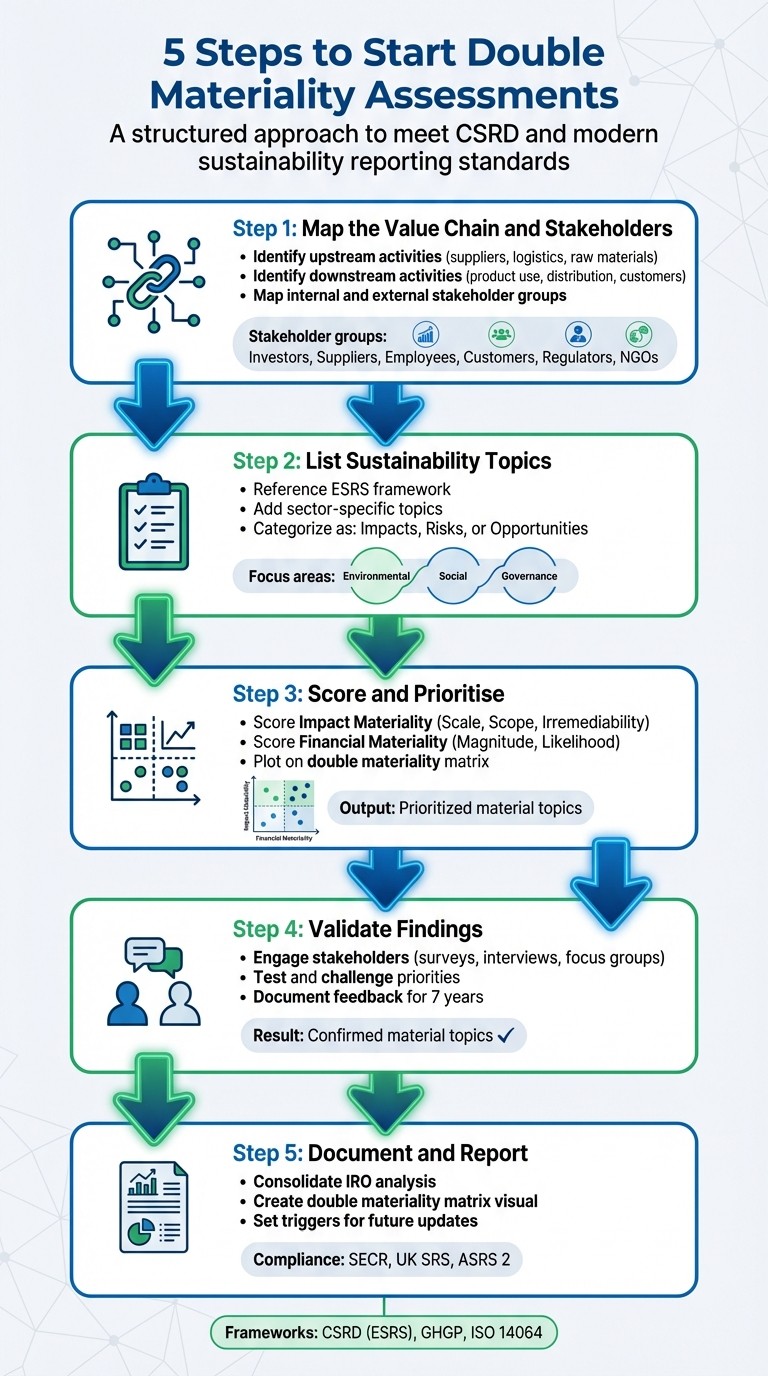

5 Steps to Start Double Materiality Assessments

Feb 9, 2026

Double materiality turns compliance into strategic insight — 5 steps to map value chains, prioritise topics, validate stakeholders and create audit-ready reports.

Double materiality assessments are essential for businesses aiming to meet modern sustainability reporting standards. They evaluate a company’s impact in two ways: impact materiality (how the company affects society and the environment) and financial materiality (how sustainability risks/opportunities affect the company financially). This dual approach is already mandatory under the EU’s CSRD and is gaining momentum in the UK and Australia.

Here’s a quick overview of the 5 steps to conduct a double materiality assessment:

Map the value chain and stakeholders: Identify all operational touchpoints and key stakeholder groups (e.g., employees, suppliers, regulators).

List sustainability topics: Use frameworks like ESRS to create a list of relevant issues, categorised as impacts, risks, or opportunities.

Score and prioritise: Use a double materiality matrix to rank topics based on their financial and societal importance.

Validate findings: Engage stakeholders to confirm priorities and ensure alignment with expectations.

Document and prepare reports: Consolidate findings into a report, detailing methodology, material topics, and triggers for future updates.

