Scope 3 Data Collection: Tools for Activity vs Spend-Based

Feb 2, 2026

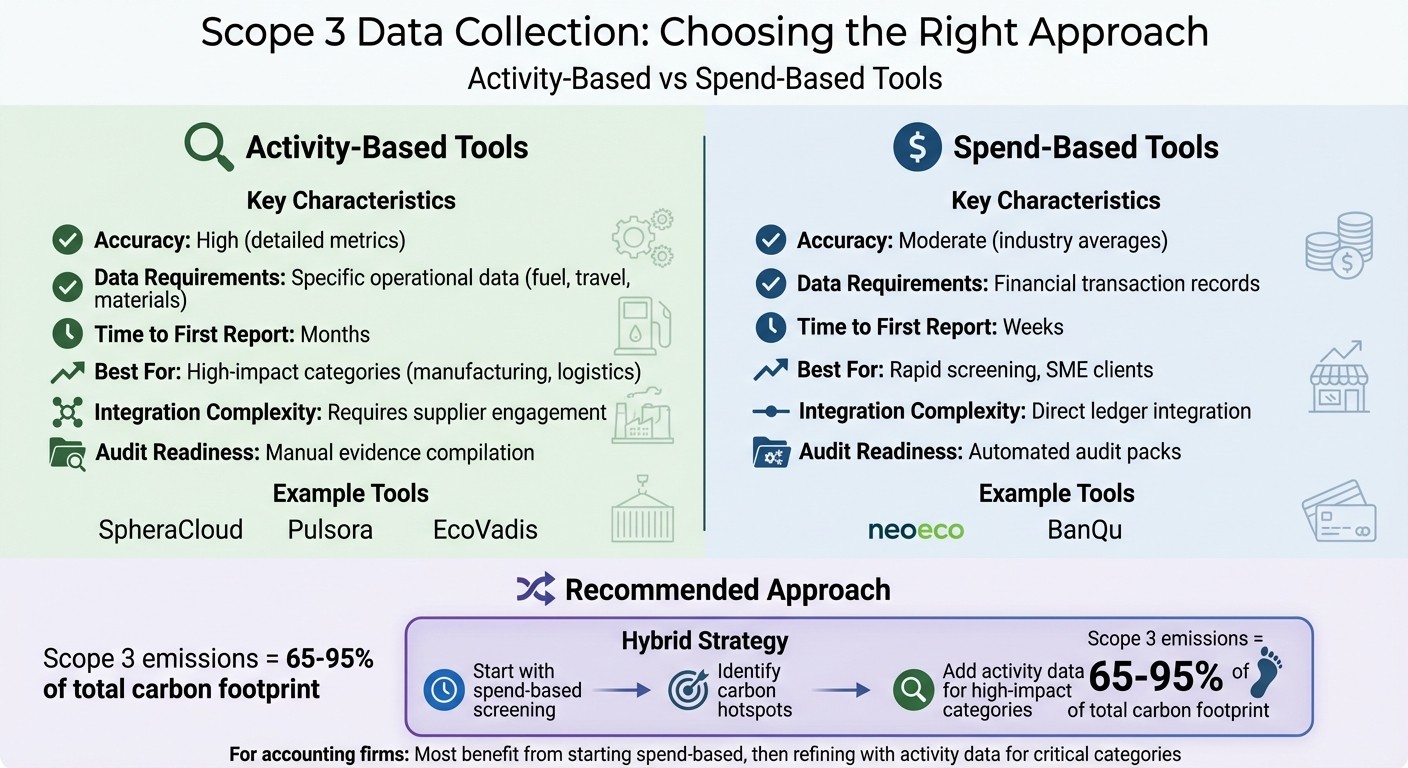

Compare activity-based and spend-based tools for Scope 3 emissions—use spend-based ledger screening for speed, then apply activity data for high-impact accuracy.

Tracking Scope 3 emissions can be complex, but the right tools simplify the process. Companies typically choose between two approaches: activity-based (detailed metrics like fuel or travel data) and spend-based (financial data linked to emission factors). Each has its strengths - activity-based offers precision, while spend-based is faster and easier to implement. Most firms benefit from combining both methods to balance accuracy with efficiency.

Key takeaways:

Activity-based tools (e.g., SpheraCloud, Pulsora, EcoVadis) focus on operational details, ideal for high-impact areas like manufacturing or logistics.

Spend-based tools (e.g., neoeco, BanQu) use financial records for rapid screening, helping identify emission hotspots quickly.

A hybrid approach starts with spend-based screening, then adds activity data for critical categories, ensuring compliance with frameworks like ISSB standards or ISO 14064.

