Aligning Materiality Across ESG Frameworks

Dec 31, 2025

Compare ISSB, GRI and UK SRS materiality approaches and learn how integrated financial‑sustainability data simplifies reporting and audit readiness.

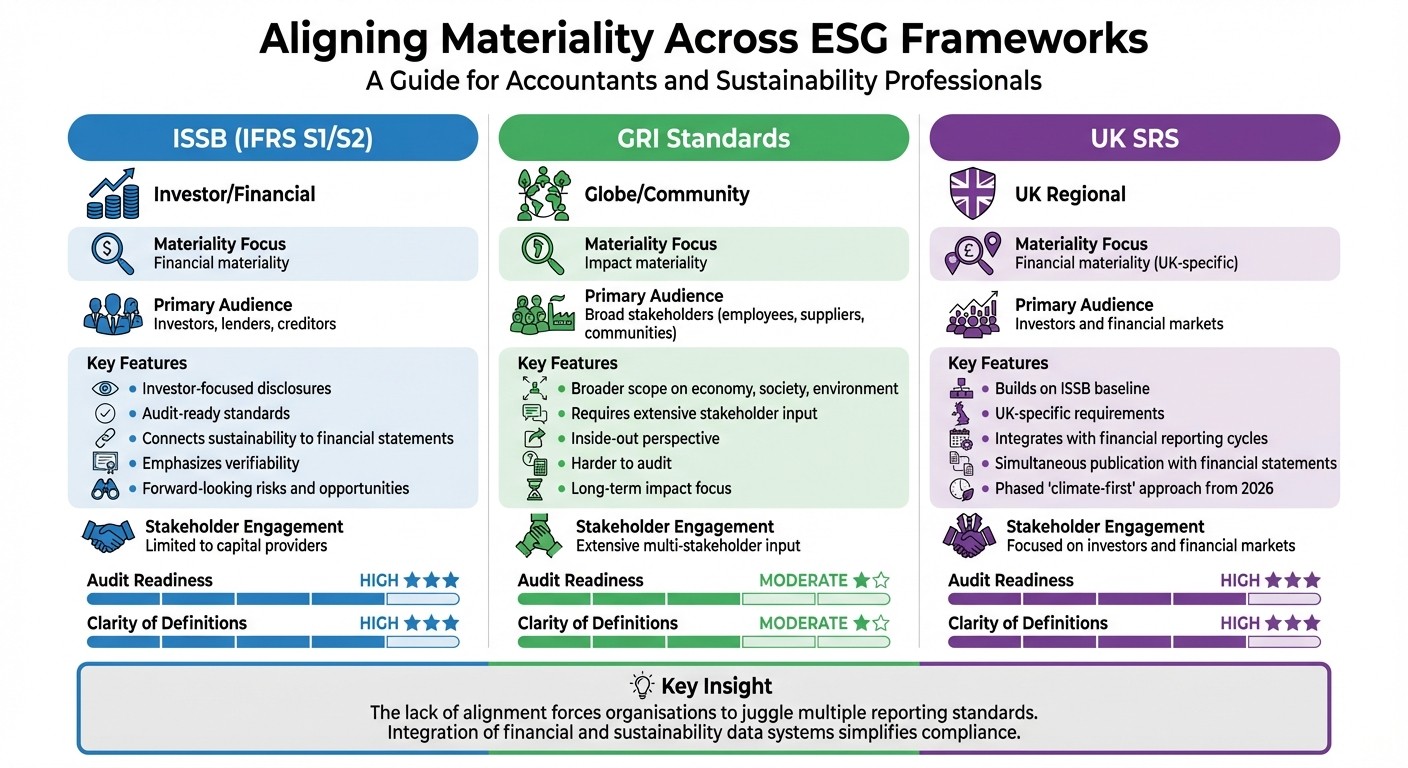

Materiality in ESG reporting is a growing challenge. Different frameworks - ISSB, GRI, and UK SRS - define materiality in conflicting ways, creating complexity for accountants and sustainability professionals. Here’s what you need to know:

ISSB Standards focus on financial materiality, prioritising data relevant to investors and immediate decision-making. It integrates sustainability risks with financial data, making disclosures audit-ready.

