UK SRS and ESG Data: Aligning for 2026 Compliance

Feb 1, 2026

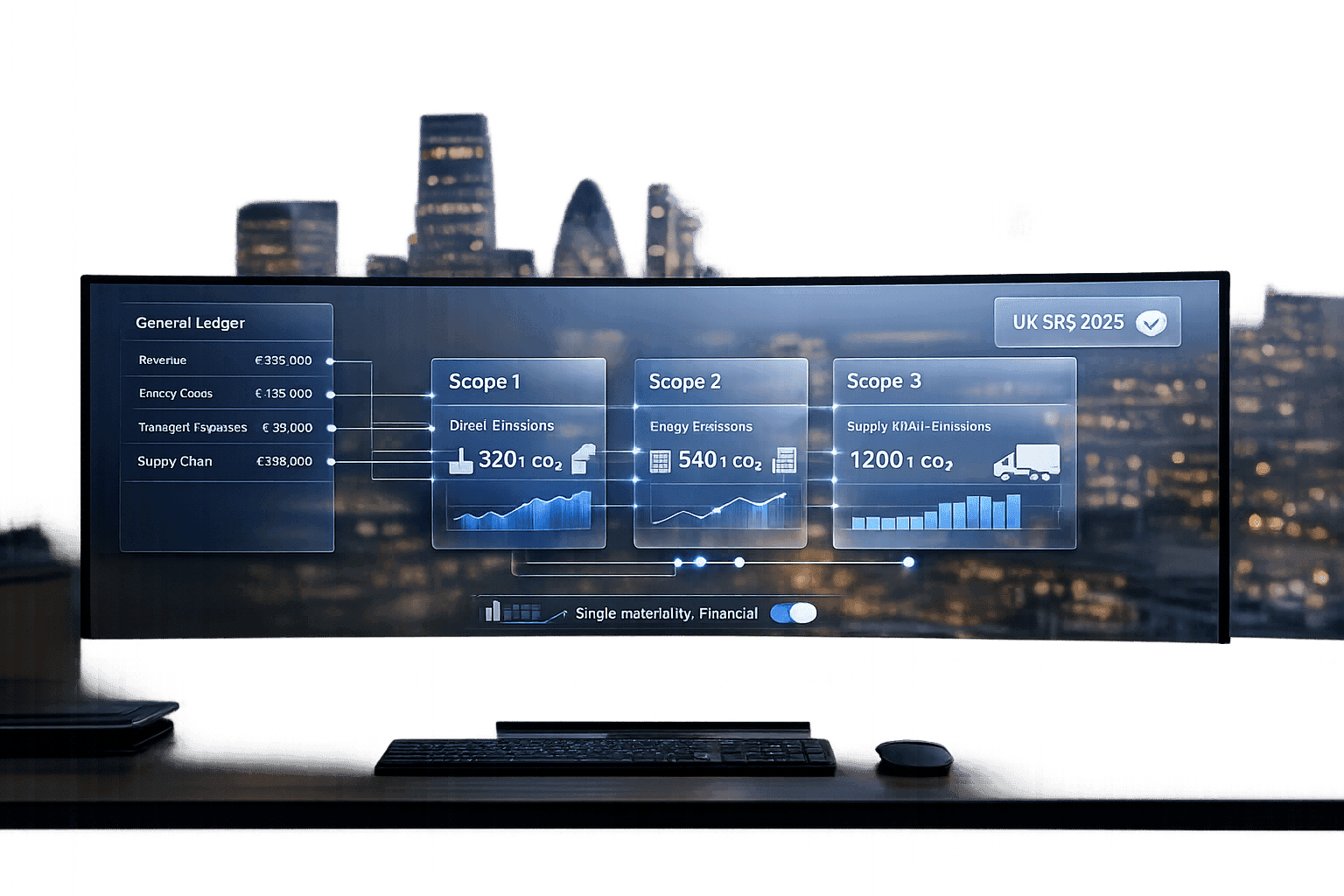

Covers UK SRS requirements from 2026 for large organisations, the single‑materiality focus, and how integrated tools map financial ledgers to Scope 1–3 emissions.

From 2026, large organisations and central government bodies in the UK must comply with the UK Sustainability Reporting Standards (UK SRS). These standards, based on the ISSB framework, focus on integrating sustainability data with financial reporting. The final versions of UK SRS S1 and S2 will be available for voluntary use earlier in 2026, with mandatory adoption soon after.

Key points to know:

Who is affected? Organisations with over 500 employees or £500m+ in operating income.

What is required? Reporting on sustainability risks and opportunities tied to financial materiality, focusing on Scope 1, 2, and 3 emissions initially.

