems, consolidating client data and automating compliance-ready templates. This not only helps you produce professional, audit-ready reports but also opens up new revenue opportunities for your firm.

To explore how integrating finance and sustainability can support broader ESG compliance, check out neoeco's approach to aligning finance and sustainability.

Preparing and Auditing ESRS S3 Disclosures

Once governance structures are in place and data collection is underway, the next step is to ensure your ESRS S3 disclosures are thorough, reliable, and ready for external audit. Under the CSRD, independent auditors are required to provide limited assurance for ESRS disclosures, ensuring that the reported data is both reliable and accurate. To meet these standards, your reports need to be structured, transparent, and traceable from the very beginning. Let’s explore how to compile, verify, and prepare disclosures that meet these requirements.

Creating Audit-Ready Reports

Every figure you report - whether it’s the number of community training sessions or the amount invested in local initiatives - must be backed by solid documentation. This includes evidence such as stakeholder engagement records, meeting minutes, receipts for investments, and logs of grievances addressed. As Ravi Abeywardana, Director of Sustainability, Reporting and Assurance at ICAEW, explains:

"In 2026, accountants will play a critical role in preparing companies to disclose and assure sustainability information".

To ensure an effective audit trail, document every stage of data collection. This is especially crucial for ESRS S3, which requires reporting on 66 specific data points. Instead of relying on manual spreadsheets, consider using digital tools to track community impacts and streamline the process.

When reporting on value chain impacts, it’s important to be upfront about any data limitations. For example, if you rely on sector averages or proxies for data from suppliers or distributors, make sure to clearly explain the methodologies used, the limits of the data, the degree of uncertainty involved, and the steps you’re taking to improve data quality over time. The ICAEW guidance highlights:

"Disclosures relating to... emissions should focus on transparency, with entities clearly outlining the methodology used for calculations, the limitations of the underlying data, the level of estimation uncertainty, and the steps being taken to improve data quality over time".

Auditors often value this kind of transparency and narrative detail more than a single estimated figure, as it demonstrates a rigorous and honest approach to reporting.

Once your audit trail is in place, ensure your disclosures also comply with broader transparency standards.

Meeting Transparency and Consistency Requirements

Your ESRS S3 disclosures must align with ESRS 2 (General Disclosures), which covers governance, strategy, and the management of impacts, risks, and opportunities. This means your S3 report can't exist in isolation - it needs to integrate seamlessly with your broader sustainability and financial statements. Check whether your sustainability statement is prepared on a consolidated or individual basis, and ensure its scope aligns with your financial reporting.

To meet EU requirements for digital comparability, prepare your reports in a digitally tagged XBRL format. This format makes it easier for investors and regulators to analyse and compare data across different companies. Use the EFRAG data point list to map out your disclosures and ensure they align with your double materiality assessment.

Consistency is key across reporting periods. If you make changes to how your disclosures are prepared or presented, provide revised comparative figures unless it’s impractical to do so. If you identify material errors in prior periods, disclose the nature of these errors and how they’ve been corrected for each affected period. Applying this level of precision ensures your sustainability disclosures meet the same rigorous standards expected of financial reporting.

Technology can greatly simplify this process. Tools like neoeco's Policy & Evidence Hub centralise documentation and seamlessly integrate with financial systems like Xero, Sage, and QuickBooks. This integration ensures your sustainability disclosures are not only accurate but also audit-ready. By adopting a financially integrated approach, your firm can produce professional reports that are trusted by both clients and auditors.

Conclusion

ESRS S3 compliance is more than just a box-ticking exercise - it represents a shift in how businesses acknowledge and manage their impact on the communities they touch. With the Corporate Sustainability Reporting Directive (CSRD) extending mandatory sustainability reporting to around 49,000 companies across the EU, accountants are in a unique position to bring the same level of precision and professionalism to community impact data as they do to financial statements. This role isn't limited to compiling reports; it involves creating audit-ready ESG data systems that identify risks, engage stakeholders, and deliver compliant disclosures.