GRI Standards adopt impact materiality, looking at how organisations affect the economy, society, and environment. This requires extensive stakeholder engagement but complicates assurance.

UK SRS aligns with ISSB’s financial materiality but adds a regional focus. It demands simultaneous publication of sustainability and financial reports, ensuring better data integration.

The lack of alignment between these frameworks forces organisations to juggle multiple reporting standards. However, integrating financial and sustainability data systems can simplify compliance and improve clarity for investors. For UK organisations, the phased introduction of UK SRS starting in 2026 offers a manageable path forward, beginning with climate-related disclosures.

Framework | Materiality Focus | Key Features |

|---|---|---|

ISSB (IFRS S1/S2) | Financial | Investor-focused, audit-ready, connects sustainability to financial statements. |

GRI Standards | Impact | Broader scope, requires stakeholder input, harder to audit. |

UK SRS | Financial | UK-specific, integrates sustainability with financial reporting cycles. |

Understanding these differences is vital for effective ESG reporting and compliance.

ESG Framework Comparison: ISSB vs GRI vs UK SRS Materiality Standards

1. ISSB Standards (IFRS S1 and S2)

Definition of Materiality

The ISSB adopts a financial materiality perspective, focusing on one key question: could this information influence decisions made by investors, lenders, or creditors? According to IFRS S1, information is considered material if "omitting, misstating or obscuring that information can influence decisions that primary users of general purpose financial reports make on the basis of those reports".

What sets ISSB materiality apart is its emphasis on forward-looking risks and opportunities. It prioritises issues that could impact current investment decisions, while largely discounting risks that may arise in the distant future. Professor Chris Nobes of Royal Holloway, University of London, illustrates this point: "A reporting entity may not need to worry about disclosing it [a future risk] because it is not material for today's decisions by today's users. There's a sort of discounting going on". This approach requires accountants to evaluate not only the size of a risk but also its immediacy and relevance to present-day investment choices. As a result, there’s a strong need for financial data to be tightly integrated with sustainability reporting.

Alignment with Financial Data

The ISSB framework calls for a close connection between sustainability disclosures and financial data. Organisations are expected to align these disclosures with their financial statements. For example, assumptions like discount rates, inflation estimates, and growth projections must be consistent across both sustainability and financial reports, as far as is feasible under the relevant GAAP.

This alignment goes beyond general consistency. Companies must clearly explain how sustainability-related risks affect their financial position and specify which financial statement figures - such as totals and subtotals - are impacted. For accountants, this creates an opportunity to utilise systems that integrate sustainability data with recognised financial categories, making ISSB reporting more streamlined and actionable.

Audit and Assurance Readiness

Under IFRS S1, verifiability is a key qualitative characteristic, requiring data to be accurate and reliable enough for independent experts to agree on its validity. This emphasis on verifiable data makes ISSB disclosures more audit-ready compared to frameworks that rely on broader stakeholder perspectives. Companies are required to document their governance processes, controls, and procedures for managing sustainability risks - an approach that closely mirrors the internal controls already used in financial reporting.

This rigorous focus aligns with the growing demand for consistency across ESG reporting frameworks. As jurisdictions like the UK establish oversight mechanisms for sustainability assurance providers, accountants can prepare by maintaining a "materiality ledger" to record the rationale behind excluding certain indicators.