Quick Comparison:

Factor | Activity-Based Tools | Spend-Based Tools |

|---|---|---|

Accuracy | High (detailed metrics) | Moderate (industry averages) |

Data Requirements | Specific operational data | Financial transaction records |

Time to First Report | Months | Weeks |

Best For | High-impact categories | Rapid screening |

Integration Complexity | Requires supplier engagement | Direct ledger integration |

Audit Readiness | Manual evidence compilation | Automated audit packs |

For most accounting firms, starting with spend-based tools like neoeco is practical, especially when working with SMEs. These tools integrate directly with software like Xero or QuickBooks, making it easier to generate reports. Over time, activity-based data can refine results for priority areas, creating a balanced strategy that meets compliance needs while keeping costs manageable.

Activity-Based vs Spend-Based Scope 3 Emissions Tools Comparison

Webinar: The Practical Guide to Scope 3 Emissions (And Why They Matter Most)

Activity-Based Data Collection Tools

Activity-based tools are designed to track metrics like fuel usage, material weights, and travel distances. These tools are particularly useful for industries like manufacturing and logistics, where emissions are closely tied to physical operations. By focusing on detailed operational data, they provide a precise picture of emissions and help businesses stay compliant with environmental standards.

Here are three examples of tools that excel in this approach, offering detailed insights through operational metrics.

SpheraCloud Scope 3 Reporting

SpheraCloud combines Life Cycle Assessments (LCAs) with environmental, health, and safety (EHS) risk systems, making it a strong choice for sectors such as chemicals and oil & gas. It provides access to over 20,000 third-party-verified datasets, updated annually, which support detailed emissions modelling across all 15 Scope 3 categories. This level of precision ensures audit-ready reports and compliance with GHG Protocol standards, all based on granular operational data.

Pulsora

Pulsora leverages AI to streamline the management of complex, multi-tier supply chains. Its 'cascading hierarchies' feature automates supplier outreach, while PulsoraAI matches emissions factors to create decarbonisation pathways and support Science-Based Target setting. With audit-ready dashboards and version tracking, it simplifies compliance with SBTi requirements, offering precise data for distributed networks.

EcoVadis Carbon Action Manager

EcoVadis takes a network-based approach, gathering primary data from suppliers through standardised scorecards and calculators. This method is ideal for procurement-driven organisations focused on supplier benchmarking and risk management.

Federico Introvigne, Head of Direct Procurement, said: "The Carbon Action Manager is a unique solution that consolidates all the data we need from our suppliers in one place."

For accounting firms, this tool provides supplier-specific emissions data, enhancing both accuracy and audit reliability by focusing on granular, primary data rather than relying on general industry averages.

Feature | SpheraCloud | Pulsora | EcoVadis Carbon Action Manager |

|---|---|---|---|

Primary Approach | Life Cycle Assessment (LCA) & EHS Integration | AI-driven multi-tier supplier engagement | Network-based supplier scorecards |

Data Strength | 20,000+ verified datasets for in-depth modelling | PulsoraAI for decarbonisation pathways | Primary data collection from a shared supplier network |

Best For | Asset-heavy industries (Chemicals, Oil & Gas) | Large, distributed global organisations | Companies focused on supply chain risk and benchmarking |

Audit Readiness | High; aligned with GHG Protocol and EHS standards | High; includes audit-ready dashboards and SBTi alignment | Moderate to High; emphasises standardised primary data |

Spend-Based Data Collection Tools

Spend-based tools analyse financial transactions to connect spending with emission categories, offering a fast way to screen Scope 3 emissions. By using procurement data from existing accounting systems, these tools apply industry-average emission factors to spending categories. This allows accounting firms to conduct a complete Scope 3 screening across an entire value chain within weeks instead of months.

While this method isn't as precise - since it relies on monetary values and sector averages - it excels at quickly identifying carbon hotspots. It provides a starting point for understanding Scope 1, 2, and 3 emissions, which typically account for 65% to 95% of a company's total carbon footprint. This rapid assessment helps businesses prioritise areas for deeper investigation. Spend-based tools work well alongside activity-based data collection, offering quick insights directly from financial records.

Among the spend-based tools available, neoeco is particularly noteworthy for its seamless integration with financial ledgers.

neoeco

neoeco is tailored for accounting firms in the UK and Australia. Unlike general carbon tracking platforms, it connects directly to financial ledgers like Xero, Sage, QuickBooks, and Microsoft Dynamics 365 Business Central. Transactions are automatically assigned to emissions categories recognised under frameworks such as GHGP, ISO 14064, and national standards like SECR, UK SRS, and ASRS 2.