Using tools like neoeco, businesses can integrate financial and sustainability data for accurate, audit-ready reports, simplifying compliance with frameworks like SECR and UK SRS.

5 Steps to Complete a Double Materiality Assessment

Tutorial: How to do a Double Materiality Assessment (DMA)

This tutorial provides a high-level overview, but you should also learn how to prepare for external audits to ensure your assessment meets regulatory standards.

Step 1: Map Your Client's Value Chain and Stakeholders

Start by mapping your client's entire value chain - from sourcing raw materials to the final disposal of products. This step ensures you capture all potential impacts and financial risks, covering both upstream activities (like suppliers, logistics, and raw material extraction) and downstream activities (such as product use, distribution, and customer behaviour). Without this complete overview, critical risks or impacts may go unnoticed, which could compromise reporting accuracy. Once you have a thorough map of operations, the next task is to identify key stakeholder groups throughout the chain.

To pinpoint value chain touchpoints, review documents like sustainability reports, climate risk assessments, due diligence records, and risk registers. These resources highlight where the business interacts with environmental and social factors. Financial records can help determine financial materiality, while sustainability documents focus on impact materiality. If the firm uses tools like neoeco, the platform automatically links financial transactions to recognised emissions categories, making the data collection process smoother.

The next step is to identify key stakeholders across the value chain. These include internal groups like employees and board members, as well as external parties such as suppliers, customers, investors, lenders, regulators, and NGOs. Each group offers distinct insights into material topics. If direct access to stakeholders like end customers isn’t possible, consider using proxies, such as the client’s sales team, to gather relevant information.

Here’s a quick reference table for engaging different stakeholder groups:

Stakeholder Group | Engagement Method |

|---|---|

Investors/Lenders | Meetings, surveys |

Suppliers | Engagement programmes, audits |

Employees | Internal workshops, surveys |

Customers | Surveys, sales team proxies |

Regulators/NGOs | Consultations, media review |

This mapping process lays the groundwork for further analysis. Use a mix of surveys (ideal for large groups like employees or customers), interviews (suitable for key individuals such as major suppliers or experts), and focus groups (helpful for addressing complex topics that require consensus). Combining these methods ensures you gather both broad quantitative data and detailed qualitative insights across the value chain. This foundational work is crucial for the scoring, validation, and reporting stages that follow.

Step 2: List Sustainability Topics and Impacts, Risks, and Opportunities

After mapping the value chain and identifying stakeholders, the next step is to compile a detailed list of sustainability topics relevant to your client’s operations. Start by referencing the European Sustainability Reporting Standards (ESRS), which outline a standardised framework of sector-neutral sustainability matters. This framework spans environmental, social, and governance topics that are broadly applicable across industries. To make the list more tailored, add topics specific to the client’s sector, geographic location, and business model. Once the list is complete, categorise each topic to understand both internal impacts and external risks.

Each topic should be classified as an Impact (how the company influences its surroundings), a Risk (external threats related to sustainability), or an Opportunity (potential areas for creating value). This approach ensures you address both Impact Materiality (the organisation's effect on the world) and Financial Materiality (how sustainability issues affect the organisation). For negative impacts, evaluate scale, scope, and irremediability; for positive impacts, focus on scale and scope.

To streamline this process, automated tools can be a game-changer. Solutions like neoeco automatically map financial transactions to recognised emissions categories under frameworks like GHGP and ISO 14064. This provides finance-grade carbon data that’s consistent and ready for audits, saving valuable time. Collaboration is equally important here - engage teams from finance, risk management, legal, and sustainability to assess both the financial implications and the environmental impacts of each topic.

This comprehensive topic list will form the backbone for scoring and prioritisation in the next step.

Step 3: Score and Prioritise Using a Double Materiality Matrix

To prioritise sustainability topics effectively, score each one across two dimensions: Impact Materiality and Financial Materiality. For impact materiality, evaluate based on Scale, Scope, and Irremediability. For financial materiality, focus on Magnitude and Likelihood.

Once scored, plot the results on a matrix. Topics that rank high on both dimensions should be treated as top priorities. However, even if a topic scores highly on just one dimension, it is still considered material. For example, Telefónica’s 2021 assessment highlighted that greenhouse gas emissions were material from both perspectives, while other issues were significant from only one angle. This structured approach ensures a focused and actionable materiality matrix.

Using insights from your supply chain reporting and identified topics, this step quantifies the issues that need immediate attention. To standardise scoring across teams, translate ESRS criteria into sector-specific definitions. For instance, clearly define what constitutes a "Scale 5" impact for your organisation. When evaluating topics, consider their impact over short-, medium-, and long-term horizons. Involve cross-functional teams - such as finance, risk, and sustainability - to comprehensively assess financial and environmental dimensions.