2. GRI Standards

Definition of Materiality

The Global Reporting Initiative (GRI) takes a distinctive approach to materiality, focusing on how a company's actions affect the economy, environment, and society. This contrasts with the ISSB's financial materiality, which centres on investors. As KPMG puts it, "Impact materiality requires an 'inward-out' approach where entities must consider how their actions could impact, and be material to, a broad range of stakeholders". For accountants working across multiple frameworks, this difference is crucial - what qualifies as material under GRI may not align with ISSB standards. This broader perspective naturally calls for a more inclusive stakeholder engagement process.

Stakeholder Engagement

GRI emphasises the importance of engaging a wide range of stakeholders, such as employees, suppliers, and local communities. Unlike standards that focus on the primary users of financial reports, GRI-aligned reporting seeks to meet the needs of all stakeholders. However, this inclusivity can lead to an overwhelming amount of data, requiring accountants to carefully assess which impacts warrant disclosure. To manage this, many organisations now use double materiality assessments, considering both environmental and social impacts alongside financial factors. This dual approach helps organisations comply with various jurisdictional requirements.

Alignment with Financial Data

Linking these broader impacts to financial metrics adds another layer of complexity. While ISSB standards demand consistency between sustainability assumptions and financial data, GRI's "inside-out" perspective often captures long-term impacts that may not immediately appear in financial terms. As Professor Nobes highlights, "The ESRS include thousands of words, but no definition of impact materiality. I would be very alarmed if I were a CFO or auditor having to comply with these rules". To navigate this challenge, accountants need systems capable of tracking both financial and non-financial metrics over time.

Audit and Assurance Readiness

These nuances in GRI standards significantly influence data management and assurance readiness. With its broad stakeholder scope and open-ended definition of impact materiality, GRI poses unique challenges for assurance. The International Standard on Sustainability Assurance (ISSA) 5000 is currently being developed to offer a profession-neutral framework for third-party assurance of sustainability disclosures. However, the lack of clear boundaries around impact materiality leaves auditors to determine which impacts are significant. In the UK, a voluntary registration scheme for sustainability assurance providers is under consideration, potentially opening the field to both audit and non-audit professionals. This evolving regulatory environment highlights the need for organisations to document their stakeholder engagement processes thoroughly and maintain clear audit trails, even when the data does not directly tie to financial statements.

3. UK Sustainability Reporting Standard (UK SRS)

Definition of Materiality

The UK SRS adopts a single materiality perspective, much like the ISSB. Under this framework, information is considered material if leaving it out or misstating it could sway the decisions of investors and lenders. This approach focuses on how sustainability-related risks and opportunities influence an organisation's cash flows, access to funding, or cost of capital over short, medium, or long-term horizons. The emphasis on consistent materiality ensures more streamlined ESG disclosures. Ed Packshaw, Head of Risk, Reporting and Communications at Simply Sustainable, highlights this trend:

"Despite key differences between the UK SRS and CSRD – particularly the UK's focus on single materiality – the broader trend is clear: sustainability is becoming a core financial requirement".

Stakeholder Engagement

Unlike GRI’s broader stakeholder model, the UK SRS is investor-focused by design. To ensure the standards serve the public good, the UK government has set up a Technical Advisory Committee (TAC) comprising 11 to 15 members. This group includes preparers, users, and auditors, who engage in stakeholder outreach. For accountants, this means materiality assessments should prioritise the data capital providers need to make informed choices. Large organisations are also required to gather sustainability data from SMEs within their supply chains to calculate Scope 3 emissions using traceability systems. This investor-driven focus underscores the importance of aligning sustainability and financial reporting cycles.

Alignment with Financial Data

The UK SRS mandates that sustainability disclosures be published alongside financial statements, removing the one-year delay. This alignment fosters a unified reporting cycle, strengthening the connection between financial and sustainability data. For intricate areas like financed emissions, professionals can use prior-period balance sheet data for loans and investments when real-time value chain information isn’t accessible. Tools such as neoeco integrate with platforms like Xero, Sage, and QuickBooks to automatically map financial transactions to recognised emissions categories under GHGP and UK SRS. This eliminates the need for manual data conversion, ensuring precise, finance-grade reporting.