How does it differ? Unlike EU's double materiality approach, UK SRS focuses on single materiality to align with investor needs.

Support tools: Platforms like neoeco automate compliance by linking financial data to emissions categories, simplifying reporting and audits.

The UK SRS aims to ensure sustainability data matches the reliability of financial disclosures, meeting the expectations of regulators and investors alike.

Understanding UK Sustainability Reporting Standards (ISSB Adoption)

1. UK SRS Reporting Framework

The UK SRS framework builds on the foundations set by the International Sustainability Standards Board (ISSB), particularly IFRS S1 (General Requirements) and IFRS S2 (Climate-related Disclosures). It introduces six specific amendments tailored for UK reporting requirements. This framework is mandatory for central government bodies with over 500 full-time equivalent (FTE) staff or organisations generating more than £500 million in operating income or grant funding. The UK government plans to release the final versions of UK SRS S1 and S2 for voluntary use by early 2026, with mandatory compliance expected to follow soon after.

Compliance Features

The framework is built around four key pillars: Governance, Strategy, Risk Management, and Metrics and Targets. Its focus on financial materiality means organisations must disclose sustainability risks and opportunities that could influence enterprise value over short, medium, or long-term horizons. Unlike the EU's CSRD, which adopts a double materiality approach, the UK SRS framework prioritises single materiality to better align with investor needs. This streamlined focus simplifies reporting processes while directly supporting investment decisions. Additionally, a "comply or explain" mechanism allows organisations to justify non-compliance, outlining their plans and timelines for meeting requirements.

To ease the transition, the government has introduced a climate-first relief period. This allows organisations to concentrate on Scope 1, 2, and 3 disclosures for the first two years, with broader sustainability reporting becoming mandatory from Year 3 onwards. Renata Ulloa, ESG & Reporting Senior Consultant at Anthesis, highlights the framework's broader implications:

"The UK SRS represents more than a compliance exercise – it's a catalyst to integrate sustainability into decision-making and drive long-term value creation."

Data Integration

The framework ensures that sustainability data is integrated directly into financial disclosures. Organisations are required to incorporate sustainability risks into their corporate reports, ensuring these risks are reflected in financial statements, cash flow analyses, and impairment assessments. The reporting boundary for sustainability data must align with the financial reporting boundary, typically following a "control approach" or "equity share" model as defined by the GHG Protocol.

For organisations navigating this dual alignment, Aligning ESG data with ISSB provides a structured method to seamlessly integrate financial and sustainability data. This alignment reinforces the principle that sustainability figures should be as reliable and transparent as financial data - a core idea driving the UK SRS framework. This approach underlines the increasing expectation for sustainability information to meet the same standards of accuracy and trustworthiness as financial disclosures.

2. neoeco Sustainability Accounting Software

neoeco is a sustainability accounting tool tailored for UK accounting firms navigating the complexities of UK SRS and ESG reporting. By directly connecting to financial ledgers like Xero, Sage, and QuickBooks, it eliminates the need for manual data entry and outdated spreadsheets.

Compliance Features

neoeco supports a range of frameworks, including UK SRS, ISSB, CSRD, TCFD, and GRI. This all-in-one approach ensures that financial and sustainability disclosures remain consistent, meeting the UK SRS requirement for aligned reporting boundaries. The platform offers pre-built templates to generate compliance-ready reports in minutes, while a live checklist tracks completed, pending, or review-ready tasks. To aid audits and assurance processes under ISO 14064 or ISSA 5000, neoeco includes a policy and evidence hub that stores supporting documentation. This creates a clear audit trail, ensuring transparency across both financial and sustainability reporting.

Data Integration

neoeco goes beyond compliance by seamlessly integrating financial and ESG data. Its "smart matching" technology automatically links financial ledger entries to Scope 1, 2, and 3 emissions categories, following the Greenhouse Gas Protocol and UK SRS guidelines. Transactions are mapped to recognised categories under frameworks like GHGP, ISO 14064, SECR, and UK SRS. This integration reduces inconsistencies across reporting frameworks, while the system also cleans and organises imported data to meet audit standards. For firms dealing with Scope 3 emissions, this automated process significantly cuts down the time spent on data preparation and validation.

Automation and Efficiency

With its advanced data integration, neoeco streamlines operations to save time and effort. AI-driven transaction matching, along with automated data validation and cleaning, removes the need for manual processes. The platform covers 96 ESG impact categories through Life Cycle Assessment (LCA), providing detailed insights without extra work. Real-time dashboards replace static reports, giving firms instant visibility into emissions intensity and trends. Secure auditor access eliminates the hassle of back-and-forth emails, while firms can produce branded client reports featuring their own logos and colours for a professional touch.