The platform uses Life Cycle Assessment (LCA) methodologies to link transactions to over 90 ESG impact factors. This provides a finer level of detail compared to traditional spend-based tools that rely solely on generic emission factors. neoeco’s unique approach, known as Financially-integrated Sustainability Management (FiSM), embeds ESG data directly into financial systems, avoiding the need for separate tools or manual data handling. Audit-ready reports are generated straight from financial workflows, eliminating the need for spreadsheets.

Additionally, neoeco features a Policy and Evidence Hub, which stores compliance documents and gives auditors direct access to reports and evidence, cutting down on email-based data requests. Its AI-powered document extraction can process utility bills and supplier invoices in multiple languages, simplifying data collection for Scope 3 emissions across complex supply chains.

Pricing starts at £34/month per company (billed annually) for the Standard plan, which includes three users, GHGP/SECR reports, and AI document extraction. The Premium plan, priced at £99/month, offers additional features like LCA coverage, support for ten users, and ISO 14064 audit packs. Enterprise pricing is available for firms needing unlimited users and customised client portals.

BanQu

BanQu focuses on real-time spend-based tracking, using configurable dashboards to link financial transactions with emissions data. It is ideal for organisations managing distributed procurement networks, providing real-time visibility into emissions as transactions occur. This makes it particularly suited for companies with complex, multi-tier supply chains where spend data is more accessible than detailed activity metrics.

Feature | neoeco | BanQu |

|---|---|---|

Primary Focus | Financially-integrated sustainability for accounting firms | Real-time supply chain emissions tracking |

Integration | Direct ledger (Xero, Sage, QuickBooks, Dynamics) | Configurable spend data uploads |

Methodology | LCA-based (90+ impact factors) | Spend-based emission factor assignment |

Compliance Support | GHGP, ISO 14064, SECR, UK SRS, ASRS 2 | General GHG Protocol alignment |

Best For | Accounting firms serving SMEs and mid-market clients | Large organisations with distributed procurement |

Audit Readiness | One-click audit-ready reports and evidence hub | Dashboards and spend-based documentation |

Activity-Based vs Spend-Based Tools: A Comparison

Activity-based tools focus on precision by using detailed operational data, while spend-based tools prioritise speed, offering quick Scope 3 screenings based on financial ledgers. Activity-based methods require specific metrics like fuel consumption or kilometres travelled, delivering higher accuracy but demanding more time and effort. On the other hand, spend-based tools use financial transactions and apply industry-average emission factors to spending categories. This method sacrifices some accuracy but enables a complete Scope 3 screening within weeks. At its core, the choice between these tools depends on whether operational detail or rapid financial integration is more important.

For accounting firms handling a variety of client portfolios, spend-based tools often serve as a practical starting point. These tools integrate seamlessly with financial systems like Xero, Sage, or QuickBooks, eliminating the need for additional data collection from clients. After identifying carbon hotspots through spend-based analysis, firms can shift to activity-based methods for categories with the greatest environmental impact. This combination of approaches creates a balanced strategy that aligns with ISSB reporting requirements.

When it comes to compliance, the two approaches differ significantly. Spend-based tools, such as neoeco, simplify compliance by automatically mapping transactions to recognised frameworks. In contrast, activity-based tools require more manual configuration to meet specific standards, but they offer the granularity needed for organisations aiming for ISO 14064 certification or detailed Scope 3 emissions reporting, especially in complex supply chains.

Factor | Activity-Based (Primary Data) | Spend-Based (Secondary Data) |

|---|---|---|

Accuracy | High - uses actual operational metrics | Moderate - relies on sector averages |

Data Requirements | Detailed supplier and operational data | Financial transaction records only |

Time to First Report | Months (extensive data gathering) | Weeks (leverages existing ledgers) |

Best For | High-impact categories, ISO 14064 | Rapid screening, SME clients |

Integration Complexity | Requires supplier engagement | Direct ledger connection (Xero, Sage) |

Audit Readiness | Requires manual evidence compilation | Automated audit packs and evidence hubs |

For most accounting firms, a hybrid approach delivers the best results. Starting with spend-based tools helps establish a baseline and pinpoint areas of concern. Then, activity-based data can be added for the most critical categories, ensuring a balance between accuracy and practicality. This staged method keeps implementation costs manageable, which is especially important when expanding sustainability services alongside traditional accounting offerings.

Hybrid and Gap-Filling Methods

Accounting firms often face a familiar hurdle: clients rarely have comprehensive operational data for all 15 Scope 3 categories. This is where a hybrid approach comes into play. By blending spend-based analysis with targeted activity-based data, firms can build a more complete emissions inventory. The process starts with financial transactions as the foundation, then incorporates supplier-specific data for key categories like purchased goods, transport, or business travel. The result? A practical balance between precision and feasibility.