Audit and Assurance Readiness

Harmonising financial and sustainability data is only the first step; ensuring readiness for audit and assurance is equally critical. The UK government is exploring a voluntary registration scheme for sustainability assurance providers, to be overseen by the Audit, Reporting and Governance Authority (ARGA). These providers must adhere to standards equivalent to ISSA 5000, and the scheme will be open to both audit and non-audit professionals. Renata Ulloa, ESG & Reporting Senior Consultant at Anthesis, underscores the broader implications:

"The UK SRS represents more than a compliance exercise – it's a catalyst to integrate sustainability into decision-making and drive long-term value creation".

To get ready, organisations need to compile quantitative evidence supporting their decisions to include or exclude sustainability information. Implementation is set to begin in January 2026, starting with a phased "climate-first" approach that focuses initially on climate-related disclosures.

Selecting the Right Materiality Assessment Approach | Impact, Financial, or Double Materiality

Framework Comparison: Strengths and Weaknesses

Building on the detailed definitions above, let’s delve into the strengths and challenges of each framework, highlighting how they cater to different reporting needs.

ISSB (IFRS S1 and S2) stands out for its focus on financial materiality - essentially, information that could influence decisions made by investors, lenders, or creditors . This investor-centric approach ensures disclosures are straightforward and align with established accounting standards, making them easier for auditors to verify. However, this narrow scope means it may miss broader societal impacts that don’t directly affect cash flows or cost of capital.

GRI Standards, on the other hand, take a different route by focusing on impact materiality. This approach examines how an organisation affects the economy, environment, and people. It requires significant stakeholder engagement to paint a full picture of an organisation's overall footprint. While this makes the framework more inclusive, the broad definition of impact materiality can make auditing tricky and leave preparers unsure about what constitutes complete disclosure. This trade-off between inclusivity and precision is a key consideration when choosing this framework.

UK SRS combines financial materiality with a regional twist. It adopts ISSB's baseline while allowing for optional SASB sector-based standards. By requiring sustainability disclosures to be published alongside financial statements, it strengthens both connectivity and audit readiness. Additionally, the framework is supported by a voluntary registration scheme for sustainability assurance providers, overseen by the Audit, Reporting and Governance Authority (ARGA), ensuring adherence to standards equivalent to ISSA 5000. Its phased, "climate-first" approach gives organisations time to adapt before expanding their sustainability reporting efforts.

The choice of framework ultimately depends on the audience and regulatory requirements. ISSB and UK SRS are excellent for investor-focused reporting, offering clear definitions and high audit readiness. Meanwhile, GRI suits organisations aiming for transparency on societal impacts, though it demands a more nuanced approach. Tools like neoeco can help bridge these frameworks by integrating financial data with recognised emissions standards like GHGP, ISO 14064, and UK SRS - streamlining compliance without manual conversions.

Feature | ISSB (IFRS S1/S2) | GRI Standards | UK SRS |

|---|---|---|---|

Materiality Focus | Financial materiality | Impact materiality | Financial materiality |

Clarity of Definitions | High; investor-focused | Moderate; subjective and broader | High; builds on ISSB with UK-specific guidance |

Stakeholder Engagement | Limited to capital providers | Extensive multi-stakeholder input | Focused on investors and financial markets |

Audit Readiness | High; standardised approach | Challenging; more subjective | High; supported by UK assurance framework |

Conclusion

When it comes to ESG disclosures, accountants face a pivotal choice: frameworks like ISSB and UK SRS centre on financial materiality - data that influences investor decisions regarding cash flows and cost of capital. Meanwhile, GRI takes a different route, focusing on impact materiality, which examines how an organisation's actions affect people and the environment. For clients operating across multiple jurisdictions, a dual approach becomes unavoidable.