Pros and Cons

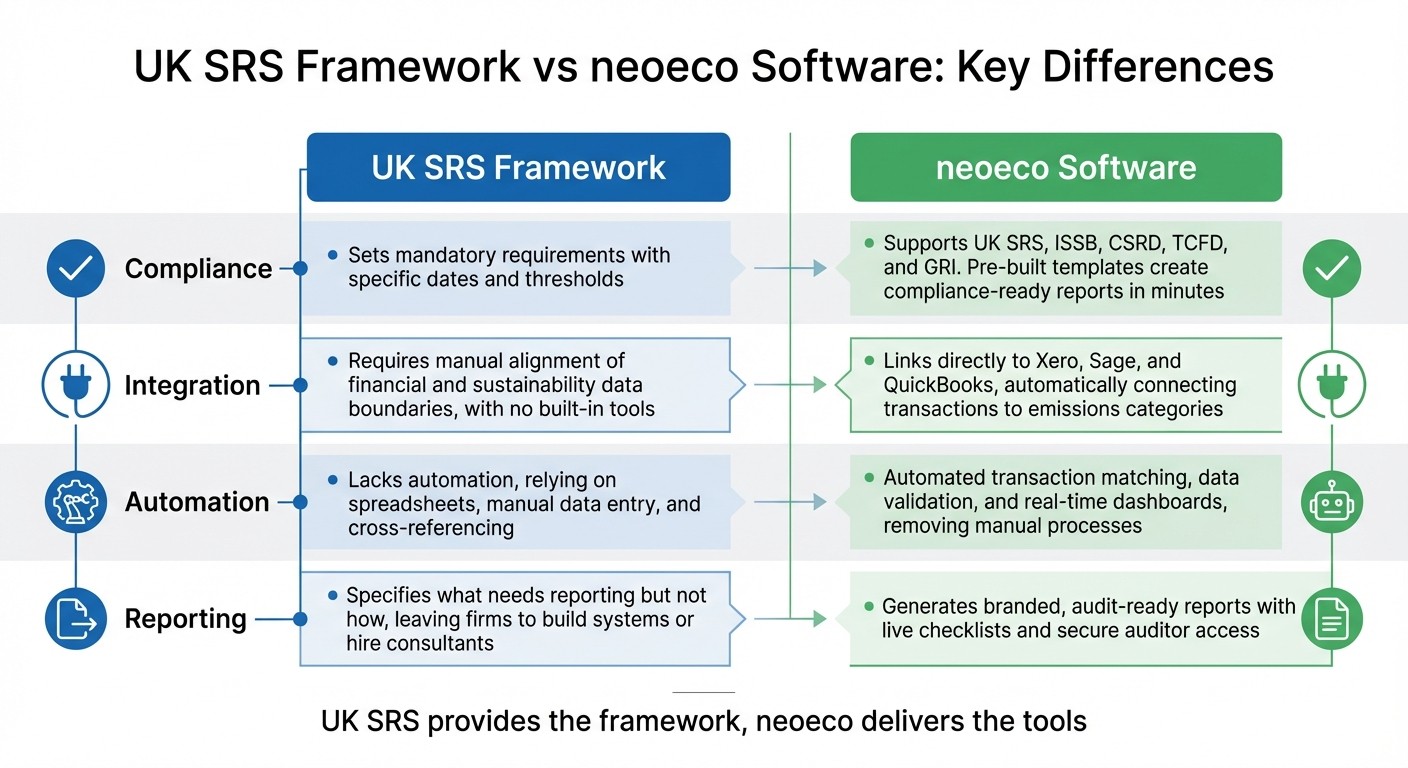

UK SRS Framework vs neoeco Software: Compliance Comparison 2026

The UK SRS lays out the rules for reporting but doesn't provide the tools to collect, validate, or report data effectively. That’s where neoeco steps in - it turns the framework's requirements into automated workflows that work with your clients' existing financial systems. This comparison highlights the gap between regulatory guidelines and practical solutions.

Here’s how they stack up across key areas:

Aspect | UK SRS Framework | neoeco Software |

|---|---|---|

Compliance | Sets out mandatory requirements, with dates and thresholds detailed elsewhere. | Supports UK SRS, ISSB, CSRD, TCFD, and GRI. This makes it easier to align ESG data with ISSB and other global standards. Pre-built templates create compliance-ready reports in minutes. |

Integration | Requires manual alignment of financial and sustainability data boundaries, with no built-in tools. | Links directly to platforms like Xero, Sage, and QuickBooks, automatically connecting transactions to emissions categories. |

Automation | Lacks automation, relying on spreadsheets, manual data entry, and cross-referencing. | Offers automated transaction matching, data validation, and real-time dashboards, removing the need for manual processes. |

Reporting | Specifies what needs reporting but not how, leaving firms to build systems or hire consultants. | Generates branded, audit-ready reports with live checklists and secure auditor access. |

This comparison shows the clear advantage of using integrated software like neoeco to meet UK SRS requirements and investor expectations.