The framework's five core disclosure areas - spanning policies, governance, targets, and performance tracking - demand the same meticulous approach applied in financial audits. And with penalties reaching up to €10 million in countries like Germany, the stakes are undoubtedly high. However, the potential benefits are just as compelling: over 80% of investors now prioritise sustainability data during due diligence. Transparent and reliable reporting on community impact can not only meet regulatory demands but also enhance client trust and improve market positioning.

Accuracy and transparency in reporting are central to building trust and ensuring compliance with ESRS S3. Technology is playing an increasingly important role in simplifying this process. While 55% of finance professionals still rely on spreadsheets for ESG data, platforms like neoeco offer a more streamlined solution. By integrating directly with financial tools like Xero, Sage, and QuickBooks, and providing features such as a centralised Policy & Evidence Hub and built-in audit checklists, these tools help businesses create professional, audit-ready reports efficiently.

As Mark Carney, the former Governor of the Bank of England, aptly put it:

"With better information as a foundation, we can build a virtuous circle of better understanding of tomorrow's risks, better pricing for investors, and better decisions by policymakers".

FAQs

What steps should accountants follow to ensure compliance with ESRS S3?

To comply with ESRS S3, which addresses the impacts on affected communities, accountants should adopt a clear and organised approach:

Start by defining the reporting boundaries. This means identifying subsidiaries, joint ventures, and supply-chain activities that fall within the scope of the disclosure. Then, carry out a double-materiality assessment. This assessment evaluates two key aspects: how the organisation’s activities impact communities (impact materiality) and how community-related issues could influence the organisation's financial performance (financial materiality).

With the material issues identified, the next step is data collection and reporting. This includes gathering both quantitative data, such as community engagement metrics, and qualitative details like policies and strategies, ensuring alignment with ESRS S3 requirements. The data must also adhere to general disclosure standards covering governance, strategy, and metrics. Accountants should pay attention to practical details, such as validating reporting periods, safeguarding confidential information, and ensuring the data can be compared over time.

Finally, ensure the report is validated against the ESRS S3 framework. Obtain approval through internal audits and, if possible, use integrated sustainability accounting tools like neoeco. These tools can simplify data extraction and help produce accurate, audit-ready reports with greater efficiency.

What is the double materiality approach, and how does it affect financial reporting under ESRS S3?

The double materiality approach under ESRS S3 pushes businesses to delve into two critical areas: the impact of their activities on affected communities and how community-related sustainability issues might affect their financial performance. This framework ensures that both social and financial aspects are considered in sustainability reporting.

By using this method, companies can offer a fuller picture of their operations, linking financial data with ESG (Environmental, Social, and Governance) factors. This approach not only aids in regulatory compliance but also helps stakeholders grasp the wider effects of a company's actions on society and its long-term economic stability.

What makes collecting and managing community impact data for ESRS S3 challenging?

Collecting and managing community impact data for ESRS S3 can feel like navigating a maze, largely due to the concept of double materiality. This approach requires businesses to evaluate both impact materiality (how their actions affect local communities) and financial materiality (how those community impacts, in turn, influence the company’s financial performance). Pinpointing relevant community outcomes, establishing consistent metrics, and aligning with ESRS standards often demand significant input from stakeholders and a fair amount of judgement - especially when widely accepted indicators aren't available.

Some of the common hurdles include making estimates and judgements about which data matters most, managing sensitive or confidential information from stakeholders, ensuring data consistency over time, and dealing with gaps or inconsistencies throughout the value chain. These challenges can be particularly overwhelming for smaller organisations that might lack dedicated sustainability teams or sophisticated data systems.

This is where specialised tools like neoeco come into play. By connecting directly with financial data, neoeco automates the mapping of transactions to recognised community impact categories and produces accurate, audit-ready reports. This not only cuts down on manual work but also boosts data accuracy and ensures compliance with ESRS S3 requirements.