Tools like neoeco can simplify this process. Platforms like this automatically map financial transactions to recognised emissions categories under GHGP and ISO 14064, offering finance-grade carbon data with full audit trails. By eliminating spreadsheet errors, they deliver accurate, real-time data. Their live dashboards also let you monitor thresholds and track progress against science-based targets, turning materiality into a strategic advantage rather than just a compliance task.

To refine your understanding, it’s important to distinguish between single materiality and double materiality.

Single Materiality vs Double Materiality

The distinction between these two approaches is critical for correctly framing your assessment.

Single materiality focuses solely on issues that have a direct financial impact on the company. For instance, emissions would be reported only if they affect the company’s financial position.

Double materiality, on the other hand, includes issues that are either financially significant or have meaningful external impacts on society and the environment. Under this approach, emissions would be reported not only for financial reasons but also if they significantly contribute to climate change.

The table below highlights the differences:

Aspect | Single Materiality | Double Materiality |

|---|---|---|

Core Focus | Financial position and performance (Outside-In) | Financial position and societal/environmental impact (Inside-Out) |

Primary Audience | Investors, lenders, and creditors | Investors, regulators, employees, and local communities |

Scope | Issues with measurable financial impact on the company | Issues that are either financially material or have significant external impacts |

Frameworks | ISSB (IFRS S1 & S2) | CSRD (ESRS), GRI |

Example | Reporting emissions when financially consequential | Reporting emissions if they significantly contribute to climate change |

With a well-defined matrix, the next step is to validate these material topics with your stakeholders.

Step 4: Validate Material Topics with Stakeholders

After scoring and prioritising your material topics, the next step is to validate them with key stakeholders. This isn't just a formality - it’s a critical step to ensure your assessment reflects genuine concerns and can withstand scrutiny. PwC highlights the importance of this process:

Test your material topics with stakeholders and leave room for them to challenge and discuss strategic considerations.

This involves engaging with internal leadership, suppliers, customers, and community representatives to confirm that your priorities align with both financial risks and broader societal issues. It builds on the groundwork laid in the earlier mapping and scoring phases.

Different stakeholders require tailored engagement methods. For instance:

Surveys are ideal for gathering broad feedback from employees or customers on prioritised topics.

Structured interviews work best when seeking detailed insights from suppliers or investors about specific risks.

Focus groups are effective for reaching consensus on complex issues with community leaders or NGOs.

Choose the method that fits the needs of each stakeholder group to get the most relevant input.

It's essential to document both internal and external perspectives during this process. Keep records of stakeholder identification, engagement strategies, survey or interview data, validation evidence, and any change management activities for seven years. This includes maintaining contact lists, questionnaires, transcripts, cross-references, and approval workflows. Without this comprehensive audit trail, your assessment may not stand up to external assurance or regulatory review. Stakeholder feedback should directly inform your documentation, linking back to the groups identified in earlier steps.

This is where neoeco's audit-ready features can make a big difference. Instead of juggling multiple documents, the platform offers a Policy & Evidence Hub to securely store all supporting materials. Its live checklist helps you track progress - showing what’s completed, what’s missing, and what’s ready for review. This makes it easy to share evidence with auditors or assurance providers without endless back-and-forth emails. These tools streamline the validation process and support smoother reporting.

Once stakeholder validation is complete and your documentation is well-organised, you’ll be ready to move on to finalising the full assessment and preparing for reporting in the next step.

Step 5: Document the Assessment and Prepare for Reporting

Once stakeholders have validated the findings, it's time to consolidate everything into a comprehensive report. This document should detail your methodology, the material topics identified, and the conditions that will trigger future updates. This serves as the backbone for compliance with frameworks like SECR, UK SRS, or ASRS 2, and it must be thorough enough to withstand external scrutiny.

A key component of the report is the Impact, Risk, and Opportunity (IRO) analysis. This analysis should address both the actual and potential impacts on people and the environment (the inside-out perspective) as well as the financial risks and opportunities relevant to your client’s business (the outside-in perspective). To make this information more digestible, include a double materiality matrix. This visual tool ranks each topic based on its financial relevance and its broader impact, offering a clear snapshot of priorities. The report, built on validated stakeholder input, not only ensures compliance but also aligns with strategic sustainability objectives.

Another critical element is documenting the triggers that will necessitate updates to your assessment. These triggers might include shifts in revenue, the introduction of new product lines, regulatory changes, or heightened stakeholder concerns. By setting clear thresholds and maintaining traceable ESG data systems, you make future updates more straightforward and defensible.