The UK SRS provides the framework, but neoeco delivers the tools. While the framework ensures legal compliance, without integration and automation, it can become a tedious and time-consuming task. That’s exactly the challenge financially-integrated sustainability management aims to solve. neoeco transforms UK SRS compliance into an efficient, audit-ready process.

Conclusion

The changing regulatory environment is pushing for a closer connection between financial and sustainability reporting. The UK government plans to release the final versions of UK SRS S1 and S2 for voluntary use by early 2026. Already, between October 2023 and March 2024, over 1,000 companies have referenced ISSB standards in their reports. Additionally, around 80% of US institutional investors now factor in sustainability information when making investment decisions. This marks a significant shift in what clients expect from accountants.

neoeco simplifies compliance with UK SRS by seamlessly integrating with platforms like Xero, Sage, and QuickBooks. It automates the mapping of transactions to emissions categories, removing the need for manual spreadsheets and ensuring sustainability data is built on reliable financial records. For firms managing central government bodies with more than 500 full-time employees or over £500 million in operating income, this integration is critical to meet mandatory reporting thresholds. By aligning with UK SRS standards, neoeco strengthens the trust between accountants and their clients.

The platform also enables firms to produce audit-ready, branded reports and maintain an up-to-date compliance checklist. These reports meet UK SRS minimum requirements, covering all Scope 1 and Scope 2 emissions, and Scope 3 emissions where relevant. This streamlined process not only ensures compliance but also enhances client confidence.

With 75% of investors demanding sustainability assurance to match the detail and accuracy of financial audits, firms need tools that deliver the same precision. neoeco’s approach to ISSB reporting ensures sustainability data meets the same high standards as financial statements.

UK SRS sets the framework, and neoeco provides the tools. Together, they make 2026 compliance straightforward, positioning your firm as a reliable partner in both finance and sustainability.

FAQs

How does the UK SRS differ from the EU's CSRD in sustainability reporting?

The UK SRS (Sustainability Disclosure Standards) and the EU’s CSRD (Corporate Sustainability Reporting Directive) take different approaches when it comes to scope, focus, and reporting requirements.

The UK SRS, which aligns with global standards like ISSB, integrates sustainability details directly into financial reporting. It places a strong emphasis on emissions data - specifically Scopes 1, 2, and 3 - and governance matters. Reports under this framework are prepared in pounds sterling (£), ensuring data is consistent and audit-ready.

In contrast, the EU’s CSRD adopts a wider lens. It requires detailed disclosures across environmental, social, and governance areas, with a special focus on double materiality. This means companies must evaluate both their impact on the environment and society, as well as how sustainability issues influence their own operations. Reports are prepared in euros (€) and demand industry-specific insights, scenario analyses, and consideration of regional climate risks like floods or droughts.

While both frameworks aim to enhance transparency, their priorities differ: the UK SRS leans towards globally consistent, finance-driven reporting, whereas the CSRD takes a broader, stakeholder-focused approach, tailored to regional and local needs.

How does neoeco help large organisations comply with UK SRS requirements?

Neoeco simplifies UK SRS compliance for large organisations by seamlessly linking sustainability metrics with financial data. It automates the process of aligning transactions with recognised emissions categories under frameworks such as GHGP, ISO 14064, SECR, and UK SRS. This eliminates the need for manual data entry or reliance on spreadsheets, ensuring precision and efficiency.

The platform collects emissions data across scopes 1, 2, and 3, delivering finance-grade carbon reports that meet UK SRS standards. This streamlines audit preparation and enables organisations to fulfil their disclosure obligations while integrating sustainability initiatives into their broader ESG strategies. Neoeco allows organisations to navigate compliance with ease, saving time and minimising the risk of errors.

What does the 'comply or explain' approach mean in the UK SRS framework?

The 'comply or explain' approach within the UK SRS framework gives organisations two options: either meet the reporting standards or offer a well-reasoned explanation for not doing so. This system strikes a balance between ensuring transparency and offering flexibility for businesses dealing with specific challenges.

By encouraging openness, this approach helps stakeholders gain insight into how organisations are tackling sustainability issues. It also supports the broader objectives of responsible reporting and adherence to compliance standards.

Related Blog Posts

Deliver carbon accounting you can stand behind.

Built on real financial data, with full transparency and control — so every number holds up under scrutiny.