This divergence in focus highlights the need for robust, integrated data systems. As Professor Chris Nobes explains, "The ESRS and ISSB standards are carefully worded to achieve some alignment on what they mean by 'financial materiality', but that ESRS also require disclosures if there is 'impact materiality', creating the two-dimensional 'double materiality'". This alignment offers an opportunity: accountants can develop a unified materiality framework to meet various reporting requirements - provided their data infrastructure is up to the task.

For UK accountants, UK SRS provides a logical starting point. Its climate-first transition relief allows organisations to focus exclusively on climate-related risks for the first two years. Additionally, the requirement to publish sustainability and financial statements simultaneously ensures a clear connection between the two. This phased approach gives firms time to build capabilities before expanding their focus to broader sustainability issues, aligning sustainability reporting with financial discipline.

Effective data integration is critical here. Sustainability disclosures must be underpinned by the same rigorous data systems used for financial reporting. Tools like neoeco simplify this process by automatically mapping transactions to recognised emissions categories, such as those under GHGP, ISO 14064, and UK SRS. This eliminates manual conversions and produces audit-ready outputs. By embedding sustainability reporting directly into clients' financial ledgers, accountants can deliver the accuracy and transparency that both investors and auditors expect. While the scope of frameworks like ISSB, GRI, and UK SRS may differ, their success relies on a shared foundation: accurate, integrated data.

To navigate these frameworks effectively, start with a solid materiality process, invest in integrated data systems, and adopt a phased implementation strategy.

FAQs

How can organisations align their reporting across different ESG frameworks?

Understanding how to align ESG reporting across frameworks like ISSB, GRI, and UK SRS begins with grasping their differing views on materiality. The ISSB and UK SRS prioritise financial materiality, focusing on issues that directly impact a company’s financial performance. In contrast, the GRI adopts a broader double materiality approach, considering not only financial impacts but also societal and environmental effects. By recognising these distinctions, organisations can craft a materiality assessment that satisfies the demands of all three frameworks.

To achieve this, start by mapping your value chain to identify key sustainability risks and opportunities. Then, prioritise topics based on the criteria of each framework. Tools like neoeco can make this process easier by automating emissions mapping and generating audit-ready reports directly from financial data. This approach ensures your reporting is accurate and consistent while cutting down on manual work. Regular updates to your assessments, informed by stakeholder feedback and regulatory shifts, will help you stay aligned as requirements evolve.

What is the difference between financial and impact materiality in ESG reporting?

Financial materiality examines how sustainability-related risks and opportunities influence a company’s financial health - be it its position, performance, or cash flow. This approach takes an outside-in perspective, focusing on what matters most to investors, lenders, and other providers of capital. Typically expressed in monetary terms, it aligns with standards like IFRS S1/S2 and ISSB guidance.

Impact materiality, in contrast, adopts an inside-out perspective. It looks at how a company’s actions affect the environment, society, and the economy. This approach highlights issues that are significant to external stakeholders, such as local communities, regulators, or NGOs. Examples of these impacts include carbon emissions, biodiversity loss, and human rights concerns, with frameworks like the ESRS and GRI providing guidance.

By incorporating both perspectives, accountants can harmonise materiality assessments across frameworks such as ISSB, GRI, and UK SRS. This ensures reports address investor needs while also capturing the organisation’s wider sustainability impacts.

Why is the UK Sustainability Reporting Standards (UK SRS) focusing on climate disclosures first in its implementation?

The UK Sustainability Disclosure Requirements (SRS) are rolling out in stages, starting with a focus on climate-related disclosures. This approach aligns with the International Sustainability Standards Board's (ISSB) global framework, promoting consistency in how organisations report their data. By prioritising climate, the strategy allows businesses at different levels of preparedness to develop strong systems and reliable data processes before tackling wider sustainability obligations.

This step-by-step method not only helps companies adapt to the new standards but also addresses pressing climate issues, making the shift to full sustainability reporting more manageable.