But even with a hybrid framework, data gaps are inevitable. To address these, firms rely on public emissions factors from trusted sources like DEFRA and the EPA. These organisations provide industry-average conversion factors that translate spending or activity into carbon equivalents. When precise supplier data isn’t available, these factors offer a scientifically sound fallback. However, it’s crucial to document the distinction between secondary and primary data sources. That’s where an Inventory Management Plan (IMP) becomes essential. This plan outlines when primary data should be prioritised, when secondary factors can be used, and strategies for improving data quality over time.

For firms aiming to streamline this process, tools like neoeco Premium can be a game-changer. Priced at £99 per month per company (billed annually), it offers evidence readiness trackers. These trackers automatically monitor which parts of a report have supporting documentation and where client input is still needed. This automation shifts the audit trail from being a tedious spreadsheet task to an efficient control system. It also simplifies compliance with frameworks like aligning ESG data with ISSB requirements or ISO 14064 standards.

The hybrid approach works best when paired with clear escalation rules. Start with a spend-based screening across all categories to identify the top three to five carbon hotspots. Then, request activity-based data only for those high-impact areas. This phased strategy reduces the burden on clients while ensuring the necessary level of detail. Over time, as clients improve their data collection capabilities, firms can transition more categories from secondary to primary data sources. This gradual shift enhances accuracy without overwhelming resources, aligning perfectly with Scope 3 reporting goals.

Conclusion

Choosing the right Scope 3 tool is all about aligning with your clients' needs and compliance goals. Spend-based tools provide a quick, finance-driven starting point, while activity-based tools offer more accuracy but demand deeper client participation and robust data. For most accounting firms, it's not an either/or decision. A practical approach is to begin with spend-based screening to pinpoint carbon hotspots, then incorporate activity-based data where it adds the most value.

Platforms like neoeco simplify Scope 3 reporting by seamlessly integrating with accounting software like Xero, Sage, and QuickBooks. This eliminates the need for spreadsheets or manual data handling, delivering audit-ready reports directly from financial data.

Equally important is how well the tool supports transparent reporting. When clients or external reviewers question how emissions figures were calculated, a clear path from financial records to emissions data is essential. Relying solely on industry averages can make this trail murky. In contrast, financially integrated platforms ensure transparency with science-backed methodologies that comply with ISSB reporting requirements and UK SRS standards. This isn't just about meeting compliance - it’s about earning client trust and establishing your firm as a trusted adviser in sustainability.

FAQs

What are the advantages of using a hybrid approach to collect Scope 3 emissions data?

A hybrid strategy for collecting Scope 3 emissions data combines primary data - specific information sourced directly from suppliers or operations - with secondary data, such as industry averages or estimates. This blend strikes a balance between being precise and efficient, allowing organisations to focus on high-impact areas with detailed, traceable data while using less resource-intensive methods for lower-priority categories.

By prioritising primary data where it has the most impact, businesses can align more effectively with standards like ISSB and UK regulations. Meanwhile, secondary data enables faster, broader evaluations. Tools like neoeco simplify this process by automating data mapping and seamlessly integrating both data types into audit-ready reports, making the reporting process smoother and more scalable.

This method doesn’t just improve data reliability and regulatory compliance; it also fosters stakeholder confidence by demonstrating a thorough and professional approach to emissions reporting.

How do spend-based tools work with accounting software such as Xero or QuickBooks?

Spend-based tools work effortlessly with accounting software like Xero or QuickBooks by directly linking to the financial ledger. This connection enables them to pull transaction data automatically, eliminating the need for manual data entry or spreadsheets.

Take neoeco, for instance. This tool is tailored for accounting firms and works with clients' financial data. It categorises transactions according to recognised emissions standards such as the GHGP, ISO 14064, and UK-specific frameworks like SECR. The result? Precise, audit-ready carbon data that supports sustainability reporting while cutting down on admin work.

Why is it beneficial to use both activity-based and spend-based data for Scope 3 emissions reporting?

Using both activity-based and spend-based data for Scope 3 emissions reporting gives organisations a clearer and more detailed view of their carbon footprint. Here's how each works:

Activity-based data comes directly from suppliers or operational records. It provides precise, traceable insights into specific emission sources, making it highly reliable for detailed reporting.

Spend-based data, on the other hand, estimates emissions based on financial transactions. While less specific, it’s faster to gather and helps pinpoint key areas of impact when activity data isn’t available.

By combining these two methods, organisations can start with spend-based data to set initial baselines and then refine their reporting with activity-based data for critical areas. This dual approach ensures compliance with frameworks like the GHG Protocol and SECR, enhancing transparency and accuracy.

Tools like neoeco simplify this process by automating data collection and mapping financial transactions to recognised emissions categories. This not only saves time but also helps companies produce accurate, audit-ready reports with ease.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.