Platforms like neoeco simplify the reporting process by integrating financial data with emissions categories recognised under frameworks such as GHGP, ISO 14064, SECR, and UK SRS. These tools connect seamlessly with accounting software like Xero, Sage, and QuickBooks, automatically mapping transactions to the appropriate emissions categories. This eliminates the need for cumbersome spreadsheets and manual data conversion, allowing you to create branded, audit-ready reports in just minutes. The Policy & Evidence Hub securely stores all supporting documentation, while live dashboards provide real-time insights into emissions trends and intensity. Auditors can be granted direct access to evidence, cutting down on endless email exchanges and version control issues.

With these steps completed, your firm will be well-prepared to meet compliance demands and strengthen its role as a trusted sustainability advisor.

Conclusion

Double materiality assessments elevate accounting firms from simply ensuring compliance to becoming strategic partners in financial resilience and societal impact. By adopting this approach, you can help clients identify external financial risks - like regulatory shifts and climate challenges - while addressing internal impacts, such as environmental practices and labour conditions. The outcome? A comprehensive perspective that empowers clients to mitigate risks and capitalise on opportunities.

This shift is becoming essential as global trends push for integrated sustainability reporting. For instance, 51% of companies in the Asia-Pacific region have already embraced double materiality. Here in the UK, frameworks like SECR, UK SRS, and ASRS 2 are driving similar changes. The complexity of these requirements makes manual processes unfeasible, which is where platforms like neoeco step in. Neoeco integrates seamlessly with tools like Xero, Sage, and QuickBooks, mapping transactions to recognised emissions standards such as GHGP and ISO 14064. Its Policy & Evidence Hub ensures secure documentation storage, while live dashboards provide real-time insights into emissions trends. Auditors gain secure access to evidence, and branded, audit-ready reports can be generated in minutes instead of weeks.

By combining sustainability data with financial data on the same ledger, your reports achieve a level of precision and trust that regulators and clients expect. This isn't just about meeting compliance requirements - it's about delivering reliable, audit-grade insights. With tools like neoeco, managing Scope 3 emissions becomes a straightforward and transparent process, eliminating the usual headaches of data collection and reporting.

Incorporating double materiality into your services not only ensures compliance but also strengthens client relationships and opens up new revenue opportunities. Your clients gain a powerful resource for strategic decision-making and long-term planning, while your firm stays ahead in a rapidly changing market.

Start small - apply these methods with one client, refine your process, and then scale across your practice using the right tools and frameworks. This step-by-step approach can transform your firm into a leader in sustainability-focused advisory services.

FAQs

What’s the difference between single and double materiality in ESG reporting?

Single materiality zeroes in on how environmental, social, and governance (ESG) factors influence a company's financial performance and risks. In simple terms, it’s about identifying issues that could directly affect the company’s bottom line - whether that’s profitability, valuation, or economic outcomes.

On the other hand, double materiality expands the scope by looking at both financial materiality and what’s known as impact materiality. This means it not only examines how ESG factors affect the company but also considers the reverse: how the company’s operations impact society and the environment. It’s a dual lens - covering financial risks to the business and the organisation’s broader effects on the world around it.

This dual perspective aligns with frameworks like the EU’s Corporate Sustainability Reporting Directive (CSRD) and European Sustainability Reporting Standards (ESRS). These frameworks emphasise the growing need for transparency and deeper stakeholder engagement in sustainability reporting.

How can I map my value chain and identify key stakeholders effectively?

To create a clear map of your value chain and pinpoint key stakeholders, start by listing everyone who impacts or is affected by your organisation’s environmental, social, and governance (ESG) performance. This typically includes groups like suppliers, customers, employees, investors, regulators, and local communities. Engaging with these stakeholders through methods like surveys, interviews, or meetings can provide a range of perspectives on critical ESG issues.

After gathering feedback, organise stakeholders by their influence on your organisation and the impact your activities have on them. Using structured approaches, such as scoring systems, can help prioritise their importance. This approach aligns with double materiality frameworks, such as CSRD and ISSB, ensuring your focus remains on the most pressing ESG factors.

To simplify and ensure accuracy, you might explore sustainability accounting tools like neoeco. These platforms can automate tasks like data collection, stakeholder mapping, and impact analysis, ensuring compliance and producing audit-ready results.

What tools can help with double materiality assessments?

Navigating double materiality assessments doesn't have to be overwhelming - especially with the right tools and resources at your disposal. For instance, neoeco offers specialised software designed for accounting firms. It automates data collection, links transactions to recognised emissions categories, and produces detailed, audit-ready reports. By connecting directly to financial data, it helps ensure compliance with frameworks like the CSRD and ESRS.

Beyond software, there are also practical guides and checklists available. These resources cover everything from pinpointing material topics to engaging stakeholders and documenting findings. They’re a handy way to make sure your assessments stay thorough and aligned with the latest ESG standards.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.